Europe Ethylene Market Size, Share, Trends, Industry Analysis Report

By Feedstock (Naphtha, Ethane), By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6273

- Base Year: 2024

- Historical Data: 2020-2023

Overview

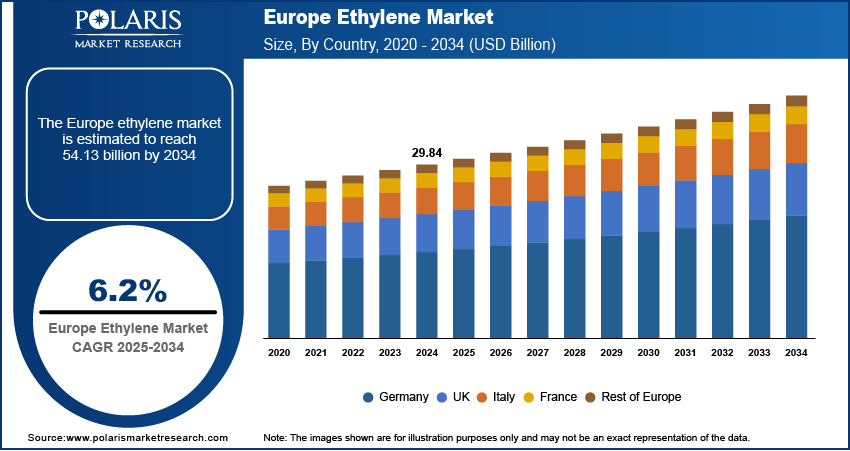

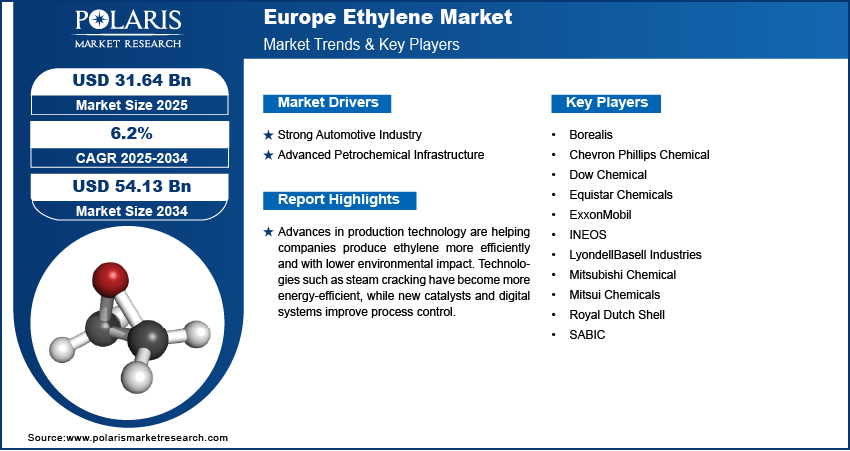

The Europe ethylene market size was valued at USD 29.84 billion in 2024, growing at a CAGR of 6.2% from 2025 to 2034. The market growth is driven by strong automotive industry and advanced petrochemical infrastructure.

Key Insights

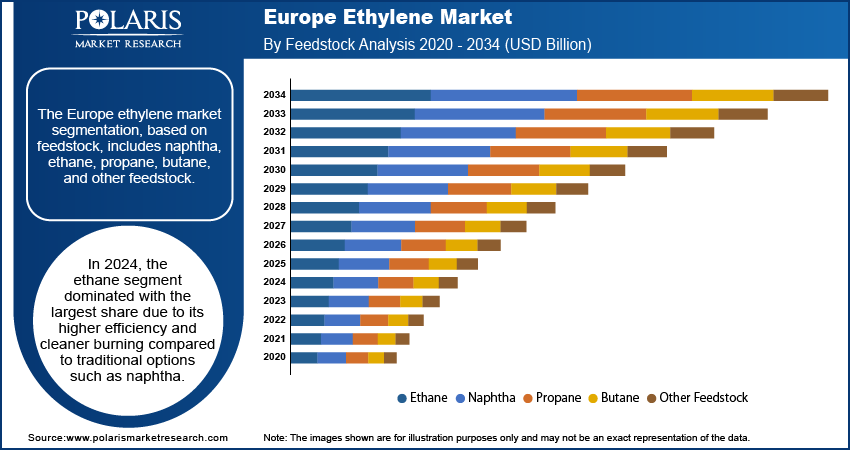

- In 2024, the ethane segment held the largest market share, due to its higher efficiency and cleaner combustion compared to traditional alternatives such as naphtha.

