Food & Beverage Industry Pumps Market Size, Share, Trends, Industry Analysis Report

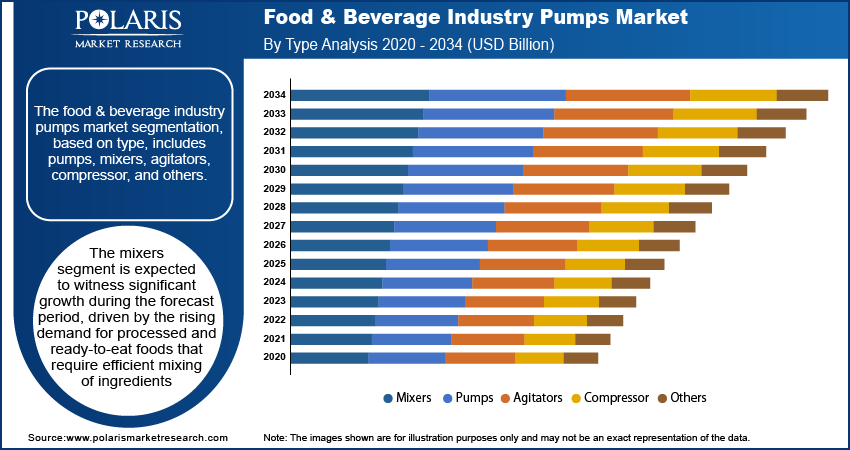

: By Type (Pumps, Mixers, Agitators, Compressor, and Others), Pressure, Flow, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 125

- Format: PDF

- Report ID: PM5605

- Base Year: 2024

- Historical Data: 2020-2023

Food & Beverage Industry Pumps Market Overview

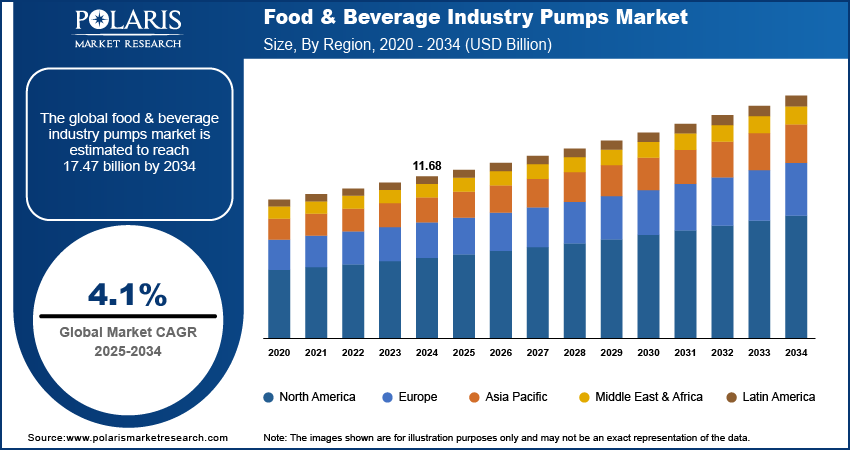

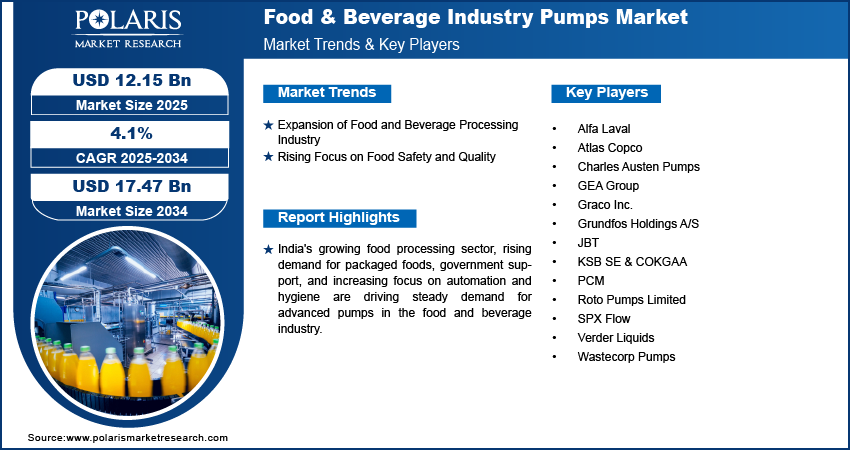

Food & beverage industry pumps market size was valued at USD 11.68 billion in 2024. The market is projected to grow from USD 12.15 billion in 2025 to USD 17.47 billion by 2034, exhibiting a CAGR of 4.1% during the forecast period.

