U.S. Maritime Cybersecurity Market Size, Share, Trend, Industry Analysis Report

By Component (Solution, Services), By Security Type, By Deployment, By Organization Size, By End User – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6184

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

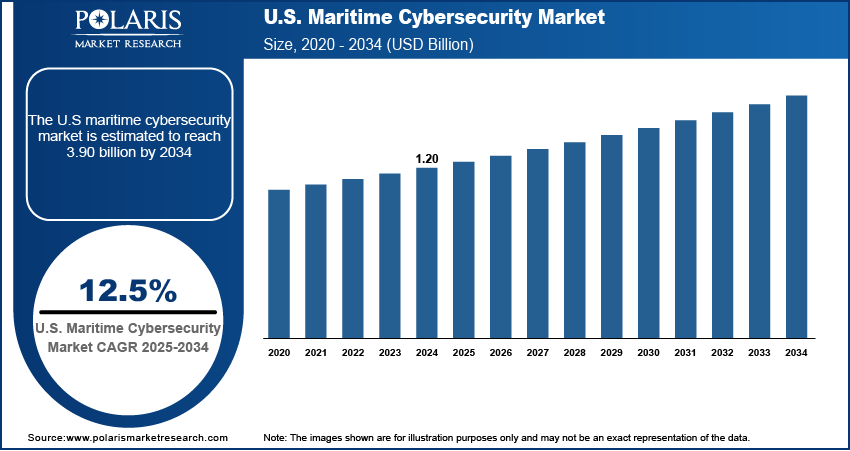

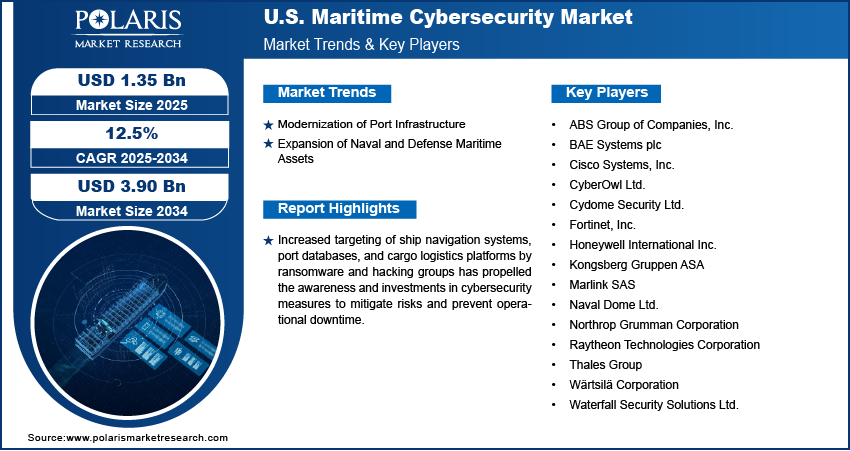

The U.S. maritime cybersecurity market size was valued at USD 1.20 billion in 2024, growing at a CAGR of 12.5% from 2025 to 2034. Growing trade volume across U.S. shipping lanes demands greater reliance on digital systems for navigation and logistics, making cybersecurity critical for avoiding disruptions and maintaining trust.

Key Insights

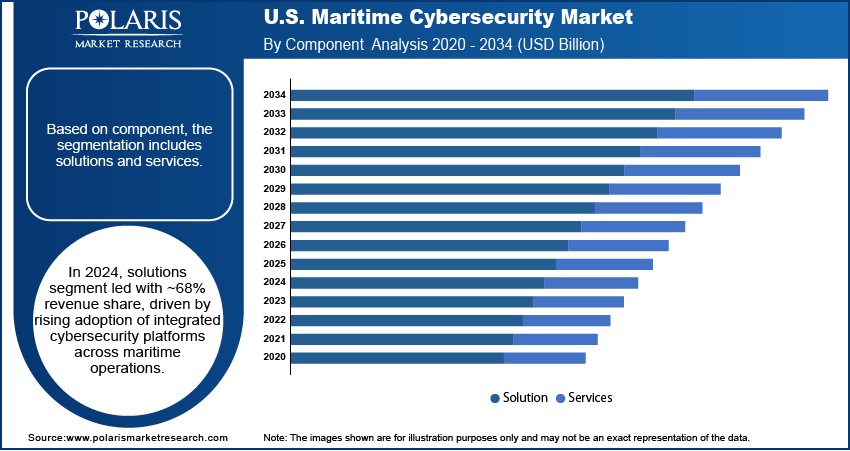

- The solution segment held ~68% of the market share in 2024, driven by the rising adoption of integrated cybersecurity platforms across ports, fleets, and offshore operations.

