Europe Subcutaneous Immunoglobulin Market Size, Share, Trends, Industry Analysis Report

By Product (IgG, IgA, IgM), By Application, By End Use, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6396

- Base Year: 2024

- Historical Data: 2020-2023

Overview

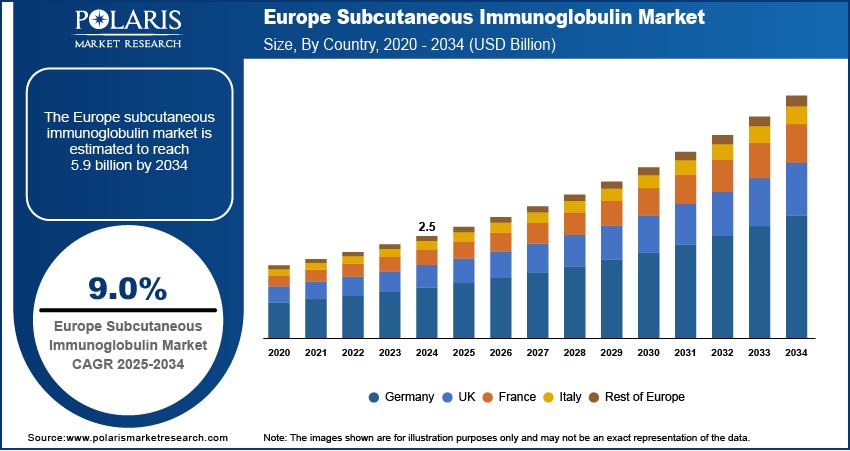

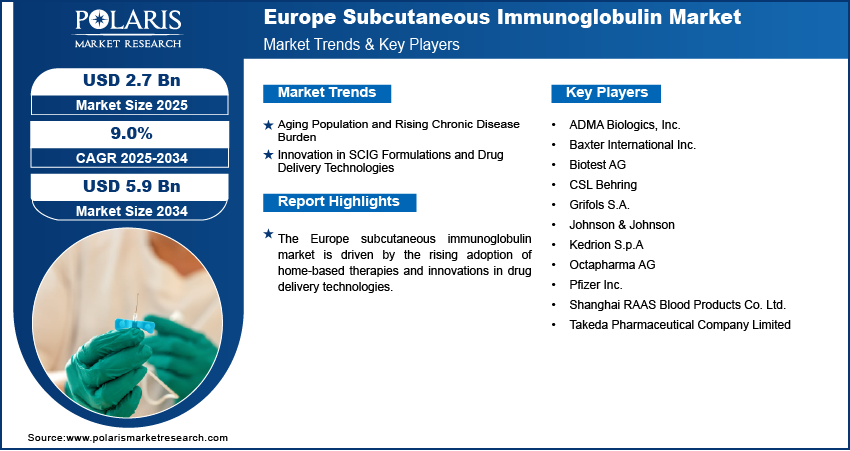

The Europe subcutaneous immunoglobulin (SCIG) market size was valued at USD 2.5 billion in 2024, growing at a CAGR of 9.0% from 2025 to 2034. Key factors driving demand include growing prevalence of primary immunodeficiency disorders (PID), favorable reimbursement policies and healthcare infrastructure, aging population and the rising chronic disease burden, and innovation in SCIG formulations and drug delivery technologies.

