Inspection Machines Market Size, Share, Trends, Industry Analysis Report

: By Product (Vision Inspection System, X-ray Inspection System, Leak Detection System, Metal Detectors, and Others), Type, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM3233

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

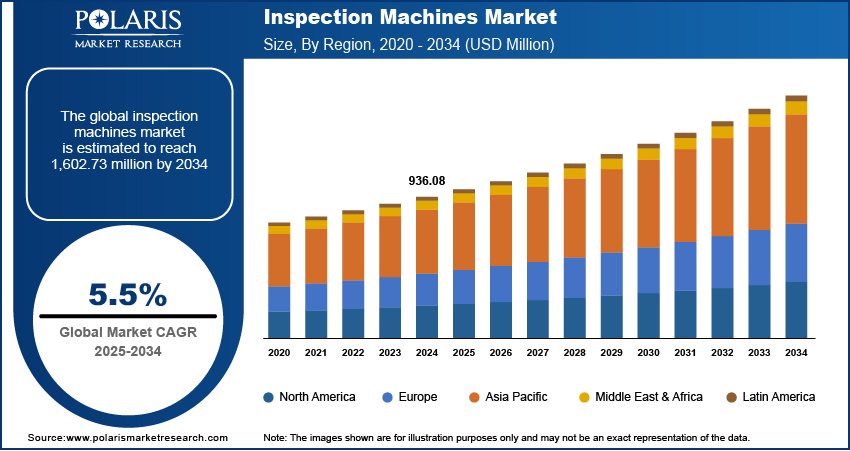

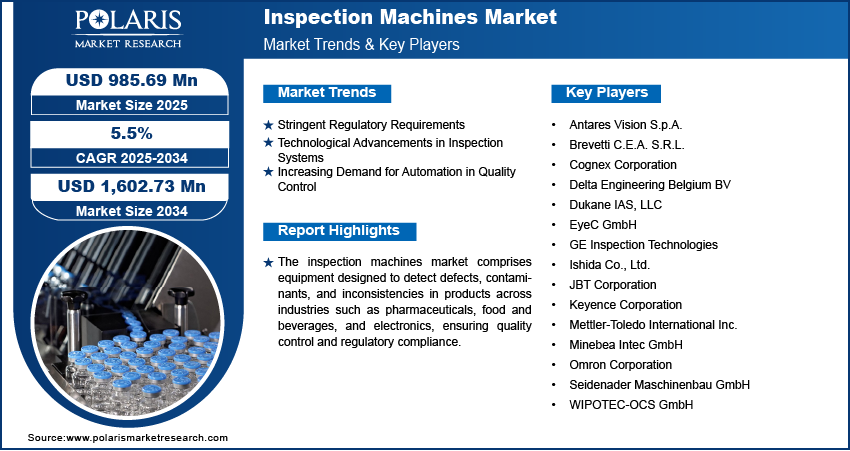

The inspection machines market size was valued at USD 936.08 million in 2024, growing at a CAGR of 5.5% during 2025–2034. The market growth is primarily fueled by the growing regulatory requirements in the food and pharmaceutical sectors and the rising demand for accurate inspection solutions.

Key Insights

- The vision inspection systems segment accounted for the largest market share in 2024, owing to the growing adoption of these systems across sectors such as electronics and pharmaceuticals.

- The pharmaceutical and biotechnology segment is projected to witness the highest growth rate. The segment’s growth is primarily attributed to the rising demand for biopharmaceuticals and personalized medicines.

- North America led the global market in 2024. The region’s advanced manufacturing infrastructure and stringent regulatory frameworks contribute to its leading market share.

- Asia Pacific is projected to witness significant growth, primarily due to rising investments by emerging economies across sectors such as pharmaceuticals and automotive manufacturing.

Industry Dynamics

- The rigorous regulations across industries such as food and beverages and pharmaceuticals to ensure quality and product safety is fueling the adoption of inspection machines.

- Advancements in imaging technologies and the integration of artificial intelligence and machine learning algorithms is propelling the market forward.

- The shift towards sustainable and energy-efficient inspection technologies is projected to provide several market opportunities in the coming years.

- High initial investment and maintenance costs of inspection machines may hinder market growth.

Market Statistics

2024 Market Size: USD 936.08 million

2034 Projected Market Size: USD 1,602.73 million

CAGR (2025-2034): 5.5%

North America: Largest Market in 2024

AI Impact on Inspection Machines Market

- AI enhances defect detection by analyzing high-resolution images and sensor data with higher accuracy as compared manual inspections.

