Europe Aircraft Tires Market Share, Size, Trends, Industry Analysis Report

By Type (Radial-Ply Tires, Bias-Ply Tires); By Aircraft Type; By Platform (Fixed-Wing Aircraft, Rotary-Wing Aircraft); By End-User; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 114

- Format: PDF

- Report ID: PM4946

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

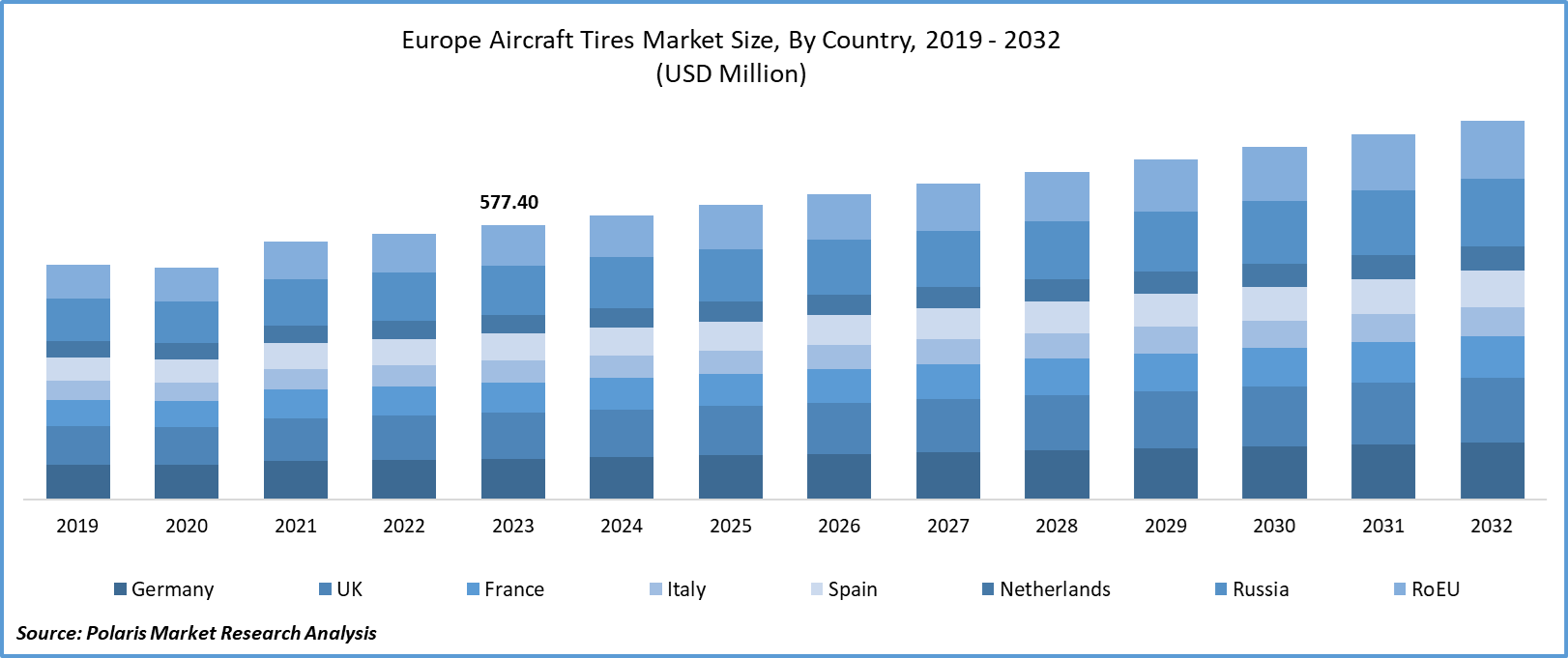

Europe aircraft tires market size was valued at USD 577.40 million in 2023. The market is anticipated to grow from USD 597.90 million in 2024 to USD 797.28 million by 2032, exhibiting the CAGR of 3.7% during the forecast period.