Key Insights

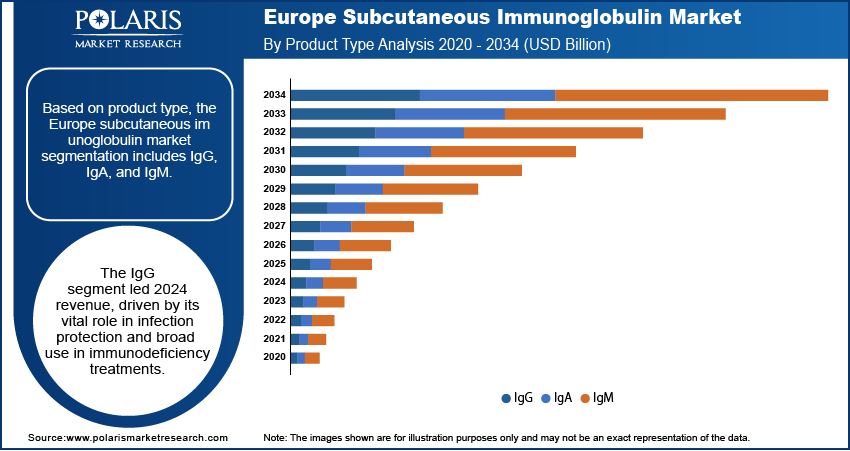

- The IgG segment dominated the revenue share in 2024 due to its essential role in providing comprehensive immune protection for a wide range of immunodeficiency disorders, both primary and secondary.

- The secondary immunodeficiency segment is projected for substantial growth during the forecast period, driven by an aging population, increased chronic diseases, and rising use of immunosuppressive treatments.

- The hospitals segment led the market in 2024 owing to their advanced facilities, specialist expertise, and ability to handle complex treatment initiation and management.

Industry Dynamics

- An older population and rising chronic disease rates are increasing demand for long-term immune therapies such as SCIG among susceptible elderly patients.

- The industry growth is fueled by new, patient-friendly SCIG formulations and delivery technologies that enhance treatment effectiveness and convenience.

- Complex and fragmented reimbursement policies across different European healthcare systems create barriers to patient access and consistent adoption of SCIG therapies.

- The high prevalence of chronic conditions in an aging population presents substantial latent demand for convenient, long-term home-based treatment options.

Market Statistics

- 2024 Market Size: USD 2.5 billion

- 2034 Projected Market Size: USD 5.9 billion

- CAGR (2025–2034): 9.0%

- Germany: largest share in 2024

Subcutaneous immunoglobulin (SCIG) is a therapeutic preparation of concentrated antibodies administered under the skin to help patients with immune system deficiencies maintain adequate protection against infections. The Europe subcutaneous immunoglobulin market is witnessing strong growth, primarily driven by the increasing prevalence of primary immunodeficiency disorders (PID). There is a rising demand for effective long-term immunoglobulin therapies that allow for flexible dosing and reduced hospital dependency as awareness and diagnosis rates of PID improve across the region. SCIG administration is particularly favored due to its ability to provide steady immunoglobulin levels, minimize systemic side effects, and improve patient quality of life, thereby accelerating its adoption among the expanding patient pool.

The presence of favorable reimbursement policies and robust healthcare infrastructure drives the growth of the Europe subcutaneous immunoglobulin market. Many European countries have established reimbursement frameworks that cover immunoglobulin therapies, ensuring broader access to treatment for patients with chronic immune conditions. In addition, the well-developed healthcare infrastructure across the region facilitates widespread availability of SCIG therapies through specialized treatment centers and home healthcare programs. These supportive systems lower the financial burden on patients and encourage physicians to adopt SCIG as a standard therapy, thereby reinforcing its position within the treatment landscape.

Drivers & Opportunities

Aging Population and Rising Chronic Disease Burden: The aging population and the rising chronic disease burden are driving the market, as both factors contribute to increased demand for long-term immune support therapies. Elderly individuals are more susceptible to immune system decline and are often affected by chronic conditions that compromise immune response, leading to a greater need for immunoglobulin replacement. According to 2024 EU data, over 40% of citizens aged 65 and older in Europe have two or more chronic conditions. The prevalence of age-associated immunological disorders continues to rise with Europe’s demographic trend of a steadily aging population, thereby expanding the patient base for SCIG. The therapy’s convenience, safety profile, and suitability for long-term management make it a preferred option in addressing the immune health needs of this vulnerable population.

