ESOP Administration Market Size, Share, Trend, Industry Analysis Report

By Size (Large Enterprises, Medium Businesses, Small Businesses), By Type, By Application, By Industry, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5889

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

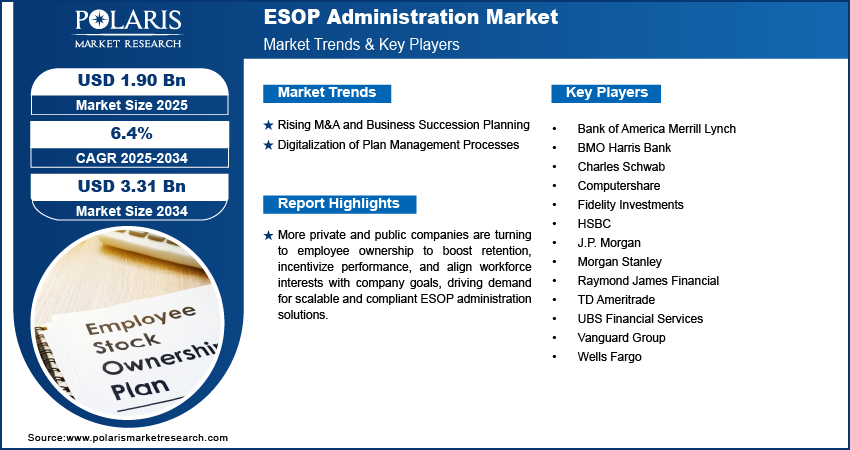

The global Employee Stock Ownership Plan (ESOP) administration market size was valued at USD 1.78 billion in 2024 and is projected to register a CAGR of 6.4% from 2025 to 2034. More private and public companies are turning to employee ownership to boost retention, incentivize performance, and align workforce interests with company goals, driving demand for scalable and compliant ESOP administration solutions.

The ESOP (Employee Stock Ownership Plan) administration market refers to the ecosystem of platforms, service providers, and software tools that manage and facilitate employee stock ownership plans for organizations. It includes services related to compliance reporting, valuation, recordkeeping, plan design, communication, and transaction processing, ensuring smooth execution and legal adherence of equity-based compensation structures. Stringent IRS, DOL, and ERISA requirements necessitate specialized platforms and third-party administrators to manage tax reporting, audits, and legal compliance, fueling the need for professional ESOP administration services.

To Understand More About this Research: Request a Free Sample Report

Private equity firms are investing in or structuring ESOPs to unlock tax advantages and boost employee engagement, creating new demand for high-quality ESOP administration providers. Additionally, companies are leveraging ESOPs as part of broader financial wellness programs, pushing administrators to offer better employee education tools, communication platforms, and transparent reporting capabilities.

Market Dynamics

Rising M&A and Business Succession Planning

The increasing number of mergers, acquisitions, and ownership transitions among small and mid-sized businesses is creating a strong need for reliable succession planning. Many business owners are turning to ESOPs as a strategic exit plan that allows them to transfer ownership gradually while preserving company culture and rewarding loyal employees. Implementing an ESOP involves several complex processes, including legal structuring, employee communication, valuation, and compliance, which must be managed carefully to avoid legal and financial pitfalls. This complexity fuels demand for specialized ESOP administration services to manage these elements efficiently. Providers offering end-to-end solutions, including plan setup, annual valuations, recordkeeping, and regulatory reporting, are increasingly favored in such scenarios. Businesses consider ESOPs not just as an ownership model, but also as a way to secure long-term stability and incentivize employees. The trend continues to grow as more companies seek tax-efficient and employee-friendly succession strategies.

Digitalization of Plan Management Processes

The shift toward digital tools is reshaping the way organizations manage and administer employee stock ownership plans. Companies are adopting cloud-based platforms that provide real-time access to participant data, automate key administrative tasks, and ensure better compliance tracking. According to the Cloud Security Alliance, cloud computing adoption has surged to 98% among organizations, up from 91% in 2020. Features such as digital signatures, personalized dashboards, and automated alerts are enhancing the user experience while reducing manual errors and administrative burden. Employees benefit from easier access to account statements, educational resources, and transaction histories, making participation more transparent and engaging. Employers and plan administrators also gain through centralized platforms that streamline reporting, auditing, and communication. This digital evolution is driving efficiency and scalability, positioning ESOP technology providers as key partners in modern equity management. The trend reflects a broader movement toward digitizing HR and financial operations, making ESOP administration more agile, accurate, and aligned with evolving workplace expectations. Hence, rising digitalization of plan management processes boost the demand for ESOP administration.

