Desiccant Dehumidifier Market Size, Share, Trends, & Industry Analysis Report

By Product (Fixed/Mounted and Portable), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM5174

- Base Year: 2024

- Historical Data: 2020-2023

Overview

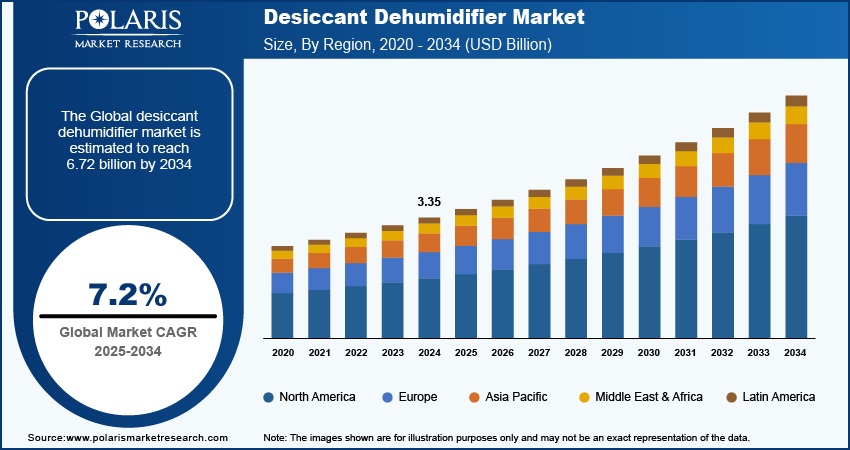

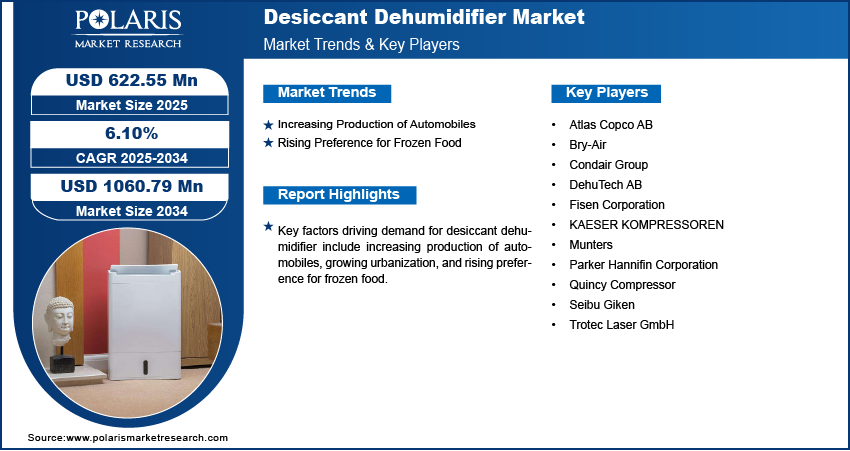

The global desiccant dehumidifier market size was valued at USD 591.40 million in 2024, growing at a CAGR of 6.10% from 2025 to 2034. Key factors driving demand for desiccant dehumidifier include increasing production of automobiles, growing urbanization, and rising preference for frozen food.

Key Insights

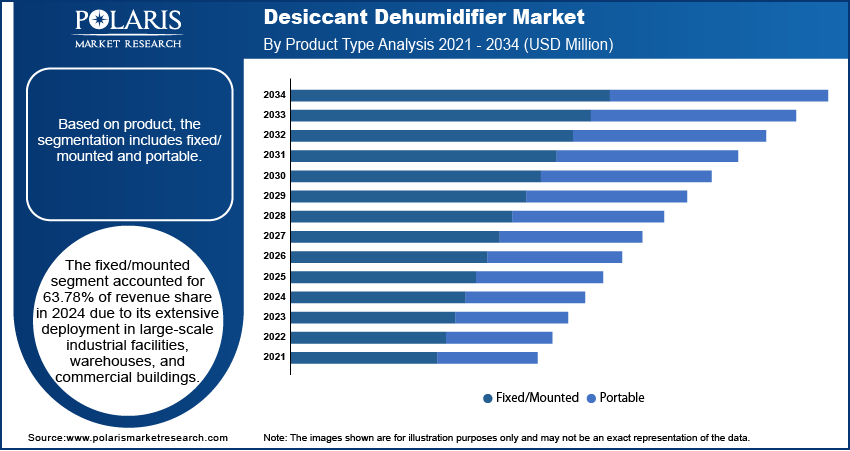

- The fixed/mounted segment accounted for 63.78% of revenue share in 2024 due to its extensive deployment in large-scale industrial facilities.