Food and beverage industry pumps are specialized equipment designed to handle the processing, transfer, and packaging of liquids, solids, and semi-solids in food and drink production. These pumps ensure hygiene, precision, and efficiency, meeting stringent sanitation and regulatory standards while maintaining product integrity.

Global lifestyles are becoming busier, leading to a rising preference for processed and ready meals. According to the International Food Information Council, a significant 53% of the American populace posits that processed foods can contribute positively to a balanced diet. This surge in demand drives the need for efficient food production systems, including pumps capable of handling various ingredients such as liquids, powders, and semi-solids. Pumps play a crucial role in processing beverages, dairy, sauces, and other food products by ensuring ingredients move smoothly through different production stages. This not only helps maintain consistency and quality but also optimizes production efficiency. The increasing scale of food and beverage companies to meet consumer demand accelerates the need for specialized pumps in food processing, thereby driving the food & beverage industry pumps market growth.

To Understand More About this Research: Request a Free Sample Report

The food and beverage industry is evolving with advancements in technology, especially in pump systems. Modern industrial pumps are now smarter, more energy-efficient, and designed to operate with minimal maintenance. Intelligent pumps self-monitor and adjust performance, improving production reliability and reducing downtime. These technological improvements help manufacturers enhance productivity while maintaining high-quality standards. Additionally, energy-efficient pumps help reduce costs by consuming less power, benefiting both the environment and the bottom line. Such innovations make pumps a crucial component in the modern food and beverage production process, which in turn is driving the food & beverage industry pumps market demand.

Food & Beverage Industry Pumps Market Dynamics

Expansion of Food and Beverage Processing Industry

The food and beverage processing industry is expanding globally. According to the India Brand Equity Foundation, the food processing industry, categorized under the registered manufacturing sector, employs approximately 1.93 million individuals. Additionally, the unregistered industry employs approximately 5.1 million workers. This expansion leads to a greater need for reliable pumps that improve production efficiency and meet the growing volume of packaged food. The need for specialized pumps increases as new plants and facilities come online. These pumps are used in various processes such as transferring liquids, mixing ingredients, and bottling beverages. Therefore, the development of the food and beverage processing industries is fueling the food & beverage industry pumps market expansion.

Rising Focus on Food Safety and Quality

Increasing consumer awareness about food safety and quality puts food manufacturers under pressure to maintain high standards throughout their production. Hygiene and contamination prevention are top priorities in the food and beverage sector, which is why pumps used in this industry are designed with special features. Hygienic pumps are crafted from materials that prevent bacteria growth and are easy to clean, ensuring no cross-contamination between different food batches. Regulatory bodies are also enforcing stricter rules regarding food production processes, pushing manufacturers to invest in high-quality, food-safe pumps to ensure compliance with these regulations, thereby driving the growth of the food & beverage industry pump revenue.

Food & Beverage Industry Pumps Market Segment Analysis

Food & Beverage Industry Pumps Market Assessment by Type

The food & beverage industry pumps market segmentation, based on type, includes pumps, mixers, agitators, compressor, and others. The mixers segment is expected to witness significant market growth during the forecast period, driven by the rising demand for processed and ready-to-eat foods that require efficient mixing of ingredients. Mixers play a key role in ensuring product consistency, texture, and taste, which are essential in food production. Manufacturers are increasingly investing in advanced mixing technologies as they aim to improve quality and production efficiency, thereby boosting demand for mixers and driving segmental growth in the global market.

Food & Beverage Industry Pumps Market Evaluation by Application

The food & beverage industry pumps market is segmented by application into alcoholic beverages, non-alcoholic beverages, dairy products, fruits and vegetables, bakery and confectionary, and others. The non-alcoholic beverages segment dominated the food & beverage industry pumps market in 2024 due to the high global consumption of drinks such as juices, soft drinks, energy drinks, and bottled water. These products require pumps that handle high volumes while maintaining hygiene and preserving taste. Beverage manufacturers are expanding their production lines as health-conscious consumers increasingly prefer non-alcoholic options, driving the demand for efficient and sanitary pump systems in this segment of the market.

