Ethylene Market Size, Share, Trends, Industry Analysis Report

By Feedstock (Naphtha, Ethane), By Application, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM1516

- Base Year: 2024

- Historical Data: 2020-2023

Overview

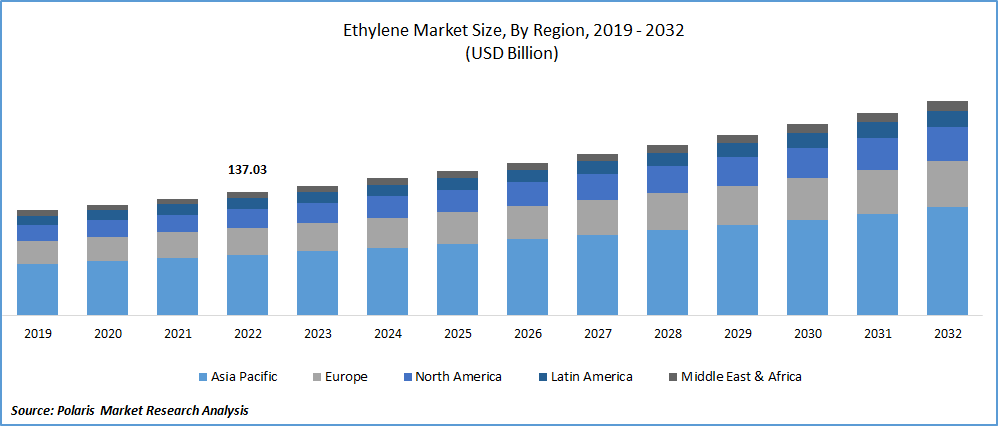

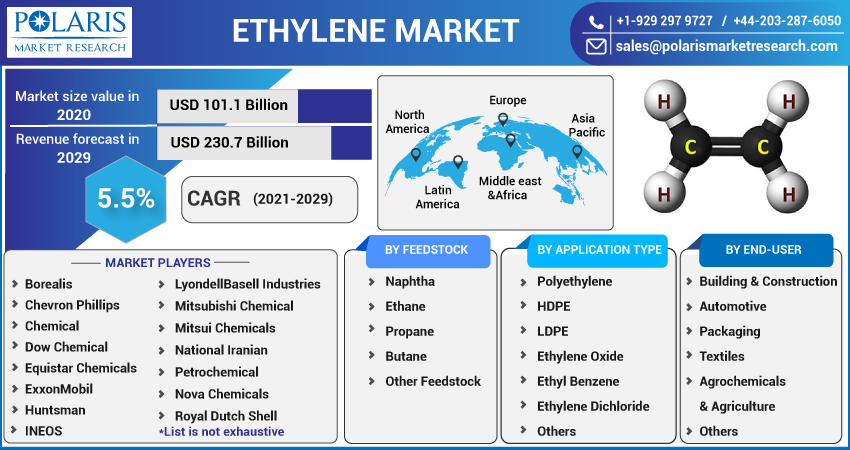

The global ethylene market size was valued at USD 193.88 billion in 2024, growing at a CAGR of 5.8% from 2025 to 2034. The market growth is driven by expansion of the automotive industry and growth in the construction sector.

Key Insights

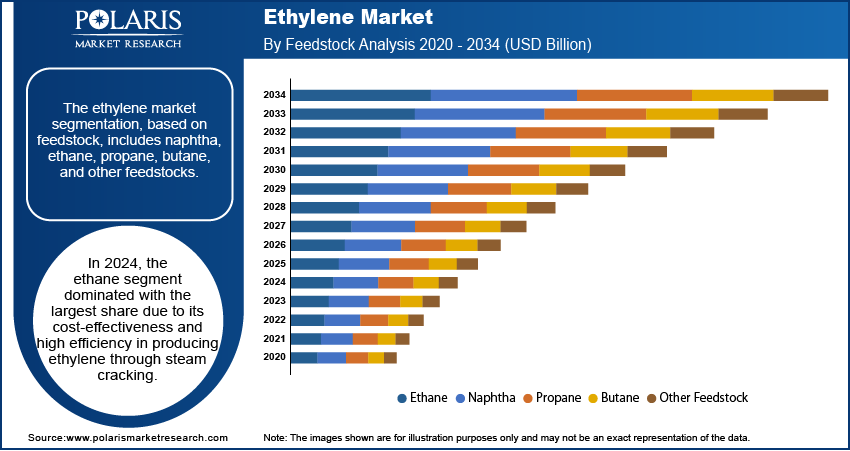

- In 2024, the ethane segment held the largest market share in 2024 due to its cost-efficiency and high yield in ethylene production through steam cracking.

- The automotive segment is anticipated to grow significantly during the forecast period, driven by the use of ethylene in lightweight materials that enhance fuel efficiency and help meet emission regulations.

