Facility Management Market Share, Size, Trends, Industry Analysis Report

By Service (In-house, Outsourced); By Type; By End Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 138

- Format: PDF

- Report ID: PM2552

- Base Year: 2024

- Historical Data: 2020-2023

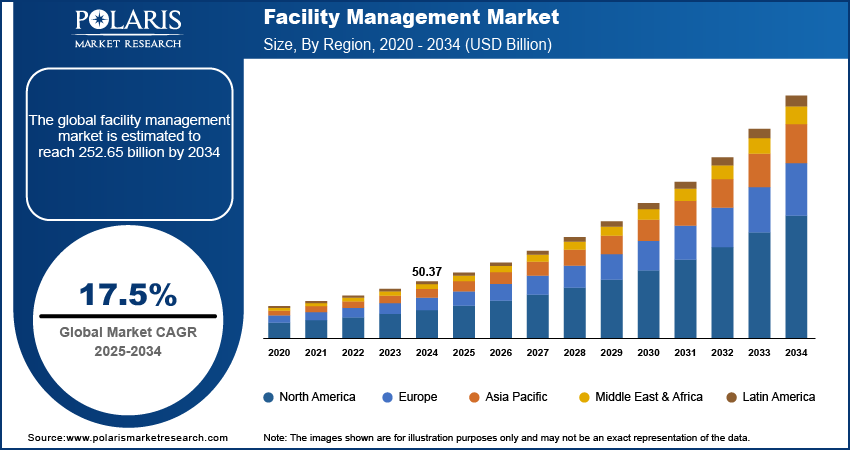

The global facility management market was valued at USD 50.37 billion in 2024 and is expected to grow at a CAGR of 17.5% during the forecast period. Key factors driving the demand includes rise in focus of enterprises to comply with regulatory policies, growth in inclination to use advanced technologies to maintain sustainability at workplaces, and heavy investments in infrastructure.

Key Insights

- The hard services category accounted for the largest share of the market in 2024, driven by increased demand from the construction sector.

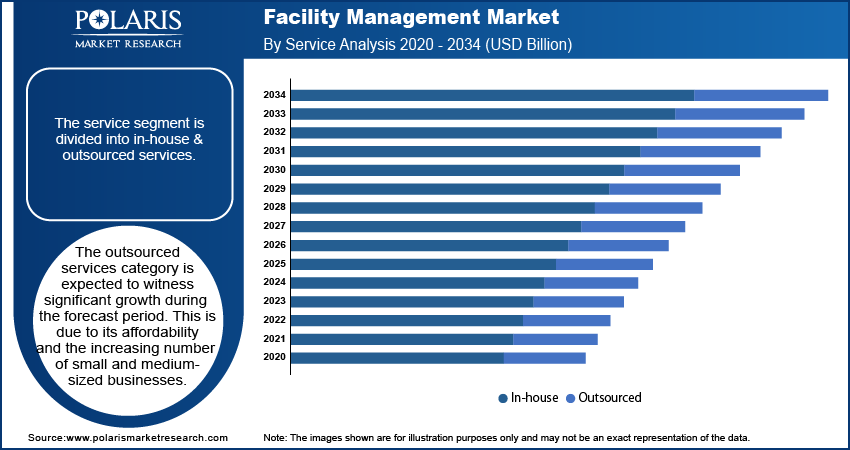

- The outsourced services category is expected to witness significant growth during the forecast period. This is due to its affordability and the increasing number of small and medium-sized businesses.

- North America held the largest market share in 2024. This is due to the adoption of new and emerging technologies.

- The Asia Pacific facility management market is expected to grow significantly. This is due to projects focused on ongoing infrastructure development in the region.

Industry Dynamics

- Government regulations that impose stricter mandates on safety and sustainability require companies to look to external services, which only increases demand for these services.

- The use of smart building technologies, powered by IoT and AI, to manage energy consumption and achieve emission reductions has boosted the market demand.

- The demand for IoT and AI is price-sensitive due to increased competition, which results in lower margins.

