Canned Motor Pumps Market Size, Share, Trends, Industry Analysis Report

By Type (Standard Basic Pumps, Reverse Circulation Pumps), By Pump Design, By Motor Type, By Capacity, By Installation Type, By End User, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM6162

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

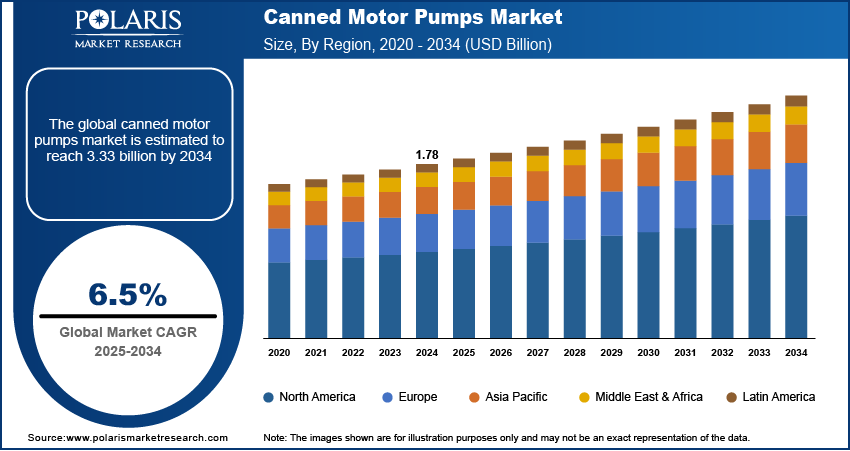

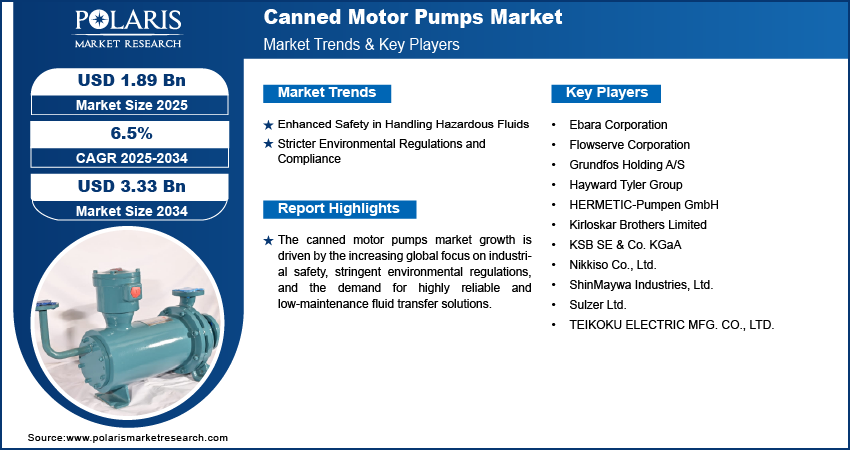

The global canned motor pumps market size was valued at USD 1.78 billion in 2024 and is anticipated to register a CAGR of 6.5% from 2025 to 2034. The industry growth is primarily driven by the increasing need for leak-free and safe handling of hazardous fluids in various industries. Stricter environmental regulations also push for the adoption of these pumps due to their minimal leakage risks.

