U.S. Artificial Intelligence in Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Component (Hardware, Software), By Technology, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6397

- Base Year: 2024

- Historical Data: 2020-2023

Overview

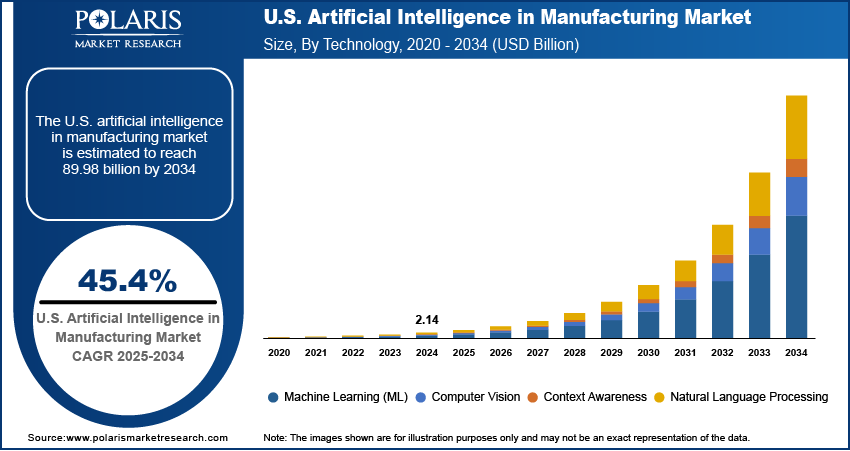

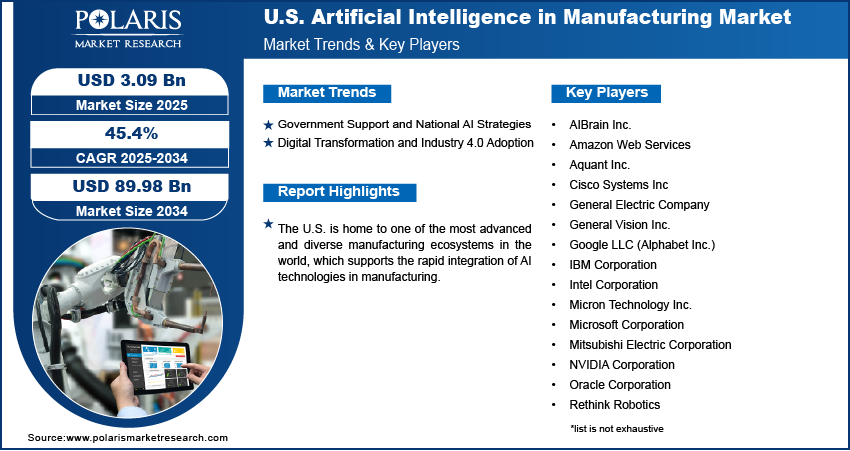

The U.S. artificial intelligence (AI) in manufacturing market size was valued at USD 2.14 billion in 2024, growing at a CAGR of 45.4% from 2025 to 2034. The market growth is driven by government support and national AI strategies, and digital transformation and industry 4.0 adoption.

Key Insights

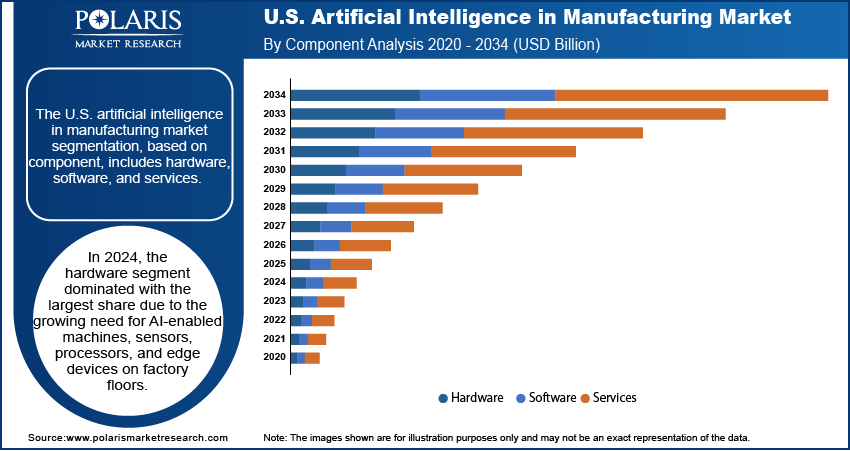

- The hardware segment led the U.S. AI in manufacturing market in 2024, driven by rising demand for advanced computing infrastructure, AI-integrated sensors, and robotics across manufacturing facilities.