Segment Insights

Type Analysis

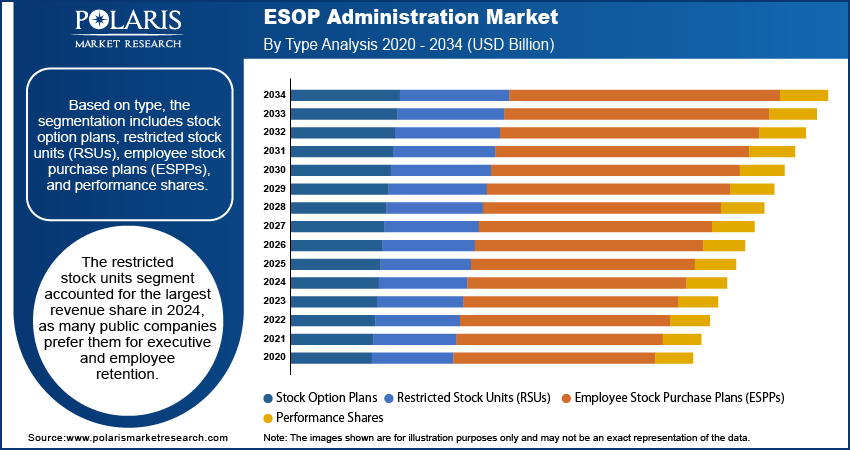

Based on type, the segmentation includes stock option plans, restricted stock units (RSUs), employee stock purchase plans (ESPPs), and performance shares. The restricted stock units segment accounted for the largest revenue share in 2024 as many public companies prefer them for executive and employee retention. RSUs simplify accounting, do not require employees to exercise options, and align with performance goals. They provide guaranteed equity on vesting, supporting workforce stability. High take-up rates among leadership and middle management generate significant administrative volume. RSUs require compliance tracking, taxation management, and detailed reporting, boosting demand for professional administration. The predictable vesting schedules and performance-based structure also make RSUs a central driver of ESOP administration revenue.

The employee stock purchase plans (ESPPs) segment is expected to register the highest CAGR from 2025 to 2034 as more firms expand offers to all employees. ESPPs encourage participation by providing share discounts and payroll-based investments, key motivators in employee engagement programs. Their administrative needs include eligibility tracking, contribution management, and tax handling. Modern digital platforms make onboarding and communication seamless, enhancing accessibility. Increasing adoption in diverse sectors supports a balanced ownership culture. With ERP and payroll systems integrating ESPP modules, real-time data syncing and compliance become easier, propelling adoption of ESPP administration.

Application Analysis

Based on application, the segmentation includes executive compensation, broad-based employee ownership, start-up equity incentives, and technology & startups. In 2024, the executive compensation segment accounted for the largest revenue share, fueled by high-value equity components such as RSUs, performance shares, and options awarded to top leadership. These packages require detailed valuation, vesting tracking, and regulatory reporting, adding administrative complexity. C-suite equity programs demand secure record-keeping and customized disclosures. High-profile industries such as tech and healthcare often grant significant leadership equity, increasing plan administration volume. A growing trend toward multi-year incentive plans, total shareholder returns metrics, and time-based vesting also drives demand. Administrators handling executive plans must ensure compliance with financial regulations, D&O insurance requirements, and proxy statement disclosures.

The start-up equity incentives segment is projected to register a significant CAGR over the forecast period, driven by the increasing number of venture-backed companies offering stock options and RSU grants to attract talent. Early-stage businesses often use equity as a cost-effective retention tool. Plans such as ISOs or SARs require specialized valuation, regulatory advisory, and cap table management, making outsourcing essential. As more start-ups mature, they evolve into public-scale ESOPs, further increasing administrative needs. Modern platforms simplify grant issuance, exercise tracking, and liquidity events. Dynamic plan scaling supports growth-stage operations, driving demand for cloud-based ESOP administration tailored to start-up business cycles.

Industry Analysis

Based on industry, the segmentation includes financial services, manufacturing, and professional services. In 2024, the financial services sector earned the highest revenue in the ESOP services market. This was mainly due to the wide use of equity-based rewards like RSUs, stock options, and deferred bonuses by brokers, analysts, and private bankers. These rewards are closely tied to employee performance and require accurate tracking and valuation. Many firms also use ESOPs to align employee goals with company growth. The industry faces strict rules from regulators like the SEC and FINRA, which demand detailed records and regular reports. Managing these plans involves tracking different types of grants, calculating stock values using models like Black-Scholes, monitoring trading restrictions, and preparing equity reports—all of which increase the demand for ESOP services.