Food & Beverage Industry Pumps Market Regional Analysis

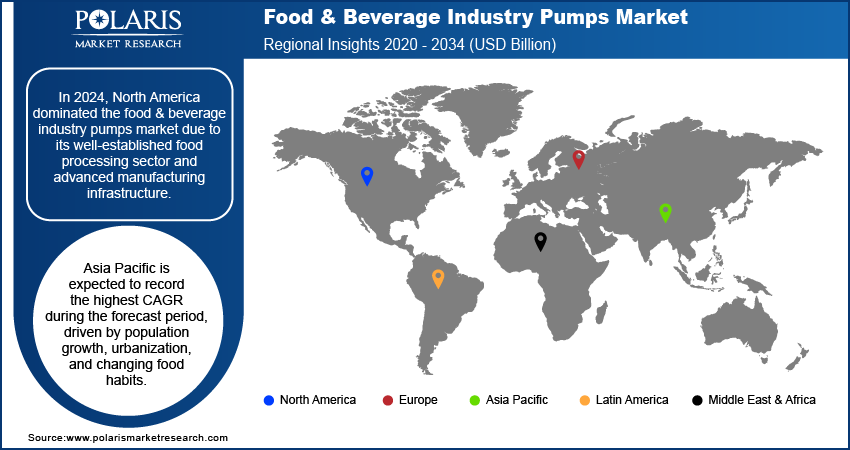

By region, the study provides the food & beverage industry pumps market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the market due to its well-established food processing sector and advanced manufacturing infrastructure. Countries such as the US and Canada have high consumption rates of processed and packaged foods, which increases the demand for efficient and hygienic pumping systems. The presence of leading food and beverage brands and strict food safety regulations further drives the adoption of advanced pump technologies. Additionally, rising investments in automation and sustainability within the food industry further support the growth in demand for industrial pumps, thereby driving the expansion of the food & beverage industry pumps market in North America.

Asia Pacific is expected to record the highest food & beverage industry pumps market CAGR during the forecast period, driven by population growth, urbanization, and changing food habits. Countries such as China, Japan, and Southeast Asian nations are seeing a rise in demand for processed foods and beverages. This is encouraging manufacturers to upgrade their production facilities with efficient pump systems. Increasing foreign investments in the region’s food processing sector and supportive government policies, are further boosting the growth in demand. The need for reliable and hygienic pumping solutions continues to rise across Asia Pacific as more international food brands enter the market and local players expand, thereby driving the market growth in Asia Pacific.

The food & beverage industry pumps market in India is experiencing substantial growth due to its expanding food processing sector and growing consumer demand for packaged and ready meals. Rapid urbanization and changing lifestyles have led to an increase in the consumption of processed foods and beverages, prompting manufacturers to adopt modern production technologies. The government’s support through initiatives such as “Make in India” and the development of food parks is encouraging both local and international investments. The demand for high-quality, hygienic, and energy-efficient pumps is expected to increase in India as food safety standards improve and automation in food production expands, thereby driving the growth of the market in Asia Pacific.

Food & Beverage Industry Pumps Market Key Players & Competitive Analysis Report

The food & beverage industry pumps market opportunity is constantly evolving, with numerous companies striving to innovate and distinguish themselves. Leading global corporations dominate the market by leveraging extensive research and development, and advanced techniques. These companies pursue strategic initiatives such as mergers, acquisitions, partnerships, and collaborations to enhance their product offerings and expand into new markets.

New companies are impacting the industry by introducing innovative products to meet the demand of specific market sectors. According to the food & beverage industry pumps market analysis, this competitive trend is amplified by continuous progress in product offerings. Major players in the market include Alfa Laval; Atlas Copco; Charles Austen Pumps; GEA Group; Graco Inc.; Grundfos Holdings A/S; JBT; KSB SE & COKGAA; PCM; Roto Pumps Limited; SPX Flow; Verder Liquids; and Wastecorp Pumps.