- The computer vision segment experienced substantial growth in 2024, fueled by the growing need for automated inspection, workplace safety monitoring, and visual data analysis in industries such as automotive, aerospace, and food production.

- The production planning segment is projected to witness strong growth during the forecast period as manufacturers seek greater flexibility and responsiveness to address shifting consumer demands, workforce shortages, and ongoing supply chain challenges.

- The medical devices segment held the largest share in 2024, supported by the United States’ robust healthcare industry, strong research and development capabilities, and stringent regulatory standards that demand high-precision, AI-assisted manufacturing processes

Industry Dynamics

- Government support and national AI strategies drive the adoption of AI in manufacturing.

- Digital transformation and Industry 4.0 adoption fuel the industry growth.

- The advanced and diverse manufacturing ecosystems in the U.S. supports the rapid integration of AI technologies

- High initial investment costs and integration complexities are restraining the adoption of AI in manufacturing.

Market Statistics

- 2024 Market Size: USD 2.14 billion

- 2034 Projected Market Size: USD 89.98 billion

- CAGR (2025–2034): 45.4%

Artificial intelligence (AI) in manufacturing refers to the use of AI technologies such as machine learning, computer vision, and robotics to optimize production processes, improve quality control, and reduce downtime. It enables predictive maintenance, real-time monitoring, and automated decision-making across supply chains and factory operations. AI helps manufacturers increase efficiency, lower costs, and respond more quickly to market demands by analyzing large volumes of data.

The U.S. is a global leader in AI innovation, due to the presence of major technology firms such as IBM, Microsoft, Google, Amazon, and numerous startups focused on industrial AI. These companies actively collaborate with manufacturers to develop and deploy tailored AI solutions, including predictive maintenance, process automation, and quality control systems. The U.S. startup ecosystem, supported by venture capital and accelerators, is continually producing new AI tools designed specifically for factory environments. This close synergy between tech developers and industrial users are fueling wide-scale deployment, thereby driving the growth.

The U.S. is home to one of the most advanced and diverse manufacturing ecosystems in the world, which supports the rapid integration of AI technologies. From aerospace and automotive to electronics and medical devices, U.S. manufacturers are adopting AI to improve production efficiency, reduce downtime, and optimize resource use. Many of these industries already have strong digital infrastructure, making it easier to scale AI applications. Additionally, collaborations between industry and research institutions support real-world testing and deployment of AI in high-value manufacturing environments, thereby accelerating the pace of commercial adoption across sectors.

Drivers & Opportunities

Government Support and National AI Strategies: The U.S. government's emphasis on technological advancement is driving AI adoption in manufacturing. Initiatives such as the National AI Initiative Act and funding from the CHIPS and Science Act support AI research, development, and industrial integration. Federal agencies are partnering with private companies to modernize critical manufacturing infrastructure through AI. These national strategies encourage innovation, provide funding incentives, and promote the use of AI across supply chains. Combined with defense-related innovation programs, the government’s proactive approach is fueling the growth.

Digital Transformation and Industry 4.0 Adoption: Digital transformation is a central theme for U.S. manufacturers aiming to stay competitive globally. The push toward smart factories, data-driven decision-making, and real-time analytics is fueling AI investments across the sector. Many companies are integrating AI as part of broader Industry 4.0 initiatives, which include robotics, industrial IoT, and cloud computing. The U.S. manufacturers deploy AI across various production stages from planning and scheduling to quality assurance with access to digital infrastructure and advanced analytics platforms, thereby driving the growth.

Segmental Insights

Component Analysis

The U.S. artificial intelligence in manufacturing market segmentation, based on component, includes hardware, software, and services. In 2024, the hardware segment dominated with the largest share driven by strong demand for high-performance computing systems, AI-enabled sensors, and robotics. The presence of leading technology firms and chipmakers such as Intel, NVIDIA, and Micron supports rapid innovation and local availability of advanced hardware components. U.S. manufacturers are investing heavily in modernizing factory floors with edge computing, industrial automation, and smart robotics. This infrastructure is essential for enabling real-time AI processing and system integration. Federal incentives under programs such as the CHIPS and Science Act have further accelerated domestic semiconductor production and AI hardware deployment across industrial sectors, thereby fueling the segment growth.

Technology Analysis

The U.S. artificial intelligence in manufacturing market segmentation, based on technology, includes machine learning (ML), computer vision, context awareness, and natural language processing. The computer vision segment accounted for significant growth fueled by increased demand for automated quality inspection, worker safety monitoring, and visual analytics in sectors such as automotive, aerospace, and food processing. The U.S. manufacturers are turning to AI-powered vision systems to meet high product quality standards and reduce reliance on manual inspection. The technology is further being adopted for real-time defect detection, assembly verification, and predictive maintenance. Strong AI research capabilities, paired with the commercial availability of affordable, high-resolution imaging hardware, have made computer vision a practical and scalable solution for U.S. manufacturers seeking precision and efficiency.

