Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Market Size, Share, Trends, & Industry Analysis Report

By Service Type (In-House, Contract Outsourcing), By Synthesis Type, By Animal Type, By Therapeutic Category, By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6400

- Base Year: 2024

- Historical Data: 2020-2023

Overview

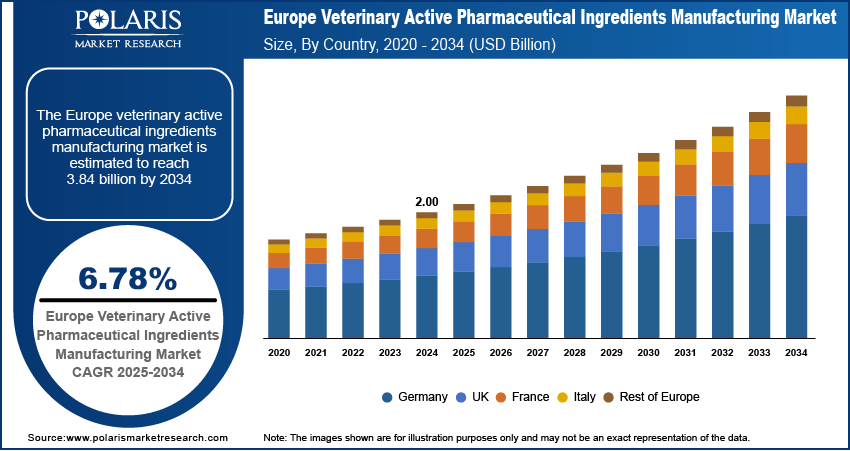

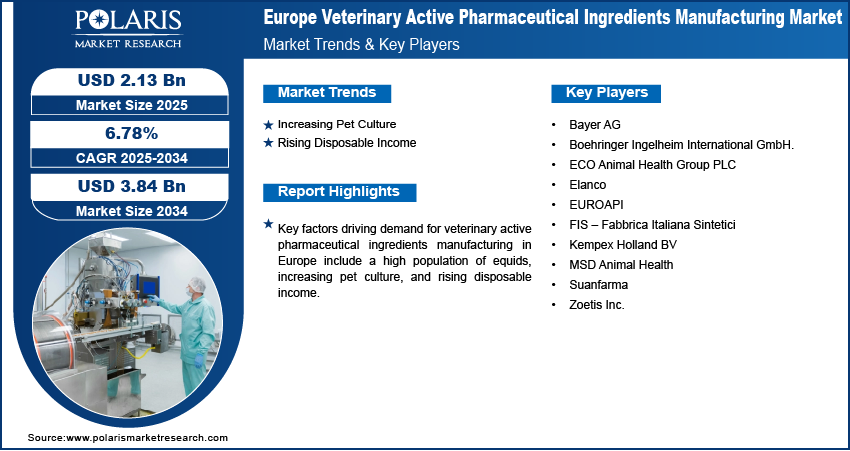

The Europe veterinary active pharmaceutical ingredients (API) manufacturing market size was valued at USD 2.00 billion in 2024, growing at a CAGR of 6.78% from 2025 to 2034. Key factors driving demand for veterinary active pharmaceutical ingredients manufacturing in Europe include a high population of equids, increasing pet culture, and rising disposable income.

Key Insights

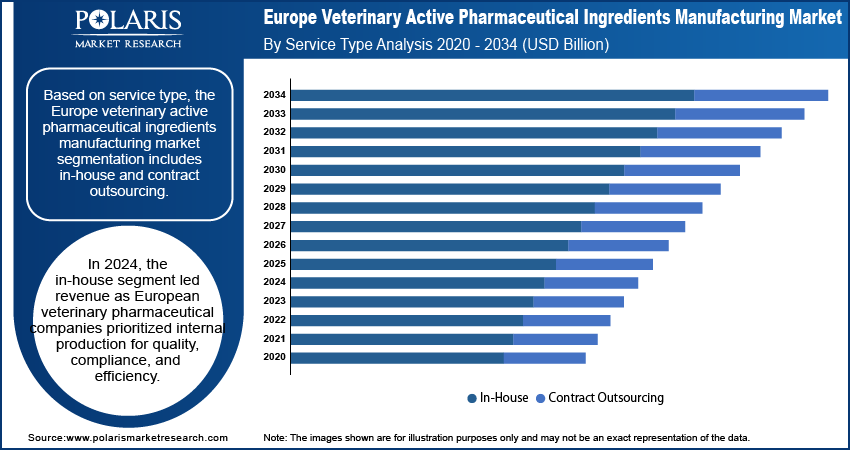

- The in-house segment dominated the revenue share in 2024 due to the growing preference of veterinary pharmaceutical companies to rely on their internal production capabilities to ensure quality consistency and regulatory compliance.

