Japan Dietary Supplements Market Size, Share, Trends, Industry Analysis Report

By Type (Vitamins, Minerals), By Form, By Application, By Distribution Channel, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6182

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

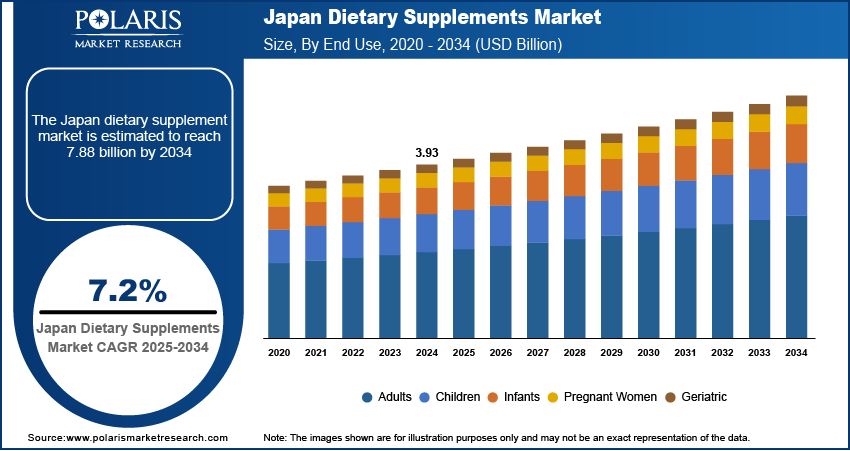

The Japan dietary supplements market size was valued at USD 3.93 billion in 2024, growing at a CAGR of 7.2% from 2025 to 2034. The market growth is driven by ageing population and trust in functional foods and science-based products.

Key Insights

- In 2024, the vitamins segment dominated with the largest share, driven by the widespread adoption of vitamin supplements aimed at addressing the nutrient deficiencies prevalent in contemporary diets.

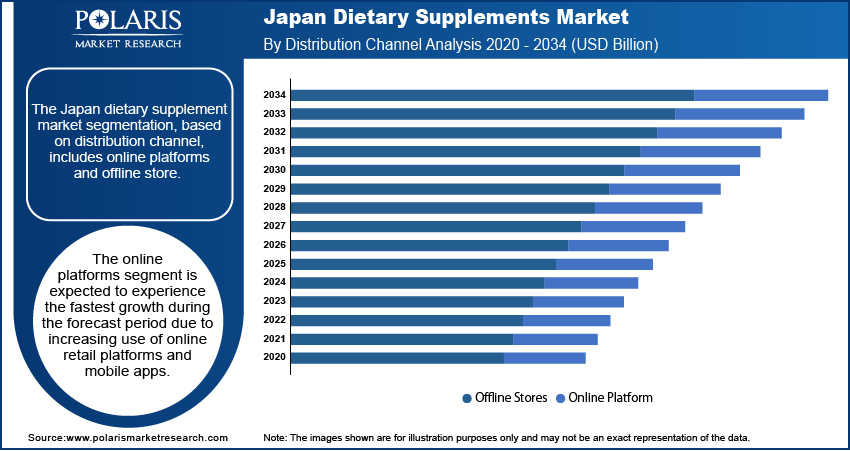

- The online platforms segment is expected to experience the fastest growth during the forecast period due to the escalating utilization of e-commerce platforms and mobile applications for retail transactions.

Industry Dynamics

- Trust in functional foods and science-based products drives the Japan dietary supplements market growth.

- Aging population and age-related health concerns fuel the industry growth.

- Consumers who go to the gym, play sports, or follow workout routines often use dietary supplements to improve performance and recovery, thereby driving the demand

- High regulatory scrutiny and inconsistent product quality standards restrain widespread adoption of supplements.

Market Statistics

- 2024 Market Size: USD 3.93 billion

- 2034 Projected Market Size: USD 7.88 billion

- CAGR (2025–2034): 7.2%

To Understand More About this Research: Request a Free Sample Report

Dietary supplements are products consumed orally. They contain nutrients such as vitamins, minerals, herbs, amino acids, and enzymes intended to supplement the diet. They are available in numerous forms such as tablets, capsules, powders, and liquids. These supplements are not meant to replace whole foods but to support overall health or address specific nutritional gaps.

Japanese culture emphasizes staying healthy and preventing illness through daily habits. Many individuals include supplements in their routine to avoid health problems before they occur. Healthcare providers and media often encourage regular self-care, which increases awareness about nutritional needs. Kampo, or traditional Japanese medicine, also influences the use of herbs and natural remedies in supplement form. Consumers believe that maintaining health through nutrition is essential. This mindset leads to consistent demand for vitamins, minerals, and herbal supplements. The commitment to long-term wellness drives demand and shapes how products are developed and marketed in Japan.

Online shopping has become a major channel for purchasing dietary supplements in Japan. Consumers prefer websites and mobile apps that offer a wide range of products, detailed information, and customer reviews. Home delivery and subscription models provide added convenience for regular buyers. Digital health platforms and mobile health apps often recommend supplements based on lifestyle, diet, or personal goals. The growing use of smartphones and internet access supports this trend. Additionally, many brands focus on reaching customers through social media and health-related websites. Expansion of e-commerce is helping local and international brands grow in the country.

Drivers & Opportunities

Ageing Population: Japan has the highest proportion of elderly people in the world, leading to strong demand for health-related products. According to the World Bank Group, in 2024, 30% of Japan’s total population was 65 years and older. Older adults often face age-related health concerns such as weak bones, reduced immunity, and memory loss. Dietary supplements are commonly used to support daily health and maintain independence. Products such as calcium, vitamin D, and memory-boosting supplements are especially popular. Healthcare professionals and family members often recommend regular supplement use. The focus on healthy aging in Japanese society continues to increase consumer interest in products that support long-term well-being, thereby fueling the Japan dietary supplements market growth.