The professional services segment is projected to register the highest CAGR over the forecast period, driven by increased ESOP adoption in firms ranging from consultancies to legal and tech-enabled agencies. Equity plans serve as employee incentive tools and retention vehicles in competitive labor markets. Advisors and employees in these firms often expect transparent equity rewards and regular vesting progress, creating demand for user-friendly administration platforms. Rolling out ESOPs across boutique and mid-tier firms requires plan design, compliance, and investor communication. Administrators also support equity education and performance tracking tools. Shift toward remote work further pushes digital, cloud-based ESOP administration across this rapidly expanding sector.

Size Analysis

Based on size, the segmentation includes large enterprises, medium businesses, and small businesses. In 2024, the large enterprises segment accounted for the largest revenue share due to its complex equity compensation plans, involving multiple tiers and geographic jurisdictions. These organizations require scalable platforms to manage large employee counts and integrate with financial reporting and HR systems. They need logistics across multiple share classes, vesting conditions, blackout windows, and regulatory compliance. Administrator tasks include international plan alignment, audit coordination, and centralized stock ledgers. Complex service-level agreements and security standards make outsourcing ESOP services cost-effective and reliable. Additionally, enterprise plans often support M&A spin-outs, secondary liquidity events, and global tax obligations, all driving demand for advanced ESOP administration.

The small businesses segment is projected to register the highest CAGR over the forecast period, as more early-stage and privately owned companies explore ESOPs for succession planning and employee motivation. A shift toward inclusive ownership models is prompting even sub-50-employee firms to implement simplified equity plans. Demand for subscription-based ESOP platforms, offering turnkey plan templates, grant automation, and compliance support, is growing. Providers offering affordable, digital-first administration are enabling smaller firms to launch equity participation quickly. As these businesses grow, they often increase equity grant use and graduate to more complex plan types, requiring enhanced valuation services, annual reporting, and liquidity management, fueling rapid segment growth.

Regional Analysis

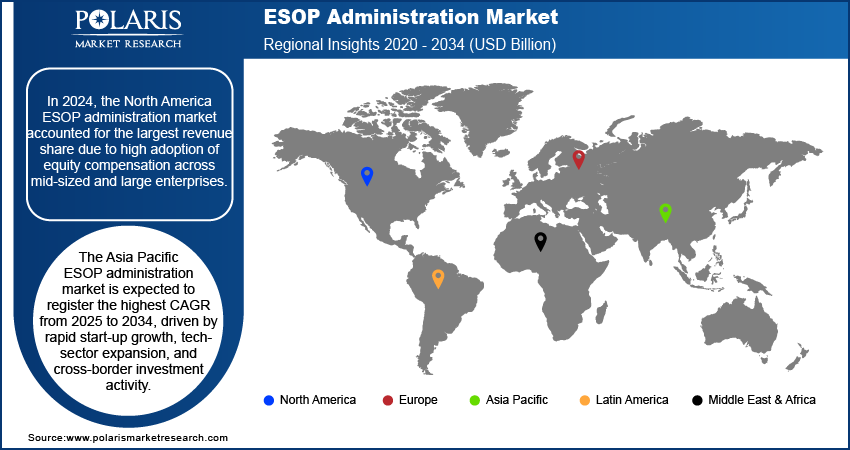

In 2024, the North America ESOP administration market accounted for the largest revenue share due to high adoption of equity compensation across mid-sized and large enterprises. The U.S. Small Business Administration (SBA) released a report indicating a significant increase in employee-owned businesses through Employee Stock Ownership Plans (ESOPs) in FY 2023, with over 250 transactions completed. Notably, most of these transactions were concentrated in the manufacturing and professional services sectors, highlighting the ESOP model's appeal for succession planning and workforce engagement in these industries. Widespread use of restricted stock units, performance shares, and employee stock purchase plans has created sustained demand for specialized administration solutions. Mature financial infrastructure, favorable regulatory environment, and growing use of digital platforms have contributed to efficient plan management and compliance. Increasing M&A activity and business succession planning among privately held companies have further supported growth. Service providers in the region offer tailored solutions, including cap table management, tax reporting, and plan automation, which enhances operational efficiency and reduces fiduciary risk.

U.S. ESOP Administration Market Trends

The U.S. market accounted for the largest revenue share in 2024, driven by the country’s strong corporate equity culture and a favorable regulatory framework under ERISA. Employers across sectors, especially in tech, finance, and manufacturing, widely deploy ESOPs and RSUs as core components of compensation strategy. High plan complexity, frequent equity events, and audit requirements necessitate robust third-party administration services. The presence of leading digital platforms and consultants offering valuation, compliance, and recordkeeping support ensures scalable and secure plan operations. Demand is further reinforced by ongoing succession needs among aging business owners transferring ownership through ESOPs.

