U.S. Protein Purification and Isolation Market Size, Share, Trends, Industry Analysis Report

By Product (Instruments, Consumables), By Technology, By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6199

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

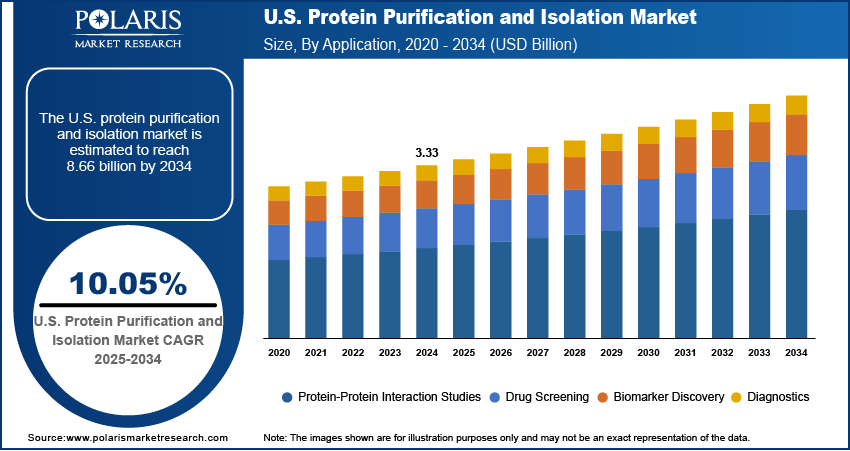

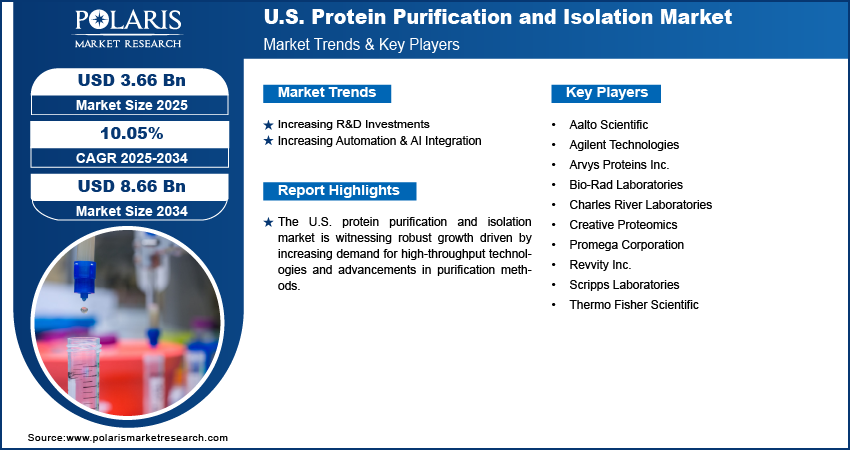

The U.S. protein purification and isolation market size was valued at USD 3.33 billion in 2024, growing at a CAGR of 10.05% from 2025 to 2034. Key factors driving demand for protein purification and isolation in the U.S. include the rising demand for biologics, growing investments in research and development, and integration of automation and artificial intelligence.

Key Insights

- The consumables segment dominated the market in 2024, as reagents, columns, and kits are repeatedly used in protein isolation, purification, and analysis workflows, creating steady demand.

- The electrophoresis segment is growing due to its critical role in analyzing protein size, purity, and structure, for drug development and biomedical research.

- The protein-protein interaction studies segment led in 2024, fueled by their importance in understanding disease pathways and drug target identification, especially in cancer and neurodegenerative research.

- Hospitals are the fastest-growing segment, as proteomics becomes integral to clinical diagnostics, enabling precision medicine approaches such as biomarker-based therapies.

Industry Dynamics

- In the U.S., rising R&D investments in biopharma fuel demand for high-purity protein isolation, driving reagent and instrument use for biologics, vaccines, and targeted therapies.

- The rising adoption of AI and automation boosts efficiency, reproducibility, and scalability in protein purification, meeting biopharma and academic lab needs.

- High costs and complexity restrict smaller labs and emerging markets, hindering adoption in resource-limited environments.

- Growing biologics demand spurs innovation in affordable, automated purification tech, with AI streamlining workflows to broaden accessibility.

Market Statistics

- 2024 Market Size: USD 3.33 billion

- 2034 Projected Market Size: USD 8.66 billion

- CAGR (2025–2034): 10.05%

To Understand More About this Research: Request a Free Sample Report

AI Impact on U.S. Protein Purification and Isolation Market

- AI platforms increase reproducibility, reduce manual intervention, and enable high-throughput screening in large-scale biopharmaceutical and academic environments.

- AI algorithms are used to optimize purification protocols by predicting outcomes, accelerating analysis, and reducing errors, which shortens the overall research cycle.

- The rising adoption of AI in protein purification and isolation enhances productivity and enables consistent results, which makes the purification process more scalable and cost-effective.