Industry Trends

The Europe aircraft tires market has witnessed significant growth in recent years, driven by the increasing tourism activities within the countries that are responsible for the rising demand for regional aircraft tires. The European Union's statistical office, Eurostat, reported that between August 2021 and August 2022, commercial aviation in Europe increased by roughly 25%. In August 2022, 596,930 commercial flights were operating within the European Union, 14% fewer than in August 2019, when 695,912 commercial airlines were operating within the continent. Because of this, the need for aviation tires in the region is being fuelled by the expansion of European tourism.

To Understand More About this Research:Request a Free Sample Report

European airlines have expanded their fleet size in response to the anticipated rise in air traffic passengers. As a result, Airbus has been dominating the market thanks to the numerous airline orders it has received. For instance, the business got 95 new orders as of April 2022, most of which were for A321Neo models, considerably outpacing the competition. In May 2022, Norwegian Air placed a 50-aircraft Boeing 737 MAX 8 order in May 2022, with options to buy a further 30 aircraft. As a result, Boeing's business potential in Europe grew. Thus, rising fleet size & aircraft developments are propelling the demand for aircraft tires and boosting market growth.

The pandemic caused a reduction in new aircraft orders, affecting the demand for aircraft tires, and major aviation companies like Boeing, Airbus, Emirates, British Airways, and Delta reported substantial financial losses. Additionally, disruptions in the supply chain due to lockdowns and travel restrictions made it challenging for tire makers to source raw materials, further exacerbating the situation. However, the European aircraft tire market is projected to revive with the gradual easing of travel restrictions and economic recovery. The aircraft tires market is expected to grow with advanced technologies to automate production lines, enhance efficiency, and reduce labor costs, enabling them to adapt and return to the market faster.

Key Takeaways

- Germany dominated the market and contributed highest market share

- By type category, the radial-ply tires segment accounted for the largest Europe Aircraft Tires market share and is expected to grow with the highest CAGR

- By aircraft type category, the commercial aviation segment dominated and is anticipated to grow with a lucrative CAGR over the Europe Aircraft Tires market forecast period

What Are the Market Drivers Driving the Demand for Market?

Rising Adoption of Sustainability in Aircraft Industry in Europe

The market is experiencing significant growth due to the potential for zero-carbon and zero-emissions aircraft on intra-European routes is promising. Electric aviation is anticipated to see growth in the near future. Environmental regulations in Europe are becoming more stringent, prompting governments and airports to implement proactive measures to minimize the environmental impact of aviation. For instance, Schiphol Airport in the Netherlands has proposed a cap on the number of flights it will accommodate annually, as improvements in fuel efficiency alone are insufficient to meet emissions standards. France has also recently announced a ban on short-haul flights as part of its eco-friendly transportation initiatives. These regulations are projected to influence the aviation sector in the years ahead significantly, necessitating rapid adaptation of business models by industry stakeholders to maintain operational licenses. The advancement of battery and hydrogen electric aircraft presents a valuable opportunity to reduce the industry's environmental impact, enabling airlines to comply with new regulations and avoid further restrictions.

Which Factor Is Restraining the Demand for Market?

Asset Management Challenges in Maintenance of Aviation Tires Impede the Growth of the Market

Asset management involves overseeing, regulating, and preserving the lifecycle of the aircraft industry. This ensures that the aviation equipment operates at its optimal level and fulfills its intended purpose. This can be a complex task, as it entails monitoring and controlling numerous aviation assets with diverse and intricate requirements. Additionally, maintaining the accuracy of asset information can be problematic due to outdated, inconsistent, or scattered data across multiple systems. Integrating asset management into existing systems and processes can be a lengthy and demanding process, particularly when dealing with legacy systems and data. Furthermore, asset management often necessitates compliance with various regulations, such as those related to the environment, health, and safety, which can be intricate and multifaceted. The management of assets requires a substantial allocation of resources, including workforce, technology, and expertise, which can be challenging to acquire and sustain.

