Erythropoietin Drugs Market Size, Share, Trends, Industry Analysis Report

: By Type (Biologics and Biosimilars), Product, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 116

- Format: PDF

- Report ID: PM3354

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

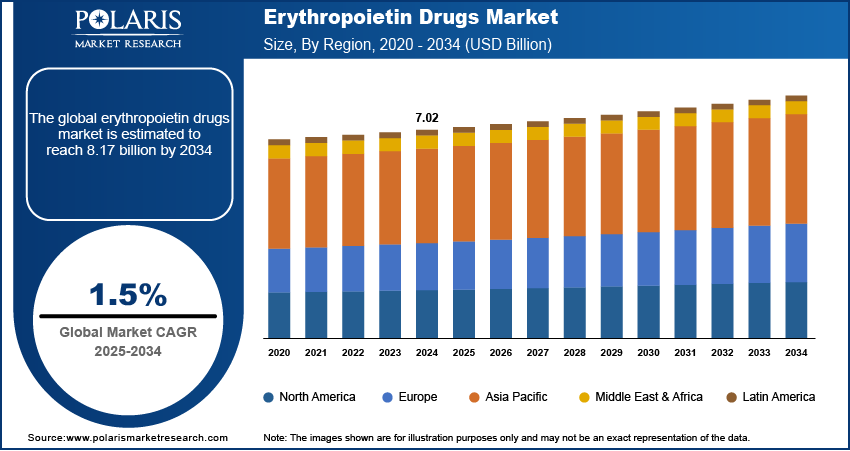

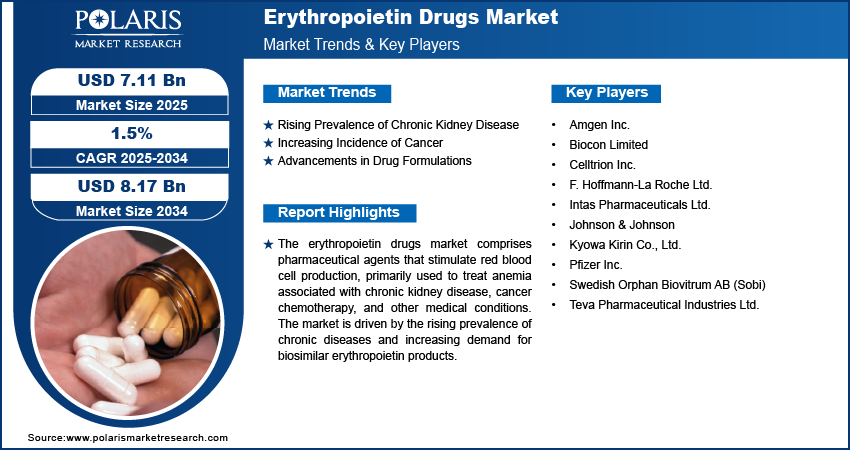

The global erythropoietin drugs market size was valued at USD 7.02 billion in 2024, growing at a CAGR of 1.5% during 2025–2034. The market growth is primarily fueled by the rising prevalence of chronic diseases, the expanding geriatric population, and advancements in biologic drug development.