Protein purification and isolation refer to the processes used to extract and refine specific proteins from complex biological mixtures for downstream applications in research, diagnostics, and therapeutics. In the U.S., the market is witnessing sustained growth, primarily driven by the rising demand for biologics. Biologics such as monoclonal antibodies, therapeutic enzymes, and recombinant proteins require high levels of purity and consistency, making advanced purification technologies essential to their development and production. The need for reliable, scalable purification methods becomes increasingly critical as pharmaceutical companies boost efforts to expand biologic drug pipelines, thereby reinforcing market expansion.

The U.S. market is further expanding the scope of proteomics research. Proteomics, the large-scale study of proteins and their functions, relies heavily on precise isolation techniques to analyze protein structure, expression, and interaction. The growing focus on understanding disease mechanisms at the molecular level has accelerated investments in proteomics, particularly across academic institutions and biotech firms. This has created strong demand for innovative purification tools that can handle complex samples with high sensitivity and accuracy. Therefore, as proteomics continues to evolve as a central component of personalized medicine and biomarker discovery, the protein purification and isolation market is expected to remain a foundational pillar supporting this scientific advancement.

Drivers & Opportunities

Increasing R&D investments: The growing investments in research and development across the U.S. biomedical and pharmaceutical sectors are driving the expansion opportunities for the U.S. protein purification and isolation market. There is an increasing demand for efficient and high-purity protein isolation methods. R&D efforts often require repeated and scalable purification processes, which boost the consumption of reagents, columns, and advanced instrumentation as the focus shifts to developing novel biologics, vaccines, and targeted therapies. In December 2024, Syncell secured USD 15M Series A funding, a total of USD 30 million, led by Taiwania Capital, to accelerate global commercialization of its Microscoop platform. Plans include instrument placements in the U.S. and new offices in the U.S. and Taiwan. Additionally, government funding and private-sector initiatives to advance drug discovery and molecular biology support the adoption of innovative purification technologies, reinforcing the market’s growth momentum.

Increasing Automation & AI integration: The integration of automation and artificial intelligence (AI) into protein purification workflows is transforming the operational efficiency and precision of laboratories across the U.S. Automated platforms reduce manual intervention, enhance reproducibility, and allow high-throughput screening, which is especially crucial in large-scale biopharmaceutical and academic environments. In May 2025, Seer, Inc. launched its Proteograph Product Suite, including the Proteograph ONE Assay and SP200 Automation Instrument, enabling scalable, high-resolution mass spec proteomics. It overcomes throughput and cost barriers for population-scale proteomics studies. AI algorithms contribute to optimizing purification protocols by predicting outcomes, reducing errors, and accelerating analysis, thereby shortening the overall research cycle. This technological shift improves productivity and also enables consistent results, making protein purification more scalable and cost-effective, factors that are increasingly vital in modern life sciences research.

Segmental Insights

Product Analysis

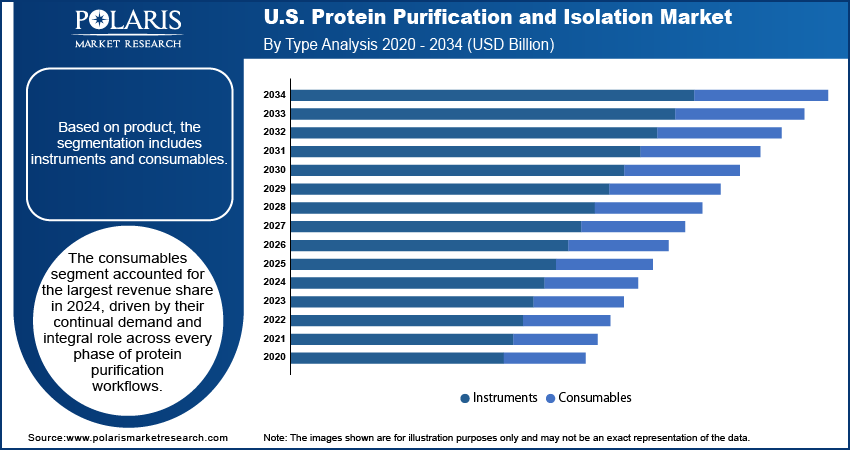

Based on product, the U.S. protein purification and isolation market segmentation includes instruments and consumables. The consumables segment accounted for the largest revenue share in 2024, driven by their continual demand and integral role across every phase of protein purification workflows. Products such as reagents, kits, spin columns, membranes, and affinity resins are indispensable in daily laboratory procedures, requiring regular replenishment in both academic labs and biopharmaceutical production settings. Their broad compatibility with a wide range of instrumentation and standardized protocols supports their high usage. The expanding footprint of life science research, along with strong investments in proteomics and biologics manufacturing across U.S. institutions, continues to sustain demand for these consumables, making them a primary revenue contributor.

Technology Analysis

In terms of technology, the U.S. protein purification and isolation market segmentation includes ultrafiltration, precipitation, chromatography, electrophoresis, western blotting, and others. The electrophoresis segment is expected to witness significant growth during the forecast period, supported by its precision in evaluating protein size, purity, and molecular structure. Electrophoresis is extensively applied in both academic research and hospital-based laboratories for disease characterization and biomarker validation as a foundational method in molecular biology. The introduction of high-resolution, automated electrophoresis platforms in the U.S. is improving throughput and reproducibility, making the technology more attractive to labs managing large datasets. The growing need for detailed proteomic profiling in translational research and diagnostics underpins its continued adoption.

