Geothermal Energy Market Size, Share, Trends, Industry Analysis Report

By Technology (Flash Steam, Dry Steam, Binary Cycle Power Plants), By Power Output, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6188

- Base Year: 2024

- Historical Data: 2020-2023

Overview

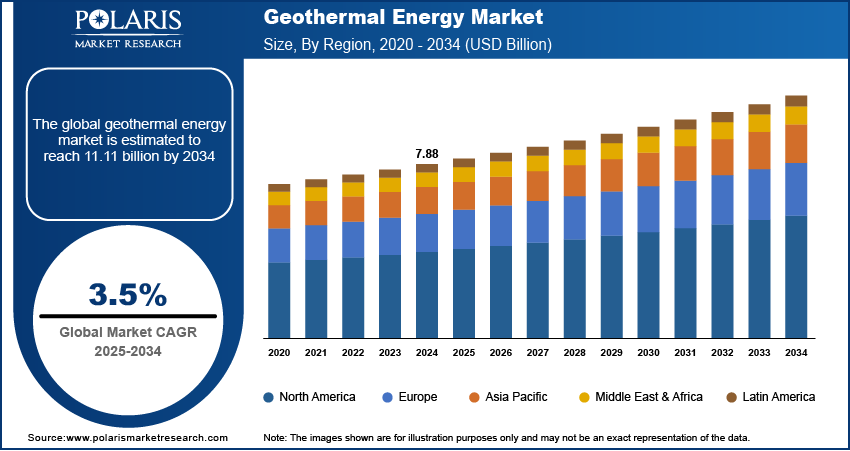

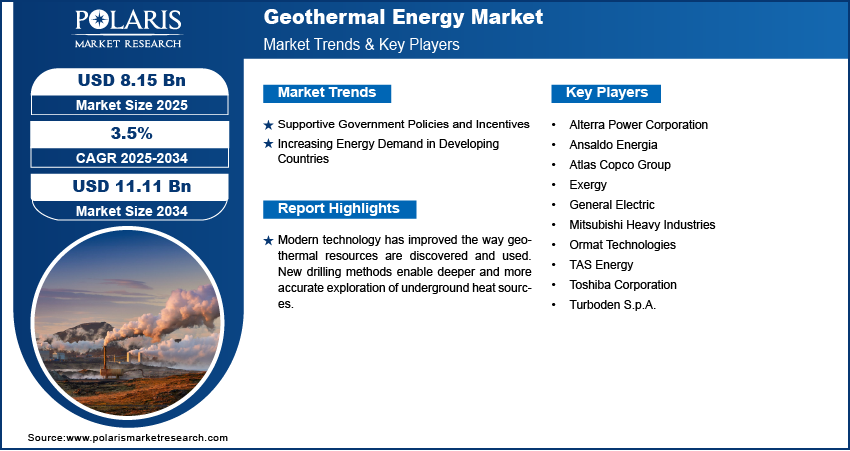

The global geothermal energy market size was valued at USD 7.88 billion in 2024, growing at a CAGR of 3.5% from 2025 to 2034. The market growth is driven by supportive government policies and incentives and increasing energy demand in developing countries.

Key Insights

- In 2024, the binary cycle power plants segment dominated with the largest share due to its capability to efficiently harness electricity from low to medium temperature geothermal sources, which are more prevalent globally.

- The up to 5MW segment is expected to experience significant growth during the forecast period as these smaller-scale systems are particularly well-suited for localized energy solutions, making them ideal for deployment in remote or off-grid regions.

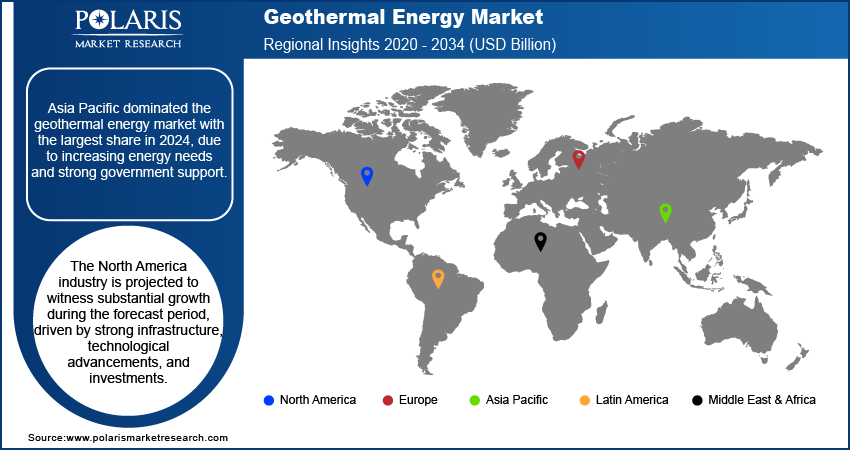

- The market in Asia Pacific dominated with the largest share in 2024, driven by escalating energy demands and robust governmental initiatives supporting geothermal development.

