Europe Pipeline Pigging Market Share, Size, Trends, Industry Analysis Report

By Services (Pigging, Intelligent Pigging); By Application; By End-Use; By Country; Segment Forecast, 2024 - 2032

- Published Date:May-2024

- Pages: 114

- Format: PDF

- Report ID: PM4924

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

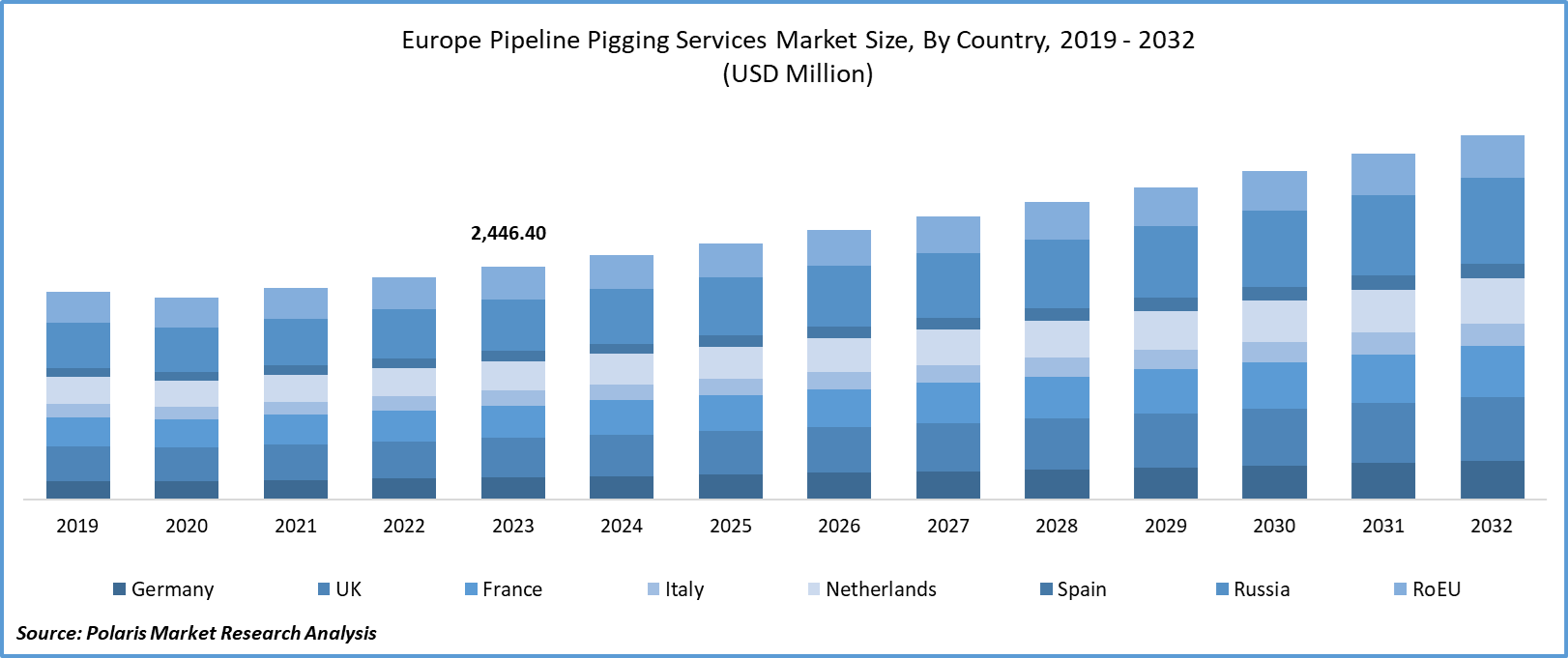

Europe Pipeline Pigging market size was valued at USD 2,446.40 million in 2023. The market is anticipated to grow from USD 2,567.21 million in 2024 to USD 3,826.95 million by 2032, exhibiting the CAGR of 5.1% during the forecast period.

Industry Trends

The European pipeline-pigging services market is witnessing significant growth driven by several factors. The region's abundance of oil and gas pipelines necessitates regular maintenance and inspection, resulting in heightened demand for pipeline pigging services. Major oil and gas companies in the region are increasingly investing in these services to ensure pipeline safety and efficiency, leading to a rise in the number of service providers.

