Europe Neobanking Market Share, Size, Trends, Industry Analysis Report

By Account Type (Business Account, Savings Account, Others); By Service Type; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Mar-2024

- Pages: 120

- Format: PDF

- Report ID: PM4491

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

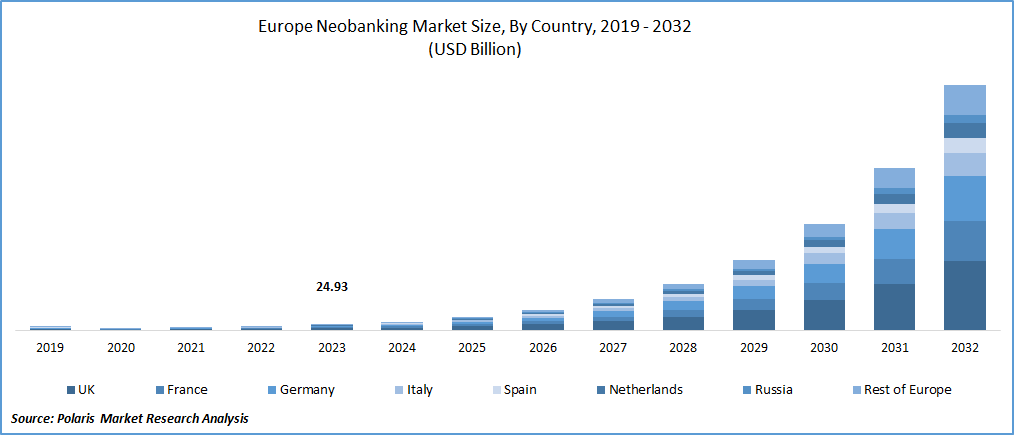

The Europe neobanking market was valued at USD 24.93 billion in 2023 and is expected to grow at a CAGR of 51.4% during the forecast period.

Europe is adapting to the latest technological innovations and changing its bank systems. Most companies in the U.K., France, and Germany are providing complete contactless platforms. This in sequence, has attracted consumers for utilization of neobanking services which are available. Further, the leading banks in the region are partnering with the new banking platform to deliver easy and convenient services to their consumers.

To Understand More About this Research:Request a Free Sample Report

- For instance, in July 2023, US-based JP Morgan plans to unveil a digital bank in Germany in late 2024 or at the beginning of 2025.

A neobank is a financial technology that offers banking services through a website or mobile application. These services include bill payments, electronic money transfers, and direct deposits or mobile check deposits. Neobanks generally offer better rates and lower fees compared to traditional banks.

The European Union’s Revised Payment Services has eased the entry of non-traditional financial players, like neobanks, into the market by permitting third-party providers to access the customer’s account data from the traditional banks with the consent of the customer. This had permitted neobanks to develop an innovative solution.

The COVID-19 pandemic has substantially impacted the European neobanking market growth. As people are highly dependent on digital services during the lockdown phase, this has facilitated the adoption of new banking solutions across the region. During the period of COVID-19 in 2020, the rise in the demand for neobanking has created an opportunity for neobanking service providers in Europe. The adoption of the Neobanking Market development has witnessed a surge in individuals belonging to higher and middle-income brackets, particularly during the COVID-19 restrictions, which have limited offline transactions.

Industry Dynamics

Growth Drivers

- Rising internet perception will drive the growth of the neobanking market

The rising internet perception drives the growth of the neobanking market size. The use of digital technologies is adopted across all the industries in Europe, mainly in the financial industry, especially for financial transactions. Mobile payments, which include transactions conducted through portable electronic devices such as cell phones, smartwatches, or tablets, serve as an alternative to traditional methods such as cash, checks, and physical debit or credit cards.

In addition, the increase in online transactions, along with the rising demand for effortless and customized banking services, is accelerating the implementation of neobanking solutions. This trend is expected to transform the financial industry in Europe.