Innovation in SCIG Formulations and Drug Delivery Technologies: Innovation in SCIG formulations and drug delivery technologies is driving the growth opportunities, as advancements are making treatment more patient-friendly and effective. For instance, in March 2022, Sanofi and IGM Biosciences collaborated to develop and commercialize novel IgM antibody agonists targeting three oncology and three immunology/inflammation targets. These engineered antibodies offer enhanced binding potential over traditional IgG therapies. These types of newer formulations are designed to allow higher concentrations with lower infusion volumes, reducing the time and frequency of administration. Additionally, improvements in drug delivery devices, such as user-friendly infusion pumps and prefilled syringes, are enhancing treatment compliance and enabling more patients to manage therapy at home with ease. These innovations improve patient comfort and compliance and also align with Europe’s healthcare focus on home-based and personalized treatment approaches, further boosting the adoption of SCIG across the region.

Segmental Insights

Product Type Analysis

Based on product type, the segmentation includes IgG, IgA, and IgM. The IgG segment accounted for the largest revenue share in 2024, primarily due to its critical role in providing broad-spectrum protection against infections and its widespread use in treating both primary and secondary immunodeficiency conditions. IgG is the most abundant immunoglobulin in human serum, making it the preferred choice for replacement therapy, especially in chronic immune deficiencies. Its proven clinical efficacy, longer half-life, and strong safety profile drive higher adoption in Europe, where the demand for reliable and effective immune support solutions is steadily rising.

Application Analysis

In terms of application, the segmentation includes primary immunodeficiency disease and secondary immunodeficiency disease. The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period. The growth is attributed to the aging population, rising prevalence of chronic illnesses, and growing use of immunosuppressive therapies in cancer and autoimmune disease diagnostic. Patients undergoing such treatments are at greater risk of compromised immunity, driving the need for subcutaneous immunoglobulin therapy as a preventive and supportive measure. SCIG adoption for secondary immunodeficiency is gaining momentum as healthcare systems emphasize personalized and long-term disease management.

End Use Analysis

The Europe SCIG market segmentation, based on end use, includes hospitals, homecare, clinics, and others. The hospitals held the largest share in 2024 due to their advanced infrastructure, availability of specialized healthcare professionals, and capacity to manage complex cases. They serve as central hubs for diagnosis, treatment initiation, and patient monitoring, which is essential for managing immunodeficiency disorders. Moreover, hospitals play a critical role in ensuring safe administration and guiding patients transitioning to home-based SCIG therapy, thereby reinforcing their dominant position in the European market.

Country Analysis

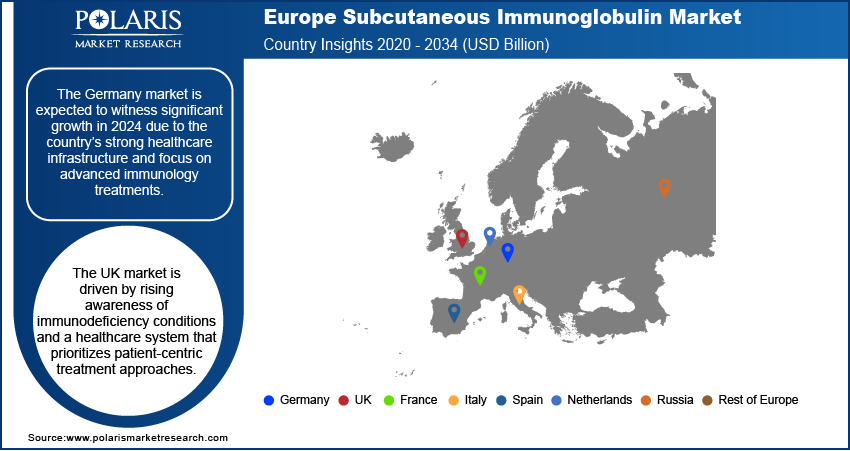

Germany Subcutaneous Immunoglobulin Market Assessment

Germany dominated the market in 2024, due to the country’s strong healthcare infrastructure and focus on advanced immunology treatments. A well-established network of specialized clinics and research institutions supports the early diagnosis and management of immunodeficiency disorders, creating higher demand for SCIG therapies. Furthermore, favorable reimbursement frameworks and increasing physician preference for home-based care solutions are contributing to wider adoption, reinforcing Germany’s position as one of the major markets within Europe.