- Machine learning algorithms identify patterns and anomalies, enabling predictive maintenance and reducing equipment downtime.

- AI-powered systems optimize inspection workflows. This helps increase throughput and operational efficiency in manufacturing and quality control.

- Advanced analytics provide actionable insights to improve product quality, streamline processes, and reduce waste across production lines.

To Understand More About this Research: Request a Free Sample Report

The inspection machines market encompasses equipment used for quality control and defect detection across industries such as pharmaceuticals, food and beverages, and electronics. These machines ensure compliance with regulatory standards and enhance product safety by identifying inconsistencies, contamination, or packaging defects. Inspection machines market growth is driven by increasing regulatory requirements in the pharmaceutical and food sectors, advancements in automation and artificial intelligence, and the rising need for high-speed, accurate inspection solutions. Key trends include the integration of vision inspection systems, machine learning-based analytics, and the adoption of robotic inspection technologies to improve efficiency and accuracy.

Market Dynamics

Stringent Regulatory Requirements

Industries such as pharmaceuticals and food and beverages are subject to rigorous regulations to ensure product safety and quality. For instance, the US Food and Drug Administration enforces strict guidelines for manufacturing practices, necessitating the adoption of advanced inspection machines to comply with these standards. Similarly, the European Medicines Agency (EMA) mandates comprehensive quality control measures, prompting companies to integrate sophisticated inspection systems into their production lines. These regulatory frameworks compel manufacturers to invest in inspection technologies that can detect defects, contaminants, and inconsistencies, thereby ensuring compliance and safeguarding public health. Hence, the rising stringent regulatory requirements boost the inspection machines market demand.

Technological Advancements in Inspection Systems

Advancements in imaging technologies, such as high-resolution cameras and X-ray systems, have enhanced the precision and speed of inspections, enabling the detection of minute defects that were previously undetectable. The integration of artificial intelligence (AI) and machine learning (ML) algorithms allows inspection systems to learn from data, improving their accuracy over time and reducing false positives. These technologies facilitate real-time analysis and decision-making, streamlining quality control processes across various industries. Thus, continuous technological advancements in inspection systems propel the inspection machines market development.

Increasing Demand for Automation in Quality Control

The shift toward automation in manufacturing processes is a major driver for the adoption of inspection machines. Automated inspection systems offer higher throughput and consistency compared to manual methods, reducing human error and operational costs. In the pharmaceutical industry, for example, automated vision inspection systems are utilized to examine vials and ampoules for defects, ensuring product integrity without slowing down production lines. The food and beverage sector also employs automated/digital X-ray inspection systems to detect foreign objects in products, enhancing consumer safety. The trend towards Industry 4.0 and smart manufacturing further accelerates the demand for automated inspection solutions, as they integrate seamlessly with other automated processes, providing comprehensive quality assurance.

Market Segment Insights

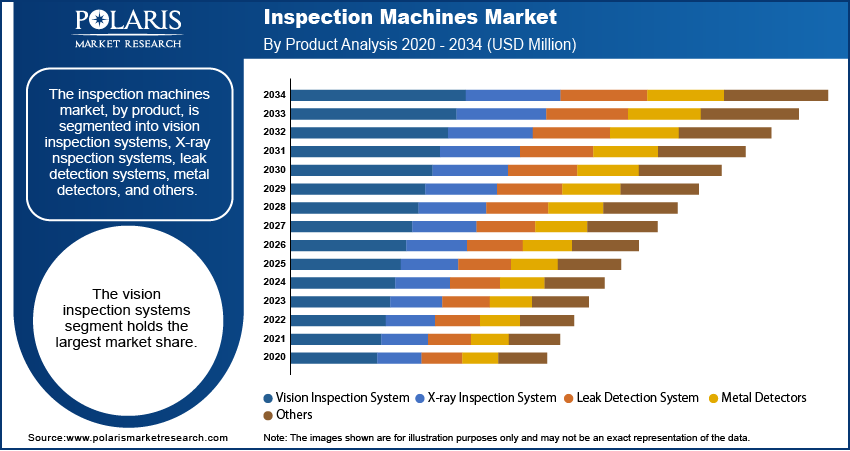

Assessment by Product Outlook

The inspection machines market, by product, is segmented into vision inspection systems, X-ray inspection systems, leak detection systems, metal detectors, and others. In 2024, the vision inspection systems segment held the largest market share. This dominance is attributed to their widespread adoption across industries such as pharmaceuticals, food and beverages, and electronics, where they are utilized for their precision in detecting defects, contaminants, and inconsistencies. The increasing demand for automation and stringent quality control standards further boost the adoption of vision inspection systems.