The primary drivers of demand for pipeline pigging services include regulatory requirements, aging pipeline infrastructure, expansion and construction of new pipelines, and the need to optimize pipeline performance and minimize downtime. The pipeline pigging services market comprises a mix of large multinational companies, specialized pigging service providers, engineering firms, and equipment manufacturers. These companies offer a range of pigging services, including cleaning, inspection, maintenance, and pigging equipment rental and sales. Some companies may also provide bespoke pigging solutions tailored to specific pipeline requirements. For instance, in April 2024, iNPIPE Products partnered with Avove, a prominent capital infrastructure and engineering services company, to introduce its established technology to the UK water industry. This collaboration aims to drive innovation, streamline project timelines, and significantly reduce costs and waste. Together, the companies offer comprehensive turnkey solutions for cleaning large-scale water pipelines and safeguarding water company assets.

To Understand More About this Research: Request a Free Sample Report

The innovative partnerships between companies leverages combined expertise in pipeline cleaning, inspection, and maintenance using groundbreaking smart pigging technology. Compared to traditional methods, smart pig technology offers more efficient and effective cleaning methods, along with reductions in CO2 emissions, time, costs, excavations, haul roads, and water usage.

Key Takeaways

- UK dominated the market with the largest market share

- By services category, the intelligent pigging segment accounted for the largest Europe Pipeline Pigging market share

- By application category, the crack & leakage detection segment is anticipated to grow with a lucrative CAGR over the Europe Pipeline Pigging market forecast period

What are the market drivers driving the demand for market?

Rising adoption of advanced pigging technologies

The market is experiencing significant growth due to the escalating demand for pipelines used in transportation of potable water must undergo regular cleaning to prevent biofouling, debris buildup, and infections. The gel material created by OKFT Ltd, a Hungarian company in collaboration with the University of Szeged, is composed of food-grade ingredients, primarily water. As a result, the gel dissolves and evaporates after use. Gel pigging is becoming increasingly popular, with applications in municipal and industrial water pipelines, district heating systems, maritime water systems, drilling platforms, and even gas pipelines. In addition to cleaning, the gel can also be used to rescue traditional pigs that become stuck in pipelines, thanks to its flexibility and consistency.

Which factor is restraining the demand for market?

Inability to navigate varying diameters or sharp bends

The pipeline cleaning includes foam pigs which are are often chosen by operators as cleaning tools in pipelines that contain minimal debris, as they offer an optimal solution for pigging. However, it is important to note that the ideal pipeline for mechanical pigs, and to some extent foam pigs, is one that maintains a consistent diameter without any changes or sharp bends.

In reality, most pipelines do not meet this ideal criterion. They often have variations in diameter, even if they are minor, as well as bends and other complex areas that a pig must navigate in order to effectively carry out the pigging process. Even though foam pigs are perceived to be more flexible compared to their mechanical counterparts, they still need to be supplied in the exact size of the pipeline in order to maximize their effectiveness.

Report Segmentation

The market is primarily segmented based on services, application, end-use and country.

|

By Services |

By Application |

By End-Use |

By Country |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Category Wise Insights

By Services Insights

Based on services analysis, the market is segmented into pigging and intelligent pigging. The pigging segment has dominated the Europe's Pipeline Pigging market. The intelligent pigging services is expected to grow at the fastest CAGR over the forecast period owing to the increasing demand for energy transportation infrastructure and stringent regulations mandating pipeline integrity management. Furthermore, the rise in exploration and production activities in remote and challenging terrains has necessitated the adoption of advanced inspection techniques like intelligent pigging. One of the driving factors behind the adoption of intelligent pigging is its ability to provide accurate and real-time data, enabling proactive maintenance and minimizing the risk of catastrophic failures. Moreover, the integration of technologies such as robotics, artificial intelligence, and data analytics enhances the efficiency and effectiveness of pipeline inspection, reducing downtime and operational costs for asset owners.

Further, key players in the market are introducing pipeline pigging services with integrating of intelligence for fastening the process. For instance, In January 2019, T.D. Williamson, unveiled a specialized 4-inch inspection device tailored for low-pressure and small-diameter pipelines. This pioneering tool delivers notable advantages by cutting down on inspection duration and expenses. It facilitates the gathering of accurate and extensive information regarding metal degradation and pipeline geometry within a single operation.