- The automotive segment is projected to grow significantly during the forecast period, fueled by rising demand for lightweight materials that support better fuel efficiency and reduced emissions.

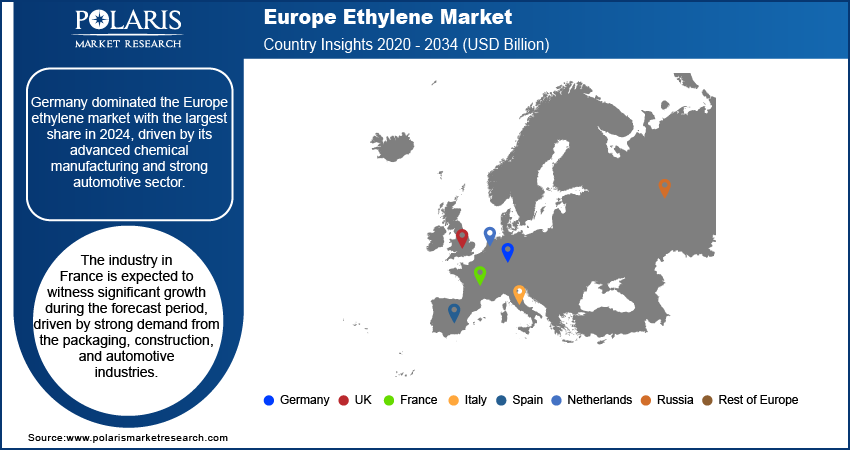

- Germany led the European ethylene market in 2024, supported by its strong chemical manufacturing base and a well-established automotive industry.

- The ethylene market in France is expected to grow considerably during the forecast period, driven by increasing demand from key sectors such as packaging, construction, and automotive

Industry Dynamics

- Strong automotive industry drives the demand for ethylene.

- Advanced petrochemical infrastructure is fueling the industry growth.

- Advances in production technology are helping companies produce ethylene more efficiently and with lower environmental impact.

- High environmental concerns and strict regulations on plastic production and waste management restrain the growth of the ethylene industry.

Market Statistics

- 2024 Market Size: USD 29.84 billion

- 2034 Projected Market Size: USD 54.13 billion

- CAGR (2025–2034): 6.2%

- Germany: Largest market in 2024

Ethylene, a colorless, flammable gas with a sweet odor, is widely used as a key raw material in the petrochemical industry. It is primarily used to produce polyethylene, the most common plastic, as well as other chemicals such as ethylene oxide and ethylene glycol. Ethylene also acts as a natural plant hormone that regulates growth and ripening in fruits.

Europe’s growing commitment to sustainability and recycling is reshaping the packaging industry, where ethylene plays a critical role. Polyethylene, derived from ethylene, is widely used in flexible packaging. To meet EU regulations and consumer demand for eco-friendly products, companies are investing in recyclable and bio-based packaging solutions. Innovation in circular economy practices, such as chemical recycling and waste-to-feedstock technologies, is driving demand for advanced ethylene derivatives. The transition to greener packaging solutions continues to support ethylene demand while aligning with Europe’s long-term environmental goals.

The construction industry in Europe is a significant consumer of ethylene-based materials such as insulation, piping, and flooring. The demand for ethylene derivatives is on the rise with growing investments in green buildings, smart cities, and energy-efficient infrastructure. Government stimulus packages and recovery funds targeting housing and infrastructure projects in countries such as France, Spain, and Eastern Europe further boost this trend. Additionally, stricter building codes are driving the use of high-performance materials made from ethylene. This demand from construction applications fuels the Europe ethylene market growth.

