Environmental Remediation Market Share, Size, Trends, Industry Analysis Report

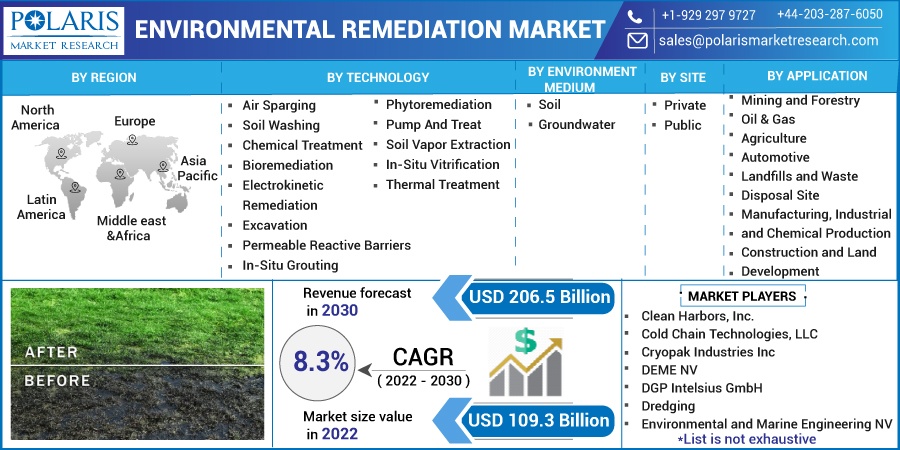

By Technology; By Environment Medium (Soil and Groundwater); By Site (Private and Public); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 118

- Format: PDF

- Report ID: PM2836

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

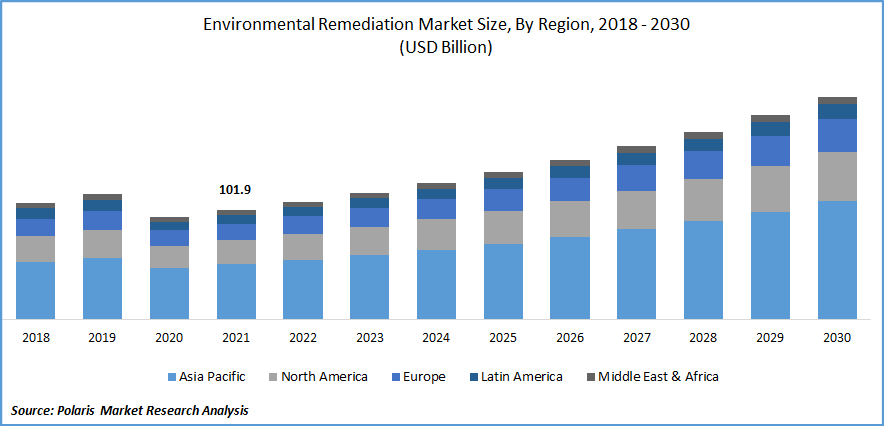

The global environmental remediation market was valued at USD 101.9 billion in 2021 and is expected to grow at a CAGR of 8.3% during the forecast period. The growing demand for environmental remediation is expected to be driven by rapid urbanization, rising environmental standards, and growing awareness regarding environmental protection.

Know more about this report: Request for sample pages

The increasing adoption of environmental remediation technology across various sectors is due to the expansion of environmentally friendly industries and rising government regulations towards health & safety. In addition, the increasing global population and their requirement for clean and hygienic air and water have resulted in the demand for remediation technology. Furthermore, growing projects across manufacturing and industrial sectors across developing nations will likely complement the market growth.

The COVID-19 pandemic had a negative impact on the growth of the market. Due to strict government norms, the pandemic created demand destruction and hampered shipping capacities s. In addition, the delay of raw materials and labor required for remediation projects due to the complete lockdown across the globe severely damaged the market, resulting in increased expense and uncertainty of the project; moreover, many companies halted the environmental remediation project, which hampered the market growth.

Many end-use industries adopt remediation technologies to protect the environment from harmful concerns. But these services require large equipment to treat the waste, such as dumpers, trucks, and excavators. This equipment is quite expensive, and many small-scale industries cannot afford it, which is a major factor restraining market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Rising land and water contamination issues across emerging nations likely drive the global environmental remediation market. The emission of hazardous gases in many industries, waste disposal and management, and chemical waste generation from various industrial activities are increasing environmental waste. Furthermore, government regulations and enforcement to impede remediation services, rising funding for pollution management, and awareness among different sectors related to environmental issues are factors propelling the market growth.

Changing climate and human activities has resulted in rising temperature and increasing level of greenhouse gases which results in the contamination of air, land, and water. With the technology innovation, many manufacturers focus on monitoring environmental damage through geospatial measurement. In addition, many industries and corporations have adopted drone technology for environmental monitoring and follow government rules to maintain ecological stability; such factors drive market growth.