Key Insights

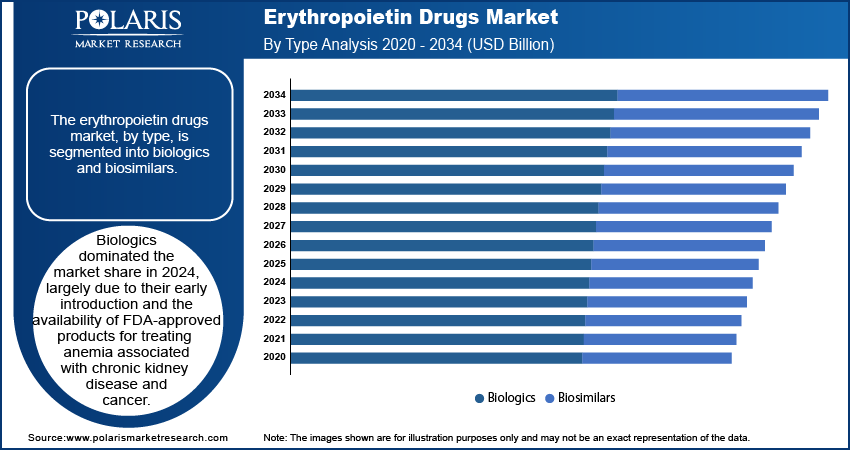

- The biologics segment dominated the market in 2024. The segment’s dominance is largely fueled by the early introduction and availability of FDA-approved products.

- The darbepoetin-alfa segment is registering significant growth. The longer half-life of darbepoetin-alfa allows for less frequent dosing schedules and improves patient compliance.

- The renal diseases segment led the market in 2024, primarily driven by the high incidence of CKD that often leads to anemia.

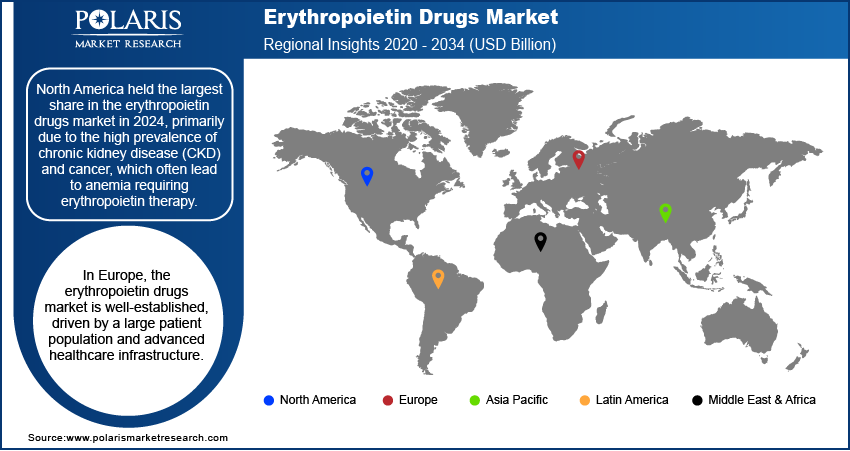

- North America dominated the market in 2024, owing to the region’s high prevalence of CKD and cancer and rising investments in R&D.

- Asia Pacific is poised to register sustained growth. The rising demand for low-cost therapeutics has resulted in increased focus on the development of biosimilars in the region.

Industry Dynamics

- The rising incidence of chronic kidney disease (CKD) has boosted the demand for effective anemia management methods, including erythropoietin drugs.

- Technological innovations in drug formulations, including the development of long-acting erythropoietin formulations, are propelling market expansion.

- Expanding healthcare infrastructure, especially in emerging economies, is expected to provide significant market opportunities.

- Stringent regulatory frameworks may present market challenges.

Market Statistics

2024 Market Size: USD 7.02 billion

2034 Projected Market Size: USD 8.17 billion

CAGR (2025-2034): 1.5%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The erythropoietin drugs market focuses on the production and distribution of erythropoietin-based therapies, which are primarily used to treat anemia associated with chronic kidney disease, cancer chemotherapy, and certain other medical conditions.

The erythropoietin market is experiencing significant growth, driven by the increasing prevalence of chronic diseases such as anemia associated with chronic kidney disease (CKD), cancer, and HIV. As the demand for effective treatment options rises, biosimilar erythropoietin products are gaining traction due to their cost-effectiveness and comparable therapeutic efficacy to biologics. Advancements in biologic drug development, including recombinant DNA technology, have further enhanced the efficiency and accessibility of erythropoietin therapies. Additionally, the expanding geriatric population, which is more susceptible to anemia and other chronic conditions, is fueling market demand. Emerging economies are playing a pivotal role in market expansion, with improved healthcare infrastructure, government initiatives, and increased access to advanced biologics, further driving the adoption of erythropoietin-based treatments.