Alfa Laval is a Swedish multinational company that specializes in heat transfer, separation, and fluid handling technologies. Founded in 1883 the company initially focused on dairy centrifuges and has since expanded into various industrial applications. Headquartered in Lund, Sweden, Alfa Laval is publicly traded. The company operates across three main business divisions: Energy, Food & Water, and Marine. The Energy division focuses on solutions for power generation, oil & gas, and renewable energy sectors. The Food & Water division caters to food processing, beverage production, wastewater treatment, and water purification. Meanwhile, the Marine division offers equipment such as pumps, heat exchangers, and separators for maritime use. Alfa Laval's core technologies are central to its product offerings. The company invests in research and development, which results in the introduction of new products each year. Its products are used across various industries, contributing to operational efficiency and environmental management. Alfa Laval has a global presence, with products sold in over 100 countries. It operates 42 major production facilities across Europe, Asia, the USA, and Latin America, and maintains more than 100 service centers worldwide. Key regions include Sweden, China, Denmark, India, and the United States. Its operations are supported by regional centers in various locations. Alfa Laval offers LKH centrifugal pumps for various food and beverage applications, SolidC for cost-efficiency, MR for CIP returns, and UltraPure with Q-doc.

Atlas Copco, founded in 1873 and headquartered in Nacka, Stockholm County, Sweden, is a major industrial equipment manufacturer. The company produces a range of products, including compressors, vacuum systems, air treatment equipment, industrial tools, and assembly systems. Its operations are divided into four main business areas: Compressor Technique, Vacuum Technique, Industrial Technique, and Power Technique. Compressor Technique involves industrial compressors and related services for sectors such as manufacturing and oil and gas. Vacuum Technique provides vacuum products for industries such as semiconductors and food packaging. Industrial Technique focuses on assembly systems and power tools, mainly for automotive and aerospace industries. Power Technique produces portable equipment like compressors and generators for construction projects. Atlas Copco operates globally with customer centers in 71 countries and sales operations in over 180 countries. Its manufacturing facilities are located in several countries, including the United States, Germany, China, Japan, South Korea, and India. Sales are conducted directly or through distributors, allowing the company to maintain a broad presence. Atlas Copco provides contamination-free compressed air solutions for the food and beverage industry. Their oil-free compressors ensure air purity, preventing contamination and maintaining product quality.

Key Companies in Food & Beverage Industry Pumps Market

- Alfa Laval

- Atlas Copco

- Charles Austen Pumps

- GEA Group

- Graco Inc.

- Grundfos Holdings A/S

- JBT

- KSB SE & COKGAA

- PCM

- Roto Pumps Limited

- SPX Flow

- Verder Liquids

- Wastecorp Pumps

Food & Beverage Industry Pumps Market Developments

April 2025: Graco Inc. launched an improved version of its Quantm electric double diaphragm (EODD) pump line, featuring 480V input power. The new model also incorporates Xtreme Torque motor technology, enhancing efficiency, reliability, and cost-saving opportunities.

December 2024: Roto Pumps Ltd. launched its Roto Cake Pumps at IFAT 2024 in Mumbai. These pumps are designed for handling viscous liquids and sludge cakes, offering efficient, odour-free solutions with high flow rates and pressure resistance.

Food & Beverage Industry Pumps Market Segmentation

By Type Outlook (Revenue USD Billion, 2020–2034)

- Pumps

- Mixers

- Agitators

- Compressor

- Others

By Pressure Outlook (Revenue USD Billion, 2020–2034)

- Below 15 Bars

- 15-30 Bars

- Above 30 Bars

By Flow Outlook (Revenue USD Billion, 2020–2034)

- Less than 10 liter Per Second

- 10-100 liter Per Second

- More than 100 liter Per Second

By Application Outlook (Revenue USD Billion, 2020–2034)

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Dairy Products

- Fruits and Vegetables

- Bakery and Confectionary

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food & Beverage Industry Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 11.68 billion |

|

Market Size Value in 2025 |

USD 12.15 billion |

|

Revenue Forecast by 2034 |

USD 17.47 billion |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The food & beverage industry pumps market size was valued at USD 11.68 billion in 2024 and is projected to grow to USD 17.47 billion by 2034.

The global market is projected to register a CAGR of 4.1% during the forecast period, 2025-2034.

North America had the largest share in the global market in 2024.

The key players in the market are Alfa Laval; Atlas Copco; Charles Austen Pumps; GEA Group; Graco Inc.; Grundfos Holdings A/S; JBT; KSB SE & COKGAA; PCM; Roto Pumps Limited; SPX Flow; Verder Liquids; and Wastecorp Pumps.

The non-alcoholic beverage segment dominated the food & beverage industry pumps market in 2024 due to rising consumption of juices, energy drinks and other beverages.

The mixers segment is expected to witness significant growth during the forecast period driven by the rising demand for processed and ready-to-eat foods that require efficient mixing of ingredients.