Europe Desiccant Dehumidifier Market Size, Share, Trends, & Industry Analysis Report

By Product (Fixed/Mounted and Portable), By Application, By End User, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6428

- Base Year: 2024

- Historical Data: 2020-2023

Overview

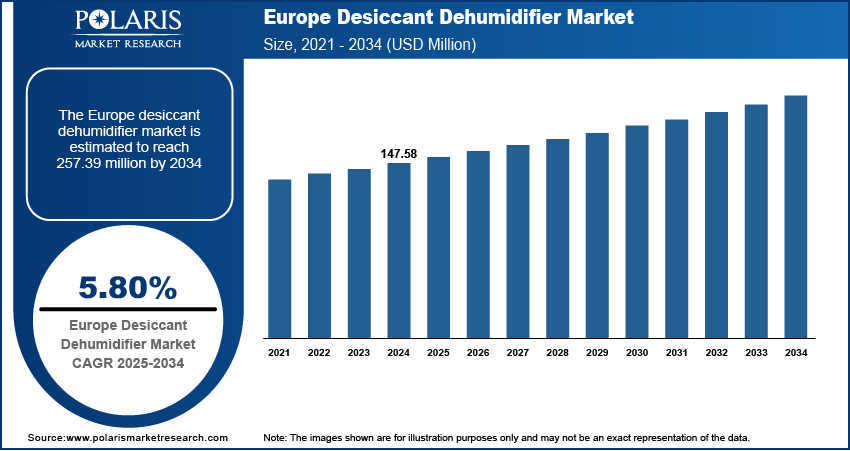

The Europe desiccant dehumidifier market size was valued at USD 147.58 million in 2024, growing at a CAGR of 5.80% from 2025 to 2034. Key factors driving demand for desiccant dehumidifiers in Europe include high production of automobiles, growing investment in semiconductor manufacturing, and increasing urbanization.

Key Insights

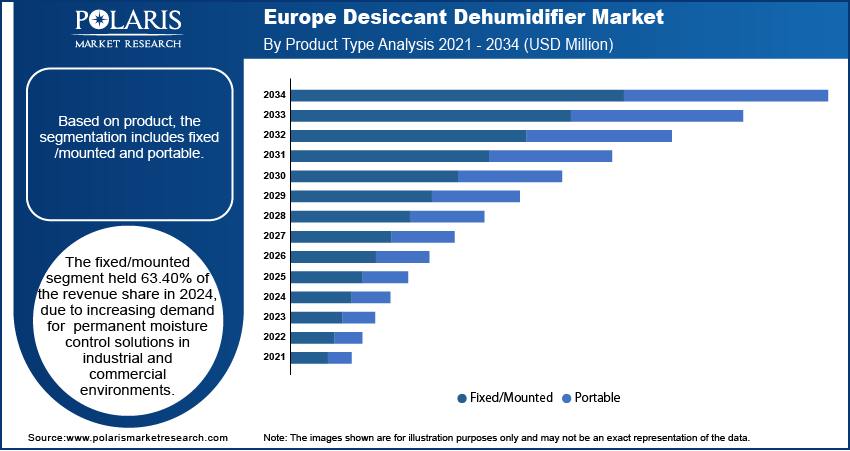

- The fixed/mounted segment held 63.40% of the revenue share in 2024, due to increasing demand for permanent moisture control solutions in industrial settings.

- The construction segment accounted for 22.32% of the revenue share in 2024 due to the need for moisture control during building and renovation projects.