By Application Insights

Based on application analysis, the market has been segmented into metal loss/corrosion detection, crack & leakage detection, geometry measurement & bend detection, others. The metal loss/corrosion detection segment has dominated the market and crack & leakage detection segment is anticipated to grow at the fastest CAGR over the forecast period. The dominance of metal loss/corrosion detection segment is owing to several driving factors contributing to the demand for metal loss and corrosion detection services in the pipeline pigging market. Firstly, stringent regulations and safety standards mandate regular inspection and maintenance of pipelines to ensure compliance and mitigate the risk of accidents or environmental incidents.

Aging pipeline infrastructure further underscores the need for comprehensive inspection and monitoring to address corrosion and metal loss issues promptly. Additionally, the increasing complexity and scale of pipeline networks, coupled with the expansion of operations into remote or challenging environments, necessitate advanced inspection technologies to maintain the integrity and reliability of the infrastructure. As a result, the demand for metal loss and corrosion detection services is expected to continue growing, with service providers focusing on developing and deploying advanced technologies to meet the evolving needs of the market while ensuring the safety and reliability of pipeline networks.

Country-wise Insights

UK

The UK leads the Pipeline Pigging market in Europe, the growth driven by several factors. The region's abundance of oil and gas pipelines necessitates regular maintenance and inspection, resulting in heightened demand for pipeline pigging services. Major oil and gas companies in the region are increasingly investing in these services to ensure pipeline safety and efficiency, leading to a rise in the number of service providers.

Pigtek is a UK-based company established in 2000, specializing in supplying pipeline cleaning pigs, pipeline pig services, and ancillary pigging equipment. As an independent, privately owned entity, Pigtek focuses on providing tailored solutions for specific applications within the international oil and gas industry. Their specialist products and on-site services are exclusively dedicated to pipeline pigging, offering expertise in specialized pig design to meet unique requirements.

Competitive Landscape

The competitive landscape for the European Pipeline Pigging market is characterized by intense rivalry among key players striving to gain market share and differentiate themselves through the necessity of expanding new oil and gas pipeline projects within the European region, driven by the market's supply, production, and demand for oil and gas. Europe's region is one of the largest importers of natural gas globally has resulted in a substantial need for pipeline infrastructure to facilitate the efficient transportation of natural gas across the region giving an opportunity for the key players to expand their businesses, driving the expansion and growth of pipeline pigging services market in Europe region.

Some of the major players operating in the European market include:

- Baker Hughes Company

- Pigtek Ltd

- Dexon Technology PLC

- Applus+

- LIN SCAN

- ROSEN Group

- MISTRAS Group

- T.D. Williamson, Inc.

- PipeSurvey International.

- Penspen Limited

Recent Developments

- In August 2023, ROSEN partnered with Speir Hunter, a provider of pipeline inspection and integrity management services. This strategic alliance aims to meet the growing demand for high-quality pipeline inspections and integrity assessments.

- In April 2022, Artera Services, a provider of critical infrastructure services to the natural gas and electric industries, entered into a strategic partnership with T.D. Williamson (TDW) to offer their specialized services to their customers. The agreement primarily focuses on delivering shared services from TDW and Versiv Solutions, LLC.

- In April 2022, MISTRAS Group, in partnership with Onstream Pipeline Inspection, New Century Software, and Integrity Plus, announced the latest technological advancements in its integrated pipeline inspection and integrity solutions. These technologies are designed to enhance pipeline safety and compliance and are aimed at experts in the field.

Report Coverage

The Europe Pipeline Pigging market report emphasizes on key countries across the region to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the region. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, on services, application, end-use and their futuristic growth opportunities.

Pipeline Pigging Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2,567.21 million |

|

Revenue forecast in 2032 |

USD 3,826.95 million |

|

CAGR |

5.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Services, By Application, By End-Use, By Country |

|

Regional scope |

UK, France, Germany, Italy, Spain, Netherlands, Russia, Rest of Europe |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The Europe Pipeline Pigging market size is expected to reach USD 3,826.95 Million by 2032

Key players in the market are Baker Hughes Company, Pigtek Ltd, Dexon Technology PLC, Applus+, LIN SCAN

Europe Pipeline Pigging market exhibiting the CAGR of 5.1% during the forecast period.

The Europe Pipeline Pigging Services Market report covering key segments are services, application, end-use and country.