Key Insights

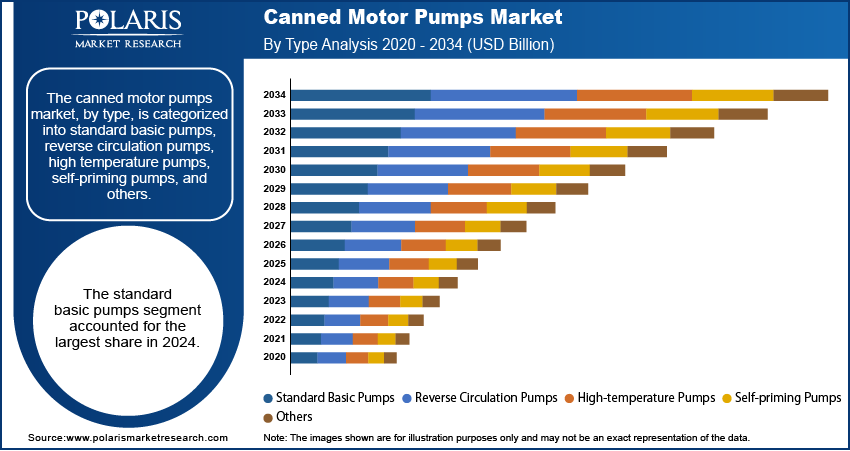

- By type, the standard basic pumps segment held the largest share in 2024 due to their widespread applicability and ease of integration across numerous general industrial processes, offering reliable and cost-effective solutions for common fluid transfer needs.

- Based on pump design, the single-stage pumps segment held the largest share in 2024, primarily because of their simpler design, which leads to easier installation, reduced maintenance, and lower initial costs.

- In terms of motor type, the induction motors segment held the largest share in 2024, driven by their robust construction, inherent reliability, and overall cost-effectiveness.

- The low capacity pumps segment, by capacity, held the largest share in 2024, owing to their versatility and extensive use in smaller-scale industrial processes, laboratory applications, and niche areas.

- Based on installation type, horizontal canned motor pumps held the largest share in 2024 due to their conventional design, which facilitates simpler installation and accessibility for maintenance in many traditional industrial setups.

- In terms of end user, the chemical industry held the largest share in 2024, driven by its critical need for safe and leak-free handling of highly hazardous, corrosive, or volatile fluids.

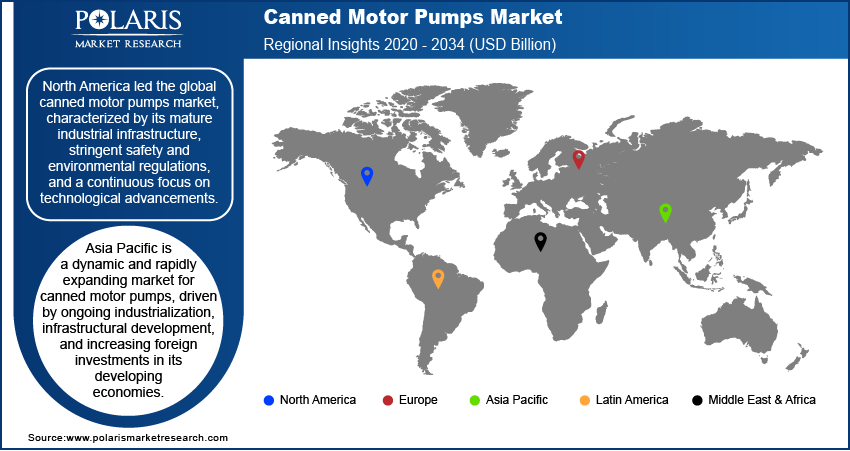

- North America stands as a leading region in the market, characterized by its mature industrial infrastructure, stringent safety and environmental regulations, and a continuous focus on technological advancements.

Industry Dynamics

- The need for completely sealed pumping solutions is a significant driver, especially when handling toxic, flammable, or corrosive materials. These solutions prevent leaks and emissions, which is crucial for operational safety and protecting personnel and the environment.

- Strict environmental regulations globally are pushing industries to adopt safer and more environmentally friendly equipment. Pumps that minimize or eliminate fugitive emissions align well with these regulations, helping companies meet compliance standards and reduce their environmental impact.

- The increasing focus on energy efficiency across industrial sectors is a key factor. Companies are seeking ways to reduce power consumption and lower operating costs. Advanced pump designs offer better energy performance compared to traditional options, contributing to significant energy savings over their lifespan and supporting sustainability goals.

