U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Market Size, Share, Trends, Industry Analysis Report

By Service Type (In-House, Contract Outsourcing), By Synthesis Type, By Animal Type, By Therapeutic Category – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM6399

- Base Year: 2024

- Historical Data: 2020-2023

Overview

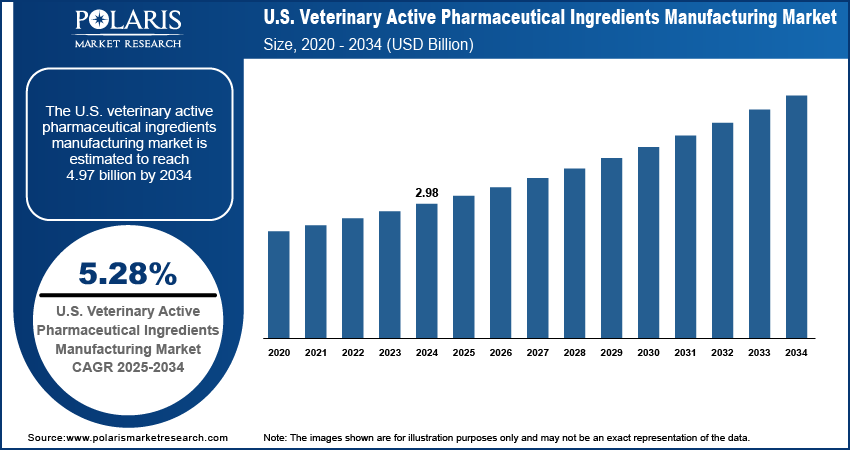

The U.S. veterinary active pharmaceutical ingredients manufacturing market size was valued at USD 2.98 billion in 2024, growing at a CAGR of 5.28% from 2025 to 2034. Key factors driving demand for U.S. veterinary active pharmaceutical ingredients manufacturing include increasing disposable income, rising pet ownership, and growing animal health expenditure.

Key Insights

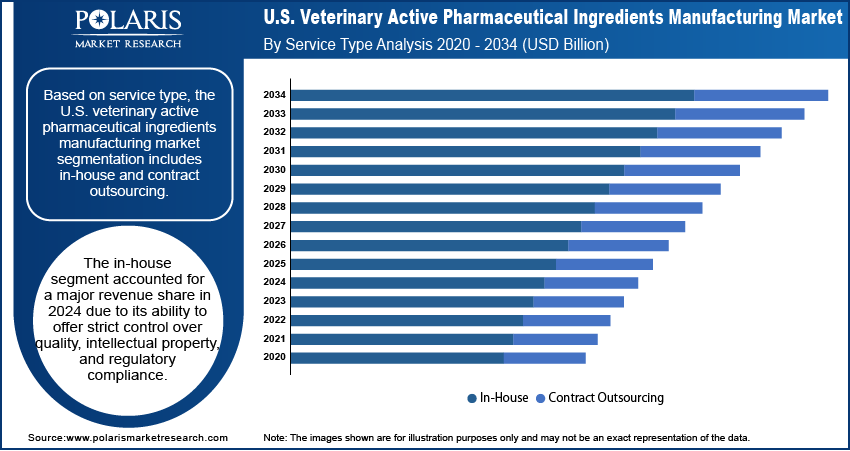

- The in-house segment accounted for a major revenue share in 2024 due to its ability to offer strict control over quality.

- The production animals segment dominated the revenue share in 2024 due to strong demand for veterinary medicines in swine, cattle, and poultry production.

Industry Dynamics

- Increasing disposable income is driving the demand for veterinary active pharmaceutical ingredients manufacturing by empowering pet owners to spend more on advanced and preventative animal healthcare.

- Rising pet ownership is fueling the U.S. veterinary active pharmaceutical ingredients manufacturing market growth by encouraging regular veterinary visits and higher drug utilization.

- Growing advancements in manufacturing processes are expected to create a lucrative market opportunity during the forecast period.

- Stringent regulations governing the quality of pharmaceutical products and vaccines for animals hinder the market growth.

Market Statistics

- 2024 Market Size: USD 2.98 Billion

- 2034 Projected Market Size: USD 4.97 Billion

- CAGR (2025–2034): 5.28%

Artificial Intelligence (AI) Impact on U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Market

- AI accelerates drug discovery by analyzing large datasets to identify novel veterinary APIs, reducing R&D costs and timelines.

- Predictive analytics powered by AI helps manufacturers optimize formulations and improve efficacy of antiparasitics, anti-infectives, and NSAIDs.

- AI-driven automation enhances production efficiency, minimizes human error, and ensures consistent quality standards in API manufacturing.

- AI-enabled supply chain management improves raw material sourcing, inventory planning, and distribution efficiency across the U.S. market.