- The industrial segment held 55.33% of revenue share in 2024, due to widespread adoption of desiccant dehumidifiers across manufacturing plants and food processing units.

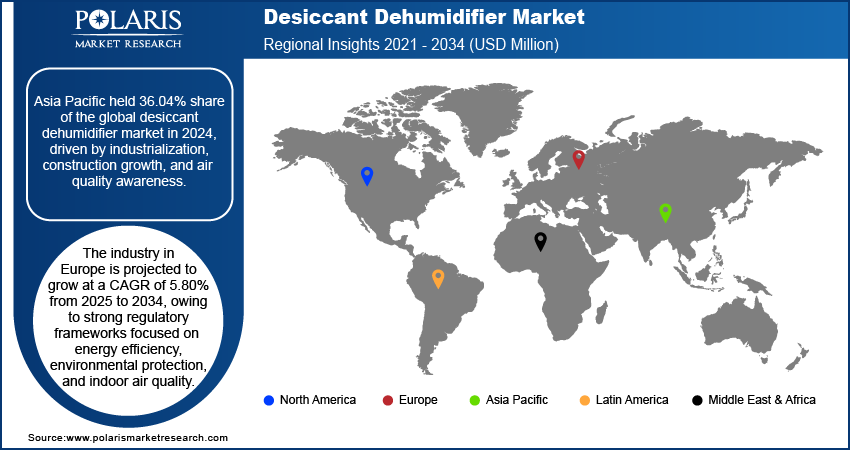

- Asia Pacific desiccant dehumidifier market held 36.04% of the global desiccant dehumidifier market share in 2024, owing to rapid industrialization and increasing construction activities.

- China held 39.60% of the revenue share in the Asia Pacific desiccant dehumidifier landscape in 2024, due to its booming manufacturing sector.

- The industry in Europe is projected to grow at a CAGR of 5.80% from 2025 to 2034, owing to strong regulatory frameworks focused on energy efficiency.

Industry Dynamics

- The rising production of automobiles is boosting demand for desiccant dehumidifiers as automakers need strict humidity control solutions to ensure product quality.

- The increasing preference for frozen food is fueling the adoption of desiccant dehumidifiers as they maintain dry and controlled environments to preserve product quality.

- The growing consumption of beer across the globe is creating a lucrative market opportunity.

- The high cost of desiccant dehumidifiers is estimated to impede the market growth.

Market Statistics

- 2024 Market Size: USD 591.40 Million

- 2034 Projected Market Size: USD 1060.79 Million

- CAGR (2025-2034): 6.10%

- Asia Pacific: Largest Market Share

AI Impact on Desiccant Dehumidifier Market

- AI enhances efficiency by enabling smart humidity control through real-time data analysis.

- Predictive maintenance powered by AI reduces downtime and extends equipment lifespan.

- Integration with IoT and AI allows remote monitoring and adaptive operation in varying conditions.

- AI-driven demand forecasting improves production planning and market responsiveness.

- Personalized user settings via AI algorithms boost customer satisfaction and adoption in residential and industrial sectors.

A desiccant dehumidifier is a humidity control device that removes excess moisture from the air using a desiccant material, typically silica gel or zeolite, which has a strong affinity for water molecules. These systems absorb or adsorbs water vapor directly from the air, making it effective even in low-temperature or low-humidity environments where traditional units often underperform. The absorbed moisture is later released during a regeneration process, where heated air dries the desiccant, allowing it to be reused continuously.

These dehumidifiers play a crucial role in industries and commercial spaces that require strict humidity control to maintain product quality and operational efficiency. In the pharmaceutical industry, they prevent moisture-sensitive drugs from degrading. Electronics manufacturing facilities use them to protect sensitive components from moisture damage, while cold storage units rely on them to prevent frost buildup. In food processing and storage, they reduce spoilage, mold growth, and bacterial contamination.