Application Analysis

The U.S. artificial intelligence in manufacturing market segmentation, based on application, includes material movement, predictive maintenance & machinery inspection, production planning, field services, quality control & reclamation, and others. The production planning segment is expected to experience significant growth as manufacturers aim to become more agile in response to fluctuating consumer demand, labor shortages, and supply chain disruptions. AI helps optimize production schedules, resource allocation, and inventory management, enabling smarter, data-driven decision-making. With growing complexity in product lines and increasing pressure to reduce lead times, manufacturers are using AI tools to improve efficiency and adaptability. Additionally, the U.S. government’s push for domestic manufacturing and supply chain resilience is prompting companies to reconfigure operations, thereby fueling the segment growth.

End Use Analysis

The U.S. artificial intelligence in manufacturing market segmentation, based on end use, includes semiconductor & electronics, energy & power, medical devices, automobile, heavy metal & machine manufacturing, and others. The medical devices segment dominated with the largest share in 2024, driven by the country’s strong healthcare sector, advanced R&D ecosystem, and strict regulatory requirements. The U.S. manufacturers are leveraging AI to maintain high levels of product quality, traceability, and compliance with FDA standards. The demand for precision manufacturing in producing complex devices such as implants, diagnostic tools, and wearable technologies has made AI essential for automating inspection, ensuring consistency, and optimizing production workflows. Furthermore, increased investments in personalized medicine and connected health devices encouraged AI adoption throughout the medical device manufacturing lifecycle.

Key Players and Competitive Analysis

The competitive landscape of the U.S. artificial intelligence in manufacturing market is defined by a robust mix of global tech giants, industrial automation leaders, and specialized AI startups. Key players such as Amazon Web Services, IBM, Google (Alphabet Inc.), Microsoft, and Oracle provide cloud-based AI platforms that support a wide range of manufacturing applications, from predictive maintenance to process optimization. Hardware innovators such as Intel, NVIDIA, and Micron Technology are critical in enabling high-performance AI computing at the factory level. Industrial technology firms such as General Electric, Rockwell Automation, and Cisco Systems offer AI-integrated automation and control solutions. Emerging companies such as Sight Machine, Aquant Inc., and SparkCognition contribute niche innovations in real-time analytics and machine learning for manufacturing environments. The competitive environment is driven by continuous R&D, partnerships between tech and manufacturing firms, and a national push for digital transformation and domestic industrial growth.

Key Players

- AIBrain Inc.

- Amazon Web Services

- Aquant Inc.

- Cisco Systems Inc

- General Electric Company

- General Vision Inc.

- Google LLC (Alphabet Inc.)

- IBM Corporation

- Intel Corporation

- Micron Technology Inc.

- Microsoft Corporation

- Mitsubishi Electric Corporation

- NVIDIA Corporation

- Oracle Corporation

- Rethink Robotics

- Rockwell Automation Inc

- SAP SE

- Siemens AG

- Sight Machine

- Spark Cognition Inc.

Artificial Intelligence in Manufacturing Industry Developments

In June 2025, Amazon launched its new AI foundation model, DeepFleet, to enhance robotic fleet efficiency and deployed its one millionth robot, improving delivery speed, reducing operational costs, and reinforcing its leadership in intelligent warehouse automation.

U.S. Artificial Intelligence in Manufacturing Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Machine Learning (ML)

- Computer Vision

- Context Awareness

- Natural Language Processing

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Material Movement

- Predictive Maintenance & Machinery Inspection

- Production Planning

- Field Services

- Quality Control & Reclamation

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Semiconductor & Electronics

- Energy & Power

- Medical devices

- Automobile

- Heavy Metal & Machine Manufacturing

- Others

U.S. Artificial Intelligence in Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.14 Billion |

|

Market Size in 2025 |

USD 3.09 Billion |

|

Revenue Forecast by 2034 |

USD 89.98 Billion |

|

CAGR |

45.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.14 billion in 2024 and is projected to grow to USD 89.98 billion by 2034.

The market is projected to register a CAGR of 45.4% during the forecast period.

A few of the key players in the market are Microsoft Corporation; Mitsubishi Electric Corporation; NVIDIA Corporation; Oracle Corporation; Rethink Robotics; Rockwell Automation Inc; SAP SE; Siemens AG; Sight Machine; and Spark Cognition Inc.

The hardware segment dominated the market share in 2024.

The production planning segment is expected to witness the significant growth during the forecast period.