- In terms of synthesis type, the segmentation includes chemical-based API, biological API, and HPAPI. The chemical-based API segment accounted for a major revenue share in 2024 due to its cost-effectiveness and ability to address a wide range of animal health conditions.

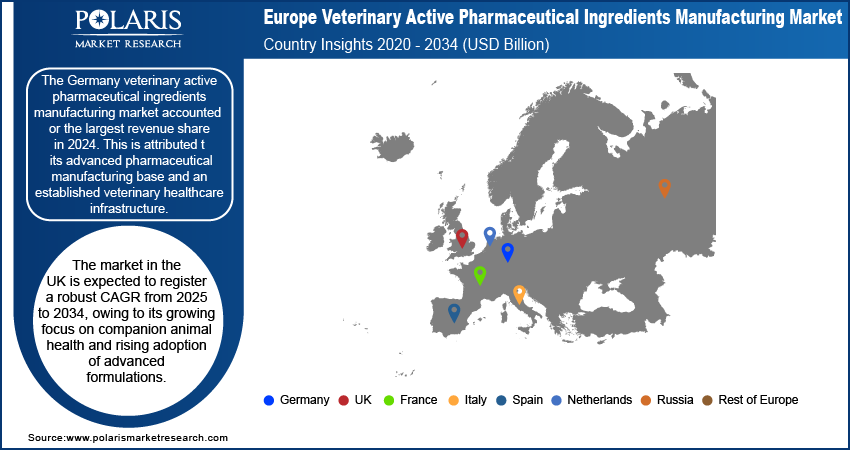

- The Germany veterinary active pharmaceutical ingredients manufacturing market accounted for the largest revenue share in 2024, owing to its advanced pharmaceutical manufacturing base.

- The market in the UK is expected to grow at a robust CAGR from 2025 to 2034, owing to the rising adoption of advanced formulations to treat veterinary diseases.

Industry Dynamics

- Increasing pet culture is driving owners to invest in high-quality healthcare, preventive medicines, and treatments for their animals, which is fueling the need for veterinary active pharmaceutical ingredients.

- Rising disposable income is empowering pet owners to allocate more funds to their animals' healthcare, directly increasing demand for veterinary APIs.

- Rising animal health expenditure is expected to create a lucrative market opportunity during the forecast period.

- Stringent regulations governing the efficacy of pharmaceutical products and vaccines for animals hinder the market growth.

Artificial Intelligence (AI) Impact on Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Market

- AI is revolutionizing Europe's veterinary API manufacturing by optimizing production efficiency and precision.

- AI is accelerating drug discovery through predictive modeling of novel compounds while ensuring stringent quality control via automated monitoring systems.

- AI-driven supply chain enhancements prevent shortages, and advanced analytics enable personalized veterinary medicines.

Market Statistics

- 2024 Market Size: USD 2.00 Billion

- 2034 Projected Market Size: USD 3.84 Billion

- CAGR (2025–2034): 6.78%

Veterinary active pharmaceutical ingredients manufacturing is the process of producing the core, biologically active substances used in animal medicines. These ingredients are the essential components that diagnose, treat, or prevent diseases in livestock, companion animals, and wildlife. After manufacturing, APIs are formulated into final dosage forms such as tablets, injectables, or feed additives.

The Europe veterinary API manufacturing sector is a highly regulated and advanced industry, operating under strict good manufacturing practice (GMP) standards set by the European Medicines Agency (EMA). It is a critical component of the region's robust animal health industry, supplying innovative ingredients for both food-producing and companion animals. The industry is characterized by significant investment in research and development, focusing on novel therapies, antimicrobial stewardship, and ensuring a secure supply chain for veterinary medicines across the member states.

The Europe veterinary active pharmaceutical ingredients manufacturing market demand is driven by the high population of equids. According to Eurogroup for Animals, the total population of equids within the European Union was around seven million in 2022, which created a demand for veterinary active pharmaceutical ingredients (APIs) as equids such as horses, donkeys, and zebras require a greater volume of pharmaceuticals to maintain their health. Owners, breeders, and veterinarians in the region are also actively seeking effective and safe pharmaceuticals, driving manufacturers to scale the production of active pharmaceutical ingredients (APIs). Additionally, disease outbreaks in dense equine populations are prompting widespread use of therapeutics, further fueling demand for high-quality APIs. Therefore, the high population of equids in Europe is driving the market growth.