Trust in Functional Foods and Science-Based Products: Japanese consumers trust dietary supplements that are backed by scientific research and official approval. Government programs such as FOSHU (Foods for Specified Health Uses) and FNFC (Foods with Nutrient Function Claims) help regulate the market and ensure product safety. Products carrying these certifications are seen as reliable and effective. Many consumers check for clear labels and clinical data before making a purchase. Companies that invest in research and follow strict quality standards often gain a competitive advantage. Confidence in science-based products supports consumer loyalty and fuels demand for the supplement across different age groups, thereby boosting the Japan dietary supplements market expansion.

Segmental Insights

Type Analysis

The segmentation, based on type, includes vitamins, minerals, amino acids, botanicals, probiotics, enzymes, and others. In 2024, the vitamins segment dominated with the largest share as many individuals use vitamin supplements to maintain daily health, especially due to nutrient gaps in modern diets. Products such as vitamin C, vitamin D, and multivitamins are widely used by both older adults and younger working populations. Health-conscious consumers rely on vitamins to support energy, immune strength, and general wellness. High trust in products backed by government approval and clinical studies further supports the growth. Moreover, the cultural focus on preventive care and aging health further fuels the segment growth.

Distribution Channel Analysis

The Japan dietary supplement market segmentation, based on distribution channel, includes online platforms and offline store. The online platforms segment is expected to experience the fastest growth during the forecast period due to increasing use of online retail platforms and mobile apps. Consumers value the ability to compare products, read reviews, and receive personalized recommendations without visiting a store. Online channels further offer easier access to both domestic and international brands, attracting a wider range of buyers. Subscription services, fast delivery, and user-friendly websites are improving the shopping experience. Digital platforms appeal strongly to busy professionals and tech-savvy younger consumers. Additionally, growth in e-commerce is reshaping the purchase trend in Japan, driving the segment growth.

Key Players and Competitive Analysis

The Japan dietary supplements market features a competitive landscape that includes both global giants and specialized players. Multinational companies such as Abbott Laboratories, Bayer AG, Pfizer Inc., and GlaxoSmithKline plc have a strong presence, leveraging their research expertise and established healthcare reputations to offer a wide range of scientifically backed products. Direct-selling companies such as Amway Corp. and Herbalife International maintain loyal customer bases through personalized nutrition and extensive distribution networks. Ingredient suppliers such as The Archer-Daniels-Midland Company and Glanbia Plc support the market by providing high-quality raw materials. Local and regional players, including Nature’s Sunshine Products and PharmaNutrics Himalaya Global Holdings, focus on herbal and natural supplements favored in Japan. Competitive advantages stem from product innovation, adherence to Japan’s strict regulatory standards, and the ability to cater to the aging population’s specific health needs. Online sales growth and partnerships with digital health platforms are also reshaping competition within the market.

Key Players

- Abbott Laboratories

- Amway Corp.

- Bayer AG

- dsm-firmenich

- Glanbia Plc

- GlaxoSmithKline plc

- Herbalife International of America, Inc.

- Nature’s Sunshine Products, Inc.

- Pfizer Inc.

- PharmaNutrics Himalaya Global Holdings Ltd.

- The Archer-Daniels-Midland Company

Japan Dietary Supplements Industry Developments

In January 2024, Abbott launched its PROTALITY brand, starting with a high-protein nutrition shake. This product targets adults seeking weight management while preserving muscle mass and optimizing nutrition, aligning with contemporary trends in nutritional science.

In November 2024, dsm-firmenich, in collaboration with Rohto Pharmaceutical, launched Vision R in Japan. This innovative multivitamin, using patented Sprinkle It Technology, address nutritional gaps among seniors to support healthy longevity and improve overall health.

Japan Dietary Supplements Market Segmentation

By Type Outlook (Revenue, USD Billion; 2020–2034)

- Vitamins

- Minerals

- Amino Acids

- Botanicals

- Probiotics

- Enzymes

- Others

By Form Outlook (Revenue, USD Billion; 2020–2034)

- Tablets

- Capsules

- Gummies

- Powder

- Soft Gels

- Liquids

- Others

By Application Outlook (Revenue, USD Billion; 2020–2034)

- Energy & Weight Management

- Bone & Joint Health

- Immunity

- General Health

- Cardia Health

- Others

By Distribution Channel Outlook (Revenue, USD Billion; 2020–2034)

- Online Platforms

- Offline Stores

By End Use Outlook (Revenue, USD Billion; 2020–2034)

- Adults

- Children

- Infants

- Pregnant Women

- Geriatric

Japan Dietary Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.93 Billion |

|

Market Size in 2025 |

USD 4.20 Billion |

|

Revenue Forecast by 2034 |

USD 7.88 Billion |

|

CAGR |

7.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.93 billion in 2024 and is projected to grow to USD 7.88 billion by 2034.

The market is projected to register a CAGR of 7.2% during the forecast period.

A few of the key players in the market are Abbott Laboratories; Glanbia Plc; The Archer-Daniels-Midland Company; dsm-firmenich: Nature’s Sunshine Products, Inc.; GlaxoSmithKline plc; Amway Corp.; Herbalife International of America, Inc.; PharmaNutrics Himalaya Global Holdings Ltd.; Pfizer Inc.; and Bayer AG.

The vitamin segment dominated the market share in 2024.

The online platform segment is expected to witness the fastest growth during the forecast period.