Evaluation by Type Outlook

The inspection machines market, by type, is categorized into fully automated, semi-automated, and manual systems. The fully automated segment holds the largest market share. This dominance is attributed to their high throughput rates, enhanced inspection accuracy, and compliance with stringent regulatory standards, making them indispensable in industries such as pharmaceuticals and biotechnology. The integration of advanced technologies, including artificial intelligence and machine learning, has further augmented the efficiency and reliability of these systems, leading to their widespread adoption.

Assessment by End Use Outlook

The inspection machines market, by end use, is segmented into pharmaceutical and biotechnology companies, medical device manufacturers, and others. The pharmaceutical and biotechnology companies segment holds the largest market share. This prominence is driven by stringent regulatory requirements necessitating rigorous quality control measures to ensure product safety and efficacy. The increasing adoption of automation and technological advancements in inspection systems further supports this segment's dominance, as companies strive to enhance manufacturing efficiency and comply with evolving industry standards.

The pharmaceutical and biotechnology segment is experiencing the highest growth rate due to the rising demand for biopharmaceuticals, biosimilars, and personalized medicines, which require precise and reliable inspection processes. Additionally, the focus on reducing production costs, minimizing product recalls, and improving overall manufacturing efficiency has led to increased investments in advanced inspection technologies within this sector.

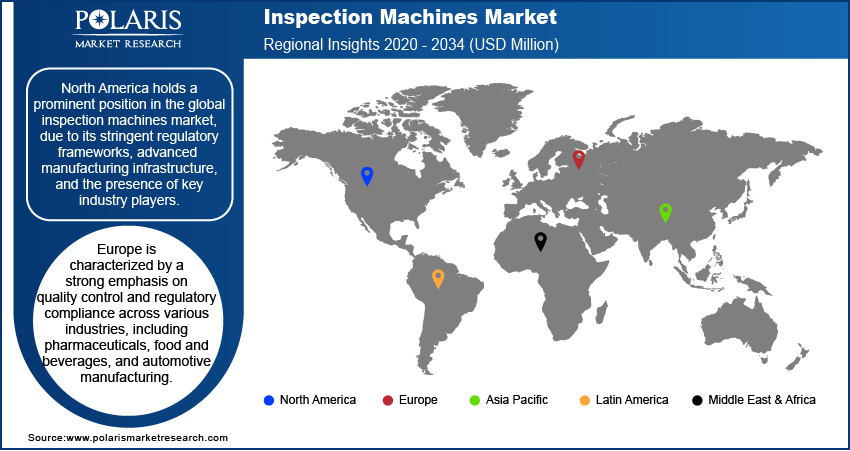

Regional Outlook

By region, the study provides inspection machines market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America accounted for the largest market share. This dominance is primarily attributed to the region’s stringent regulatory frameworks, advanced manufacturing infrastructure, and the presence of key industry players. Industries such as pharmaceuticals, food and beverages, and electronics in North America are major contributors to market growth, driven by the need for compliance with rigorous quality and safety standards. Additionally, technological advancements and a strong focus on research and development propel the inspection machines market expansion in this region.

Europe is characterized by a strong emphasis on quality control and regulatory compliance across various industries, including pharmaceuticals, food and beverages, and automotive manufacturing. Countries such as Germany, France, and the UK are at the forefront of adopting advanced inspection technologies to ensure product safety and adherence to stringent standards. The pharmaceutical sector, in particular, mandates rigorous inspection protocols to comply with European Pharmacopoeia standards, driving the demand for sophisticated inspection systems. Additionally, the region's focus on environmental sustainability and consumer safety further propels the integration of innovative inspection solutions in manufacturing processes.

The Asia Pacific inspection machines market is expected to witness significant growth during the forecast period. Countries such as China, Japan, and India are experiencing increased investments in sectors such as automotive manufacturing, electronics production, and pharmaceuticals. This surge is driven by the need to enhance product quality and safety to meet both domestic and international standards. The food & beverage industry also contributes to market expansion, with manufacturers implementing advanced inspection technologies to ensure product integrity and consumer safety. Government initiatives promoting industrial automation and smart manufacturing further support the adoption of state-of-the-art inspection systems in the region.