- The network security segment accounted for ~32% of revenue share in 2024, due to the growing need to protect critical communication links between vessels, ports, and control centers.

- The on-premise deployment segment captured ~67% of the market in 2024, favored for its high data control, low latency, and compliance with maritime security standards.

- The commercial shipping segment led with ~38% revenue share in 2024, driven by extensive digitalization in cargo tracking and fleet management.

Industry Dynamics

- Increasing federal mandates from DHS and USCG are driving cybersecurity adoption across ports and commercial maritime operators.

- Rising cyber threats to critical infrastructure have accelerated investments in secure communication and real-time threat detection systems.

- Integration of AI-powered monitoring enhances vessel-to-shore security and supports compliance with evolving U.S. maritime regulations.

- Fragmented regulatory standards across states and port authorities slow down uniform cybersecurity implementation across the national maritime network.

Market Statistics

- 2024 Market Size: USD 1.20 billion

- 2034 Projected Market Size: USD 3.90 billion

- CAGR (2025–2034): 12.5%

To Understand More About this Research: Request a Free Sample Report

The U.S. maritime cybersecurity market refers to technologies, services, and strategies designed to protect critical maritime infrastructure, vessels, port operations, and offshore platforms from cyber threats. It focuses on safeguarding digital navigation, communication, cargo management, and control systems from unauthorized access and disruptions. The U.S. ports are investing heavily in digital infrastructure such as automated cranes, smart container tracking, and IoT-based systems, which increases exposure to cyber threats and drives demand for robust cybersecurity solutions to ensure safe and efficient port operations.

Strict cybersecurity mandates from agencies such as the U.S. Coast Guard and the Maritime Transportation Security Act are compelling maritime operators to adopt advanced security frameworks, driving consistent investments in threat detection, response protocols, and compliance solutions. Moreover, increasing deployment of digitally controlled naval vessels and surveillance systems in U.S. defense operations is fueling demand for military-grade maritime cybersecurity to safeguard sensitive data, operational communications, and national security infrastructure from state-sponsored cyber threats.

Drivers and Opportunities

Modernization of Port Infrastructure: In the U.S., ports are undergoing major digital upgrades to improve operational efficiency and cargo handling. For instance, in November 2024, the American Administration unveiled the Port Infrastructure Development Program (PIDP), dedicating over USD 653 million to finance 41 specific port enhancement projects across the U.S. Investments are being made in automated cranes, IoT-based sensors, and smart container tracking systems that streamline vessel movement and cargo logistics. While these technologies improve productivity, they also increase the risk of cyber threats targeting critical infrastructure. Cybercriminals can exploit networked systems to cause disruptions, steal sensitive shipping data, or manipulate operations. To counter these risks, ports are integrating advanced cybersecurity tools that protect against unauthorized access, malware, and data breaches. This shift toward smarter port infrastructure is driving steady growth in demand for maritime cybersecurity.

Expansion of Naval and Defense Maritime Assets: U.S. defense agencies are expanding their use of connected maritime technologies, including autonomous naval vessels, smart surveillance systems, and AI-driven command platforms. According to the U.S. Naval Institute, the Navy's initiative to acquire 85 new vessels is projected to have an estimated total expenditure of USD 1 trillion. These systems depend on secure data exchange and reliable communication networks to carry out critical missions. Any cyberattack targeting such systems could compromise national security, operational secrecy, or weapon systems. To prevent these risks, military operations are placing greater emphasis on advanced maritime cybersecurity solutions. These include secure encryption, threat detection, and response mechanisms tailored for defense-grade environments.