- The North America industry is projected to witness substantial growth during the forecast period, driven by advancements in infrastructure, technology, and increased investments in geothermal projects.

- The U.S. industry is projected to witness substantial growth during the forecast period as the U.S. is one of the leading countries in geothermal energy production, mainly concentrated in states such as California, Nevada, and Utah.

Industry Dynamics

- Supportive government policies and incentives drive the adoption of geothermal energy.

- Increasing energy demand in developing countries is fueling the industry growth.

- Technological advancements are making geothermal energy more practical and affordable.

- High upfront capital costs for exploration, drilling, and plant setup restrain the industry growth.

Market Statistics

- 2024 Market Size: USD 7.88 billion

- 2034 Projected Market Size: USD 11.11 billion

- CAGR (2025–2034): 3.5%

- Asia Pacific: Largest market in 2024

Geothermal energy is heat derived from the Earth’s interior, generated by the natural decay of radioactive elements in the Earth’s core, mantle, and crust. This heat can be harnessed to produce electricity, provide direct heating, or support industrial processes. As a renewable and reliable energy source, geothermal offers constant, low-emission power with minimal environmental impact.

Energy sources such as solar and wind depend on the weather conditions, which can cause supply issues. Geothermal energy provides power continuously, day and night, regardless of external conditions. This makes it useful for supporting electric power grids that require constant power. A stable power source is important for industries, hospitals, and homes. Uninterrupted electricity is further essential in areas with frequent power outages. Geothermal plants help reduce such problems and improve energy reliability. This consistent performance increases its value in both developed and developing energy regions, thereby driving the growth.

Modern technology has improved the way geothermal resources are discovered and used. New drilling methods allow deeper and more accurate exploration of underground heat sources. Advanced tools reduce costs and increase safety during the drilling process. Improved geothermal systems make it possible to create energy from areas that were previously unusable. These improvements allow more regions to benefit from geothermal power. Additionally, better technology helps shorten project timelines, making geothermal energy more practical and affordable, thereby driving its adoption.

Drivers & Opportunities

Supportive Government Policies and Incentives: Governments are introducing policies that promote the use of renewable energy. According to the European Parliament, in February 2025, the European Commission initiated the Clean Industrial Deal, allocating ~USD 117 billion to improve industrial competitiveness and adopt the transition to renewable energy sources. This initiative seeks to achieve sustainability in energy systems by implementing revised investment regulations and streamlining State aid mechanisms to facilitate quicker investment flows. Rules and regulations often encourage energy companies to adopt clean energy solutions. These measures make it easier for companies to start and run geothermal power plants. Lower costs and fewer risks attract more investors, helping geothermal energy grow more quickly in different regions, thereby fueling the growth.

Increasing Energy Demand in Developing Countries: Developing countries are experiencing strong growth in rural & urban population, and industries. According to the World Bank Group, in 2024, in India alone, 37% of the population lives in urban areas. This leads to a greater need for energy. Many of these countries face challenges such as power shortages and high electricity costs. Geothermal energy provides a local and long-term solution to meet these needs. It can help improve electricity access in remote regions. The ability to generate clean and steady power makes geothermal a strong choice for countries seeking energy independence and development, thereby boosting the growth.

Segmental Insights

Technology Analysis

The segmentation, based on technology, includes flash steam, dry steam, and binary cycle power plants. In 2024, the binary cycle power plants segment dominated with the largest share. These systems are efficient at generating electricity from low to medium-temperature geothermal sources, which are more commonly found around the world. The ability to operate in areas with lower heat levels makes binary cycle plants suitable for a wide range of locations. They further have a closed-loop design, which minimizes emissions and environmental impact. Additionally, this technology is gaining popularity due to its flexibility, low environmental risks, and consistent power output, making it a preferred choice for both new projects and small-scale development, thereby fueling the segment growth.

