Europe Bus Market Share, Size, Trends, Industry Analysis Report

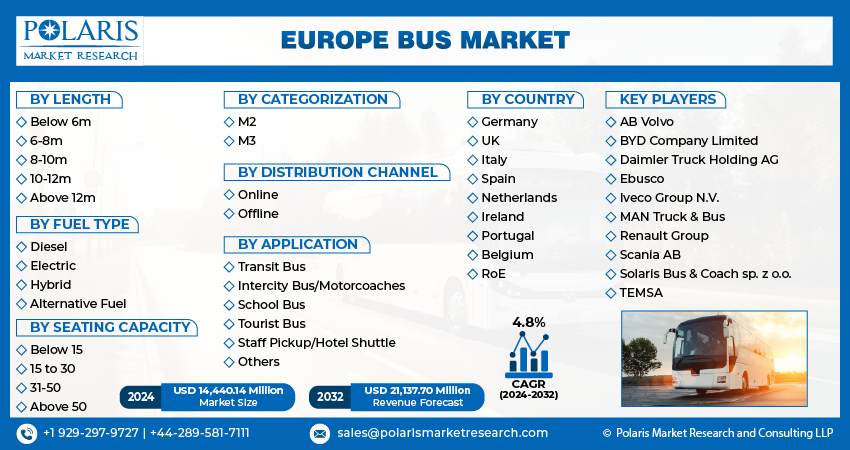

By Length, By Fuel Type, By Seating Capacity, By Categorization (M2, M3), By Application, By Country, And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4200

- Base Year: 2023

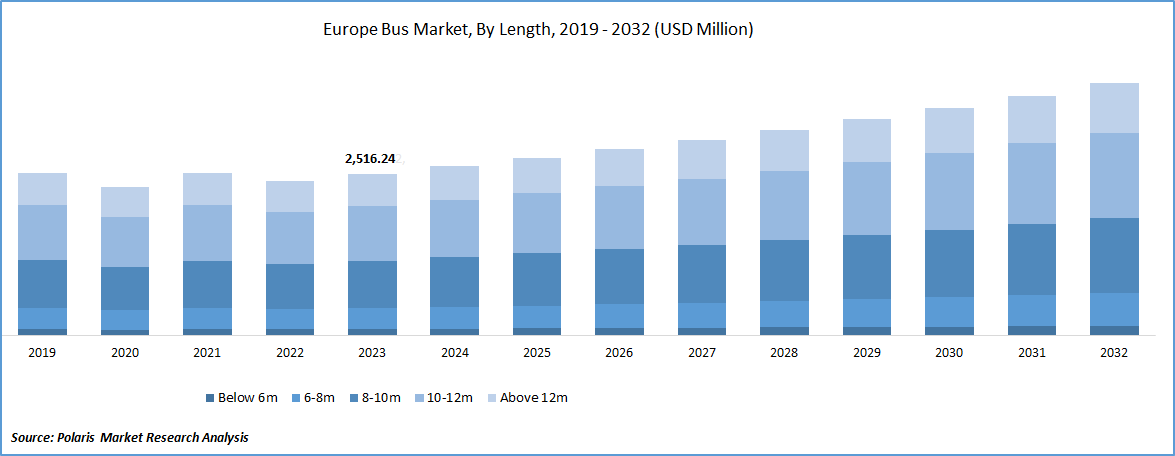

- Historical Data: 2019-2022

Report Outlook

The Europe bus market was valued at USD 13,805.93 million in 2023 and is expected to grow at a CAGR of 4.8% during the forecast period. The Europe bus market is a dynamic and vital sector of the transportation industry, catering to various passenger transportation needs across different regions and applications. Buses serve as a cost-effective and efficient mode of transportation for urban and intercity travel, school transportation, tourism, and more.

As cities and urban areas continue to grow, the demand for efficient and sustainable public transportation systems becomes increasingly critical. Buses play a pivotal role in meeting this demand, offering a cost-effective solution for mass transit. Governments and city authorities are making significant investments in expanding and modernizing bus fleets to enhance public transportation infrastructure, alleviate congestion, and reduce emissions.