Market Statistics

- 2024 Market Size: USD 1.78 billion

- 2034 Projected Market Size: USD 3.33 billion

- CAGR (2025–2034): 6.5%

- North America: Largest market in 2024

The canned motor pumps sector involves the design, making, and selling of sealless centrifugal pumps. These pumps have a motor and pump integrated onto a single shaft, where the pumped fluid itself lubricates the bearings and cools the motor, eliminating the need for traditional mechanical seals. This unique design makes them ideal for handling hazardous, toxic, and volatile fluids without leakage.

One of the drivers for the adoption of canned motor pumps is the increasing focus on maintenance-free and low-noise operations across various industrial settings. Traditional pumps with mechanical seals often require regular maintenance and can be prone to leaks, leading to downtime and higher operating costs. Canned motor pumps, with their hermetically sealed design, reduce these issues significantly. Their integrated structure also minimizes vibration and noise, making them suitable for sensitive environments where quiet operation is preferred.

Another driver is the growing demand for specialized pumps in niche applications such as cryogenic systems and nuclear power plants. Canned motor pumps are well-suited for extremely low or high temperatures and handling critical, sensitive, or radioactive fluids due to their robust and leak-proof nature. For instance, in nuclear facilities, the need for zero leakage of radioactive coolants is paramount for safety and environmental protection. The U.S. Department of Energy's (DOE) publications often detail the strict requirements for equipment used in nuclear energy applications, emphasizing the need for highly reliable and containment-focused pumping systems that canned motor pumps can provide.

Drivers and Trends

Enhanced Safety in Handling Hazardous Fluids: The paramount concern for safety when dealing with hazardous, toxic, and volatile chemicals is a major driver for the canned motor pumps sector. Industries such as chemical processing, oil and gas, and pharmaceuticals frequently transport aggressive or dangerous fluids, where any leakage can lead to severe environmental damage, health risks to personnel, or costly production losses. Canned motor pumps offer a completely sealed design, eliminating mechanical seals, which are common points of failure and leakage in traditional pump systems. This sealless design ensures the containment of even highly corrosive or explosive substances.

The National Center for Biotechnology Information (NCBI) highlights the critical importance of minimizing exposure to hazardous chemicals in laboratory and industrial pumps settings. In their publication "Prudent Practices in the Laboratory", they emphasize the need to "minimize exposure to chemicals" and be "prepared for accidents," indicating that robust containment is essential for worker safety and environmental protection. This inherent safety feature of canned motor pumps, by preventing any contact between the fluid and the atmosphere, makes them highly desirable for applications where safety cannot be compromised. The focus on preventing leaks in systems handling dangerous materials is directly driving demand in this market.

Stricter Environmental Regulations and Compliance: The growing global emphasis on environmental protection and the subsequent tightening of regulations regarding industrial emissions and waste management are significantly boosting the adoption of canned motor pumps. Governments and international bodies are imposing stricter limits on the release of pollutants into the air, water, and soil. Traditional pumps, even with well-maintained mechanical seals, can experience minor leakage, known as fugitive emissions, which contribute to environmental pollution. Industries are under immense pressure to comply with these stringent rules to avoid heavy penalties, legal actions, and reputational damage.

The U.S. Environmental Protection Agency (EPA) enforces comprehensive regulations, such as those under the Clean Air Act (CAA) and the Resource Conservation and Recovery Act (RCRA), which aim to control hazardous air pollutants and manage hazardous waste from "cradle to grave." These regulations, as detailed on the EPA's website, compel industries to adopt technologies that reduce or eliminate environmental contamination, including food and beverage industry pumps. Canned motor pumps, by offering a zero-leakage solution, help companies achieve compliance with evolving environmental standards and contribute to sustainable operations. This regulatory push is a strong force propelling the growth.