Market Dynamics

Rising Prevalence of Chronic Kidney Disease

The increasing incidence of chronic kidney disease (CKD) significantly propels the demand for erythropoietin drugs. CKD often leads to anemia due to the kidneys' diminished capacity to produce erythropoietin, a hormone essential for red blood cell production. In the US, over 37 million individuals are affected by CKD, as reported by the Centers for Disease Control and Prevention (CDC) in 2021. This substantial patient population necessitates effective anemia management, thereby driving the erythropoietin drugs market expansion.

Increasing Incidence of Cancer

The rising number of cancer cases globally contributes to the erythropoietin drugs market growth. Cancer patients frequently develop anemia, either as a direct consequence of the disease or as a side effect of treatments like chemotherapy. According to the World Health Organization (WHO), there were an estimated 20 million new cancer cases worldwide in 2022. Managing cancer-related anemia often involves the administration of erythropoietin drugs to stimulate red blood cell production, thereby enhancing patient quality of life and treatment outcomes.

Advancements in Drug Formulations

Technological innovations in drug formulations have markedly influenced the erythropoietin drugs market. The development of long-acting erythropoietin formulations, such as darbepoetin-alfa, has reduced the frequency of dosing, improving patient compliance and convenience. These advancements not only enhance therapeutic efficacy but also expand the applicability of erythropoietin drugs across various medical conditions associated with anemia.

Segment Insights

Assessment – Type-Based Insights

The erythropoietin drugs market, by type, is segmented into biologics and biosimilars. Biologics dominated the market share in 2024, largely due to their early introduction and the availability of FDA-approved products for treating anemia associated with chronic kidney disease and cancer. Notable biologic erythropoietin drugs include Epogen and Aranesp, which have been widely adopted in clinical practice. However, the market dynamics are shifting as patents for several biologic erythropoietin drugs expire, leading to increased competition from biosimilars.

Biosimilars are emerging as a rapidly growing segment within the erythropoietin drugs market. These agents offer comparable therapeutic efficacy to their biologic counterparts but at a reduced cost, making them an attractive option for healthcare systems aiming to manage expenses without compromising patient care.

Evaluation – Product-Based Insights

The erythropoietin drugs market, by product, is segmented into erythropoietin and darbepoetin-alfa. The erythropoietin segment held the largest market share in 2024. This dominance is attributed to its widespread use in treating anemia associated with chronic kidney disease and cancer chemotherapy. Erythropoietin drugs, such as epoetin-alfa and epoetin-beta, have been extensively utilized due to their proven efficacy in stimulating red blood cell production. The established clinical success and broad therapeutic applications of these agents have solidified their leading position in the market.

The darbepoetin-alfa segment is experiencing significant growth within the market. Darbepoetin-alfa is a modified form of erythropoietin with a longer half-life, allowing for less frequent dosing schedules, which enhances patient compliance and convenience. Initiatives by pharmaceutical companies, such as financial assistance programs, have further facilitated patient access to darbepoetin-alfa therapies. These factors collectively contribute to the robust growth observed in the darbepoetin-alfa segment.

Outlook– Application-Based Insights

The erythropoietin drugs market, by application, is segmented into cancer, renal diseases, neurology, and others. The renal diseases segment held the largest market share in 2024. This dominance is primarily due to the high prevalence of CKD, which often leads to anemia as the diseased kidneys fail to produce adequate erythropoietin, a hormone essential for red blood cell production. Erythropoietin drugs are thus extensively utilized to manage anemia in CKD patients, enhancing their quality of life and reducing the need for blood transfusions. The availability of well-established reimbursement policies for renal treatments further supports the widespread adoption of these therapies in this segment.