Veterinary active pharmaceutical ingredients (APIs) manufacturing involves the production of biologically active substances used in formulating medicines for animals. These APIs serve as the core components in veterinary drugs that treat infections, manage pain, control parasites, and support animal health. They are essential in ensuring the safety, productivity, and welfare of livestock and companion animals. The manufacturing process requires stringent quality control, advanced technology, and adherence to regulatory standards to maintain purity, efficacy, and consistency, ultimately safeguarding animal and human health through improved veterinary care.

In the U.S., veterinary API manufacturing plays a critical role in supporting the country’s large livestock industry and growing pet care market. The industry focuses on producing high-quality APIs such as antiparasitics, antibiotics, and anti-inflammatory agents to address the rising demand for animal healthcare. Strong regulatory oversight by the FDA ensures strict compliance with safety and efficacy standards. The sector benefits from advanced pharmaceutical technologies, expanding research in animal health, and increasing awareness of zoonotic disease prevention.

The U.S. veterinary active pharmaceutical ingredients manufacturing industry is driven by the rising animal health expenditure. American Pet Products Association, in its report, stated that USD 151.9 billion was spent on pets in 2024 in the U.S. compared to USD 147.09 billion in 2023. This drove pet owners and livestock producers to invest in disease prevention and productivity-enhancing medicines to protect economic value, which created the need for veterinary active pharmaceutical ingredients (APIs). Furthermore, rising animal health expenditure is funding more R&D activities into novel therapeutics. This is fueling veterinary pharma manufacturers to develop and produce new, sophisticated APIs to meet these innovative formulations.

Drivers & Opportunities

Increasing Disposable Income: Increasing disposable income in the U.S. is boosting demand for veterinary active pharmaceutical ingredients (APIs) manufacturing by empowering pet owners to spend more on advanced and preventative animal healthcare. According to the U.S. Census Bureau, the first quarter 2025 e-commerce sales increased 5.6% from the first quarter of 2024. Families and pet owners with more disposable income are increasingly opting for premium services such as specialized medications, long-term chronic disease management, and advanced treatments that all rely on specific active ingredients. Moreover, the higher disposable income is expanding the pet insurance sector, which is further facilitating access to expensive procedures and drugs, thereby creating a sustained, high-value demand for veterinary active pharmaceutical ingredients.

Rising Pet Ownership: Rising pet ownership in the U.S. is propelling the demand for veterinary APIs manufacturing as more households spend on preventive care, therapeutic drugs, and nutritional supplements for companion animals. The growth of companion animal insurance is further encouraging regular veterinary visits and higher drug utilization, creating the need for veterinary active pharmaceutical ingredients. Hence, as the pet population expands, pharmaceutical companies require larger volumes of APIs to meet the demand for effective, safe, and diverse veterinary medicines.

Segmental Insights

Service Type Analysis

Based on service type, the segmentation includes in-house and contract outsourcing. The in-house segment accounted for a major revenue share in 2024 due to its ability to offer strict control over quality, intellectual property, and regulatory compliance. Companies such as Zoetis and Elanco invested heavily in dedicated manufacturing sites to ensure a consistent supply of active pharmaceutical ingredients (APIs) for veterinary drugs. The need to safeguard proprietary formulations, maintain higher profit margins, and achieve faster turnaround times also drove the preference for in-house production. Moreover, the rising demand for specialized veterinary medicines for companion animals encouraged firms to strengthen their internal manufacturing capabilities, contributing to segment dominance.

The contract outsourcing segment is projected to grow at a robust pace in the coming years, owing to veterinary pharmaceutical companies seeking cost efficiency and flexibility in API production. Contract manufacturing organizations (CMOs) offer advanced technologies, expertise in complex synthesis, and scalability that reduce capital expenditure for veterinary drug makers. Smaller biotechnology firms, in particular, depend on outsourcing to overcome resource constraints and bring new therapies to market quickly. Increasing regulatory complexities in the U.S. further encourage companies to partner with specialized CMOs that already comply with FDA and USDA standards. The growing prevalence of chronic diseases in pets, coupled with rising demand for affordable veterinary medicines, is expected to continue to push pharmaceutical companies toward outsourcing.

Synthesis Type Analysis

In terms of synthesis type, the segmentation includes chemical-based API, biological API, and HPAPI. The chemical-based API segment held the largest U.S. veterinary active pharmaceutical ingredients manufacturing market share in 2024. Manufacturers produced antiparasitics, anti-infectives, and non-steroidal anti-inflammatory drugs (NSAIDs) predominantly through chemical synthesis due to their cost efficiency, established processes, and scalability. The ability to achieve consistent quality and mass production supported the continued reliance on chemical-based APIs. Furthermore, the high demand for preventive and curative treatments in livestock farming, where large volumes of medications are required to safeguard herd health and ensure food safety, contributed to the dominance of the segment.