Segmental Insights

Type Analysis

Based on type, the segmentation includes standard basic pumps, reverse circulation pumps, high temperature pumps, self-priming pumps, and others. The standard basic pumps segment held the largest share in 2024. These pumps serve as fundamental solutions for a vast range of fluid transfer needs where a completely sealed and reliable system is crucial, but extreme conditions such as very high temperatures or highly viscous fluids are not the primary concern. Their straightforward design and proven performance make them a go-to choice for general industrial processes in chemical plants, oil and gas facilities, and even some aspects of water treatment. The established manufacturing processes and availability of these pumps contribute to their dominance, as they meet the foundational requirements for safety and efficiency in numerous standard pumping applications. Their versatility and robust nature underpin their significant presence in the current landscape.

The segment of high temperature pumps segment is anticipated to register the highest growth rate during the forecast period. This accelerated growth is primarily driven by the expansion of industries that increasingly rely on processes involving the transfer of fluids at elevated temperatures. These include specific applications in the chemical and petrochemical industries, power generation, and certain specialized manufacturing processes where traditional pumps struggle to maintain integrity or performance. As industrial operations push the boundaries of temperature to improve efficiency or facilitate new chemical reactions, the demand for pumps specifically engineered to withstand such harsh thermal environments without compromising safety or operational reliability becomes critical.

Pump Design Analysis

Based on pump design, the segmentation includes single-stage and multistage pumps. The single-stage segment held the largest share in 2024. This dominance can be attributed to their straightforward design, which often translates to easier installation, simpler maintenance requirements, and overall lower initial costs compared to more complex designs. Single-stage pumps are highly effective for a wide array of applications that require moderate head and flow rates, making them suitable for many general industrial uses. Their reliability and efficiency in terms of operational costs also make them a favored choice for continuous operation across various municipal and industrial settings. The reduced number of moving parts in a single-stage design further minimizes potential points of failure, contributing to their robustness and widespread adoption.

The multistage pump segment is anticipated to register the highest growth rate during the forecast period. This acceleration is driven by the increasing demand for applications requiring higher pressures and larger flow volumes, which single-stage pumps may not be able to meet efficiently. Industries such as oil and gas, power generation, and advanced chemical processing often require pumps with smart motors that can deliver fluids over long distances or lift them to considerable heights, necessitating the stepped pressure increase offered by multiple impellers. While more intricate in design and potentially having a higher upfront cost, multistage canned motor pumps are becoming increasingly vital for these demanding tasks. Their ability to generate greater power and higher pressure with potentially smaller motors leads to improved energy efficiency and renewable energy in high-pressure scenarios.

Motor Type Analysis

Based on motor type, the segmentation includes induction motors and synchronous motors. The induction motors segment held the largest share in 2024. This widespread adoption is largely attributed to their robust construction, reliability, and cost-effectiveness. Induction motors are known for their simple design, which translates into lower manufacturing costs and easier integration into various industrial systems. They are particularly well-suited for applications that do not require precise speed control or extremely high efficiency, making them a practical and economical choice for a broad range of general-purpose pumping tasks. Their proven track record and the extensive experience industries have with their operation and maintenance further solidify their leading position. The commonality of induction motors also contributes to a readily available supply chain for components and support services.

The synchronous motor segment is anticipated to register the highest growth rate during the forecast period. This growth is primarily fueled by the increasing emphasis on energy efficiency, precise control, and performance in more demanding or specialized applications. Synchronous motors offer superior efficiency, especially under varying load conditions, and allow for precise speed and position control, which is critical in certain high-tech or sensitive processes. As industries strive to reduce energy consumption and optimize their operations, the higher initial cost of synchronous motors is often offset by significant long-term energy savings and improved operational precision. Their suitability for applications requiring stable performance and exact flow rates, such as in advanced chemical processing, power generation, and certain pharmaceutical manufacturing, is driving their expanding presence.

Capacity Analysis

Based on capacity, the segmentation includes low, medium, and high. The low segment held the largest share in 2024. This dominance stems from their versatility and widespread use across a multitude of applications that do not require extremely high flow rates or pressures. These pumps are commonly employed in smaller-scale industrial processes, laboratory settings, and various niche applications where precision and containment of hazardous or sensitive fluids are critical, but the volume is limited. Their compact size often allows for easier integration into existing systems with space constraints. Furthermore, their lower energy consumption compared to larger capacity pumps makes them an attractive and economical solution for many operations seeking efficiency in smaller-scale fluid handling.