Drivers & Opportunities

Increasing Pet Culture: Rising pet culture in countries such as Germany, the UK, and France is driving owners to invest in high-quality healthcare, preventive medicines, and treatments for their animals, which is fueling the need for veterinary active pharmaceutical ingredients. As of 2023, 45% of German households have a pet, and 14% of households have two or more pets. Expanding pet culture is further encouraging owners to demand higher standards of care, including pet-specific antidepressants, compelling manufacturers to scale up production of these specialized APIs. Therefore, the rising pet culture in Europe is fueling the need for the manufacturing of veterinary active pharmaceutical ingredients.

Rising Disposable Income: Increasing disposable income in the region is empowering pet owners to allocate more funds to their animals' healthcare, directly increasing demand for veterinary APIs. In 2022, gross disposable household income (GDHI) in the UK grew by 6.3% when compared with 2021. Families with greater financial resources easily afford advanced diagnostic procedures, specialized treatments, and long-term medications for chronic conditions, all of which require specific active pharmaceutical ingredients. This financial flexibility also encourages owners to opt for premium preventive care, such as broader-spectrum parasiticides and vaccines, further driving API production. Moreover, higher income levels are making expensive, life-extending treatments like chemotherapy or novel biologics a practical option, compelling manufacturers to ramp up API production to meet the new standard of care.

Segmental Insights

Service Type Analysis

Based on service type, the market segmentation includes in-house and contract outsourcing. The in-house segment dominated the revenue share in 2024 as several established veterinary pharmaceutical companies in Europe continued to rely on their internal production capabilities to ensure quality consistency, regulatory compliance, and cost efficiency. Major firms also invested heavily in advanced production facilities equipped with modern technologies to maintain strict control over proprietary formulations and intellectual property. Strong presence of major players such as MSD Animal Health and Zoetis in countries such as Germany, France, and the UK further supported the dominance of the segment, as companies sought to reduce dependency on third parties and streamline their supply chain operations. The ability to customize production processes and maintain tighter oversight over quality standards drove the preference for in-house capabilities.

The contract outsourcing segment is projected to grow at a rapid pace in the coming years, owing to increasing demand for cost-effective and flexible manufacturing solutions. Small and mid-sized companies in the region are increasingly outsourcing production to specialized contract manufacturers to avoid heavy investments in infrastructure and to benefit from advanced technologies. Outsourcing also allows companies to scale production capacity quickly in response to rising demand for veterinary medicines, particularly antiparasitics and anti-infectives. Furthermore, contract development and manufacturing organizations (CDMOs) in Europe continue to expand their service portfolios to include formulation development, regulatory support, and clinical trial manufacturing, making them attractive partners. The growing focus on reducing operational costs and accelerating time-to-market for new veterinary drugs is expected to drive the shift toward outsourcing in the forecast period.

Synthesis Type Analysis

In terms of synthesis type, the market segmentation includes chemical-based API, biological API, and HPAPI. The chemical-based API segment accounted for a major revenue share in 2024 due to its established synthesis processes, cost-effectiveness, and ability to address a wide range of animal health conditions, including parasitic infections and bacterial diseases. The segment also benefited from the strong presence of manufacturers with large-scale production capabilities, particularly in Germany, Italy, and France, where robust pharmaceutical infrastructure supported efficient chemical synthesis. Additionally, the regulatory familiarity with chemical-based compounds ensured smooth approval processes, encouraging companies to continue investing in chemical-based API.

Animal Type Analysis

In terms of animal type, the Europe veterinary API manufacturing market segmentation includes production animals and companion animals. The production animals segment held the largest revenue share in 2024 due to the region’s strong livestock sector. Countries such as Germany, France, and Spain maintained large-scale cattle, swine, and poultry farming operations, which required a steady supply of antiparasitics, anti-infectives, and nutritional supplements made through active pharmaceutical ingredients. The rising demand for meat, dairy, and poultry products further encouraged higher adoption of veterinary APIs for production animals, contributing to the dominance of the segment.

The companion animals segment is estimated to grow at a rapid pace during the forecast period, owing to rising pet ownership, particularly in urban areas of the UK, France, and Italy. The segment also benefits from the increasing prevalence of conditions such as obesity, arthritis, and cancer in companion animals, which is creating demand for specialized APIs. Strong emotional bonds between owners and their animals, combined with the growth of pet insurance coverage, are further fueling segment expansion.

Therapeutic Category Analysis

In terms of therapeutic category, the segmentation includes antiparasitics, anti-infectives, NSAIDs, and others. The antiparasitics segment dominated the revenue share in 2024 due to rising livestock and companion animal ownership. Farmers in countries such as France, Spain, and Germany used these products extensively to protect cattle, swine, and poultry from internal and external parasites. Companion animal owners also relied on antiparasitics to manage common infestations such as fleas, ticks, and worms, which impact both animal welfare and zoonotic disease transmission. Strong regulatory emphasis on maintaining high standards of animal-derived food products further increased the adoption of antiparasitic treatments.