To Understand More About this Research: Request a Free Sample Report

In response to the growing emphasis on environmental sustainability and the reduction of carbon emissions, there is a notable shift toward electric and hybrid buses. Electric buses, powered by battery technology, are gaining popularity due to their zero-emission capabilities, lower operating costs, and improved energy efficiency. According to ACEA, new EU bus registrations had a strong first half of 2023, with sales increasing by 15% to reach 14,781 units. France led in sales volume with 2,982 units sold, marking a 22.3% increase. Other major markets also reported substantial growth, including Italy (+62.6%), Spain (+58.7%), and Germany (+27.8%). Governments and public transport operators are increasingly adopting electric and hybrid buses, driving growth in this segment.

The rising middle-class population in developing countries is contributing to the demand for personal transportation, including buses. As disposable incomes increase, more individuals and families are seeking affordable mobility options. Buses provide an economical mode of transportation for commuting within cities and towns, making them an attractive choice for middle-class consumers.

In summary, the bus market is experiencing consistent growth and transformation, driven by factors such as urbanization, environmental considerations, technological advancements, and evolving consumer preferences. The industry is assured for further expansion as governments, transport authorities, and manufacturers continue to invest in improving public transportation infrastructure and embracing sustainable mobility solutions.

Growth Drivers

Increased Utilization of Buses in the Service Sector

Numerous European countries have collaborated with private enterprises, channelling substantial funds into the improvement of road transportation facilities. This reflects their dedication to enhancing infrastructure development and expanding road networks. Governments across Europe have made significant investments in the public transport sector. As part of the European Commission's 2021-2027 budget, they have proposed allocating over USD 30 billion for transport investment, with the aim of further enhancing the region's transportation sector. Moreover, in line with the Paris Agreement, several countries in the region are increasingly committed to transitioning toward a low-carbon economy. Consequently, the demand for technologically advanced, low-emission buses in Europe is on the rise.

In 2022, Germany's lower house of parliament, the Bundestag, introduced a heavily discounted monthly transportation pass, allowing individuals in Germany to use regional public transport for just €9 (approximately $9.65) per month during June, July, and August. Lawmakers introduced this initiative with the hope of not only saving people money but also encouraging them to opt for public transport instead of driving their cars. Additionally, Luxembourg has proudly become the world's first country to offer nationwide free public transport. Since March 2022, no one needs to purchase a ticket to use the country's public transport network.

Investments in infrastructure play a pivotal role in inducing trust in public and active transportation. High-quality public transport infrastructure investments can make sustainable modes of transportation more appealing and safer, especially in the after-effect of a crisis. It is particularly crucial to support public transport agencies in maintaining infrastructure and service provision after the lockdown, as many of them have suffered significant revenue losses due to reduced ridership during the lockdown period. European governments have implemented various policies to encourage public transport usage, including fare subsidies, the creation of car-free zones, and the implementation of congestion charges, all of which contribute to making public transport a more attractive option.

Report Segmentation

The market is primarily segmented based on length, fuel type. Seating capacity, categorization, application, and region.

|

By Length |

By Fuel Type |

By Seating Capacity |

By Categorization |

By Application |

By Distribution Channel |

By Country |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Fuel Type Analysis

Electric segment is expected to grow at high rate over the forecast period

The European bus market has transformed significantly in recent years, with a clear shift towards electric buses. These buses are a cleaner and more sustainable alternative to traditional fossil fuel-powered buses. The demand for electric buses has increased due to rising environmental concerns, stringent emissions regulations, and the need to reduce greenhouse gas emissions.

Battery electric buses, also known as BEVs, are leading the shift towards electrification in the European bus market. They use rechargeable batteries to power electric motors, resulting in zero tailpipe emissions. With advancements in battery technology, electric buses now have longer ranges and faster charging times, making them a practical option for urban and suburban transit. Many European countries and cities have adopted electric buses as part of their efforts to improve air quality and combat climate change.

According to The International Council on Clean Transport, In May 2023, Quarterly data reveals that in the European city bus sector, electric buses have surpassed diesel ones in sales, marking a historic shift in road transportation. This change is not solely due to increased zero-emission sales but also because hybrid buses have overtaken diesel sales, benefiting from predictable routes and charging infrastructure.

By Application Analysis

The transit bus segment is held the largest revenue share in 2023

Transit buses are essential components of public transportation systems in cities, towns, and metropolitan areas. These large motor vehicles are purpose-built to efficiently transport multiple passengers from one location to another within urban and suburban environments. They play a crucial role in facilitating the movement of people while reducing the dependence on private cars and addressing various urban transportation challenges. These buses follow designated routes with stops, adhering to a regular schedule that allows passengers to plan their journeys effectively. Passengers board and disembark at these stops, creating an organized public transportation network.