Segmental Insights

Component Analysis

Based on component, the U.S. maritime cybersecurity market segmentation includes solutions and services. The solution segment dominated the market in 2024 with ~68% of the revenue share due to the growing implementation of integrated cybersecurity platforms across port facilities, commercial fleets, and offshore operations. Organizations are prioritizing the deployment of real-time threat monitoring, firewalls, and intrusion prevention systems to secure their digital operations. High-profile ransomware incidents targeting shipping lines have pushed companies to invest in end-to-end cybersecurity architectures rather than relying on ad hoc or reactive measures. These purpose-built solutions offer scalability and seamless integration with existing maritime IT systems, making them essential for protecting complex, multi-vessel networks and automated port terminals.

The services segment is expected to register the highest CAGR of 13.1% from 2025 to 2034 due to rising demand for managed security services, risk assessments, and incident response support across the maritime sector. Increasing regulations such as the U.S. Coast Guard’s cyber risk management framework are driving shipping firms and port authorities to seek expert guidance and third-party security audits. Limited in-house cybersecurity expertise across many maritime organizations is also encouraging the outsourcing of tasks such as continuous monitoring and threat intelligence. This shift toward proactive cyber risk management and the need for 24/7 monitoring in a dynamic threat environment are accelerating the growth of cybersecurity service offerings.

Security Type Analysis

In terms of security type, the segmentation includes network security, endpoint security, application security, cloud security, and operational technology (OT) security. The Network security segment held ~32% of the revenue share in 2024 due to the critical need to secure communication pathways across vessels, ports, and remote control centers. Increasing use of satellite links, IoT sensors, and cloud-based fleet management tools makes these networks vulnerable to interception, data breaches, or service disruptions. Maritime operators are investing in intrusion detection systems, encrypted virtual private networks, and network segmentation to safeguard sensitive information and avoid downtime. Real-time vessel tracking, navigation data, and cargo manifests are all network-reliant, making network security the frontline defense against most cyber threats in the maritime environment.

The operational technology (OT) security segment is expected to register the highest CAGR of 13.0% from 2025 to 2034 due to rising automation in port operations and onboard systems. Cranes, propulsion controls, and cargo handling systems are increasingly digitized and connected, creating a larger attack surface. Recent incidents have demonstrated how OT breaches can halt operations or damage equipment, causing massive delays and financial loss. Maritime operators are prioritizing security tools that can monitor and isolate anomalies in real-time without disrupting physical operations. Regulatory pressure is also encouraging the adoption of OT-specific security protocols, which is further fueling demand for robust, resilient OT cybersecurity frameworks across U.S. maritime infrastructure.

Deployment Analysis

In terms of deployment, the U.S. maritime cybersecurity market segmentation includes on-premise and cloud. The on-premise segment held the largest revenue share of ~67% in 2024 due to its ability to offer greater control, data privacy, and low-latency performance for mission-critical maritime systems. Many shipping firms and port authorities in the U.S. operate legacy systems and are wary of placing sensitive operational data on third-party servers. On-premise solutions are often tailored to specific fleet or terminal needs, ensuring compliance with stringent federal security regulations. Additionally, naval and defense-related maritime installations prefer localized infrastructure that can function independently of internet connectivity and avoid exposure to external cloud vulnerabilities, supporting the dominance of this deployment model.

The cloud segment is expected to register the highest CAGR of 13.1% from 2025 to 2034 due to the growing need for scalability, remote access, and centralized threat management across distributed maritime operations. Cloud-based platforms allow shipping companies and port operators to unify cybersecurity operations across fleets and facilities, gaining real-time visibility into potential risks. The shift toward digital twins, predictive analytics, and AI-driven risk detection in the maritime sector is also supporting this trend. Smaller maritime operators lacking internal infrastructure are turning to cloud solutions for cost-effective and up-to-date security tools, accelerating adoption across the ecosystem as operational and cyber complexity continues to increase.

End User Analysis

In terms of end user, the U.S. maritime cybersecurity market segmentation includes commercial shipping, naval and defense, port operators, offshore operations, and others. Commercial shipping segment held the largest revenue share of ~38% in 2024 due to its high volume of digital operations, including cargo management, electronic documentation, and fleet connectivity. Automated shipping routes, remote diagnostics, and real-time tracking systems require continuous protection from cyber threats. High-value cargo and just-in-time delivery models make commercial vessels attractive targets for cybercriminals. In response, shipping companies are heavily investing in cybersecurity to avoid disruptions that could affect overall supply chains.