The cancer segment is experiencing the highest growth rate within the erythropoietin drugs market. This surge is attributed to the increasing incidence of cancer worldwide, with many patients developing anemia either as a direct consequence of the malignancy or as a side effect of chemotherapy. Erythropoietin drugs are employed to alleviate chemotherapy-induced anemia, thereby improving patient outcomes and enabling the continuation of cancer treatment protocols. The growing awareness among healthcare providers about the benefits of managing cancer-related anemia with erythropoietin therapies contributes to the rapid expansion of this segment.

Regional Analysis

By region, the study provides the erythropoietin drugs market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America held the largest share in the erythropoietin drugs market in 2024, primarily due to the high prevalence of CKD and cancer, which often lead to anemia requiring erythropoietin therapy. The region's advanced healthcare infrastructure and significant investment in research and development further support the widespread adoption of these treatments. Additionally, the presence of major pharmaceutical companies and favorable reimbursement policies enhance patient access to erythropoietin drugs, solidifying North America's leading position in the market.

In Europe, the erythropoietin drugs market is well-established, driven by a large patient population and advanced healthcare infrastructure. The region's less stringent regulatory environment compared to North America facilitates faster drug approvals, contributing to market growth. The introduction of biosimilars has intensified competition, leading to more affordable treatment options for patients. Countries such as Germany, France, and the United Kingdom are key contributors to the market expansion in this region.

The Asia Pacific erythropoietin drugs market is poised for significant growth, primarily due to the high prevalence of anemia and chronic kidney disease, especially in countries like India and China. The demand for low-cost therapeutics has prompted many companies to focus on developing biosimilars in this region. Supportive government initiatives and the expansion of healthcare infrastructure further support market growth. For instance, the Japanese government's regulation mandates a 30% discount on biosimilars, making them more accessible to economically disadvantaged populations.

Key Players and Competitive Insights

The competitive landscape of the erythropoietin drugs market features global and regional players competing through innovation and strategic alliances. Global players leverage R&D capabilities and technological advancements to deliver advanced solutions, meeting the demand for disruptive technologies. Market trends highlight rising technological adoption driven by economic growth and geopolitical shifts. Companies focus on strategic investments, mergers, and joint ventures to strengthen market positions. Regional players offer cost-effective solutions tailored to local needs. The market experiences ongoing technological transformation, with companies investing in supply chain management and sustainability strategies. Competitive intelligence and pricing insights are critical for identifying growth opportunities. The market’s growth is driven by technological innovation, market adaptability, and strategic regional investments, ensuring sustained competitiveness in a dynamic global market. The erythropoietin drugs market features several key players actively contributing to its growth and development. Notable companies include Amgen Inc.; Johnson & Johnson; F. Hoffmann-La Roche Ltd.; Pfizer Inc.; Novartis AG; Biocon Limited; Teva Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.; LG Chem Ltd.; Wockhardt Ltd.; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd.; Celltrion Inc.; Kyowa Kirin Co., Ltd.; and Swedish Orphan Biovitrum AB.

Amgen Inc., headquartered in Thousand Oaks, California, is renowned for its innovative approach to medicine development. Founded in 1980 as Applied Molecular Genetics, Amgen has been a pioneer in using recombinant DNA technology to address critical health challenges. A significant milestone in its history was the development of Epogen (epoetin alfa), the first recombinant human erythropoietin drug. Approved by the FDA in 1989, Epogen revolutionized anemia treatment for patients undergoing kidney dialysis by stimulating red blood cell production. This breakthrough marked Amgen's entry into the erythropoietin drug market and established its leadership in nephrology therapies. Building on this success, Amgen later developed Aranesp (darbepoetin alfa), a long-acting erythropoietin analog that remains widely used for anemia management in chronic kidney disease and chemotherapy patients. The company's innovative approach to modifying erythropoietin molecules extended their efficacy and reduced dosing frequency, improving patient convenience and outcomes. Amgen continues to invest heavily in research and development to advance therapies for serious diseases, including erythropoiesis-related conditions.