Drivers & Opportunities

Strong Automotive Industry: Europe's well-established automotive sector is driving ethylene demand. According to the Organization of Motor Vehicle Manufacturers, in 2024, in Germany alone, 4.07 million passenger vehicles were manufactured. Ethylene is used to produce lightweight plastics and rubber materials that help reduce vehicle weight, improve fuel efficiency, and meet strict EU emission standards. Countries such as Germany, France, and Italy have a high concentration of automotive manufacturing and suppliers, which fuels the consumption of ethylene-based components. The demand for lightweight and durable materials is expected to increase during the forecast period with the shift toward electric vehicles (EVs) and hybrid models, further boosting ethylene usage across the automotive value chain in Europe.

Advanced Petrochemical Infrastructure: Europe has a highly developed petrochemical infrastructure with integrated production hubs located in countries such as Germany, the Netherlands, and Belgium. These hubs benefit from strong logistics, pipeline connectivity, and proximity to both raw materials and end users. The integration between refineries and petrochemical complexes allows for efficient ethylene production and distribution. This well-established ecosystem supports stable supply chains, encourages investment, and ensures cost efficiency. Europe’s infrastructure advantage supports market growth while enabling quicker adaptation to regulatory and environmental pressures as companies look to modernize and decarbonize existing plants.

Segmental Insights

Feedstock Analysis

The market segmentation, based on feedstock, includes naphtha, ethane, propane, butane, and other feedstock. In 2024, the ethane segment dominated with the largest share due to its higher efficiency and cleaner burning than traditional options, including naphtha. Driven by the region’s push for lower carbon emissions and cleaner energy sources, European petrochemical companies are gradually shifting to ethane, especially where imported ethane from the U.S. is available at competitive prices. This shift is supported by regulatory pressure to decarbonize industrial processes and modernize cracking units. Ethane’s environmental and operational advantages in ethylene production are rising as focus on sustainability in European industry policy increases, thereby fueling the segment growth.

Application Analysis

The Europe ethylene market segmentation, based on application, includes polyethylene, ethylene oxide, ethyl benzene, ethylene dichloride, and others. The ethyl benzene segment accounted for significant growth driven by Europe’s strong plastics and insulation industries, particularly in automotive and construction. Styrene-based products are used in lightweight car parts and energy-efficient building materials, both of which align with the EU’s carbon reduction goals. The need for styrene continues to grow with the increasing adoption of electric vehicles and green building practices. Additionally, rising demand for consumer electronics and packaging materials further boosts this segment growth.

End Use Analysis

The Europe ethylene market segmentation, based on end use, includes building & construction, automotive, packaging, textiles, agrochemicals & agriculture, and others. The packaging segment dominated with the largest share in 2024, driven by demand for food-grade films, bottles, and flexible packaging solutions. Europe’s consumer markets are strong, with a growing preference for lightweight and recyclable packaging materials made from polyethylene. The shift toward sustainable and circular packaging, including chemical recycling, is further increasing demand for advanced ethylene-based products. Government regulations aimed at reducing plastic waste are pushing packaging companies to innovate, often relying on ethylene-derived materials to meet new standards, thereby boosting the growth of the segment.

The automotive segment is expected to experience significant growth during the forecast period, driven by the high demand for lightweight materials that are essential for fuel efficiency and emissions reduction. Ethylene-based plastics and synthetic rubber are widely used in dashboards, bumpers, wiring, and sealing components. Automakers are increasingly using ethylene-derived materials to make vehicles lighter and more efficient, with the EU enforcing strict CO₂ emission standards and promoting electric vehicle adoption. Germany, France, and Italy continue to boost demand for advanced materials for automotive applications, thereby driving the segment growth.

Country Analysis

Germany Ethylene Market Trends

The market in Germany dominated with the largest share in 2024, driven by its advanced chemical manufacturing and strong automotive sector. Major companies such as BASF and Covestro operate large-scale ethylene production facilities, supporting domestic demand and exports. Ethylene is used extensively in the production of plastics, automotive parts, and construction materials. The country’s push for energy efficiency and sustainable manufacturing is encouraging investments in modern, low-emission ethylene plants. The demand for lightweight ethylene-based components rises as the automotive industry shifts toward electric vehicles, thereby driving the growth.