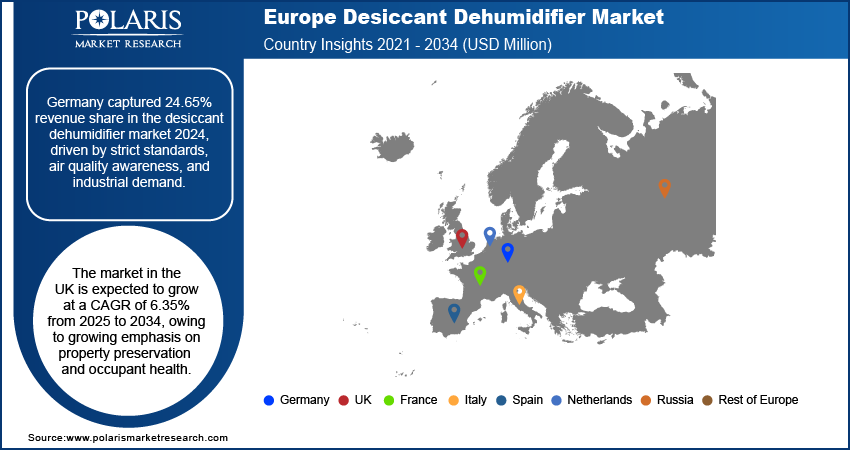

- Germany's desiccant dehumidifier market accounted for 24.65% of revenue share in 2024, owing to stringent building standards and increasing awareness of indoor air quality.

- The market in the UK is expected to grow at a CAGR of 6.35% from 2025 to 2034, owing to growing emphasis on property preservation.

Industry Dynamics

- The high production of automobiles in Europe is driving the demand for desiccant dehumidifiers as automakers use these devices in paint shops and assembly lines to maintain optimal humidity levels.

- The increasing investment in semiconductor manufacturing in the region is boosting demand for desiccant dehumidifiers, as semiconductor production requires extremely controlled environments.

- The expanding pharmaceutical sector and the rising number of data centers are creating a lucrative market opportunity.

- The high cost of desiccant dehumidifiers is projected to hamper the market growth.

AI Impact on the Europe Desiccant Dehumidifier Market

- AI is enhancing the Europe desiccant dehumidifier market by enabling smart humidity control through predictive analytics and IoT integration.

- AI-driven sensors optimize performance by adjusting operations based on real-time environmental data.

- Machine learning helps in energy consumption optimization, aligning with EU sustainability goals.

Market Statistics

- 2024 Market Size: USD 147.58 Million

- 2034 Projected Market Size: USD 257.39 Million

- CAGR (2025-2034): 5.80%

- Germany: Largest Market Share in 2024

A desiccant dehumidifier uses a hygroscopic material, such as silica gel, to absorb moisture from the air. Desiccant dehumidifiers are ideal for low-temperature environments and precise humidity control. These units are commonly used in museums, pharmaceuticals, hyperscale data centers, and industrial drying processes, where maintaining low humidity levels is critical for product quality and preservation.

The Europe desiccant dehumidifier market is driven by stringent regulations on indoor air quality and humidity control across industries. These devices are widely used in pharmaceuticals, food processing, and heritage conservation across the region as they offer efficient moisture removal in cold climates where refrigerant models are less effective. European manufacturers emphasize energy efficiency, sustainability, and smart controls, aligning with regional environmental standards, making desiccant systems a preferred choice for critical humidity-sensitive applications.

The Europe desiccant dehumidifier market demand is driven by the growing urbanization. European Commission, in its report, stated that Europe's level of urbanization is expected to increase to approximately 83.7% in 2050. This is increasing the development of commercial buildings, data centers, hospitals, and underground infrastructure that require precise moisture management equipment, such as a desiccant dehumidifier, to protect equipment and ensure indoor air quality. Urbanization in the region is also propelling industrialization, which is creating the need for climate-controlled storage and manufacturing spaces, further boosting demand for desiccant dehumidifiers. Therefore, the growing urbanization in Europe is fueling the adoption of desiccant dehumidifiers.

Drivers & Opportunities/Trends

High Production of Automobiles: Automakers use desiccant dehumidifiers in paint shops and assembly lines to maintain optimal humidity levels, which prevents moisture-related defects like paint blistering, rust formation, and electronic component damage. Hence, as automobile production scales up, manufacturers expand their facilities and invest in advanced climate control systems such as desiccant dehumidifiers to ensure consistent product quality and meet stringent industry standards. European Automobile Manufacturers' Association, in its report, stated that 14.8 million vehicles are manufactured in the European Union per year. Additionally, the growing adoption of electric vehicles (EVs) is further amplifying the demand for desiccant dehumidifiers, as EV batteries and sensitive electronics are especially vulnerable to humidity.