Report Segmentation

The market is primarily segmented based on account type, service type, application, and country.

|

By Account Type |

By Service Type |

By Application |

By Country |

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Account Type Analysis

- Business account is accounted for the largest market share in 2023

Business accounts held the largest Europe neobanking market share in 2023. Business accounts in neobanking platforms frequently have user-friendly interfaces that allow for easy navigation and access to a variety of financial tools. These digital-first banking solutions provide numerous benefits to businesses, such as streamlined and efficient financial management, cost-effective transactions, and real-time insights into their financial health. Top neobanks in Europe offer business accounts that include a debit card with all of the transactions managed from the Android application or iPhone. Businesses in Europe can improve the efficiency of their financial transactions and monitor real-time cash flow, leading to increased overall productivity. By simplifying payments to vendors, employees, and customers, businesses can also eliminate the complexities associated with managing multiple platforms.

By Service Type Analysis

- Mobile banking accounted for the largest market share in 2023

Mobile banking dominated the Europe neobanking market in 2023, most of the neobanks in Europe are offering accounts and debit cards, which can be managed through the mobile app, where users can access many features and get the benefit of it. Neobanks in the region are widening their product range to comprise savings and lending which give users an ability to access offerings from the financial service providers via their in-app marketplaces.

Payments and money transfers have witnessed the fastest growth in the European neobanking market; owing to the efficiency and convenience offered by the neobanks in payment and money transfer processes, neobanks have simplified their transactions with ideal online interfaces and user-friendly mobile applications. Additionally, the incorporation of advanced technologies such as blockchain and artificial intelligence has intensified the speed and security of payments in neobanks.

By Application Analysis

- Enterprise segment accounted for the largest market share in 2023

Enterprises in Europe are utilizing neobanking services to simplify their financial operations and intensify their efficiency. Neobanks usually deliver a user-friendly interface that mainly enables small and medium enterprises to have exceptional control over their finances and to make informed decisions. The convenience and availability of neobanking services, such as opening online accounts and quick payment processing, connect with the dynamic and agile nature of small and medium-sized enterprises. Correspondingly, most of the small and medium enterprises in Europe are utilizing neobanking solutions to enhance their financial processes and adapt to the quickly evolving digital landscape.

Regional Insights

- United Kingdom dominated the Europe Neobanking market in 2023

In the United Kingdom, neobanks offer a variety of services, such as mobile banking apps, simple account opening procedures, and personalized financial management tools. The appeal of low fees, transparent policies, and enhanced user experiences has attracted a growing customer base, particularly among younger demographics. The regulatory environment in the United Kingdom has also aided the growth of neobanks, with initiatives such as Open Banking facilitating integration and competition. As these digital players gain traction, traditional banks adapt to the changing landscape, resulting in a dynamic and competitive financial sector in the United Kingdom.

Key Market Players & Competitive Insights

The Europe neobanking market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the market include:

- Atom Bank PLC

- Banco Bilbao Vizcaya Argentaria SA

- Bunq

- Deutsche Bank AG

- Moven Enterprises

- Monzo Bank Ltd.

- N26 GmbH

- Revolut Ltd.

- Sopra Steria Group SA

- Ubank Limited

- WeBank Co., Ltd.

Recent Developments

- In December 2023, Bunq, has unveiled a new platform for customers named Finn, featuring an advanced Generative AI (GenAI).

- In May 2023, N26 GmbH launched its latest Instant Savings account, providing Spanish customers with a competitive 2.26% interest rate on their deposits.

Europe Neobanking Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 37.64 billion |

|

Revenue forecast in 2032 |

USD 1,038.24 billion |

|

CAGR |

51.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Account Type, By Service Type, By Application, By Region |

|

Country scope |

Germany, France, Italy, U.K., Russia, Spain, and Rest of Europe. |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Tinclude Atom Bank PLC, Banco Bilbao Vizcaya Argentaria SA, Bunq, Deutsche Bank AGhe key companies in Europe Neobanking Market

The Europe neobanking market is expected to grow at a CAGR of 51.4% during the forecast period.

Europe Neobanking Market report covering key segments are account type, service type, application, and country.

The key driving factors in Europe Neobanking Market are Rising internet perception will drive the growth of the neobanking market.

Europe Neobanking Market Size Worth $ 1,038.24 Billion By 2032.