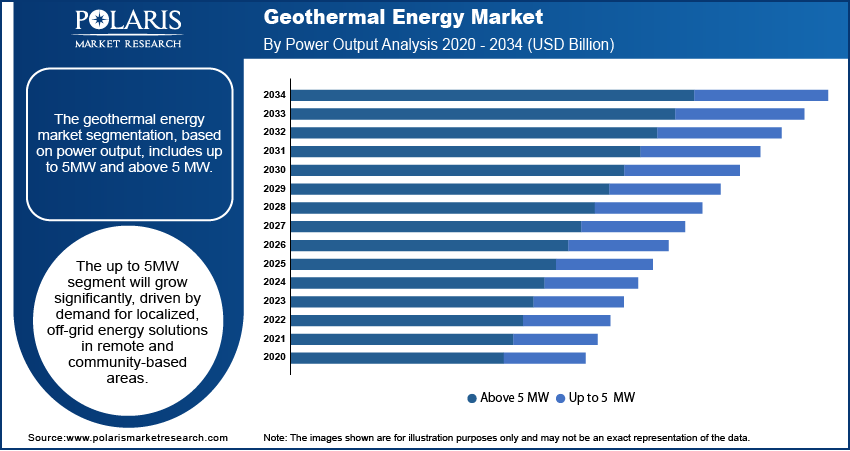

Power Output Analysis

The segmentation, based on power output, includes up to 5MW and above 5 MW. In 2024, the above 5 MW segment dominated with the largest share, as large-scale plants are usually used to supply electricity to regional grids or meet industrial demands. These high-capacity systems are typically built in regions with strong geothermal activity and large energy needs. They offer economies of scale, resulting in a lower cost per unit of energy. High output plants play an important role in ensuring a stable, long-term power supply, and are supported by government programs or utility contracts, making them an attractive investments in the renewable energy sector, thereby driving the segment growth.

The up to 5MW segment is expected to experience significant growth during the forecast period as these smaller systems are ideal for local or community-based energy needs, especially in remote or off-grid areas. Their lower setup cost and faster installation time make them a good fit for developing regions or small-scale industrial use. Additionally, smaller plants further face fewer regulatory challenges and can be placed closer to the point of use. This segment is expected to see strong development and attract new investments as interest in decentralized and reliable clean energy increases.

Application Analysis

The segmentation, based on application, includes residential, commercial, and industrial. The industrial segment is expected to experience significant growth during the forecast period as many industries require constant and reliable power for processes such as manufacturing, food drying, and chemical production. Geothermal energy provides a steady source of heat and electricity that can reduce fuel costs and carbon emissions. It further supports clean energy targets set by governments and corporations. Geothermal solutions are becoming a practical and long-term option as industries seek to reduce their energy bills and lower their environmental impact. This shift is expected to drive the higher adoption of geothermal energy in industrial sectors worldwide, thereby driving the segment growth.

Regional Analysis

Asia Pacific Geothermal Energy Market Trends

Asia Pacific dominated the market with the largest share in 2024, due to increasing energy needs and strong government support. Countries such as Indonesia, the Philippines, and Japan have high geothermal potential due to their location along the Pacific Ring of Fire. The region is seeing growing investments in geothermal exploration and development, supported by renewable energy goals and foreign partnerships. Additionally, smaller nations are further exploring geothermal to reduce reliance on fossil fuels. The demand for clean, stable, and locally sourced power is further driving the region growth.

China Geothermal Energy Market Insights

The industry in China is expected to witness significant growth during the forecast period, as China is actively expanding its use of geothermal energy to meet growing electricity demand and environmental targets. The government has included geothermal in its national energy strategy and supports development through subsidies and favorable policies. Direct-use applications such as district heating are rapidly increasing in the country. Urban areas are using geothermal systems for heating buildings to reduce air pollution. Rising investments in advanced drilling and geothermal systems are further driving the market growth in China.

North America Geothermal Energy Market Analysis

The North America industry is projected to witness substantial growth during the forecast period, driven by strong infrastructure, adoption of technological advancements, and rising investments in sustainable power plants. The region benefits from high geothermal potential, especially in western parts of the U.S. and Canada. Government incentives, such as tax credits and renewable energy targets, have encouraged the development of both large and small-scale geothermal projects. Companies are investing in new technologies such as improved geothermal systems to expand geothermal use beyond traditional locations. Additionally, geothermal energy is being used for heating, agriculture, and industrial applications, contributing to a diversified and reliable clean energy portfolio in the region.