UK Subcutaneous Immunoglobulin Market Insights

The UK market is driven by rising awareness of immunodeficiency conditions and a healthcare system that prioritizes patient-centric treatment approaches. The adoption of SCIG is supported by initiatives encouraging self-administration and home-based care, which reduce hospital burden and improve patient quality of life. Additionally, the UK’s focus on integrating innovative drug delivery technologies and expanding access through the National Health Service (NHS) further strengthens the use of SCIG as a preferred therapy option in the region.

Key Players & Competitive Analysis

The European subcutaneous immunoglobulin (SCIG) landscape is defined by intense competitive intelligence and strategy among established plasma giants. Vendor strategies prioritize technological advancement in high-concentration formulations and connected delivery systems to secure revenue growth. Growth projections are robust, supported by strong latent demand and opportunities from an aging population with rising chronic conditions. Expert's insight identifies expansion opportunities in Eastern Europe, where improving healthcare access creates a new emerging market segment. Strategic investments are heavily focused on building sustainable value chains to mitigate persistent supply chain disruptions. Success is determined by competitive positioning through superior patient support services and demonstrating long-term revenue opportunities across both developed markets and new growth areas.

A few major companies operating in the Europe subcutaneous immunoglobulin market include ADMA Biologics, Inc.; Baxter International Inc.; Biotest AG; CSL Behring; Grifols S.A.; Johnson & Johnson (Omrix Biopharmaceuticals Inc.); Kedrion S.p.A; Octapharma AG; Pfizer Inc.; Shanghai RAAS Blood Products Co. Ltd.; and Takeda Pharmaceutical Company Limited.

Key Players

- ADMA Biologics, Inc.

- Baxter International Inc.

- Biotest AG

- CSL Behring

- Grifols SA

- Johnson & Johnson (Omrix Biopharmaceuticals Inc.),

- Kedrion S.p.A

- Octapharma AG

- Pfizer Inc.

- Shanghai RAAS Blood Products Co., Ltd.

- Takeda Pharmaceutical Company Limited

Europe Subcutaneous Immunoglobulin Industry Developments

- July 2024: The FDA approved an expanded label for Grifols XEMBIFY to include treatment-naïve patients with primary immunodeficiencies. It is the first 20% subcutaneous immunoglobulin approved for initial therapy without requiring prior intravenous administration.

- January 2024: The FDA approved Takeda's HYQVIA for CIDP maintenance therapy in adults. This facilitated subcutaneous immunoglobulin allows for less frequent, at-home infusions, including self-administration after training, to prevent relapse.

Europe Subcutaneous Immunoglobulin Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- IgG

- IgA

- IgM

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Primary Immunodeficiency Disease

- Secondary Immunodeficiency Disease

By End Use (Revenue, USD Billion, 2020–2034)

- Hospitals

- Homecare

- Clinics

- Others

By Country (Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Subcutaneous Immunoglobulin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.5 Billion |

|

Market Size in 2025 |

USD 2.7 Billion |

|

Revenue Forecast by 2034 |

USD 5.9 Billion |

|

CAGR |

9.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.5 billion in 2024 and is projected to grow to USD 5.9 billion by 2034.

The market is projected to register a CAGR of 9.0% during the forecast period.

Germany dominated the market in 2024.

A few of the key players in the market are ADMA Biologics, Inc.; Baxter International Inc.; Biotest AG; CSL Behring; Grifols S.A.; Johnson & Johnson (Omrix Biopharmaceuticals Inc.); Kedrion S.p.A; Octapharma AG; Pfizer Inc.; Shanghai RAAS Blood Products Co. Ltd.; and Takeda Pharmaceutical Company Limited.

The IgG segment accounted for the largest revenue share in 2024.

The secondary immunodeficiency disease segment is expected to witness significant growth during the forecast period.