F. Hoffmann-La Roche Ltd., commonly known as Roche, is a Swiss multinational healthcare company headquartered in Basel, Switzerland. Founded in 1896, the company is a global leader in pharmaceuticals and diagnostics, with a strong focus on personalized healthcare. Roche operates under two main divisions, Pharmaceuticals and Diagnostics, and is renowned for its innovative approach to advancing science and improving lives. The company’s pharmaceutical portfolio spans treatments for cancer, infectious diseases, metabolic disorders, and hematologic conditions, among others. Roche also invests heavily in research and development, making it one of the largest spenders in pharmaceutical R&D globally. In the field of erythropoietin drugs, Roche has made contributions with its product NeoRecormon (epoetin beta). NeoRecormon is widely used for the treatment of anemia associated with chronic kidney disease and chemotherapy. Roche also developed Mircera (methoxy polyethylene glycol-epoetin beta), a long-acting erythropoietin analog that provides extended dosing intervals, improving convenience for patients. These products exemplify Roche’s commitment to addressing anemia through advanced biotechnological solutions.

List of Key Companies

- Amgen Inc.

- Biocon Limited

- Celltrion Inc.

- F. Hoffmann-La Roche Ltd.

- Intas Pharmaceuticals Ltd.

- Johnson & Johnson

- Kyowa Kirin Co., Ltd.

- Pfizer Inc.

- Swedish Orphan Biovitrum AB (Sobi)

- Teva Pharmaceutical Industries Ltd.

Erythropoietin Drugs Industry Developments

- October 2023: Genexine and KGbio obtained the first market approval from the Indonesian Food and Drug Authority (BPOM) for their novel long-acting erythropoietin, Efepoetin alfa.

Erythropoietin Drugs Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Biologics

- Biosimilars

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Erythropoietin

- Darbepoetin-alfa

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Cancer

- Renal Diseases

- Neurology

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Erythropoietin Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.02 billion |

|

Market Size Value in 2025 |

USD 7.11 billion |

|

Revenue Forecast by 2034 |

USD 8.17 billion |

|

CAGR |

1.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy: The erythropoietin drugs market has been segmented into detailed segments of type, product, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: The growth and marketing strategy in the erythropoietin drugs market focuses on expanding biosimilar offerings, strategic collaborations, and geographical expansion. Companies are investing in research and development to enhance product efficacy and secure regulatory approvals for new formulations. Market players are also forming partnerships with healthcare providers to strengthen distribution channels and improve patient access. Additionally, competitive pricing strategies, especially for biosimilars, are driving market penetration in cost-sensitive regions. Digital marketing and awareness campaigns targeting healthcare professionals and patients further support market growth.

FAQ's

The erythropoietin drugs market size was valued at USD 7.02 billion in 2024 and is projected to grow to USD 8.17 billion by 2034.

The market is projected to register a CAGR of 1.5% during the forecast period.

North America had the largest share of the market in 2024.

Notable companies include Amgen Inc.; Johnson & Johnson; F. Hoffmann-La Roche Ltd.; Pfizer Inc.; Novartis AG; Biocon Limited; Teva Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd.; LG Chem Ltd.; Wockhardt Ltd.; Intas Pharmaceuticals Ltd.; Sun Pharmaceutical Industries Ltd.; Celltrion Inc.; Kyowa Kirin Co., Ltd.; and Swedish Orphan Biovitrum AB.

The biologics segment accounted for the largest share of the market in 2024.

Erythropoietin drugs are pharmaceutical agents that stimulate red blood cell production by mimicking the action of erythropoietin, a hormone naturally produced by the kidneys. These drugs are primarily used to treat anemia associated with chronic kidney disease, cancer chemotherapy, and other medical conditions that cause a deficiency in red blood cells. They help reduce the need for blood transfusions and improve oxygen delivery in the body. Erythropoietin drugs are available as biologics and biosimilars, with formulations such as epoetin alfa, darbepoetin alfa, and others.