Country Analysis

The Germany veterinary active pharmaceutical ingredients manufacturing market accounted for the largest revenue share in 2024. This is attributed to its advanced pharmaceutical manufacturing base and an established veterinary healthcare infrastructure. German manufacturers invested heavily in research and development, which enables the production of high-quality active ingredients tailored for both companion and livestock animals. The country’s strong livestock sector, particularly in swine and cattle farming, drove consistent demand for veterinary APIs for infection control, improving animal productivity, and ensuring food safety. Moreover, Germany’s stringent regulatory framework promoted the adoption of safe and effective formulations, which further strengthened its dominance within the region.

The market in the UK is expected to grow at a robust CAGR from 2025 to 2034, owing to growing focus on companion animal health and rising adoption of advanced formulations. The UK’s pet population is projected to increase, driving demand for high-quality APIs as pet owners demand innovative therapies for chronic conditions, pain management, and preventive care. Local players in the country are collaborating with global pharmaceutical companies to expand their product pipelines, while government initiatives to ensure animal welfare are encouraging the use of standardized veterinary drugs, leading to market growth. Furthermore, the country’s active contract manufacturing supported market expansion by catering to small and mid-sized companies seeking cost-efficient production.

Key Players & Competitive Analysis Report

The European veterinary active pharmaceutical ingredients (API) manufacturing market features a competitive landscape dominated by established chemical and pharmaceutical companies, including Merck KGaA, Bayer AG, Boehringer Ingelheim, and Zoetis, alongside specialized API producers such as Sanofi Animal Health and Neogen Corporation. These players benefit from strong R&D capabilities, regulatory expertise, and vertical integration. The market is shaped by stringent EU regulations on animal health, food safety, and environmental standards, creating high entry barriers. Regional manufacturers face competition from low-cost Asian suppliers, prompting a focus on quality, traceability, and niche product differentiation. Strategic partnerships, innovation in biosimilars, and investments in sustainable manufacturing processes are key competitive levers. With rising demand for livestock productivity and companion animal healthcare, European API manufacturers emphasize compliance, innovation, and supply chain resilience to maintain leadership in this highly regulated and evolving market.

A few major companies operating in the Europe veterinary active pharmaceutical ingredients manufacturing market include Bayer AG, Boehringer Ingelheim International GmbH, ECO Animal Health Group PLC, Elanco, EUROAPI, FIS – Fabbrica Italiana Sintetici, Kempex Holland BV, MSD Animal Health, Suanfarma, and Zoetis Inc.

Key Players

- Bayer AG

- Boehringer Ingelheim International GmbH.

- ECO Animal Health Group PLC

- Elanco

- EUROAPI

- FIS – Fabbrica Italiana Sintetici

- Kempex Holland BV

- MSD Animal Health

- Suanfarma

- Zoetis Inc.

Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Industry Developments

In January 2023, MSD Animal Health, a division of Merck & Co., Inc., announced the opening of a manufacturing facility in Boxmeer, the Netherlands, for sterile filling and freeze drying of Companion Animal vaccines.

In October 2021, Zoetis invested in its biotech manufacturing and development facility in Tullamore, Ireland, to increase production capacity for single-use monoclonal antibody (mAbs) for veterinary medicines.

Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Market Segmentation

By Service Type Outlook (Revenue, USD Billion, 2020–2034)

- In House

- Contract Outsourcing

- Contract Development

- Preclinical Development

- Clinical Development

- Contract Manufacturing

- Contract Development

By Synthesis Type Mode Outlook (Revenue, USD Billion, 2020–2034)

- Chemical-based API

- Biological API

- HPAPI

By Animal Type Outlook (Revenue, USD Billion, 2020–2034)

- Production Animals

- Companion Animals

By Therapeutic Category Outlook (Revenue, USD Billion, 2020–2034)

- Antiparasitics

- Anti-infectives

- NSAIDs

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Veterinary Active Pharmaceutical Ingredients Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.00 Billion |

|

Market Size in 2025 |

USD 2.13 Billion |

|

Revenue Forecast by 2034 |

USD 3.84 Billion |

|

CAGR |

6.78% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.00 billion in 2024 and is projected to grow to USD 3.84 billion by 2034.

The market is projected to register a CAGR of 6.78% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are Bayer AG, Boehringer Ingelheim International GmbH, ECO Animal Health Group PLC, Elanco, EUROAPI, FIS – Fabbrica Italiana Sintetici, Kempex Holland BV, MSD Animal Health, Suanfarma, and Zoetis Inc.

The in-house segment dominated the Europe veterinary active pharmaceutical ingredients manufacturing market revenue share in 2024.

The companion animal segment is projected to witness the fastest growth during the forecast period