U.S. Subcutaneous Immunoglobulin Market Size, Share, Trends, Industry Analysis Report

By Product (IgG, IgA, IgM), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6395

- Base Year: 2024

- Historical Data: 2020-2023

Overview

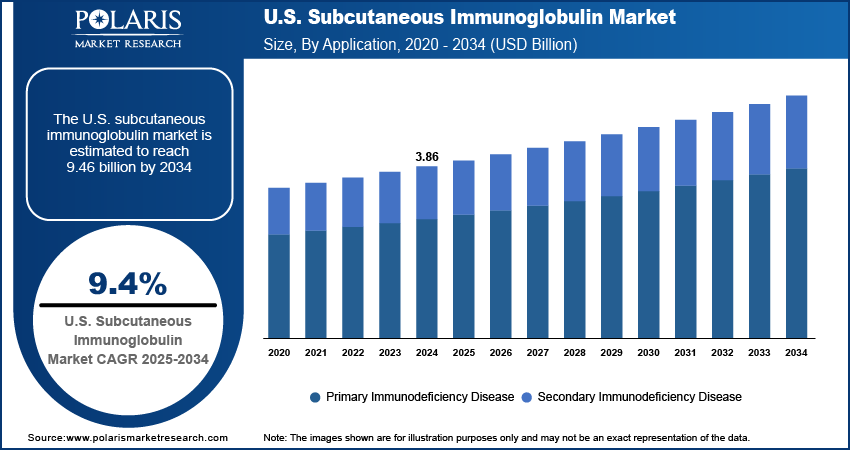

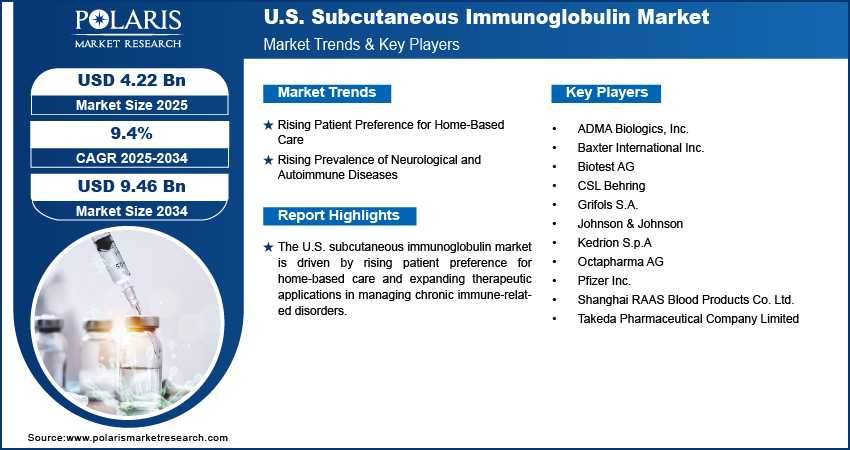

The U.S. subcutaneous immunoglobulin (SCIG) market size was valued at USD 3.86 billion in 2024, growing at a CAGR of 9.4% from 2025 to 2034. Key factors driving demand include improvements in infusion and delivery technology, increasing incidence of immunodeficiency disorders, rising patient preference for home-based care, and rising prevalence of neurological and autoimmune diseases.

Key Insights

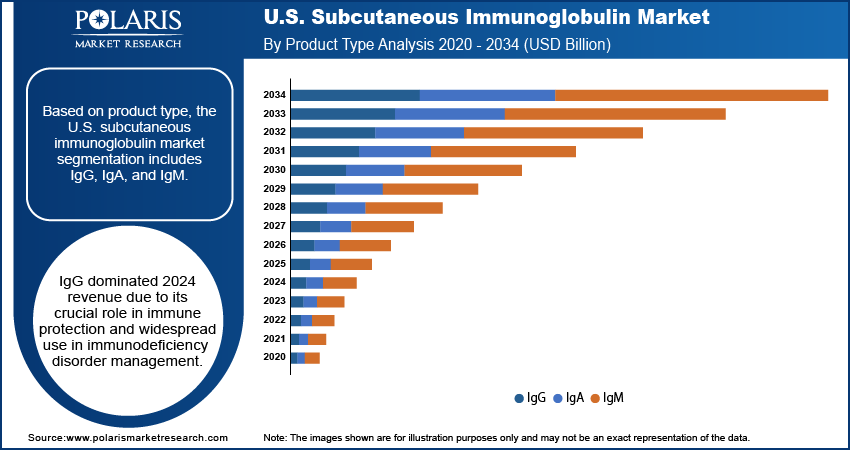

- The IgG segment dominated the market in 2024 due to its critical role in providing effective immune protection for a wide range of immunodeficiency disorders.