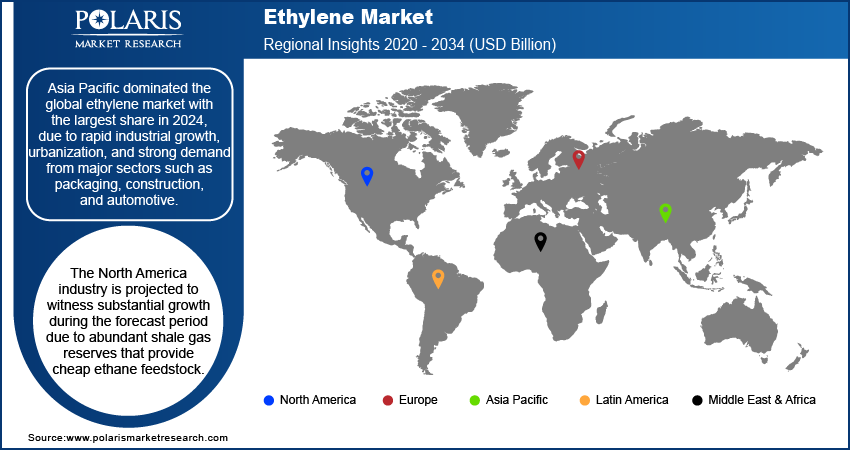

- Asia Pacific led the market in 2024, owing to rapid industrialization, urban expansion, and strong demand from key industries such as packaging, construction, and automotive.

- The market in North America is expected to witness robust growth during the forecast period, supported by abundant shale gas reserves that offer a low-cost supply of ethane, boosting ethylene production.

- The U.S. market is projected to grow considerably in the coming years, driven by its vast shale gas resources, which ensure an economical and efficient ethane supply for steam cracking processes.

Industry Dynamics

- Expansion of the automotive industry drives the demand for ethylene.

- Growth in the construction sector is fueling the industry growth.

- Advances in production technology are helping companies produce ethylene more efficiently and with lower environmental impact.

- High environmental concerns and strict regulations on plastic production and waste management restrain the growth of the ethylene industry.

Market Statistics

- 2024 Market Size: USD 193.88 billion

- 2034 Projected Market Size: USD 339.96 billion

- CAGR (2025–2034): 5.8%

- Asia Pacific: Largest market in 2024

AI Impact on Ethylene Market

- AI enhances performance optimization in ethylene production by analyzing process variables, feedstock quality, and operational conditions to maximize yield, energy efficiency, and plant throughput.

- Integration of AI enables adaptive process control, dynamically adjusting temperatures, pressures, and flow rates in cracking units based on real-time input and demand forecasts.

- AI-powered analytics support early detection of equipment wear, catalyst degradation, or process anomalies, enabling predictive maintenance and reducing downtime across ethylene manufacturing facilities.

- AI improves operator decision-making by offering real-time insights, automated alerts, and process simulations, increasing safety, reducing emissions, and enhancing overall efficiency in ethylene production environments.

Ethylene is a colorless, flammable gas with a sweet odor, widely used as a key raw material in the petrochemical industry. It is primarily used to produce polyethylene, the most common plastic, and other chemicals such as ethylene oxide and ethylene glycol. Ethylene also acts as a natural plant hormone that regulates growth and ripening in fruits.

Ethylene is a major building block in the production of plastics, especially polyethylene, which is used in packaging, containers, bags, and many everyday products. The demand for plastic products grows as consumer goods, food packaging, and e-commerce continue to grow globally. Additionally, developing countries are witnessing a rise in disposable income, which is increasing the consumption of packaged goods. This has led to a rise in the demand for polyethylene, directly boosting the ethylene demand. Therefore, the growth in plastic usage, particularly in Asia Pacific and Latin America, is driving the ethylene demand.

Advances in production technology are helping companies produce ethylene more efficiently and with lower environmental impact. Technologies such as steam cracking have become more energy-efficient, while new catalysts and digital systems improve process control. There is a shift toward using bio-based feedstocks and recycling technologies to create more sustainable ethylene products. These innovations reduce costs and carbon emissions, making production more attractive for manufacturers. Consequently, companies are expanding their ethylene capacities using modern, cleaner technologies, which supports the long-term growth of the industry.

Drivers & Opportunities

Expansion of Automotive Industry: The automotive industry uses ethylene-based products such as synthetic rubber, plastics, and antifreeze (ethylene glycol). The need for lightweight and durable plastic materials is growing as global car production, such as electric vehicles and hybrid vehicles, is expanding. According to the International Organization of Motor Vehicle Manufacturers, in 2024, 67.67 million passenger cars were manufactured. Lightweight plastic components help improve fuel efficiency and reduce vehicle weight, which is important for meeting environmental standards. Ethylene-derived materials are used in dashboards, bumpers, wiring, and engine parts. Car ownership is increasing with rising middle-class populations in emerging regions, which supports the demand for ethylene and its derivatives in vehicle manufacturing, thereby fueling the growth.