The high capacity pump segment is anticipated to register the highest growth rate during the forecast period. This growth is primarily fueled by increasing industrialization and the expansion of large-scale manufacturing and processing facilities, particularly in the chemical, oil and gas, and power generation sectors. These industries frequently require the movement of substantial volumes of fluid under demanding conditions, including high pressures and temperatures. The development of new and larger industrial plants, coupled with the modernization of existing infrastructure, is driving the need for pumps that can handle massive throughputs reliably and efficiently while maintaining the essential leak-free integrity of canned motor pump technology. As industrial processes become more intensive and scaled up, the demand for robust, high-capacity solutions continues to rise significantly.

Regional Analysis

The North America canned motor pumps market accounted for the largest share in 2024. North America represents a mature and significant market for canned motor pumps, driven by a strong emphasis on industrial safety, environmental regulations, and technological advancements. Industries across the U.S. and Canada, particularly chemical, oil and gas, and power generation, are increasingly adopting these pumps to ensure leak-free operations when handling hazardous or critical fluids. The region's well-established industrial infrastructure and a continuous focus on upgrading facilities to meet modern efficiency and safety standards contribute to a steady demand. Innovation in pump design and materials, often led by regional manufacturers, also supports the industry expansion by offering more durable and high-performing solutions for challenging applications.

U.S. Canned Motor Pumps Market Insights

In North America, the U.S. plays a pivotal role in the market for canned motor pumps, distinguished by its robust industrial base and stringent regulatory environment. The nation's significant chemical and petrochemical industries are key drivers, as they continuously invest in advanced pumping solutions to comply with federal and state environmental protection mandates. Furthermore, the extensive network of oil and gas operations, including refining and midstream sectors, prioritizes equipment that minimizes fugitive emissions and enhances operational safety. The U.S. also sees substantial demand from the nuclear power sector, where the utmost reliability and containment are crucial for managing radioactive coolants. This strong regulatory framework and a focus on advanced technology foster a consistent need for high-integrity, sealed pumping systems.

Europe Canned Motor Pumps Market Trends

Europe is a well-established and important region for the canned motor pumps industry, characterized by its mature industrial sectors and a leading position in environmental sustainability. The region's strict energy efficiency directives and emissions standards strongly influence the adoption of advanced pumping technologies that offer zero leakage and reduced energy consumption. Industries such as chemicals, pharmaceuticals, and nuclear power generation are major consumers of canned motor pumps, valuing their safety features, reliability, and low maintenance requirements. The emphasis on long-term operational costs and environmental responsibility across European industries underpins the steady demand for these specialized pumps.

The Germany canned motor pumps market dominates in Europe. Its highly developed chemical, pharmaceutical, and automotive industries, renowned for their precision and high manufacturing standards, drive substantial demand for leak-proof and highly reliable pumping solutions. German companies often lead in engineering and adopting advanced technologies, including sophisticated canned motor pump designs that offer superior energy efficiency and operational safety. The country's strong commitment to environmental protection and its robust regulatory framework further incentivize the use of pumps that prevent hazardous emissions, making it a key hub for both demand and technological innovation in the European market.

Asia Pacific Canned Motor Pumps Market Overview

Asia Pacific is a dynamic and rapidly expanding market for canned motor pumps, driven by ongoing industrialization, infrastructural development, and increasing foreign investments across its developing economies. Countries in this region are witnessing rapid growth in sectors such as chemical manufacturing, power generation, and oil and gas processing, which inherently require efficient and safe fluid handling. While traditional pump technologies still hold a presence, the rising awareness of environmental protection and industrial safety, coupled with evolving regulatory frameworks, is gradually pushing for the adoption of more advanced and leak-proof solutions such as canned motor pumps. The region's large manufacturing base also contributes to its size.