One key feature of transit buses is their accessibility. They are designed to accommodate passengers with disabilities, featuring low floors for easy boarding, wheelchair ramps or lifts, and designated seating areas for individuals with mobility challenges. This inclusivity promotes equitable access to public transportation services and enhances the overall convenience of the transit system.

The growth of transit buses has a significant influence on the European bus market. As urbanization continues to rise and environmental concerns grow, there is an increasing demand for efficient and sustainable public transportation options. Transit buses are an ideal solution for reducing traffic congestion and emissions while transporting large numbers of passengers.

In Europe, governments and cities are investing in expanding and modernizing their public transportation networks, which includes the procurement of new and eco-friendly transit buses. This growth not only fosters a healthier environment but also stimulates innovation and job opportunities within the bus manufacturing industry. Consequently, the transit bus sector is a pivotal driver of positive change in the European bus market, contributing to more efficient, accessible, and sustainable urban mobility solutions.

Country Insights

Germany held the largest share of the European bus market in 2023

The German intercity buses have expanded significantly, offering more than 1,291 travel combinations across the country. These buses typically travel at an average speed of 68 km/h, and routes via highways tend to have even higher speeds, making them an attractive choice for long-distance travel.

A significant change in the German bus market is the expansion of Flixbus into new territories, including Finland. For instance, Flixbus, a German bus company, launched its first service in Finland with a Vaasa to Warsaw route started in July, offering a 30-hour journey for 60-80 euros.

The German Federal Ministry of Transport has been proactive in promoting sustainable transportation. They have issued funding certificates to 59 transport companies, enabling the acquisition of approximately 1,033 electric buses as part of a USD 1.32 billion project. This initiative aims to reduce the carbon footprint of public transport and support the transition to electric mobility. Germany has set ambitious targets, with plans for 6,600 more electric buses by 2030.

The increase in intercity buses in Germany has been substantial, driven by both private operators like Flixbus and government initiatives to promote sustainable transportation. It is evident that the market for electric buses has been growing steadily. This growth is expected to accelerate the adoption of buses and support infrastructure development.

Key Market Players & Competitive Insigh

The Europe Bus market is characterized by intense competition, with numerous manufacturers holding a significant portion of the market share. Key business strategies employed by market participants to sustain and expand their regional presence include product launches, approvals, strategic acquisitions, and innovations.

Some of the major players operating in the market include:

- AB Volvo

- BYD Company Limited

- Daimler Truck Holding AG

- Ebusco

- Iveco Group N.V.

- MAN Truck & Bus

- Renault Group

- Scania AB

- Solaris Bus & Coach sp. z o.o.

- TEMSA

Recent Developments

- October 2023: Scania unveiled its new battery-electric bus platform at Busworld. It offers sustainable, high-capacity batteries with up to 520 kWh for heavy commercial vehicles, enabling a range of over 500 km. This marks a significant step in Scania's commitment to electrification and CO2 reduction goals, providing comprehensive e-mobility solutions.

- May 2023: Iveco Bus introduced the Streetway Elec, an addition to its diverse Streetway range, manufactured in partnership with Otokar in Turkey, featuring CNG, diesel, and battery-electric options, targeting global markets.

- September 2023: Volvo Buses partnered with MCV to manufacture bodies for its electric city and intercity buses, with production slated for 2024 and the first buses expected in 2025 as part of Volvo Buses' new European business model.

Europe Bus Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14,440.14 million |

|

Revenue forecast in 2032 |

USD 21,137.70 million |

|

CAGR |

4.8% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Length, By Fuel Type, By Seating Capacity, By Categorization, Application, By Country |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 Europe Bus Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Europe Bus Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our More Top Selling Reports:

Garage Organization and Storage Market Size & Share

Port Equipment Market Size & Share

Inspection Machines Market Size & Share

FAQ's

The Europe Bus market size is expected to reach USD 21,137.70 million by 2032

Daimler Truck Holding AG, Iveco Group N.V., AB Volvo, Scania AB, Renault Group are the top market players in the market

The Europe bus market is expected to grow at a CAGR of 4.8% during the forecast period

The Europe Bus Market report covering key segments are length, fuel type. Seating capacity, categorization, application, and region.

Increased Utilization of Buses in the Service Sector are the key driving factors in Europe Bus Market