Europe Glass Grade Silica Sand Market Share, Size, Trends, Industry Analysis Report

By Fe Content (<100ppm, 100ppm to 1000ppm); By Applications; By End-User; By Country; Segment Forecast, 2024 - 2032

- Published Date:Jun-2024

- Pages: 116

- Format: PDF

- Report ID: PM4944

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

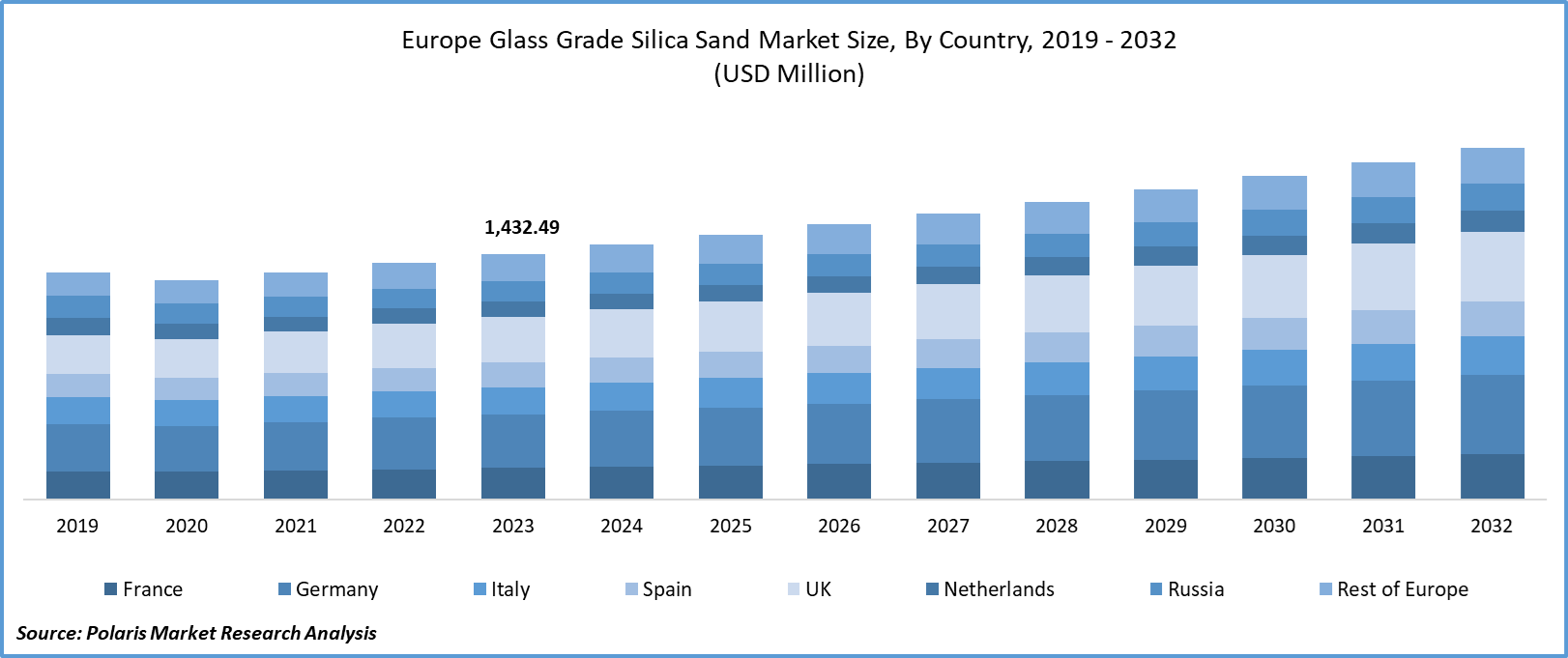

Europe glass grade silica sand market size was valued at USD 1,432.49 million in 2023. The market is anticipated to grow from USD 1,487.13 million in 2024 to USD 2,055.50 million by 2032, exhibiting the CAGR of 4.1% during the forecast period.