- The secondary immunodeficiency segment is expected to witness significant growth driven by rising prevalence of chronic illnesses and immunosuppressive treatments such as chemotherapy.

- The hospitals segment held the largest share in 2024 as the primary center for initial treatment, complex case management, and patient monitoring.

Industry Dynamics

- A growing patient preference for home-based care is accelerating SCIG adoption, driven by its superior convenience, flexibility, and reduced need for clinical visits.

- The rising rates of neurological and autoimmune disorders such as CIDP are expanding the patient pool requiring long-term SCIG therapy, fueling market growth.

- The extremely high cost of therapy and complex insurance hurdles can make SCIG unaffordable and inaccessible for many patients, limiting its adoption.

- New technologies such as easier-to-use pumps and higher-concentration products are making home treatment more convenient, attracting more patients.

Market Statistics

- 2024 Market Size: USD 3.86 billion

- 2034 Projected Market Size: USD 9.46 billion

- CAGR (2025–2034): 9.4%

AI Impact on U.S. Subcutaneous Immunoglobulin Market

- AI enhances patient diagnosis and treatment personalization by analyzing medical data, leading to more accurate and timely use of subcutaneous immunoglobulin therapies.

- AI-driven demand forecasting helps manufacturers and healthcare providers optimize inventory and supply chains, reducing shortages and ensuring consistent availability of immunoglobulin products.

- Machine learning models accelerate clinical research by identifying patient response patterns, aiding in the development of more effective and targeted subcutaneous immunoglobulin formulations.

- AI-powered virtual assistants and monitoring tools improve patient adherence to treatment regimens, enhancing outcomes and reducing complications in long-term

Subcutaneous immunoglobulin (SCIG) refers to a method of immunoglobulin replacement therapy administered under the skin to manage primary and secondary immunodeficiency disorders. In the U.S., the market growth is strongly supported by continuous improvements in infusion and delivery technology. Advanced infusion pumps, prefilled syringes, and portable medical devices have enhanced the convenience, comfort, and safety of home-based administration, reducing the dependency on clinical settings. For instance, in April 2025, Aptar's SPEED1 survey found its iPUMP connected assistant improved immunotherapy adherence by 15% and significantly increased independent treatment use among pediatric patients, while also boosting parental reassurance regarding administration. These advancements increase patient adherence and also expand accessibility for individuals requiring long-term immunoglobulin therapy. As a result, technological innovation has become a key enabler in strengthening the adoption of SCIG treatments across the country.

The rising prevalence of immunodeficiency disorders drives the U.S. subcutaneous immunoglobulin market expansion. The growing patient base with conditions such as primary immunodeficiency diseases (PIDD) and secondary immunodeficiency’s associated with chronic illnesses has fueled demand for consistent immunoglobulin therapies. SCIG, with its steady absorption profile and lower risk of systemic side effects, offers an effective and patient-friendly alternative to intravenous administration. This increasing clinical need, combined with the ability of SCIG to provide long-term management and improve patient quality of life, positions it as a vital therapeutic option in the U.S. healthcare landscape.

Drivers & Opportunities

Rising Patient Preference for Home-Based Care: Rising patient preference for home-based care is driving the U.S. subcutaneous immunoglobulin market growth opportunities, as it aligns with the broader shift toward patient-centered treatment models. SCIG therapy enables self-administration in the comfort of a home setting, offering greater flexibility, convenience, and reduced dependence on frequent hospital or clinic visits. This approach minimizes healthcare costs and also enhances treatment adherence by integrating therapy into patients' daily routines. In a country where accessibility and efficiency of care are highly valued, the ability of SCIG to support home healthcare administration makes it an attractive option for both patients and providers, thereby driving its adoption in the U.S.

Rising Prevalence of Neurological and Autoimmune Diseases: The rising prevalence of neurological and autoimmune diseases is another important factor fueling the growth of the U.S. SCIG market. Conditions such as chronic inflammatory demyelinating polyneuropathy (CIDP), multifocal motor neuropathy (MMN), and other autoimmune disorders increasingly require long-term immunoglobulin therapy. A January 2025 report by the Mayo Clinic estimated that approximately 15 million people in the U.S. are affected by one or more of 105 autoimmune diseases. SCIG offers a consistent and effective treatment solution by providing stable immunoglobulin levels with fewer systemic side effects compared to intravenous options. The demand for SCIG as a safer, more manageable, and patient-friendly therapy continues to strengthen as the patient population managing these chronic conditions expands. This growing clinical application highlights its role in addressing unmet needs across neurological and autoimmune disease management in the U.S.