- The rise in use of AI and IoT has enabled a transition from a reactive maintenance approach to a predictive data-driven model, which has created new opportunities.

Market Statistics

- 2024 Market Size: USD 50.37 billion

- 2034 Projected Market Size: USD 252.65 billion

- CAGR (2025-2034): 17.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on Facility Management Market

- AI analyze data to predict equipment failures to repair it before breakdown.

- It automates routine task and optimize use of energy to reduce operational cost.

- AI generate insights from IoT sensors for space utilization and allocation of resources.

- It enable personalized and proactive services with the shift toward reactive maintenance models.

Facility management is the organization's services, physical assets, and infrastructure coordination to assure safe, efficient, and functional environment. Various factors linked to facility management that affect an organization's efficiency and productivity. A benchmark for creating and advancing efficient strategic, operational, and financial FM concepts throughout the world is the different facility management system standard, which complies with market best practices. The services of the FM sector have become excessively commoditized, which, combined with capped rents in a commercially flooded real estate market and a significant proportion of price-sensitive end-user sectors, has led to much shorter contract timelines. The oversupply of commercial real estate has created pressure on rent returns, which has caused clients to reduce their spending on FM services.

Involving FM providers later in the building cycle, specifically post-construction maintenance, is reduced. Asset management is a service provided by FM players that have been involved in infrastructure development from the beginning and who also offer FM consulting for preventative maintenance, longer asset lives, and longer-term contracts. Enova, an FM provider, launched its AI Enova Virtual Assistant (AIEVA) to enhance the user experience for customer, job seeker, and supplier inquiries related to Enova. The demand for FM services is also increasing due to the rise in investments in medical infrastructure and the construction of healthcare facilities. Infrastructure is becoming a critical component of delivering healthcare to the general public. Healthcare institutions are investing heavily in infrastructure to deliver cutting-edge healthcare services. Therefore, this focus on infrastructure advancement is expected to create demand for specialized, integrated facility management solutions for various sectors.

Industry Dynamics

Growth Drivers

The increased attention to meeting regulations and standards for businesses has driven growth in the facility management market. Government entities are continuing to enact stricter regulations regarding building safety, energy consumption, environmental impact, and safe work practices. Knowing how to navigate this regulatory framework, particularly as rules evolve, requires human capital with specific expertise in regulations and standards. Many organizations lack sufficient in-house expertise. Facility management entities bring this essential knowledge to clients, ensuring that a given portfolio of assets complies with required laws and regulations. They mitigate the risks associated with fines for non-compliance, as well as reputational damage, by following the portfolio. This function takes compliance from a reactive duty of an organization to a strategically managed operational component. Thus, the market is increasing its demand for professional services, which is expected to ensure compliance on a systematic basis, and this is contributing to growth.

The expanding commitment of corporation's to sustainability has boosted the development of new technologies in facility management. Various companies has adopted refined solutions such as IoT sensors, AI analytics, and building control systems to analyze and manage energy consumption, minimize waste, and reduce their carbon footprint. These technologies produce actionable data analytics to support forward-looking maintenance and resource deployment, moving the organization from maintenance to environmental responsibility. In addition, the application of new environmental technology allows firms to measure success against their sustainability goals, while also beginning to capture savings and benefits to operations over time. The capacity of franchise facility management to create environmental benefits and economic value makes it an essential partner for companies implementing certified green building criteria and pursuing improved corporate social responsibility.

Report Segmentation

The market is primarily segmented based on type, service, end-use, and region.

|

By Type |

By Service |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Type Analysis

The segmentation, based on type, includes hard solutions and soft services. The hard services category accounted for the largest share of the market in 2024 due to the increased demand from the construction sector. These services include those related to HVAC, mechanical systems, plumbing, and other areas, as well as the massive building projects for the construction of industrial and commercial facilities worldwide. The nature of these services, ensuring safety, integrity, and operational continuity, assures their ongoing demand. Moreover, expertise in technology and government compliance is required for hard services to support their revenue contribution to the market.