Animal Type Analysis

In terms of animal type, the segmentation includes production animals and companion animals. The production animals segment dominated the revenue share in 2024 due to strong demand for veterinary medicines in cattle, poultry, and swine production. The U.S. agricultural sector, focused on ensuring food safety and maintaining supply chain stability, further elevated the use of veterinary drugs in livestock farming. Rising concerns about zoonotic diseases and the growing emphasis on preventive healthcare in farm animals also encouraged pharmaceutical manufacturers to strengthen their production of APIs targeted at production animals. Additionally, government policies supporting animal health and food security contributed to the segment’s leading position.

The companion animal segment is expected to grow at a rapid pace in the coming years, owing to the increasing pet ownership. Pet owners are increasingly willing to spend more on advanced healthcare for dogs, cats, and other household pets. This factor is driving demand for high-quality APIs used in biologics, anti-infectives, and pain management therapies. The growing prevalence of chronic diseases such as arthritis, diabetes, and cancer in companion animals is further boosting the need for innovative veterinary medicines. Strong emotional bonds between owners and pets, coupled with increasing insurance coverage for veterinary care, are expected to accelerate growth in the companion animal category in the years ahead.

Therapeutic Category Analysis

In terms of therapeutic category, the segmentation includes antiparasitics, anti-infectives, NSAIDs, and others. The antiparasitics segment accounted for a major revenue share in 2024 due to their extensive use in both livestock and companion animals. Farmers relied heavily on these products to control internal and external parasites that significantly reduce productivity in cattle, poultry, and swine. The need to maintain herd health and ensure food quality reinforced consistent demand for APIs used in antiparasitic formulations. Moreover, pet owners increasingly sought preventive parasite control for dogs and cats to safeguard them against fleas, ticks, and heartworms. The rising threat of parasitic resistance also pushed manufacturers to invest in next-generation molecules, further strengthening the position of this therapeutic class.

Key Players & Competitive Analysis Report

The U.S. veterinary active pharmaceutical ingredients (API) manufacturing market features a competitive landscape fragmented between large, integrated animal health corporations, and specialized contract manufacturers. Dominant players such as Zoetis and Merck Animal Health leverage vertical integration, producing APIs in-house for their proprietary formulations to control supply and quality. This contrasts with dedicated API suppliers such as Huateng Pharma and SUANFARMA, which compete on cost-effectiveness and scalable production for generic medicines. Furthermore, established chemical giants such as Ofichem Group and Fabbrica Italiana Sintetici supply niche compounds. Intensifying competition arises from stringent FDA regulations, which elevate barriers to entry, and a growing strategic focus on outsourcing to lower-cost international manufacturers to improve margins in a price-sensitive market.

A few major companies operating in the U.S. veterinary active pharmaceutical ingredients manufacturing market include Alivira Animal Health Limited, Bimeda Inc., Elanco Animal Health, Excel Industries Ltd., Fabbrica Italiana Sintetici S.p.A., Huateng Pharma, Merck Animal Health, Ofichem Group, Phibro Animal Health Corporation, Rochem International Inc., SUANFARMA, and Zoetis.

Key Companies

- Alivira Animal Health Limited

- Bimeda Inc.

- Elanco Animal Health

- Excel Industries Ltd.

- Fabbrica Italiana Sintetici S.p.A.

- Huateng Pharma

- Merck Animal Health

- Ofichem Group

- Phibro Animal Health Corporation

- Rochem International Inc.

- SUANFARMA

- Zoetis

U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Industry Developments

In January 2024, Huateng Pharma, a contract development and manufacturing organization (CDMO) specializing in APIs and intermediates, introduced a comprehensive range of veterinary solutions, including Fluralaner and Sarolaner.

In July 2023, Bimeda Inc. announced the launch of the SpectoGard Sterile Solution for veterinarians and cattle producers in the U.S.

U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- In House

- Contract Outsourcing

- Contract Development

- Preclinical Development

- Clinical Development

- Contract Manufacturing

- Contract Development

By Synthesis Type Mode Outlook (Revenue, USD Billion, 2020–2034)

- Chemical-Based API

- Biological API

- HPAPI

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Production Animals

- Companion Animals

By Therapeutic Category Outlook (Revenue, USD Billion, 2020–2034)

- Antiparasitics

- Anti-infectives

- NSAIDs

- Others

U.S. Veterinary Active Pharmaceutical Ingredients Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.98 Billion |

|

Market Size in 2025 |

USD 3.13 Billion |

|

Revenue Forecast by 2034 |

USD 4.97 Billion |

|

CAGR |

5.28% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.98 billion in 2024 and is projected to grow to USD 4.97 billion by 2034.

The market is projected to register a CAGR of 5.28% during the forecast period.

A few of the key players in the market are Alivira Animal Health Limited, Bimeda Inc., Elanco Animal Health, Excel Industries Ltd., Fabbrica Italiana Sintetici S.p.A., Huateng Pharma, Merck Animal Health, Ofichem Group, Phibro Animal Health Corporation, Rochem International Inc., SUANFARMA, and Zoetis.

The in-house segment dominated the market revenue share in 2024.

The companion animal segment is projected to witness the fastest growth during the forecast period.