Segmental Insights

Product Type Analysis

Based on product type, the U.S. subcutaneous immunoglobulin market segmentation includes IgG, IgA, and IgM. The IgG segment accounted for the largest revenue share in 2024. The dominance is primarily attributed to its key role in providing effective immune protection and its widespread use in the management of immunodeficiency disorders. IgG is the most abundant antibody in human plasma and has well-established therapeutic applications, making it the preferred choice for both primary and secondary immunodeficiency treatment. Its proven safety profile, broad availability, and compatibility with advanced infusion technologies further strengthen its adoption across diverse patient populations in the U.S., ensuring its position as the leading product type.

Application Analysis

In terms of application, the U.S. subcutaneous immunoglobulin market segmentation includes primary immunodeficiency disease and secondary immunodeficiency disease. The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period attributed to the increasing prevalence of chronic illnesses and medical treatments that compromise immune function, such as cancer therapies and organ transplants. Patients in these categories often require long-term immunoglobulin replacement to maintain adequate immune protection. SCIG provides a steady and effective therapy option that can be managed over extended durations, which makes it particularly suitable for this growing patient group in the U.S. healthcare system.

End Use Analysis

The U.S. subcutaneous immunoglobulin market segmentation, based on end use, includes hospitals, homecare, clinics, and others. The hospitals segment held the largest share in 2024. The segment growth is driven by the key role of hospitals as the primary point of care for initiating treatment, monitoring patient response, and managing complex immunodeficiency cases. Hospitals in the U.S. are equipped with advanced infusion technologies and skilled healthcare professionals, making them central to delivering immunoglobulin therapies. Furthermore, the need for initial dose adjustments, safety monitoring, and patient training is most effectively managed in a hospital setting, ensuring better clinical outcomes. This strong infrastructure and clinical oversight reinforce the dominance of hospitals as the leading end use segment.

Key Players & Competitive Analysis

The U.S. subcutaneous immunoglobulin (SCIG) market landscape is characterized by intense competitive intelligence and strategy among leading plasma companies. Vendor strategies focus on technological advancement in high-concentration formulations and facilitated infusion systems to drive revenue growth. Growth projections remain strong, fueled by a latent demand and opportunities in expanding autoimmune and neurological indications. Expert's insight points to expansion opportunities through home-based care models, a major disruption and trend. Strategic investments are concentrated on sustainable value chains to secure plasma supply, a critical factor given ongoing supply chain disruptions. Success relies on competitive positioning through superior patient support services and demonstrating long-term revenue opportunities in both developed markets and emerging market segments.

A few major companies operating in the U.S. subcutaneous immunoglobulin industry include ADMA Biologics, Inc.; Baxter International Inc.; Biotest AG; CSL Behring; Grifols S.A.; Johnson & Johnson (Omrix Biopharmaceuticals Inc.); Kedrion S.p.A; Octapharma AG; Pfizer Inc.; Shanghai RAAS Blood Products Co. Ltd.; and Takeda Pharmaceutical Company Limited.

Key Players

- ADMA Biologics, Inc.

- Baxter International Inc.

- Biotest AG

- CSL Behring

- Grifols S.A.

- Johnson & Johnson (Omrix Biopharmaceuticals Inc.)

- Kedrion S.p.A

- Octapharma AG

- Pfizer Inc.

- Shanghai RAAS Blood Products Co. Ltd.

- Takeda Pharmaceutical Company Limited

U.S. Subcutaneous Immunoglobulin Industry Developments

- July 2024: The FDA approved an expanded label for Grifols XEMBIFY to include treatment-naïve patients with primary immunodeficiencies. It is the first 20% U.S. Subcutaneous Immunoglobulin approved for initial therapy without requiring prior intravenous administration.

- January 2024: The FDA approved Takeda's HYQVIA for CIDP maintenance therapy in adults. Subcutaneous Immunoglobulin allows for less frequent, at-home infusions, including self-administration after training, to prevent relapse.

U.S. Subcutaneous Immunoglobulin Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- IgG

- IgA

- IgM

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Primary Immunodeficiency Disease

- Secondary Immunodeficiency Disease

By End Use (Revenue, USD Billion, 2020–2034)

- Hospitals

- Homecare

- Clinics

- Others

U.S. Subcutaneous Immunoglobulin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.86 Billion |

|

Market Size in 2025 |

USD 4.22 Billion |

|

Revenue Forecast by 2034 |

USD 9.46 Billion |

|

CAGR |

9.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 3.86 billion in 2024 and is projected to grow to USD 9.46 billion by 2034.

The market is projected to register a CAGR of 9.4% during the forecast period.

A few of the key players in the market are ADMA Biologics, Inc.; Baxter International Inc.; Biotest AG; CSL Behring; Grifols S.A.; Johnson & Johnson (Omrix Biopharmaceuticals Inc.); Kedrion S.p.A; Octapharma AG; Pfizer Inc.; Shanghai RAAS Blood Products Co. Ltd.; and Takeda Pharmaceutical Company Limited.

The IgG segment accounted for the largest revenue share in 2024.

The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period.