The global demand for desiccant dehumidifiers is driven by growing urbanization. United Nations, in its report, stated that the global urban population is projected to increase to around two-thirds of the total population in 2050. This is increasing the construction of commercial buildings, residential complexes, and industrial facilities that require strict humidity control equipment, such as desiccant dehumidifiers, to protect electronic equipment, improve indoor air quality, and prevent mold growth. Urbanization is also expanding industries such as pharmaceuticals, food processing, and electronics manufacturing, which depend on precise humidity solutions to maintain product quality. Furthermore, rising disposable incomes in urban populations allow more people to invest in home comfort solutions, including dehumidifiers. Therefore, the growing urbanization is propelling the demand for desiccant dehumidifiers.

Drivers & Opportunities/Trends

Increasing Production of Automobiles: The rising production of automobiles is boosting demand for desiccant dehumidifiers as automakers need strict humidity control solutions to ensure product quality. According to the European Automobile Manufacturers' Association, in 2022, 85.4 million motor vehicles were produced around the world, an increase of 5.7% compared to 2021. Automakers heavily install desiccant dehumidifiers in production lines, paint shops, and assembly areas to prevent moisture-related issues such as corrosion, paint defects, and electronic component damage. Suppliers of automotive parts also rely on desiccant dehumidifiers to protect sensitive materials such as leather, fabrics, and electrical systems during manufacturing and storage. Therefore, as automobile production expands to meet global mobility needs, automakers and suppliers invest more in humidity management solutions, which directly fuels demand for desiccant dehumidifiers.

Rising Preference for Frozen Food: Frozen food manufacturers and cold storage operators widely use desiccant dehumidifiers to maintain dry and controlled environments to preserve product quality. Growing consumer reliance on ready-to-eat meals, frozen fruits, vegetables, and seafood is driving the expansion of cold chain infrastructure, which is further raising the need for reliable humidity control solutions. Therefore, as frozen food consumption continues to surge globally, the industry invests more in advanced dehumidification solutions to meet safety standards and ensure consistent product quality.

Segmental Insights

Product Analysis

Based on product, the segmentation includes fixed/mounted and portable. The fixed/mounted segment accounted for 63.78% of revenue share in 2024 due to its extensive deployment in large-scale industrial facilities, warehouses, and commercial buildings. Manufacturers, logistics companies, and pharmaceutical firms prefer these systems as they deliver consistent humidity control in expansive spaces where moisture fluctuations can compromise product quality and safety. Industries dealing with food processing, electronics, and chemicals rely heavily on these devices, as they ensure reliable operations and safeguard sensitive goods against mold, corrosion, and spoilage. The long service life and ability to integrate into central air systems further strengthened the preference for a fixed/mounted desiccant dehumidifier.

The portable segment is projected to grow at a CAGR of 7.19% from 2025 to 2034, owing to rising demand from smaller units for laboratories and residential applications. Businesses and homeowners increasingly are opting for flexibility and mobility in moisture control solutions, particularly in regions witnessing seasonal humidity variations. Growth in the construction of smart homes and compact commercial spaces is also supporting the segment's growth. Additionally, advancements in lightweight designs and user-friendly features are enhancing their adoption, making this category a key contributor to future industry expansion.

Application Analysis

In terms of application, the segmentation includes energy, chemical, construction, electronics, and food & pharmaceuticals. The energy segment adopted 16.09 thousand units of desiccant dehumidifier globally, due to the critical need for reliable humidity control in power plants, wind turbine nacelles, and energy storage facilities. Operators in this industry invested heavily in moisture management equipment such as desiccant dehumidifiers to prevent corrosion of turbines, electrical systems, and structural components, which directly impacts operational efficiency and safety. The rising number of renewable energy projects, particularly in wind and solar, further increased demand, as equipment in these environments requires protection from condensation and moisture-related failures. Energy companies also prioritize long-term cost savings, and these systems help reduce maintenance expenses by extending the lifespan of high-value assets.