The soft service category is anticipated to expand significantly throughout the projected period. This growth is driven by the increased focus on improving employee productivity, well-being, and work experience. Cleaning, landscaping, and security services have become an integral part of branding and talent acquisition strategies. Thus, enterprises are outsourcing these essential functions to specific providers.

Service Analysis

The service segment is divided into in-house & outsourced services. The outsourced services category is expected to witness significant growth during the forecast period. This is due to its affordability and the increasing number of small and medium-sized businesses. Outsourcing services allows small and medium-sized businesses to access advanced technologies and specialized expertise without incurring significant investment. It also enables companies to improve operational flexibility and scalability by shifting their focus to their core competencies. Thus, this trend of collaborating with FM providers is expected to boost service delivery.

Regional Analysis

North America Facility Management Market Assessment

North America held the largest market share in 2024. This is due to the presence of economically and technically capable individuals in the U.S. and Canada, which facilitates the adoption of new and emerging technologies. Stronger positions of facility management industry participants allow organizations in the region a competitive advantage over others in other regions. The region also has developed countries with established facilities. Thus demand is significantly increasing for these solutions with businesses within the telecommunications and IT industries.

Asia Pacific Facility Management Market Insights

The Asia Pacific facility management market is expected to grow significantly. This is due to projects focused on ongoing infrastructure development in the region. Rapid urbanization is creating demand for both hardware and software FM services, especially as a result of the substantial level of development in the commercial real estate sector, industrial parks, and smart cities. Growing economies has boosted standards for facility management beyond the traditional in-house maintenance approaches. Facility management expertise is being leveraged as governments implement stricter building safety and energy efficiency regulations, while also striving for more sustainable outcomes in asset management. New infrastructure projects, changing regulations, and the continued expansion of multinational corporations in the region provide a strong case for the industry to drive facility management services forward. Moreover, the region's expanding industrial base, accompanied by the return of economic activity, also supports the need for standard and efficient service delivery methods.

Competitive Insight

A few key players are ISS A/S, Compass Corporation, Aramark Company, Jones Lang Lasalle IP Corp., Cushman & Wakefield, Tenon Organization, Inc., Dussman Organization, IBM, ORACLE, Trimble Corporation, Accruent, MRI SOFTWARE Corporation, Causeway Information technology, and Spacewell International.

Recent Developments

- June 2025: Solutions+ and Serco expanded Khadamat Facilities Management L.L.C. through a partnership to advance the UAE’s Integrated Facilities Management (IFM). The enhanced partnership is a step towards delivering operational excellence, innovation, and sustainability across the UAE’s critical infrastructure.

- April 2025: ServiceChannel, a platform provider for the procurement and delivery of facilities services, launched an online ecosystem that offers multi-site customers and service providers access to a dynamic network of facilities management tools, services, and solution providers.

Facility Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 50.37 billion |

| Market size value in 2025 | USD 58.97 billion |

|

Revenue forecast in 2034 |

USD 252.65 billion |

|

CAGR |

12.5 % from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Type, By Service, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ISS A/S, Compass Corporation, Aramark Company, Jones Lang Lasalle IP Corp., Cushman & Wakefield, Tenon Organization, Inc., Dussman Organization, IBM, ORACLE, Trimble Corporation, Accruent, MRI SOFTWARE Corporation, Causeway Information technology, and Spacewell International |

FAQ's

• The global market size was valued at USD 50.37 billion in 2024 and is projected to grow to USD 252.65 billion by 2034.

• The global market is projected to register a CAGR of 17.5% during the forecast period.

• North America dominated the global market share in 2024.

• A few key players are ISS A/S, Compass Corporation, Aramark Company, Jones Lang Lasalle IP Corp., Cushman & Wakefield, Tenon Organization, Inc., Dussman Organization, IBM, ORACLE, Trimble Corporation, Accruent, MRI SOFTWARE Corporation, Causeway Information technology, and Spacewell International.

• The hard services category accounted for the largest share of the market in 2024.

• The outsourced services category is expected to witness significant growth during the forecast period.