Growth in Construction Sector: The construction sector is growing worldwide. According to the Government of Canada, in 2023, 596,000 people were employed in the construction sector in Onterio, Canada. Ethylene is used in making pipes, insulation, flooring, paints, and adhesives, which are materials widely used in residential and commercial construction. The construction sector is seeing strong growth in many regions as urbanization expands and governments invest in infrastructure. Additionally, developing countries such as India and China are heavily investing in smart cities, affordable housing, and transportation networks. These activities require large amounts of ethylene-based materials. The need for energy-efficient, long-lasting building materials further increases the use of ethylene products in modern construction solutions, thereby driving the growth.

Segmental Insights

Feedstock Analysis

The segmentation, based on feedstock, includes naphtha, ethane, propane, butane, and other feedstock. In 2024, the ethane segment dominated with the largest share due to its cost-effectiveness and high efficiency in producing ethylene through steam cracking. The abundance of ethane, especially in North America due to shale gas development, has made it the preferred feedstock. It provides better yields of ethylene compared to other feedstocks such as naphtha or propane. Countries with access to natural gas reserves are investing in ethane-based crackers to reduce production costs and improve margins. This shift toward ethane as a primary raw material, especially in regions such as the U.S. Gulf Coast and the Middle East, is further driving the segment growth.

Application Analysis

The segmentation, based on application, includes polyethylene, ethylene oxide, ethyl benzene, ethylene dichloride, and others. The ethyl benzene segment accounted for significant growth as ethyl benzene is primarily used to produce styrene, which is further processed into plastics, resins, and synthetic rubbers. The rising demand for styrene-based products in packaging, electronics, insulation, and consumer goods is directly driving the ethylbenzene demand. The use of styrene in construction and automotive components grows as industrialization and urbanization grow in emerging economies. This leads to higher demand for ethylbenzene, and in turn, ethylene. Moreover, the expanding global manufacturing sector and rise in durable consumer goods fuel the segment growth.

End Use Analysis

The segmentation, based on end use, includes building & construction, automotive, packaging, textiles, agrochemicals & agriculture, and others. The packaging segment dominated with the largest share due to the wide use of polyethylene films, bottles, and containers. The global rise in online shopping, food delivery, and consumer goods has created a surge in demand for flexible, lightweight, and durable packaging. Food safety, extended shelf life, and convenience packaging trends are further pushing companies to use more plastic materials made from ethylene. In developing regions, the growth of organized retail and FMCG sectors further boosts the demand for ethylene in packaging applications.

The automotive segment is expected to experience significant growth during the forecast period as ethylene is widely used to reduce vehicle weight, improve fuel efficiency, and meet emission standards. Manufacturers are turning to lightweight materials for components such as bumpers, dashboards, and under-the-hood parts as global demand for electric and fuel-efficient vehicles grows. Ethylene is further used to produce antifreeze (ethylene glycol), which is essential in automotive cooling systems. The rapid expansion of vehicle production in countries such as China, India, and Mexico is driving the market growth.

Regional Analysis

Asia Pacific Ethylene Market Trends

Asia Pacific dominated the global market with the largest share in 2024, due to rapid industrial growth, urbanization, and strong demand from major sectors such as packaging, construction, and automotive. Countries, including China, India, South Korea, and Japan, are major consumers and producers of ethylene. Rising disposable income, growing middle-class populations, and booming e-commerce are increasing the need for ethylene-based plastics and packaging. Additionally, governments are investing in large-scale petrochemical complexes to boost local manufacturing. The region’s access to low-cost labor and growing demand for consumer goods make Asia Pacific a major hub for ethylene production and consumption, thereby driving growth.

China Ethylene Market Insights

The industry in China is expected to witness significant growth during the forecast period, driven by its large manufacturing sector and expanding urban infrastructure. High demand for packaging, construction materials, and automotive components fuels ethylene consumption. The Chinese government’s push for self-sufficiency in petrochemicals has led to large investments in integrated ethylene plants and refinery expansions. Additionally, rapid e-commerce growth and urban migration increase the need for plastics and packaging, much of which depends on ethylene, thereby fueling the industry growth in the country.

North America Ethylene Market Analysis

The North America industry is projected to witness substantial growth during the forecast period due to abundant shale gas reserves that provide cheap ethane feedstock. The region has witnessed significant investments in ethane crackers, boosting production capacity and making North America a major ethylene exporter. Demand from industries such as packaging, automotive, and construction is strong, and innovation in production technologies supports efficient, low-cost operations. The U.S. and Canada are further benefiting from rising exports of polyethylene and other ethylene derivatives to Asia and Latin America, thereby boosting the growth.

U.S. Ethylene Market Overview

The U.S. industry is projected to witness substantial growth during the forecast period due to its large shale gas reserves, which provide cost-effective ethane for steam cracking. Over the past decade, several world-scale ethylene plants have been built in Texas and Louisiana, turning the U.S. into a major global supplier. Strong demand from packaging, automotive, and industrial applications keeps domestic consumption high, while a significant portion is exported as polyethylene. The country's advanced infrastructure, technological innovation, and favorable regulatory environment attract continuous investment. These advantages make the U.S. one of the most competitive and influential regions in the ethylene industry.

Europe Ethylene Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by the rising demand from the packaging, automotive, and construction sectors. The region focuses heavily on sustainability and circular economy practices, which encourages innovation in ethylene production and recycling. Strict environmental regulations are pushing companies to invest in cleaner technologies and shift toward bio-based or recycled feedstocks. Despite higher production costs compared to regions such as North America and Asia, Europe benefits from strong research, advanced infrastructure, and integration across the petrochemical value chain. Moreover, growing interest in green plastics and EU climate goals further fuels ethylene demand and development.

Germany Ethylene Market Outlook

The market in Germany is expected to experience significant growth driven by its strong manufacturing base and advanced chemical industry. The country uses ethylene in various high-value applications, including automotive parts, construction materials, and packaging. Germany invests in research-driven innovation and sustainable solutions. It is a home to major chemical companies such as BASF and Covestro. The automotive industry, in particular, drives demand for lightweight and durable ethylene-derived plastics. Germany further emphasizes energy efficiency and low-emission production, aligning with EU sustainability targets, thereby driving the growth.

Key Players and Competitive Analysis

The global ethylene market has been highly competitive, dominated by major players such as ExxonMobil, Dow, SABIC, Shell, Chevron Phillips Chemical, LyondellBasell, INEOS, Borealis, Mitsubishi Chemical, Mitsui Chemicals, Huntsman, Equistar Chemicals, National Iranian Petrochemical Company, and Nova Chemicals. ExxonMobil led with massive production capacity, especially in its Baytown and Beaumont facilities. SABIC capitalized on low-cost Middle Eastern feedstocks, while LyondellBasell stood out as a leading technology licensor with a focus on sustainability. Chevron Phillips operated significant cracker assets in the U.S., generating multi-billion-dollar revenues. INEOS and Borealis expanded their presence through joint ventures such as Borouge in the Middle East. Dow and Shell maintained strong global footprints, while Mitsubishi, Mitsui, and Huntsman focused on innovation and strategic expansions. National Iranian Petrochemical and Nova Chemicals contributed to regional competitiveness. These companies competed on scale, integration, technological advancement, and efforts to align with global environmental and regulatory shifts.

Key Players

- Borealis

- Chevron Phillips Chemical

- Dow Chemical

- Equistar Chemicals

- ExxonMobil

- Huntsman

- INEOS

- LyondellBasell Industries

- Mitsubishi Chemical

- Mitsui Chemicals

- National Iranian Petrochemical

- Nova Chemicals

- Royal Dutch Shell

- SABIC

Ethylene Industry Developments

In August 2024, BPCL selected Lummus Technologies to provide its advanced technology for a large-scale ethylene plant in India. The agreement marked a significant step in expanding India's petrochemical capacity with advanced, energy-efficient production solutions.

In November 2024, Sinopec launched its new ethylene complex in Tianjin, northern China, boosting its annual ethylene capacity by 1.2 million tons. The integrated site advanced Sinopec’s energy efficiency, sustainability, and production of high-value petrochemicals for diverse industries.

Ethylene Market Segmentation

By Feedstock Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Naphtha

- Ethane

- Propane

- Butane

- Other Feedstock

By Application Output Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Ethylene Dichloride

- Others

By End Use Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- Building & Construction

- Automotive

- Packaging

- Textiles

- Agrochemicals & Agriculture

- Others

By Regional Outlook (Volume Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Ethylene Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 193.88 Billion |

|

Market Size in 2025 |

USD 204.84 Billion |

|

Revenue Forecast by 2034 |

USD 339.96 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 193.88 billion in 2024 and is projected to grow to USD 339.96 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are Borealis, Chevron Phillips Chemical, Dow Chemical, Equistar Chemicals, ExxonMobil, Huntsman, INEOS, LyondellBasell Industries, Mitsubishi Chemical, Mitsui Chemicals, National Iranian Petrochemical, Nova Chemicals, Royal Dutch Shell, and SABIC.

The ethane segment dominated the market share in 2024.

The automotive segment is expected to witness the significant growth during the forecast period.