Report Segmentation

The market is primarily segmented based on type, aircraft type, platform, end-user, and country.

|

By Type |

By Aircraft Type |

By Platform |

By End-User |

By Country |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Type Insights

Based on type analysis, the market is segmented into radial-ply tires, bias-ply tires. The radial-ply tires segment holds the largest market revenue share and is projected to grow at a CAGR during the projected period, mainly driven by several factors. The radial tire offers a higher number of landings per tread and is lighter in weight. However, there may be a trade-off in terms of the lifespan of retreads. Radial aircraft tires differ from bias aircraft tires in that the plies run radially from bead to bead at approximately 90° to the center-line of the tire. Radial tires have a rigid belt and flexible carcass, which allows for more landings and reduces rolling resistance.

These tires are generally resistant to penetrations and cuts, especially in the tread area, due to their unique construction process. The stiffer tread in radial tires helps distribute weight evenly, resulting in a consistent contact patch and improved traction. This leads to reduced wear and longer tread life. During landing, aircraft tires generate more heat, which can be withstood by the radial-ply tires, driving the growth of the European aircraft tires market.

By Aircraft Type Insights

Based on aircraft type analysis, the market has been segmented into commercial aviation, military aviation, business, and general aviation. The commercial aviation segment has dominated the market and is anticipated to grow at the fastest CAGR over the forecast period, owing to the magnitude of air traffic. With gradually rising departures per hour in scheduled commercial traffic alone, aircraft are constantly taking off across Europe. Aviation plays a vital role in connecting people and transporting goods throughout Europe, which has profoundly influenced the social and economic development of the European regions, contributing to their sustainability. By utilizing technology and best practices from commercial aviation, the European aircraft tires market is expected to grow further.

Country-wise Insights

Germany

Germany leads the Aircraft Tires market in Europe owing to the rising purchases of commercial aircraft across Germany are a result of the growing need for transportation from the e-commerce and international trade sectors, which has enhanced market value and growth. The need for passenger and freight planes for transportation across Europe is driven by the Lufthansa Group, the second-largest airline in Europe, which has its headquarters in Germany. The majority of the passengers that Lufthansa Group transports to/from Germany are passengers.

Competitive Landscape

The competitive landscape for the European aircraft tires market is characterized by intense competition among key players striving to gain market share. These players are constantly focusing on product development, enhancing sustainability and technological upgradation to meet the customer demands by differentiating themselves through innovation and strategic partnerships. Leading aircraft tires companies dominate the market with their comprehensive aircraft tires solutions tailored to aviation industries driving innovation, expanding the market of the European aircraft tires.

Some of the major players operating in the European market include:

- Bridgestone Corporation Europe

- Continental AG

- Desser Aerospace Companies

- Dunlop Aircraft Tyres Ltd.

- Goodyear Tire and Rubber Company.

- Michelin

- Petlas Tire Corporation

- Qingdao Sentury Tires Company Limited

- Safran Landing Systems

- Trelleborg AB

Recent Developments

- In January 2023, Desser Tire & Rubber Co., LLC. acquired Europe’s leading aircraft tire distributor, Watts Aviation (“Watts”). The combination of Watts and Desser creates the opportunity to enhance service to its current customers via its broadened transatlantic footprint and win new customers as a result of its extended geographical reach. The newly expanded company will continue its focus on providing its customers with exceptional levels of product support and service.

- In May 2022, Lufthansa announced plans to buy 10 brand-new freighters and 7 new passenger Boeing airplanes for a total list price of around USD 6 billion. As a result of several such fleet and aircraft advancements within the country, the market is anticipated to have high growth rates over the forecast period.

- In October 2020, Bridgestone Aircraft Tire Europe launched easytrack app for tracking and health monitoring of aviation tires.

Report Coverage

The Europe aircraft tires market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, component, application, organization size, vertical, and their futuristic growth opportunities.

Aircraft Tires Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 597.90 million |

|

Revenue forecast in 2032 |

USD 797.28 million |

|

CAGR |

3.7% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Application, By Organization Size, By Vertical, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Europe Aircraft Tires Market report covering key segments are on type, aircraft type, platform, end-user, and country.

Europe Aircraft Tires Market Size Worth USD 797.28 Million By 2032

Europe aircraft tires market exhibiting the CAGR of 3.7% during the forecast period.

The key driving factors in Europe Aircraft Tires Market are Rising adoption of sustainability in aircraft industry in Europe