Growing Investment in Semiconductor Manufacturing: The increasing investment in semiconductor manufacturing in the region is boosting demand for desiccant dehumidifiers, as semiconductor production requires extremely controlled environments. In 2023, the European Union launched the EU Chips Act, which aims to mobilize over €43 billion or USD 47.13 billion in public and private investment until 2030 to strengthen the EU's semiconductor ecosystem. Semiconductor fabrication plants, or fabs, must maintain ultra-low humidity levels to prevent moisture from damaging sensitive wafers and microchips during production. This is driving the adoption of desiccant dehumidifiers, as even trace amounts of humidity can cause oxidation, corrosion, or defects in the microscopic circuits, leading to high rejection rates and increased costs. Therefore, as investment in semiconductor manufacturing rises, driven by the demand for advanced electronics, AI, and 5G technology, companies expand their facilities and upgrade their environmental control systems. This expansion directly increases the need for high-performance desiccant dehumidifiers, which are essential for creating and maintaining the dry, stable conditions critical to semiconductor production.

Segmental Insights

Product Analysis

Based on product, the segmentation includes fixed/mounted and portable. The fixed/mounted segment held 63.40% of the revenue share in 2024, due to increasing demand for permanent moisture control solutions in industrial and commercial environments. Manufacturers, pharmaceutical companies, food processing facilities, and data centers prioritized fixed/mounted systems for consistent humidity regulation to protect sensitive equipment, maintain product quality, and comply with stringent regulatory standards. The ability of these systems to operate efficiently in low-temperature and low-humidity conditions offers them a distinct advantage over other dehumidification technologies, especially in Northern and Central European countries where cold storage and winter conditions are prevalent. Additionally, growing investments in infrastructure and industrial automation across Germany, France, and the Nordic regions have accelerated the adoption of fixed dehumidifier systems.

The portable segment is projected to grow at a CAGR of 6.92% from 2025 to 2034, owing to rising demand in residential applications and small-scale commercial spaces. Homeowners and property managers are increasingly seeking flexible, easy-to-install solutions to combat dampness and mold in basements, bathrooms, and older buildings with poor ventilation. Portable units require no permanent installation, offer plug-and-play functionality, and are cost-effective for intermittent use, making them highly attractive to homeowners and property managers. Advancements in energy efficiency, compact design, and smart features, such as app-based monitoring and automatic humidity control, are enhancing their appeal. Furthermore, government initiatives promoting indoor air quality and energy-efficient appliances in countries like the UK, Italy, and Spain are creating favorable conditions for portable desiccant dehumidifiers to gain widespread adoption.

Application Analysis

In terms of application, the segmentation includes energy, chemical, construction, electronics, and food & pharmaceuticals. The construction segment accounted for 22.32% of the revenue share in 2024 due to the widespread need for moisture control during building and renovation projects. Contractors rely on desiccant units to maintain optimal humidity levels in enclosed environments, especially during the drying of concrete, plaster, and coatings, where excess moisture leads to structural damage, mold growth, and costly delays. Additionally, the surge in infrastructure development, residential retrofits, and commercial real estate projects across Germany, France, and the Netherlands has significantly boosted demand for strong, mobile drying solutions.

The electronics segment is estimated to grow at a CAGR of 7.28% from 2025 to 2034, owing to increasing semiconductor manufacturing and advanced electronics production. Facilities producing microchips, printed circuit boards, and sensitive electronic components require ultra-low humidity environments to prevent electrostatic discharge, corrosion, and defects during fabrication, which is increasing the demand for desiccant dehumidifiers. Furthermore, the rise of 5G technology, electric vehicles, and IoT devices is accelerating investment in cleanrooms, where even minor humidity fluctuations can compromise product yield. Desiccant dehumidifiers offer the reliability, scalability, and precision control necessary for cleanroom environments, making them crucial in this high-tech sector.

End User Analysis

In terms of end user, the segmentation includes commercial, industrial, and others. The industrial segment adopted 9.28 thousand units of desiccant dehumidifiers across Europe in 2024, due to stringent environmental control requirements across manufacturing, processing, and storage facilities. The expansion of automated production lines and the growing emphasis on compliance with EU health, safety, and quality standards, particularly in GMP (Good Manufacturing Practice) environments, have increased the demand for industrial-grade dehumidification. Additionally, aging industrial infrastructure across countries such as Italy, Spain, and Poland requires modern moisture control upgrades, further boosting adoption. The rapid integration of desiccant systems into large-scale HVAC setups in factories and processing plants contributes to the industrial sector’s dominance.