France Ethylene Market Insights

The industry in France is expected to witness significant growth during the forecast period, driven by strong demand from the packaging, construction, and automotive industries. The country is investing in eco-friendly chemical production in line with EU climate goals. French chemical companies are modernizing ethylene production facilities to improve energy efficiency and reduce emissions. Ethylene-based materials are widely used in consumer goods and infrastructure projects across the country. Additionally, France’s growing focus on green building standards and sustainable packaging is fueling demand for ethylene derivatives. This combination of industrial demand and environmental commitment supports the growth of the ethylene industry in France.

UK Ethylene Market Analysis

The UK industry is projected to witness substantial growth during the forecast period, driven by its demand in the packaging, healthcare, and consumer goods sectors. Ethylene is a key raw material for producing plastics used in food packaging, hygiene products, and pharmaceutical containers. Despite post-Brexit challenges, the UK continues to invest in chemical production and recycling technologies to align with its net-zero targets. The government’s focus on sustainability and circular economy practices is encouraging innovation in ethylene-based materials. The demand for clean, efficient ethylene production is expected to rise as domestic industries prioritize local sourcing and low-carbon products, thereby driving the growth.

Netherlands Ethylene Market Outlook

The Netherlands industry is projected to witness substantial growth during the forecast period due to its strategic port infrastructure and integrated petrochemical industry. The Port of Rotterdam hosts some of Europe’s largest ethylene crackers and serves as a key export-import gateway. The country’s strong focus on green energy and circular economy goals is influencing petrochemical companies to upgrade facilities and reduce emissions. Ethylene produced in the Netherlands supports industries across Europe, especially in packaging, construction, and automotive. Government support for innovation and sustainable industrial practices makes the Netherlands a transit hub and a growing production center for greener ethylene, thereby driving the growth.

Key Players and Competitive Analysis

The competitive landscape of the Europe ethylene market is shaped by the presence of major global and regional players such as INEOS, LyondellBasell Industries, Borealis, Royal Dutch Shell, SABIC, Dow Chemical, and ExxonMobil. INEOS and LyondellBasell are among the leading producers, with large-scale ethylene crackers and integrated operations across Europe. Shell and SABIC have strong footprints, particularly in the Netherlands, leveraging access to major ports and petrochemical clusters. Borealis, based in Austria, plays a key role in sustainable ethylene production and innovation in packaging solutions. Dow, ExxonMobil, and Mitsubishi Chemical maintain a competitive edge through advanced technologies and partnerships. Companies are increasingly focusing on decarbonization, bio-based feedstocks, and chemical recycling to meet EU climate targets. The market remains highly integrated, innovation-driven, and sustainability-focused, with a strong emphasis on modernizing production and maintaining energy efficiency to stay competitive in the global ethylene industry.

Key Players

- Borealis

- Chevron Phillips Chemical

- Dow Chemical

- Equistar Chemicals

- ExxonMobil

- INEOS

- LyondellBasell Industries

- Mitsubishi Chemical

- Mitsui Chemicals

- Royal Dutch Shell

- SABIC

Europe Ethylene Industry Developments

In November 2024, Sinopec launched its new ethylene complex in Tianjin, northern China, boosting its annual ethylene capacity by 1.2 million tons. The integrated site advanced Sinopec’s energy efficiency, sustainability, and production of high-value petrochemicals for diverse industries.

Market Segmentation

By Feedstock Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Naphtha

- Ethane

- Propane

- Butane

- Other Feedstock

By Application Output Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

By End Use Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Building & Construction

- Automotive

- Packaging

- Textiles

- Agrochemicals & Agriculture

- Others

By Country Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.84 Billion |

|

Market Size in 2025 |

USD 31.64 Billion |

|

Revenue Forecast by 2034 |

USD 54.13 Billion |

|

CAGR |

6.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to regions, countries, and segmentation. |

FAQ's

The market size was valued at USD 29.84 billion in 2024 and is projected to grow to USD 54.13 billion by 2034.

The market is projected to register a CAGR of 6.2% during the forecast period.

Germany dominated the market share in 2024.

A few of the key players in the market are Borealis, Chevron Phillips Chemical, Dow Chemical, Equistar Chemicals, ExxonMobil, INEOS, LyondellBasell Industries, Mitsubishi Chemical, Mitsui Chemicals, Royal Dutch Shell, and SABIC.

The ethane segment dominated the market share in 2024.

The automotive segment is expected to witness the significant growth during the forecast period.