U.S. Geothermal Energy Market Trends

The U.S. industry is projected to witness substantial growth during the forecast period as the U.S. is one of the leading countries in geothermal energy production, mainly concentrated in states such as California, Nevada, and Utah. The government supports the industry through research funding, tax incentives, and renewable energy policies. The U.S. Department of Energy is further promoting next-generation geothermal technologies to tap into new areas and improve efficiency. Companies are exploring improved geothermal systems to expand production beyond high-temperature zones. Geothermal energy is valued for its ability to provide constant, low-emission power, thereby driving the growth.

Europe Geothermal Energy Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by strong environmental policies and climate targets. The European Union has set ambitious goals to reduce carbon emissions and increase the share of renewable energy, which includes geothermal. Countries such as Iceland, Italy, Turkey, and France are leading in geothermal power generation, while other countries are expanding direct-use applications such as district heating. The region further benefits from well-developed infrastructure, funding programs, and public-private partnerships. Research and innovation in improved geothermal systems and heat pumps are helping expand geothermal use, thereby driving the growth.

Germany Geothermal Energy Market Outlook

The market in Germany is expected to experience significant growth as Germany is rapidly increasing its focus on geothermal energy, particularly for heating applications. The government has included geothermal as a key part of its clean energy strategy, known as the “Energiewende.” Most geothermal activity in Germany is centered on district heating systems rather than electricity generation. Southern Germany, especially Bavaria, has suitable geology and is home to several deep geothermal projects. Strong policy support, public funding, and efforts to reduce dependence on fossil fuels are driving development, thereby driving the growth of the country.

Key Players and Competitive Analysis

The geothermal energy market is highly competitive, with key players focusing on innovation, strategic partnerships, and global expansion. Ormat Technologies leads with extensive geothermal project portfolios and integrated technology solutions. General Electric and Mitsubishi Heavy Industries offer advanced turbines and micro turbines and power systems, enhancing large-scale geothermal plants. Toshiba Corporation and Ansaldo Energia specialize in high-efficiency steam turbines, contributing to stable baseload power. Exergy and Turboden S.p.A. focus on Organic Rankine Cycle (ORC) technologies, suitable for low-to-medium temperature resources. Alterra Power Corporation, now part of Innergex, leverages a strong North American footprint. Atlas Copco Group supports drilling and subsurface technologies, while TAS Energy provides modular, flexible energy solutions. Companies compete on technological expertise, environmental performance, and cost efficiency, while increasingly engaging in emerging markets and enhanced geothermal systems (EGS). Collaborations, acquisitions, and government-backed initiatives further shape this evolving landscape, driving innovation and global geothermal adoption for sustainable, 24/7 clean energy.

Key Players

- Alterra Power Corporation

- Ansaldo Energia

- Atlas Copco Group

- Exergy

- General Electric

- Mitsubishi Heavy Industries

- Ormat Technologies

- TAS Energy

- Toshiba Corporation

- Turboden S.p.A.

Geothermal Energy Industry Developments

In May 2025, The Centre for Earth Sciences and Himalayan Studies drilled Northeast India’s first geothermal production well in Dirang, Arunachal Pradesh, aiming to make it India’s first geothermal-powered town, with international support and eco-friendly energy applications.

In April 2025, Google signed its first corporate geothermal energy agreements in Taiwan with Baseload Capital, adding 10 MW of clean, constant power to the grid and marking a major step toward advancing geothermal energy across Asia Pacific and globally.

In August 2024, Meta partnered with Sage Geosystems to launch a geothermal energy project using Sage’s Geopressured Geothermal System, aiming to deliver 150 MW of carbon-free power by 2027 to support Meta’s U.S. data centers with reliable, clean energy.

Geothermal Energy Market Segmentation

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Flash Steam

- Dry Steam

- Binary Cycle Power Plants

By Power Output Outlook (Revenue, USD Billion, 2020–2034)

- Up to 5MW

- Above 5 MW

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Geothermal Energy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.88 Billion |

|

Market Size in 2025 |

USD 8.15 Billion |

|

Revenue Forecast by 2034 |

USD 11.11 Billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.88 billion in 2024 and is projected to grow to USD 11.11 billion by 2034.

The global market is projected to register a CAGR of 3.5% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Alterra Power Corporation, Ansaldo Energia, Atlas Copco Group, Exergy, General Electric, Mitsubishi Heavy Industries, Ormat Technologies, TAS Energy, Toshiba Corporation, and Turboden S.p.A.

The binary cycle power plant segment dominated the market share in 2024.

The up to 5 MW segment is expected to witness the significant growth during the forecast period.