The electronics segment is estimated to grow at a CAGR of 7.61% from 2025 to 2034, owing to the increasing sensitivity of semiconductors, circuit boards, and microelectronic components to humidity. Manufacturers in the electronics sector seek precise environmental control to avoid defects, improve production, and maintain international quality standards. The rapid expansion of data centers and consumer electronics production is also driving the demand for desiccant dehumidifiers. Additionally, the global shift toward advanced technologies such as 5G, electric vehicles, and IoT devices is driving higher production volumes, which in turn is strengthening the need for effective humidity management solutions in electronics manufacturing.

End User Analysis

In terms of end user, the segmentation includes commercial, industrial, and others. The industrial segment held 55.33% of revenue share in 2024, due to widespread adoption of desiccant dehumidifiers across manufacturing plants, food processing units, pharmaceutical facilities, and chemical industries. Companies in these areas faced strict requirements for product quality, hygiene, and safety, which made precise humidity control essential. Industrial users deployed these systems to protect raw materials, prevent microbial contamination, and reduce equipment downtime caused by moisture-induced damage. The growing scale of global supply chains and the expansion of cold storage infrastructure also contributed to the dominance of the segment, as manufacturers and distributors prioritize reliable preservation of perishable and sensitive goods.

The commercial segment is expected to grow at a CAGR of 6.59% from 2025 to 2034, owing to the rising installation of desiccant dehumidifiers in offices, retail outlets, healthcare facilities, and educational institutions. The expansion of modern infrastructure and smart buildings is also fueling demand, as facility operators seek to improve indoor air quality, occupant comfort, and energy efficiency. Commercial establishments are further investing in these systems to protect valuable assets such as documents, electronics, and furnishings from moisture damage.

Regional Analysis

Asia Pacific desiccant dehumidifier market held 36.04% of the global desiccant dehumidifier market share in 2024. This dominance is attributed to rapid industrialization, increasing construction activities, and growing awareness of indoor air quality. Countries such as India, Japan, South Korea, and Southeast Asian nations are witnessing significant investments in pharmaceuticals, food processing, and electronics manufacturing, industries that require desiccant dehumidifiers to maintain product quality and operational efficiency. Additionally, the region's tropical and humid climate, particularly in countries like Indonesia, Thailand, and Malaysia, created a need for effective moisture control solutions in both industrial and commercial spaces. Rising urbanization and the expansion of cold chain logistics for perishable goods further fueled the adoption of desiccant dehumidifiers. The urban population in Asia is expected to grow by 50% by 2050, according to the United Nations Human Settlements Programme.

China Desiccant Dehumidifier Market Insight

China held 39.60% of the revenue share in the Asia Pacific desiccant dehumidifier landscape in 2024, due to its booming manufacturing sector and stringent regulatory standards in sensitive industries. China has a high concentration of electronics, pharmaceuticals, and lithium battery production facilities, all of which require tightly controlled humidity levels to prevent product degradation and ensure safety. Government initiatives promoting advanced manufacturing and green building standards have also encouraged the adoption of energy-efficient and reliable dehumidification technologies. Moreover, increased investments in infrastructure, including subways, data centers, and underground facilities, where condensation and mold are persistent concerns, boosted the need for desiccant-based solutions.

North America Desiccant Dehumidifier Market

The North America market is projected to hold 25.28% of the global desiccant dehumidifier market share in 2034, driven by stringent environmental regulations, increasing energy efficiency standards, and the expansion of industries requiring precise humidity control. The region’s aging infrastructure, particularly in the U.S. and Canada, is leading to retrofitting and upgrading of HVAC systems with advanced dehumidification technologies to improve indoor air quality and prevent mold growth. Additionally, the growing emphasis on sustainable building practices and LEED certification has encouraged the adoption of energy-efficient desiccant systems. Cold climate conditions in northern regions are also making desiccant dehumidifiers preferable, as they perform effectively at lower temperatures where traditional systems struggle.

U.S. Desiccant Dehumidifier Market Overview

The demand for desiccant dehumidifier in the U.S. is being driven by industrial modernization, healthcare regulations, and climate-related challenges. Key industries such as pharmaceuticals, semiconductor manufacturing, and food processing are increasingly adopting desiccant systems to meet strict FDA and OSHA standards for hygiene and product safety. The expansion of data centers and cleanrooms, particularly with the growth of cloud computing and artificial intelligence, requires stable humidity control solutions to protect sensitive equipment. Federal and state-level incentives for energy-efficient technologies are also encouraging businesses and institutions to invest in advanced dehumidification solutions.