Industry Trends

The Europe glass grade silica sand market has witnessed significant growth in recent years, driven by the exceptional properties of silica sand, characterized by high purity and a desirable grain size distribution, which establish it as a fundamental raw material for the production of high-quality glass-grade products. Additionally, advancements in glass technology, exemplified by energy-efficient and self-cleaning glass innovations, are broadening the range of applications, thereby fueling the demand for the glass-grade silica sand market in Europe. Anticipated growth in the glass-grade silica sand market aligns with the prospering construction industry, particularly in emerging economies.

To Understand More About this Research:Request a Free Sample Report

The electronics sector stands out as a pivotal driver for the glass-grade silica sand market. Silica sand plays a crucial role in the manufacturing of electronic components, including semiconductors, optical fibers, and silicon wafers. As the global demand for electronic devices continues its upward trajectory fueled by technological advancements, consumer electronics, and telecommunication infrastructure development, the need for high-purity silica sand is witnessing a corresponding increase. Silicon-based materials derived from silica sand are indispensable in the production of integrated circuits and various electronic devices.

Companies engaged in silica sand projects prioritize augmenting their production capacity. This comprehensive approach involves the extraction, processing, and refinement of silica sand to meet the escalating demand across diverse industries, with a particular focus on the glass industry. The expansion of production capacity ensures a consistent and ample supply of glass-grade silica sand in the market.

For instance, in December 2022, Sibelco completed the second tranche investment of AUD 24 million in the joint venture company with Cape Silica Holdings Pty Ltd., Diatreme, elevating its joint venture interest to 26.8%. This strategic investment builds upon the initial tranche investment of AUD 11 million and reflects Sibelco's satisfaction with the joint venture's advancement in advancing world-class high-purity silica sand projects. The early completion of this investment underscores Sibelco's strong support for the joint venture, expressing confidence in its capability to provide a key resource essential for the world's specialty glass market. This investment is particularly significant amid the rapid growth of solar photovoltaic (PV) technology and the global push toward decarbonization, both of which are propelling the market for glass-grade silica sand.

Key Takeaways

- Germany dominated the market and contributed for the largest market share

- By Fe content category, the 100ppm to 1000ppm segment dominated the market and is anticipated to grow with the fastest CAGR

- By applications category, the flat glass segment is anticipated to grow with a lucrative CAGR over the Europe Glass Grade Silica Sand market forecast period

What are the market drivers driving the demand for market?

Increasing demand for glass grade silica sand in automotive industry

The production of top-quality glass components for vehicles drives the demand in the automotive industry in Europe. The automotive sector places more emphasis on safety, fuel efficiency, and design aesthetics. The need for advanced glass materials with superior strength, clarity, and durability is on the rise. Glass grade silica, known for its purity and optical properties, is a key ingredient in the manufacturing of windshields, windows, and other automotive glass parts. Additionally, the increasing popularity of electric vehicles is further fueling the demand for glass grade silica. With automotive manufacturers continuously innovating and introducing new vehicle models, the demand for high-performance glass materials made from silica is projected to rise further.

Which factor is restraining the demand for market?

Stringent Environmental Regulations

Stringent environmental regulations in Europe pose a significant challenge to the glass grade silica market by imposing compliance burdens and driving up production costs. These regulations, which focus on reducing carbon emissions, promoting sustainable manufacturing practices, and minimizing environmental impact, often require costly upgrades to manufacturing facilities to meet emissions standards and waste disposal regulations. The need to comply with these regulations not only increases financial strain but also adds administrative complexities, ultimately impeding its growth prospects in Europe.

Report Segmentation

The market is primarily segmented based on Fe content, applications, end-user, and country.

|

By Fe Content |

By Applications |

By End-User |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Fe Content Insights

Based on Fe content analysis, the market is segmented into <100ppm, 100ppm to 1000ppm. The 100ppm to 1000ppm segment is dominating and is expected to grow with a healthy CAGR over the forecast period, owing to its versatility and suitability for a wide range of applications in various industries. Silica sand within this Fe content range offers a good balance between cost-effectiveness and performance, making it a popular choice among manufacturers. It meets the high-quality standards necessary for glass production while remaining competitively priced compared to lower Fe content grades.

This segment's dominance and growth are also attributed to its adaptability to traditional glass manufacturing methods and newer technologies like solar panels and specialty glass applications. Furthermore, with a growing emphasis on sustainability and environmental responsibility in industries, silica sand falling within this Fe content range often complies with regulatory standards.

By Application Insights

Based on application analysis, the market has been segmented into glass containers, flat glass, fiberglass, specialty glass, and others. The glass container sector dominated the glass grade silica sand market in Europe owing to its glass production in industries such as beverages, food, pharmaceuticals, and cosmetics. This creates a steady demand for high-quality silica sand as a raw material. Moreover, advancements in glass manufacturing technologies have made it possible to produce lightweight yet sturdy glass containers, making them more appealing to both producers and consumers.

The flat glass segment is witnessing rapid growth in the market due to the construction industry, leading to an increased need for flat glass in applications such as windows, facades, and interior fittings in residential, commercial, and infrastructure projects. Moreover, the increasing adoption of energy-efficient glazing solutions and the incorporation of glass in contemporary building designs have boosted the demand for flat glass. Flat glasses provide excellent thermal insulation properties and the potential to contribute to green building certifications.

Country-wise Insights

Germany

The Germany dominates the market and is expected to grow at the fastest CAGR owing to increased demand from the construction sector, a surge in automotive production and sales, ongoing technological advancements, and a steady rise in per capita income. These elements collectively contribute to the growth of the silica sand market for glass-making in Germany. Construction firms in Germany are increasingly adopting environmentally friendly building techniques to mitigate environmental impact and preserve the natural balance. This approach not only aids in averting ecological damage but also contributes to cost reduction through the utilization of sustainable construction materials which is further driving the growth of this market in Europe.

Competitive Landscape

The glass grade silica sand market in Europe is highly competitive, with key players engaging in intense rivalry to maintain market share. Strategies such as product innovation, mergers and acquisitions, and geographic expansion are commonly used. Players are focusing on niche market segments and specialty applications to increase their presence. As demand from the construction, automotive, and electronics sectors drives steady growth in the European market, competition is expected to intensify further.

Some of the major players operating in the European market include:

- AGC Glass Europe

- Euroquarz GmbH

- HeidelbergCement AG

- NSG Group

- O-I Glass, Inc.

- Quarzwerke GmbH

- Quarzwerke Group

- Saint-Gobain

- Sibelco

- Silica Holdings Inc.

Recent Developments

- In September 2022, AGC Glass Europe planned to introduce a new float glass range with a reduced carbon footprint of less than 7 kg of CO2 per m2 for clear glass (4 mm thickness).

- In September 2022, Sibelco, expanded its presence through strategic acquisitions in France, the Netherlands, Spain, and Italy. Simultaneously, the company continued to foster growth in glass recycling with acquisitions in France, Poland, and Estonia. These acquisitions have not only the glass and silica sand sectors but have also significantly augmented the company's operations and footprint in France.

- In July 2022, Sibelco confirmed its acquisition of Echasa S.A., a mining company actively employed in silica sand extraction in the Basque Country, Northern Spain. This strategic move positions the quarry just 160 KM away from Sibelco's nearly silica quarry in Arija. This acquisition is intricately tied to Sibelco's forward-looking strategy, known as Sibelco 2025 aligning with the company's vision.

Report Coverage

The Europe glass grade silica sand market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, on Fe content, applications, end-user and their futuristic growth opportunities.

Glass Grade Silica Sand Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,487.13 million |

|

Revenue forecast in 2032 |

USD 2,055.50 million |

|

CAGR |

4.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Application, By Organization Size, By Vertical, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Europe Glass Grade Silica Sand Market Size Worth USD 2,055.50 Million By 2032

The top market players in the market are Euroquarz GmbH, HeidelbergCement AG, NSG Group, O-I Glass, Inc., Quarzwerke GmbH, Saint-Gobain

Europe Glass Grade Silica Sand Market report covering key segments are Fe content, applications, end-user, and country

Europe glass grade silica sand market exhibiting the CAGR of 4.1% during the forecast period.