Key Players and Competitive Insights

The competitive landscape of the inspection machines market is marked by intense competition among established manufacturers and emerging players focused on technological advancements. Companies are investing in automation, artificial intelligence (AI), and machine vision to enhance inspection accuracy, speed, and efficiency across industries such as pharmaceuticals, food & beverage, and automotive. The demand for high-precision quality control, regulatory compliance, and defect detection is driving innovation, with manufacturers integrating IoT-enabled smart inspection systems to improve real-time monitoring and data analytics. The market is also shaped by stringent government regulations, particularly in industries such as healthcare and food safety, compelling companies to develop advanced non-destructive testing (NDT) and high-speed inspection solutions. Additionally, strategic mergers and acquisitions, and partnerships are common, allowing firms to expand their technological capabilities and global footprint. As industries move toward fully automated production lines, competition continues to intensify, with a strong focus on efficiency, reliability, and cost-effectiveness.

Cognex Corporation specializes in machine vision products, including barcode readers and vision systems, which are utilized in manufacturing and distribution to enhance automation and quality control. Their technologies are applied across various industries to guide assembly robots, inspect products, and track items throughout the production process.

Mettler-Toledo International Inc. manufactures precision instruments and offers services for applications in research, quality control, and manufacturing. Their product range includes laboratory balances, pipettes, and analytical instruments, serving industries such as pharmaceuticals, food and beverage, and chemicals.

List of Key Companies

- Antares Vision S.p.A.

- Brevetti C.E.A. S.R.L.

- Cognex Corporation

- Delta Engineering Belgium BV

- Dukane IAS, LLC

- EyeC GmbH

- GE Inspection Technologies (a subsidiary of Baker Hughes Company)

- Ishida Co., Ltd.

- JBT Corporation

- Keyence Corporation

- Mettler-Toledo International Inc.

- Minebea Intec GmbH

- Omron Corporation

- Seidenader Maschinenbau GmbH (a subsidiary of Körber AG)

- WIPOTEC-OCS GmbH

Inspection Machines Industry Developments

- January 2025: Wabtec Corporation announced an agreement to acquire Evident's Inspection Technologies division for $1.78 billion. This strategic move aims to enhance Wabtec's offerings in remote visual inspection and analytical instruments across industries such as railways, mining, and manufacturing. The acquisition is expected to be finalized by mid-2025.

- August 2024: Cognex expanded its In-Sight SnAPP vision sensor capabilities by launching an AI-enabled counting tool, aiming to simplify automation of assembly verification and inventory management tasks.

Inspection Machines Market Segmentation

By Product Outlook (Revenue – USD Million, 2020–2034)

- Vision Inspection System

- X-ray Inspection System

- Leak Detection System

- Metal Detectors

- Others

By Type Outlook (Revenue – USD Million, 2020–2034)

- Fully Automated

- Semi-Automated

- Manual

By End Use Outlook (Revenue – USD Million, 2020–2034)

- Pharmaceutical & Biotech Companies

- Medical Device Manufacturer

- Others

By Regional Outlook (Revenue – USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Inspection Machines Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 936.08 million |

|

Market Size Value in 2025 |

USD 985.69 million |

|

Revenue Forecast by 2034 |

USD 1,602.73 million |

|

CAGR |

5.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The inspection machines market size was valued at USD 936.08 million in 2024 and is projected to grow to USD 1,602.73 million by 2034.

The market is projected to register a CAGR of 5.5% during the forecast period.

North America held the largest share of the inspection machines market revenue in 2024.

A few key players are Antares Vision S.p.A.; Brevetti C.E.A. S.R.L.; Cognex Corporation; Delta Engineering Belgium BV; Dukane IAS, LLC; EyeC GmbH; GE Inspection Technologies (a subsidiary of Baker Hughes Company); Ishida Co., Ltd.; JBT Corporation; Keyence Corporation; Mettler-Toledo International Inc.; Minebea Intec GmbH; Omron Corporation; Seidenader Maschinenbau GmbH (a subsidiary of Körber AG); and WIPOTEC-OCS GmbH.

The fully automated segment accounted for the largest share of the market in 2024.

Inspection machines are equipment used to detect defects, contaminants, or inconsistencies in products across various industries, including pharmaceuticals, food and beverages, and electronics. These machines ensure product quality, regulatory compliance, and manufacturing efficiency by utilizing technologies such as vision inspection systems, X-ray inspection, metal detection, and leak detection. They play a crucial role in identifying issues such as mislabeling, packaging defects, and contamination, helping manufacturers maintain safety standards and reduce product recalls.

A few key trends in the market are described below: