EV Charging Cables Market Size, Share, Trends, Industry Analysis Report

: By Charging Level (Level1, Level2, and Level3), Cable Length, Application, Power Supply, Mode, Shape, Cable Type, Jacket Material, Connector Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Dec-2024

- Pages: 120

- Format: PDF

- Report ID: PM1667

- Base Year: 2024

- Historical Data: 2020-2023

EV Charging Cables Market Overview

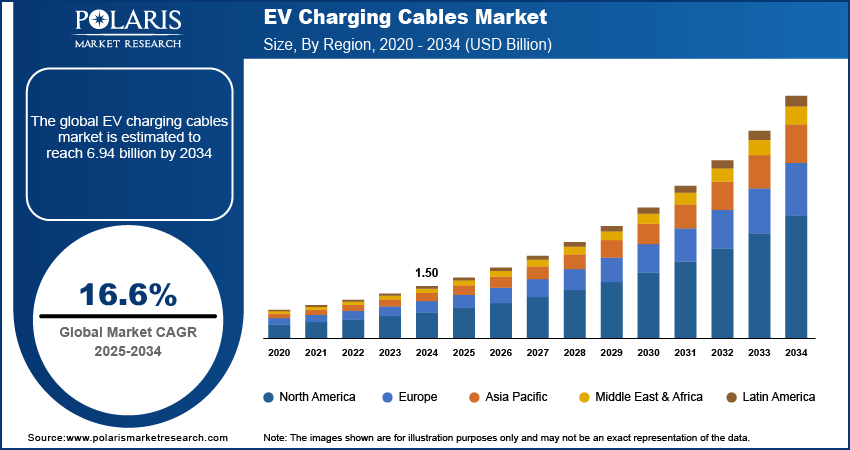

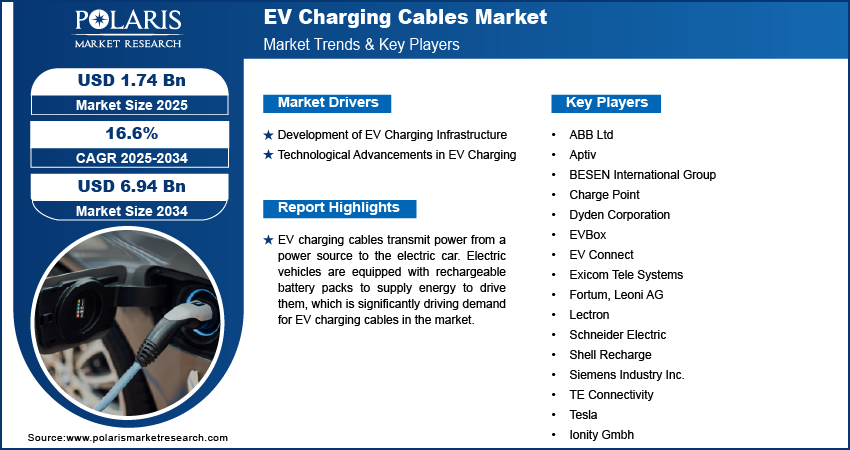

The EV charging cables market size was valued at USD 1.50 billion in 2024. The market is projected to grow from USD 1.74 billion in 2025 to USD 6.94 billion by 2034, exhibiting a CAGR of 16.6% from 2025 to 2034.

EV charging cables transmit power from a power source to the electric car. Electric vehicles are equipped with rechargeable battery packs to supply energy to drive them, which is significantly driving demand for EV charging cables in the market. Moreover, the rise in fuel prices is forcing individuals to shift from fuel cars to electric cars that are affordable and accessible over short distances. Electric charging cables optimally use electricity that cuts down expenses of fuel, thereby driving market growth.

To Understand More About this Research: Request a Free Sample Report

The rising need to reduce emissions and global carbon footprint drives the demand for electric vehicles. Battery electric vehicles (BEVs) are solely powered by electricity, which reduces greenhouse gas (GHG) emissions, air pollution, and vehicular noise. Their use also offers benefits such as low maintenance costs and reduced harmful vehicle emissions while providing comparable power. EVs are increasingly being used to restrict the emission of carbon, nitrogen, and other harmful compounds from gasoline and diesel vehicles.

EV Charging Cables Market Trends and Drivers Analysis

Development of EV Charging Infrastructure

The upgradation in charging infrastructure is driving the EV charging cables market growth. The development of public charging stations is encouraging consumers to opt for EVs. Moreover, governments around the world are highly investing in expanding EV charging infrastructure to promote sustainable development. The construction of EV charging stations by the governments, as well as various companies, is boosting market revenue. Governments are providing funding to encourage the development of EV charging stations. Government initiatives such as low or zero registration fees and exemptions from import, purchase, and road taxes have also been developed to install charging infrastructure.

Continuously decreasing prices of batteries used in electric passenger cars further supplements market growth. In addition, multiple countries have established ambitious targets for the development of charging infrastructure, which supports the growth of the EV charging cables market. For instance, China plans to deploy 0.5 million public chargers for cars, 4.3 million private electric vehicle supply equipment (EVSE) outlets, and 850 intercity quick-charge stations by 2020. The Chinese government is providing subsidies to municipalities for the construction of public battery recharge infrastructure. In France, the goal is to deploy 7 million stations by 2030, and financial incentives such as tax credits and subsidies are being offered to encourage the installation of chargers in residential areas and workplaces.

Technological Advancements in EV Charging

The growing adoption of technology across EV charging is fostering innovations and enhancing the speed and capacity of charging cables. Charging stations are utilizing advanced motors and connectors to ease the charging process. In addition, the development of various applications, such as mobile apps and software, to manage and control charging operations is driving market share.

For instance, BESEN introduced an app for home EV charging stations that has enhanced features such as setting charging time and duration and checking charging history. Hence, the innovations in electric charging cables and vehicle equipment are key factors driving market growth.

EV Charging Cables Market Segment Insights

EV Charging Cables Market Breakdown by Charging Level Insights

The EV charging cables market segmentation, based on charging level, includes Level 1, Level 2, and Level 3. The Level 1 charging level segment dominated the market in 2024 due to affordable and accessible charging cables. Also, level 1 electric cables have a slow charging speed and lower voltage that generates less heat and improves battery life. Level 1 is widely used across various applications that include homes, apartment complexes, and workplaces. Furthermore, these cables are used in electric vehicles specifically designed for short distances and are a key factor boosting EV charging cable market revenue.

Many companies are introducing innovative charging services that include portability and flexibility. For instance, Lectron’s innovative Level 1 portable chargers, which produce 110V and up to 16A, are highly convenient to use. They are compatible and durable for all-electric vehicles. Moreover, they are designed with 21 ft long cables to provide flexibility while charging.

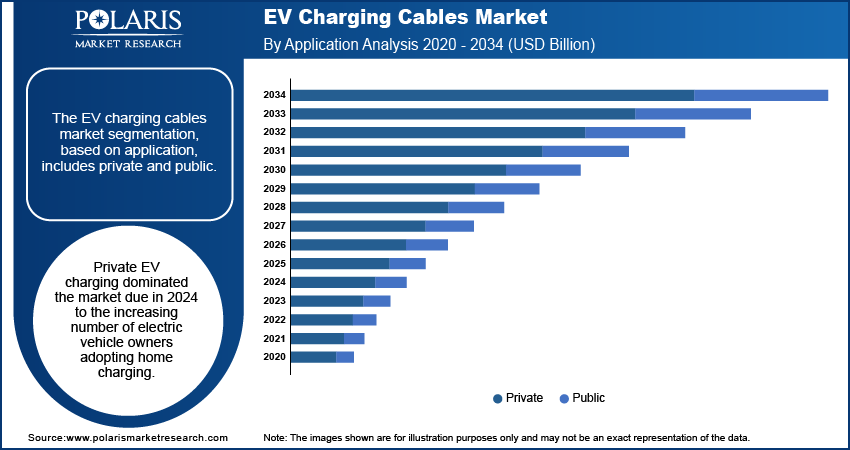

EV Charging Cables Market Breakdown by Application Insights

The EV charging cables market segmentation, based on application, includes private and public. Private EV charging dominated the market due in 2024 to the increasing number of electric vehicle owners adopting home charging. In addition, a large number of EV owners have access to private charging space, which is significantly boosting market revenue. The adoption of electric vehicles, due to rising concern for environmental safety, further encourages the development of charging plots in building complexes, apartments, offices, and others.

The rising sales of electric vehicles are driving demand for private charging space due to the need for convenient and efficient charging services. For instance, as per the International Energy Agency, 14 million sales were recorded in 2023. Simultaneously, the share of electric car sales increased from 4% in 2020 to 18% in 2023.

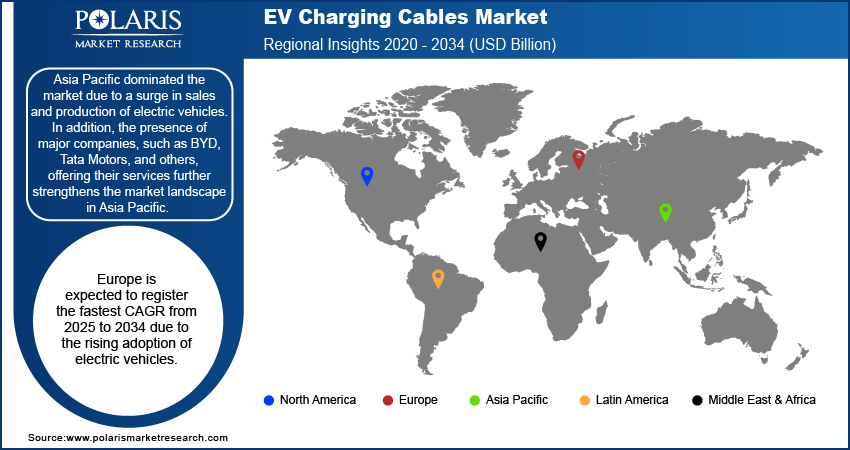

EV Charging Cables Market Breakdown by Regional Insights

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market due to a surge in sales and production of electric vehicles. In addition, the presence of major companies, such as BYD, Tata Motors, and others, offering their services further strengthens the market landscape in Asia Pacific. These market players are merging, acquiring, and collaborating to strengthen their market presence and serve better offerings in Asia Pacific, further driving the market during the forecast period.

China accounts for the largest market share in the EV charging cable market in 2024 due to the increasing number of automobile manufacturers. Also, the rise in population tends to increase demand for transportation services, which further boosts market revenue. Moreover, the emission of gases from fuel vehicles has led to increased demand for electric vehicles, including railways. The infrastructural development of electric charging stations is further supporting market expansion.

Europe is expected to register the fastest CAGR from 2025 to 2034 due to the rising adoption of electric vehicles. Besides, the government is enforcing regulations to reduce vehicle emissions and encourage individuals to opt for public transportation or electric vehicles. Moreover, the development of innovative electric transport services is driving demand for EV charging cable stations. For instance, Aike (EV Scooter manufacturer) has developed e-scooters that are widely used for city hopping. These e-scooters have significantly increased the demand for EV charging cables, boosting market revenue.

EV Charging Cables Market – Key Players & Competitive Analysis Report

Major market players are investing heavily in research and development in order to expand their product lines, which will help the EV Charging Cables market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market environment, the EV charging cables market must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the EV charging cables market to benefit clients and increase the market sector. In recent years, the EV market has offered some technological advancements. Major players in the EV charging cables market include ABB Ltd; Aptiv; BESEN International Group; Charge Point; Dyden Corporation; EVBox; EV Connect; Exicom Tele Systems; Fortum; Leoni AG; Schneider Electric; Shell Recharge; Siemens Industry Inc.; TE Connectivity; and Tesla.

Dyden Corporation, founded in 1951 and headquartered in Japan, is a manufacturer of electric vehicle charging solutions. The company’s products include EV charging stations, portable EV chargers, EV charging cables, home EV charging stations, and other equipment. The company's EV charging solutions are suitable for every industry, such as education, entertainment, fleets, fueling and convenience retail, airports, and others. In addition, Dyden’s portable chargers for electric cars have various series, such as PCD020, PCD030, and PCD040. In 2023, Dyden Corporation introduced an innovative DLB EV Charger with advancement in electric vehicle equipment technology.

EVBox, which was established in 2010, is a supplier of electric charging solutions and electric vehicle charging infrastructure (EVSE). The company's charging solutions include charging stations for residential and commercial locations, fast charging networks, and charging management software. It develops versatile charging solutions for private and company cars with charging ranges from 3.7 kW TO 22 kW. Also, the company has introduced home charging solutions to optimize energy usage and save costs. For instance, in 2023, EVBox launched Livo, which comes integrated with an Energy Management System (EMS), to allow users to control energy generation, storage, and consumption within households.

List of Key Companies in the EV Charging Cables Market

- ABB Ltd

- Aptiv

- BESEN International Group

- Charge Point

- Dyden Corporation

- EVBox

- EV Connect

- Exicom Tele Systems

- Fortum

- Leoni AG

- Lectron

- Schneider Electric

- Shell Recharge

- Siemens Industry Inc.

- TE Connectivity

- Tesla

- Ionity Gmbh

EV Charging Cables Market Developments

May 2024: EVBox released Livo 2, a new residential EV charging station that comes with enhanced solar charging features to optimize energy consumption in home charging.

June 2024: EVBox, My EV Charger, ChargeLab, and Mercedes-Benz collaborated to install two EVBox DC fast charging stations at Mercedes-Benz of Plano (Texas).

December 2023: EV Connect and BP Pulse collaborated to deliver fleet management solutions that enhance efficiency and minimize energy costs of fleet charging operations.

EV Charging Cables Market Segmentation

By Charging Level Outlook (Revenue – USD Billion, 2020–2034)

- Level 1

- Level 2

- Level 3

By Cable Length Outlook (Revenue – USD Billion, 2020–2034)

- Upto 5 meters

- 6 to 10 meters

- Above 10 meters

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Public

- Private

By Power Supply Outlook (Revenue – USD Billion, 2020–2034)

- Alternate

- Direct

By Mode Outlook (Revenue – USD Billion, 2020–2034)

- Mode 1 & 2

- Mode 3

- Mode 4

By Shape Outlook (Revenue – USD Billion, 2020–2034)

- Straight

- Coiled

By Cable Type Outlook (Revenue – USD Billion, 2020–2034)

- Normal Charging Cable

- High Power Charging Cable

- Liquid Cooled High Power Charging Cable

By Jacket Material Outlook (Revenue – USD Billion, 2020–2034)

- All Rubber

- Thermoplastic Elastomer ( TPE)

- Polyvinyl Chloride(PVC)

By Connector Type Outlook (Revenue – USD Billion, 2020–2034)

- Type 1

- Type 2

- CCS 2

- CHADEMO

- GB/T

- NACS/Tesla

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

EV Charging Cables Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1.50 billion |

|

Market Size Value in 2025 |

USD 1.74 billion |

|

Revenue Forecast in 2034 |

|

|

CAGR |

16.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The EV charging cables market size was valued at USD 1.50 billion in 2024 and is expected to grow by 6.94 billion in 2034.

The market is projected to grow at a CAGR of 16.6% from 2025 to 2034.

Asia Pacific had the largest share of the market in 2024.

The key players in the market are ABB Ltd; Aptiv; BESEN International Group; Charge Point; Dyden Corporation; EVBox; EV Connect; Exicom Tele Systems; Fortum; Leoni AG; Schneider Electric; Shell Recharge; Siemens Industry Inc.; TE Connectivity; and Tesla.

The private had the largest share of the global market in 2024.