Report Segmentation

The market is primarily segmented based on technology, environment medium, site, application, and region.

|

By Technology |

By Environment Medium |

By Site |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Bioremediation technology accounted for the largest share in 2021

The bioremediation technology segment accounted for the highest revenue share in 2021, owing to the rising concerns about plastic waste and oil spills in the environment. In addition, this technology is heavily involved in the degradation, eradication, and detoxification of chemical wastes and hazardous elements from the environment through the action of microorganisms.

Furthermore, in-situ that is per-and poly-fluoroalkyl substances (PFAS) bioremediation is significantly adopted by many oil & gas industries due to its cost-effectiveness, and the treatment doesn’t require movement of constituents, which is expected to drive the market growth.

Groundwater segment to hold highest market share

The growing activities of fertilizer application, leaking landfills, and industrial operations spills are resulting in groundwater contamination, which has increased the demand for groundwater remediation. In addition, toxic substances from storage tanks and organic waste generated after wastewater treatment pollute the groundwater and infect it with hazardous materials such as zinc, lead, and arsenic.

Furthermore, groundwater is generally used for drinking purposes across many rural areas, and this toxic component leads to a majority of health issues which is increasing the need to treat groundwater; such factors are projected to drive the segment growth.

Public site to lead the market over the forecast period

The growing environmental concerns with the increasing pollutants such as oil spills, plastic waste, and emission of harmful greenhouse gases across rural and urban areas are resulting in harm to human health, and many of these activities to dump waste are done at public sites, which is increasing the demand to treat these sites.

In addition, with the growing population across developing nations, a large amount of waste and harmful components is disposed of at various public sites. This waste, being non-biodegradable, results in many health-related disorders. Moreover, rising government stringent environmental rules to boost environmental remediation services are also supporting to complement the market growth.

Oil & gas segment is expected to witness faster growth

The demand for the oil & gas segment is expected to surge significantly over the forecast period owing to the growing adoption of remediation methods to remove volatile organic chemicals and rising awareness about environmental protection. In addition, these industries produce many harmful by-products and compounds, such as methane and anthropogenic compounds, which damage and contaminate the soil through spills that need immediate attention to treat the production units.

Moreover, the oil & gas industries use the chemical treatment method, a hydraulic fracturing technique, to treat the toxic compounds released during remediation. Government regulations to emphasize utilization of remediation technologies in these industries owing to public health and environmental impact also support the segment growth.

Asia Pacific dominates the market and is expected to grow significantly over the forecast period

Asia Pacific is the largest region for environmental remediation and is expected to witness faster growth over the forecast period owing to the rapid industrialization and growing population, which has increased air and water pollution. In addition, the increasing demand from the mining and forestry sector is also supporting segment growth.

Furthermore, this sector contaminates soil and causes much risk to human and environmental health; hence the adoption of remediation in urban and rural areas to treat mining dumps, opencast coal mines, and peatlands across China, Japan, and India; such factors are complementing the market growth.

North America is the second largest segment to witness faster growth over the forecast period owing to the rising R&D investment by key players to develop novel environmental remediation solutions and services. Government initiatives to reduce pollution and emphasize boosting the usage of remediation technologies across the U.S. and Canada are expected to support the market growth.

Competitive Insight

Some of the major players operating in the global market include AECOM Technology, BRISEA Group, Clean Harbors, Inc., Cold Chain Technologies, LLC, Cryopak Industries Inc, DEME NV, DGP Intelsius GmbH, Dredging, Environmental And Marine Engineering NV, Engineering And Maintenance Solutions, ENTACT LLC, Envirotainer AB, GEO Inc., Golder Associates Corporation, HDR, Inc., Inmark LLC, Jacobs Engineering Group, Newterra Ltd, Pelican Biothermal LLC, Sofrigam SA, Softbox Systems, Sonoco Products Company, Terra Systems, Inc., and, Weber Ambiental.

Recent Developments

In October 2022: Newterra acquired H2O engineering, Inc. to develop and innovate technologies related to complex environmental and water challenges.

In August 2021: HDR, Inc. acquired WRECO to grow its transportation and water services by improving the hydrology and hydraulics segment.

Environmental Remediation Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 109.3 billion |

|

Revenue forecast in 2030 |

USD 206.5 billion |

|

CAGR |

8.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Technology, By Environment Medium, By Site, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

AECOM Technology, Brisea Group, Clean Harbors, Inc., Cold Chain Technologies, LLC, Cryopak Industries Inc, DEME NV, DGP Intelsius GmbH, Dredging, Environmental and Marine Engineering NV, Engineering and Maintenance Solutions, ENTACT LLC, Envirotainer AB, GEO Inc., Golder Associates Corporation, HDR, Inc., Inmark, LLC, Jacobs Engineering Group, Newterra Ltd, Pelican Biothermal LLC, Sofrigam SA, Softbox Systems, Sonoco Products Company, Terra Systems, Inc., and, Weber Ambiental. |