The naval and defense segment is expected to register the highest CAGR of 13.2% from 2025 to 2034, due to the rising concerns about state-sponsored attacks and digital warfare. Modern naval fleets use networked weapons systems, AI-enabled decision support, and secure satellite communications, all of which require strong cybersecurity. U.S. defense priorities include cyber resilience in maritime domains, prompting increased spending on encrypted systems, real-time threat intelligence, and post-attack recovery solutions. Continuous updates to federal cybersecurity mandates and the integration of joint cyber-physical training exercises are accelerating the deployment of advanced security technologies within naval and coast guard operations.

Key Players and Competitive Analysis

The competitive landscape of the U.S. maritime cybersecurity market is marked by aggressive market expansion strategies and rapid technological advancements. Industry players are focusing on delivering integrated cybersecurity platforms tailored for complex maritime environments, including port logistics, autonomous vessels, and operational technology systems. Strategic alliances between cybersecurity vendors and maritime stakeholders are driving innovation in threat detection, real-time monitoring, and risk management. Joint ventures and long-term collaborations are becoming common, particularly among firms offering both IT and OT security capabilities.

Mergers and acquisitions are reshaping the competitive dynamics, as larger cybersecurity firms acquire niche players to expand their service portfolios and establish domain leadership. Post-merger integration efforts are streamlined to optimize combined technological assets and expand customer outreach across the defense and commercial shipping sectors. Industry analysis suggests a rising trend in developing AI-driven maritime security platforms and endpoint protection solutions to handle evolving threat vectors.

Key Players

- ABS Group of Companies, Inc.

- BAE Systems plc

- Cisco Systems, Inc.

- CyberOwl Ltd.

- Cydome Security Ltd.

- Fortinet, Inc.

- Honeywell International Inc.

- Kongsberg Gruppen ASA

- Marlink SAS

- Naval Dome Ltd.

- Northrop Grumman Corporation

- Raytheon Technologies Corporation

- Thales Group

- Wärtsilä Corporation

- Waterfall Security Solutions Ltd.

U.S. Maritime Cybersecurity Industry Developments

May 2025: Thales enhanced its naval cybersecurity systems by integrating AI-driven threat detection and secure digital architectures to improve cyber resilience in modern maritime operations.

June 2024: Speedcast integrated Cydome’s AI-powered threat analytics, real-time monitoring, vulnerability scanning, and SIEM capabilities into its SIGMA platform, enabling fleet-wide cybersecurity monitoring and compliance with IMO, IACS E26, and NIS2 regulations.

U.S. Maritime Cybersecurity Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solutions

- Risk and Compliance Management

- Identity and Access Management

- Firewall and Intrusion Detection Systems

- Encryption

- Incident Response

- Services

- Professional Services

- Managed Services

By Security Type Outlook (Revenue, USD Billion, 2020–2034)

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Operational Technology (OT) Security

By Deployment Outlook (Revenue, USD Billion, 2020–2034)

- On-premise

- Cloud

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Commercial Shipping

- Naval and Defense

- Port Operators

- Offshore Operations

- Others

U.S. Maritime Cybersecurity Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.20 billion |

|

Market Size in 2025 |

USD 1.35 billion |

|

Revenue Forecast by 2034 |

USD 3.90 billion |

|

CAGR |

12.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 1.20 billion in 2024 and is projected to grow to USD 3.90 billion by 2034.

The U.S. market is projected to register a CAGR of 12.5% during the forecast period.

A few of the key players in the market are ABS Group of Companies, Inc.; BAE Systems plc; Cisco Systems, Inc.; CyberOwl Ltd.; Cydome Security Ltd.; Fortinet, Inc.; Honeywell International Inc.; Kongsberg Gruppen ASA; Marlink SAS; Naval Dome Ltd.; Northrop Grumman Corporation; Raytheon Technologies Corporation; Thales Group; Wärtsilä Corporation; and Waterfall Security Solutions Ltd.

The solution segment dominated the market in 2024 with ~68% of the revenue share due to the growing implementation of integrated cybersecurity platforms across port facilities, commercial fleets, and offshore operations.

The network security segment held ~32% of the revenue share in 2024 due to the critical need to secure communication pathways across vessels, ports, and remote control centers.