Country Analysis

Germany desiccant dehumidifier market accounted for 24.65% of revenue share in 2024. This is attributed to stringent building standards, increasing awareness of indoor air quality, and the growing need for moisture control in industrial and commercial applications. Germany's push toward energy-efficient and airtight building designs, particularly under the Energy Saving Ordinance (EnEV) and the transition toward passive house standards, has led to reduced natural ventilation, thereby increasing the risk of condensation and mold growth. This propelled the need for effective dehumidification solutions, such as a desiccant dehumidifier. Additionally, sectors such as pharmaceuticals, food processing, and automotive manufacturing in the country heavily adopted desiccant dehumidifiers for humidity control and to maintain product quality.

The market in the UK is expected to grow at a CAGR of 6.35% from 2025 to 2034, owing to growing emphasis on property preservation and occupant health. Many UK homes and commercial buildings, particularly those built before the 20th century, have poor insulation and ventilation, leading to persistent damp and mold issues. This increased people's and institutional focus on effective moisture control solutions such as desiccant dehumidifiers. Moreover, regulatory attention to indoor air quality and building safety, coupled with rising awareness of health risks associated with mold exposure, is encouraging both residential and commercial users to invest in advanced dehumidification technologies.

Key Players & Competitive Analysis Report

The Europe desiccant dehumidifier market is highly competitive, featuring a mix of established global players and specialized regional manufacturers. Key companies such as Munters Group AB, Condair Group, and Atlas Copco AB dominate the market with advanced, energy-efficient solutions tailored for industrial, commercial, and pharmaceutical applications. Parker Hannifin Corporation and Trane Technologies PLC leverage their broad HVAC expertise to offer integrated dehumidification systems. Meanwhile, niche players such as Bry-Air, DehuTech AB, and Desiccant Technologies Group focus on customized, high-performance units for specific sectors. Seibu Giken and Trotec GmbH further intensify competition with innovative rotor-based technologies and portable solutions. The market is driven by stringent regulations on indoor air quality, growing demand in data centers and cleanrooms, and an increasing emphasis on energy efficiency, prompting continuous innovation and strategic expansions among competitors.

Major companies operating in the Europe desiccant dehumidifier industry include Atlas Copco AB, Bry-Air, Condair Group, DehuTech AB, Desiccant Technologies Group, Munters Group AB, Parker Hannifin Corporation, Seibu Giken, Trane Technologies PLC, and Trotec GmbH.

Key Players

- Atlas Copco AB

- Bry-Air

- Condair Group

- DehuTech AB

- Desiccant Technologies Group

- Munters Group AB

- Parker Hannifin Corporation

- Seibu Giken

- Trane Technologies PLC

- Trotec GmbH

Industry Developments

May 2025, Atlas Copco launched a new range of portable desiccant air dehumidifiers for air treatment in industries working in the toughest conditions.

October 2024, Munter signed an agreement to acquire Hotraco (NL) to strengthen its position in Europe.

July 2024, Munter expanded its digital solutions by signing an agreement to acquire the majority share in Automated Environments (AEI), a US-based company specializing in automated control systems for the layer industry.

Europe Desiccant Dehumidifier Market Segmentation

By Product Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Fixed/Mounted

- Portable

By Application Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Energy

- EV Battery Manufacturing

- Power Plants and Wind Turbines

- Chemical

- Construction

- Electronics

- Food & Pharmaceuticals

By End User Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Commercial

- Industrial

- Others

By Country Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Desiccant Dehumidifier Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 147.58 Million |

|

Market Size in 2025 |

USD 154.92 Million |

|

Revenue Forecast by 2034 |

USD 257.39 Million |

|

CAGR |

5.80% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume Thousand Units, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 147.58 million in 2024 and is projected to grow to USD 257.39 million by 2034.

The market is projected to register a CAGR of 5.80% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are Atlas Copco AB, Bry-Air, Condair Group, DehuTech AB, Desiccant Technologies Group, Munters Group AB, Parker Hannifin Corporation, Seibu Giken, Trane Technologies PLC, and Trotec GmbH.

The fixed/mounted segment dominated the market revenue share in 2024.

The electronics segment is projected to witness the fastest growth during the forecast period.