Europe Desiccant Dehumidifier Market

The industry in Europe is projected to grow at a CAGR of 5.80% from 2025 to 2034, owing to strong regulatory frameworks focused on energy efficiency, environmental protection, and indoor air quality. The EU’s Energy Performance of Buildings Directive (EPBD) and F-Gas regulations are pushing industries and building operators to adopt sustainable HVAC technologies, including energy-efficient desiccant systems. Countries such as Germany, the UK, and the Nordic nations are leading in adopting these systems in pharmaceuticals, museums, archives, and historic building preservation, where precise humidity control is essential. The region’s cold and damp climate, especially in Northern and Western Europe, increases the need for effective moisture management to prevent structural damage and mold. Furthermore, the growing trend toward smart buildings and green certifications is fostering demand for innovative dehumidification solutions that integrate seamlessly with modern building automation systems.

Key Players & Competitive Analysis Report

The desiccant dehumidifier market is highly competitive, with several key players competing for market share across industries such as pharmaceuticals, food processing, and manufacturing. Companies like Munters, Bry-Air, and Condair Group have strong reputations for reliable, energy-efficient solutions and global reach. Atlas Copco AB and KAESER KOMPRESSOREN bring expertise from the compressed air industry, giving them an advantage in industrial applications. Meanwhile, firms such as DehuTech AB and Seibu Giken focus on innovation and niche technologies. Parker Hannifin Corporation and Quincy Compressor leverage their broad product portfolios to offer integrated systems. Trotec Laser GmbH and Fisen Corporation are expanding rapidly, especially in emerging regions. With growing demand for climate control in sensitive environments, companies are investing in smarter, greener technologies to stay ahead in this evolving space.

Major companies operating in the desiccant dehumidifier industry include Atlas Copco AB, Bry-Air, Condair Group, DehuTech AB, Fisen Corporation, KAESER KOMPRESSOREN, Munters, Parker Hannifin Corporation, Quincy Compressor, Seibu Giken, and Trotec Laser GmbH.

Key Companies

- Atlas Copco AB

- Bry-Air

- Condair Group

- DehuTech AB

- Fisen Corporation

- KAESER KOMPRESSOREN

- Munters

- Parker Hannifin Corporation

- Quincy Compressor

- Seibu Giken

- Trotec Laser GmbH

Industry Developments

May 2025, Atlas Copco launched a new range of portable desiccant air dehumidifiers for air treatment in industries working in the toughest conditions.

October 2024, Munter signed an agreement to acquire Hotraco (NL) to strengthen its position in Europe.

July 2024, Munter expanded its digital solutions by signing an agreement to acquire the majority share in Automated Environments (AEI), a US-based company specializing in automated control systems for the layer industry.

Desiccant Dehumidifier Market Segmentation

By Product Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Fixed/Mounted

- Portable

By Application Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Energy

- EV Battery Manufacturing

- Power Plants and Wind Turbines

- Chemical

- Construction

- Electronics

- Food & Pharmaceuticals

By End User Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- Commercial

- Industrial

- Others

By Regional Outlook (Revenue, USD Million, Volume Thousand Units, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Desiccant Dehumidifier Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 591.40 Million |

|

Market Size in 2025 |

USD 622.55 Million |

|

Revenue Forecast by 2034 |

USD 1060.79 Million |

|

CAGR |

6.10% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million, Volume in Thousand Units, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 591.40 million in 2024 and is projected to grow to USD 1060.79 million by 2034.

The global market is projected to register a CAGR of 6.10% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Atlas Copco AB, Bry-Air, Condair Group, DehuTech AB, Fisen Corporation, KAESER KOMPRESSOREN, Munters, Parker Hannifin Corporation, Quincy Compressor, Seibu Giken, and Trotec Laser GmbH.

The fixed/mounted segment dominated the market revenue share in 2024.

The commercial segment is projected to witness the fastest growth during the forecast period.