Asia Pacific ESOP Administration Market Overview

The Asia Pacific market is expected to register the highest CAGR from 2025 to 2034, driven by rapid start-up growth, tech sector expansion, and cross-border investment activity. Emerging companies across India, Southeast Asia, and Australia are embracing employee ownership to attract and retain skilled talent. Increasing venture capital inflows and IPO activity are pushing founders to implement structured equity plans early in the business cycle. Adoption of cloud-based equity platforms is accelerating across both domestic and international enterprises seeking transparency and scalability. Regulatory modernization and awareness programs supporting wealth distribution further strengthen the regional market outlook.

China ESOP Administration Market Overview

The China ESOP (Employee Stock Ownership Plan) administration market is experiencing steady growth, driven by government support for employee equity incentives and increasing adoption among tech, manufacturing, and fintech companies. Chinese firms are using ESOPs to retain talent, boost productivity, and align employee interests with long-term company goals. Regulatory reforms by the China Securities Regulatory Commission (CSRC) have also streamlined equity incentive programs, improving transparency and compliance. Major cities like Beijing, Shanghai, and Shenzhen lead in ESOP adoption due to the concentration of high-growth enterprises and startups. However, the market still faces challenges such as valuation complexities, limited awareness in smaller firms, and evolving tax policies, which shape the demand for specialized ESOP administration services.

Europe ESOP Administration Market

The Europe market is expected to grow significantly during the forecast period, supported by increasing corporate adoption of employee ownership and performance-based equity plans. Many companies are aligning compensation strategies with shareholder value creation, particularly in countries encouraging employee participation through favorable tax schemes. Strong demand comes from both established corporates and mid-market firms aiming to build long-term loyalty and enhance governance. Plan complexity across jurisdictions requires localized expertise, driving demand for administration providers with Pan-European compliance capabilities. The shift toward digital HR systems and integrated financial software is also contributing to improved reporting accuracy and streamlined equity plan oversight across the region.

Key Players and Competitive Analysis

The competitive landscape of the ESOP administration market is shaped by growing demand for digital equity management, increased plan complexity, and expanding use across public and private companies. Industry participants are focusing on developing scalable SaaS platforms that streamline cap table management, compliance tracking, and financial reporting. Market players are actively pursuing expansion strategies through partnerships with legal and financial advisory firms, enhancing their service reach and plan customization capabilities. Strategic alliances and joint ventures are also common among equity management platforms and payroll providers, allowing seamless integration and improved user experience. Mergers and acquisitions remain a key route to expand client base and technological capabilities, especially among providers looking to serve cross-border equity plans. Competitive differentiation is being driven by innovation in analytics, mobile access, and regulatory automation. As organizations increasingly seek tailored, efficient, and secure plan administration, the market continues to attract new entrants and sustain robust competition across verticals.

List of Key Companies

- Bank of America Merrill Lynch

- BMO Harris Bank

- Charles Schwab

- Computershare

- Fidelity Investments

- HSBC

- J.P. Morgan

- Morgan Stanley

- Raymond James Financial

- TD Ameritrade

- UBS Financial Services

- Vanguard Group

- Wells Fargo

ESOP Administration Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Stock Option Plans

- Restricted Stock Units (RSUs)

- Employee Stock Purchase Plans (ESPPs)

- Performance Shares

By Application Outlook (Revenue USD Billion, 2020–2034)

- Executive Compensation

- Broad-Based Employee Ownership

- Start-Up Equity Incentives

By Industry Outlook (Revenue USD Billion, 2020–2034)

- Technology & Startups

- Financial Services

- Manufacturing

- Professional Services

By Size Outlook (Revenue USD Billion, 2020–2034)

- Large Enterprises

- Medium Businesses

- Small Businesses

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

ESOP Administration Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.78 billion |

|

Market Size in 2025 |

USD 1.90 billion |

|

Revenue Forecast by 2034 |

USD 3.31 billion |

|

CAGR |

6.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.78 billion in 2024 and is projected to grow to USD 3.31 billion by 2034.

The global market is projected to register a CAGR of 6.4% during the forecast period.

In 2024, the North America ESOP administration market accounted for the largest revenue share due to the high adoption of equity compensation across mid-sized and large enterprises.

A few of the key players are Bank of America Merrill Lynch, BMO Harris Bank, Charles Schwab, Computershare, Fidelity Investments, HSBC, J.P. Morgan, Morgan Stanley, Raymond James Financial, TD Ameritrade, UBS Financial Services, Vanguard Group, and Wells Fargo.

The restricted stock units segment accounted for the largest revenue share in 2024, as many public companies prefer them for executive and employee retention.

In 2024, the executive compensation segment accounted for the largest revenue share, fueled by high-value equity components such as RSUs, performance shares, and options awarded to top leadership