China Canned Motor Pumps Market Outlook

China is a prominent country in the Asia Pacific market for canned motor pumps, leading both in consumption and production capabilities. Its massive industrial scale, particularly in chemical production and energy sectors, creates a substantial demand for these specialized pumps. The Chinese government's increasing focus on environmental protection and industrial safety standards is progressively leading to the replacement of older, less efficient pumping systems with modern, hermetically sealed alternatives. Furthermore, significant investments in new infrastructure projects and the expansion of heavy industries are propelling the adoption of canned motor pumps for handling critical and hazardous fluids, cementing China's position as a major growth engine.

Key Players and Competitive Insights

The canned motor pumps market features a competitive landscape with several key players striving for leadership. A few major participants such as TEIKOKU ELECTRIC MFG. CO., LTD.; Nikkiso Co., Ltd.; HERMETIC-Pumpen GmbH; Kirloskar Brothers; and KSB SE & Co. KGaA are prominent in this specialized industry. These companies compete based on product innovation, reliability, technical expertise, and their ability to offer tailored solutions for diverse and demanding applications across various end-user industries. The competitive landscape is characterized by a mix of long-established companies with extensive experience in pumping technology and specialized manufacturers focusing solely on sealless pump designs.

A few prominent companies in the industry include TEIKOKU ELECTRIC MFG. CO., LTD.; Nikkiso Co., Ltd.; HERMETIC-Pumpen GmbH; Kirloskar Brothers Limited; KSB SE & Co. KGaA; Hayward Tyler Group; ShinMaywa Industries, Ltd.; Flowserve Corporation; Sulzer Ltd.; Grundfos Holding A/S; and Ebara Corporation.

Key Players

- Ebara Corporation

- Flowserve Corporation

- Grundfos Holding A/S

- Hayward Tyler Group

- HERMETIC-Pumpen GmbH

- Kirloskar Brothers Limited

- KSB SE & Co. KGaA

- Nikkiso Co., Ltd.

- ShinMaywa Industries, Ltd.

- Sulzer Ltd.

- TEIKOKU ELECTRIC MFG. CO., LTD.

Canned Motor Pumps Industry Developments

September 2024: Nikkiso Clean Energy & Industrial Gases Group (CE&IG Group), a division of Nikkiso Co., Ltd., partnered with GTT to enhance the re-liquefaction system for LNG-powered vessels. The collaboration involves incorporating GTT’s patented Recycool technology into CE&IG Group’s fuel gas systems, aiming to boost fuel efficiency and lower greenhouse gas (GHG) emissions.

Canned Motor Pumps Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Standard Basic Pumps

- Reverse Circulation Pumps

- High Temperature Pumps

- Self-priming Pumps

- Others

By Pump Design Outlook (Revenue – USD Billion, 2020–2034)

- Single-Stage

- Multistage

By Motor Type Outlook (Revenue – USD Billion, 2020–2034)

- Induction Motors

- Synchronous Motors

By Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Low

- Medium

- High

By Installation Type Outlook (Revenue – USD Billion, 2020–2034)

- Horizontal

- Vertical

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Chemical

- Oil & Gas

- Power

- Refrigeration

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Canned Motor Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.78 billion |

|

Market Size in 2025 |

USD 1.89 billion |

|

Revenue Forecast by 2034 |

USD 3.33 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.78 billion in 2024 and is projected to grow to USD 3.33 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

North America dominated the share in 2024.

A few key players in the market include TEIKOKU ELECTRIC MFG. CO., LTD.; Nikkiso Co., Ltd.; HERMETIC-Pumpen GmbH; Kirloskar Brothers Limited; KSB SE & Co. KGaA; Hayward Tyler Group; ShinMaywa Industries, Ltd.; Flowserve Corporation; Sulzer Ltd.; Grundfos Holding A/S; and Ebara Corporation.

The standard basic pumps segment accounted for the largest share in 2024.

The multistage segment is expected to witness the fastest growth during the forecast period.