Application Analysis

The segmentation, based on application, includes drug screening, biomarker discovery, protein-protein interaction studies, and diagnostics. The protein-protein interaction studies segment dominated the market in 2024, owing to the rising focus on mapping cellular pathways and molecular mechanisms underlying complex diseases. These studies are fundamental in identifying novel drug targets, especially in oncology and neurodegenerative disorders, areas where U.S. pharmaceutical and academic institutions are highly active. Demand for high-quality purified proteins and interaction analysis tools remains elevated with the nation's strong focus on precision medicine and the development of targeted biologics. This trend is expected to continue as funding in systems biology and functional genomics accelerates across major research hubs in the U.S.

End Use Analysis

In terms of end use, the segmentation includes academic and research institutes, hospitals, pharmaceutical and biotechnology companies, and CROs. The hospitals segment is projected to witness the fastest growth during the forecast period, driven by the increasing clinical integration of proteomic technologies for diagnostics and personalized treatment approaches. Hospitals in the U.S. are rapidly incorporating protein-based assays to identify disease-specific markers and tailor therapy, especially in oncology, cardiology, and infectious diseases. The expansion of in-house molecular diagnostic labs, coupled with the U.S. healthcare system's shift toward precision medicine, is propelling the adoption of protein purification tools in clinical environments. This shift reflects a broader trend of merging diagnostic and therapeutic workflows within advanced hospital networks across the country.

Key Players & Competitive Analysis

The U.S. protein purification and isolation sector is witnessing intense competition, driven by strategic investments in automation, AI, and next-gen technologies. Key players are leveraging competitive intelligence and strategy to capitalize on revenue opportunities in biologics and precision medicine. Large enterprises dominate due to advanced R&D infrastructure, while emerging academic institutions and small biotech labs present untapped potential. Industry trends highlight a shift toward high-throughput, cost-efficient solutions, with disruptions and trends such as single-use chromatography gaining traction. Revenue growth is fueled by rising demand for monoclonal antibodies and recombinant proteins, pushing vendors to adopt future development strategies such as modular purification systems. Economic and geopolitical shifts, including supply chain resilience, are reshaping sustainable value chains. Expansion opportunities exist in decentralized biomanufacturing, with growth projections emphasizing scalable platforms for small and medium-sized businesses. Expert insights suggest that technological advancements in affinity resins and liquid chromatography will redefine latent demand and opportunities, positioning innovators for long-term dominance.

A few major companies operating in the U.S. protein purification and isolation industry include Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, Promega Corporation, Charles River Laboratories, Revvity Inc., Creative Proteomics, Scripps Laboratories, Aalto Scientific, and Arvys Proteins Inc.

Key Players

- Aalto Scientific

- Agilent Technologies

- Arvys Proteins Inc.

- Bio-Rad Laboratories

- Charles River Laboratories

- Creative Proteomics

- Promega Corporation

- Revvity Inc.

- Scripps Laboratories

- Thermo Fisher Scientific

U.S. Protein Purification and Isolation Industry Developments

- March 2025: Momentum Biotechnologies acquired OmicScouts GmbH, a Munich-based proteomics CRO. This expands Momentum’s mass spectrometry services, adds validated assays, and accelerates European market entry, strengthening its global drug discovery offerings.

- January 2025: Quantum-Si launched Platinum Pro, its latest benchtop protein sequencer, offering unparalleled efficiency and accessibility. Building on the original Platinum, it simplifies proteomics research with an integrated workflow, making advanced protein sequencing available to labs worldwide.

U.S. Protein Purification and Isolation Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Instruments

- Consumables

- Kits

- Reagents

- Columns

- Magnetic Beads

- Resins

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Ultrafiltration

- Precipitation

- Chromatography

- Ion Exchange Chromatography

- Affinity Chromatography

- Reversed Phase Chromatography

- Size Exclusion Chromatography

- Hydrophobic Interaction Chromatography

- Electrophoresis

- Gel Electrophoresis

- Isoelectric Focusing

- Capillary Electrophoresis

- Western Blotting

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug Screening

- Biomarker Discovery

- Protein-Protein Interaction Studies

- Diagnostics

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Academic and Research Institutes

- Hospitals

- Pharmaceutical and Biotechnology Companies

- CROs

U.S. Protein Purification and Isolation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.33 Billion |

|

Market Size in 2025 |

USD 3.66 Billion |

|

Revenue Forecast by 2034 |

USD 8.66 Billion |

|

CAGR |

10.05% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.33 billion in 2024 and is projected to grow to USD 8.66 billion by 2034.

The market is projected to register a CAGR of 10.05% during the forecast period.

A few of the key players in the market are Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, Promega Corporation, Charles River Laboratories, Revvity Inc., Creative Proteomics, Scripps Laboratories, Aalto Scientific, and Arvys Proteins Inc.

The consumables segment dominated the market in 2024.

The electrophoresis segment is expected to witness significant growth during the forecast period.