Fatty Methyl Ester Sulfonate Market Size, Share, Trends, Industry Analysis Report

By Feedstock Source, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM6288

- Base Year: 2024

- Historical Data: 2020-2023

Overview

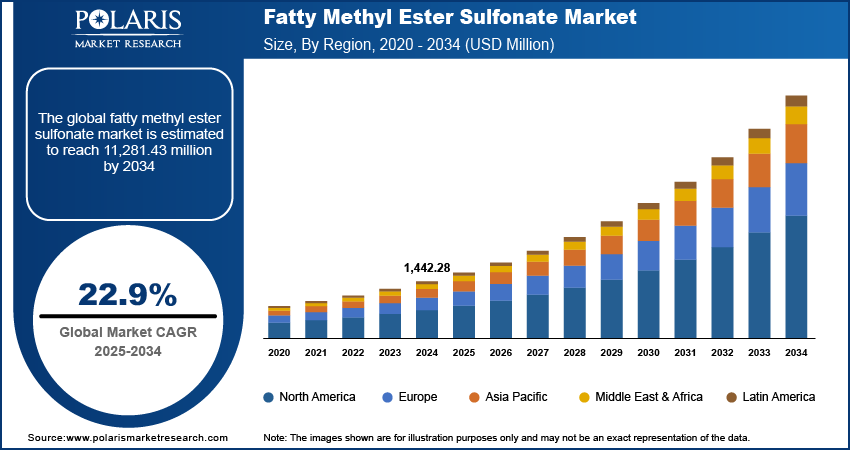

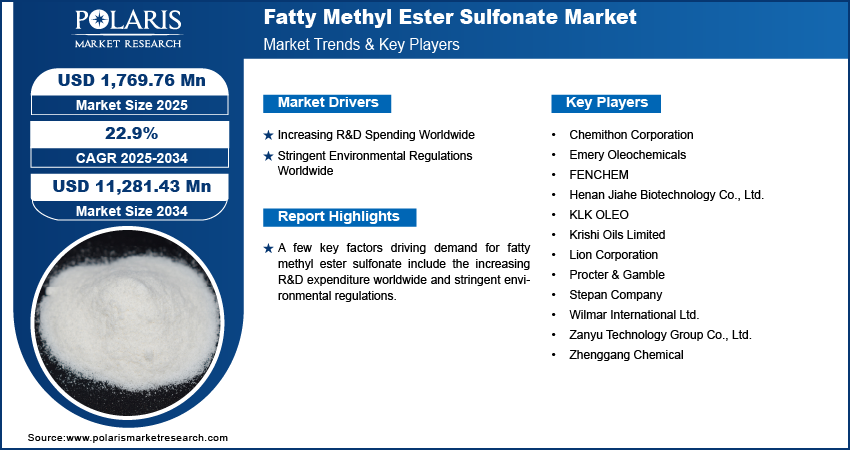

The global fatty methyl ester sulfonate market size was valued at USD 1,442.28 million in 2024, growing at a CAGR of 22.9% from 2025 to 2034. Key factors driving demand for fatty methyl ester sulfonate include the increasing R&D expenditure worldwide coupled with stringent environmental regulations.

Key Insights

- The palm oil segment dominated the market share in 2024.

- The personal care segment is projected to grow at a rapid pace in the coming years, driven by its rising application in premium skincare and haircare formulations.

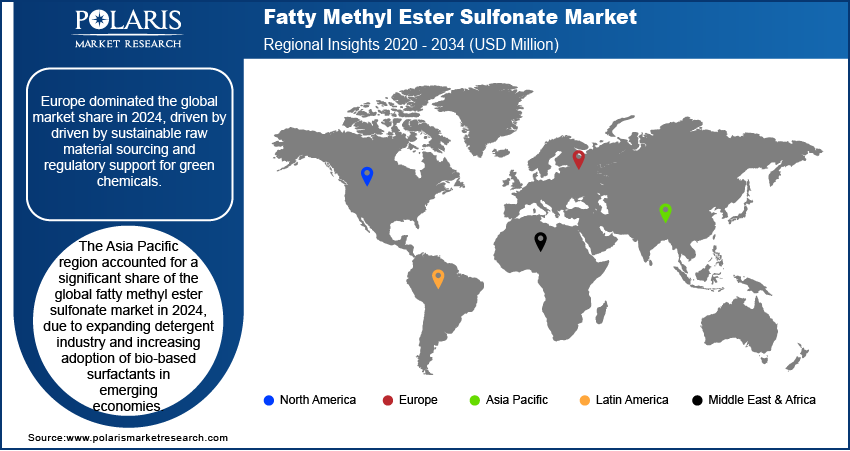

- The Europe fatty methyl ester sulfonate market dominated the global market share in 2024.

- The Germany fatty methyl ester sulfonate market is growing due to strong policy support for bio-based chemicals and investments in green technology.

- The Asia Pacific market is expected to develop at a rapid rate from 2025-2034 driven by industrial growth and supply of inexpensive raw materials.

- China and Japan are the leading nations contributing to regional growth owing to massive manufacturing capabilities and increased adoption within personal care markets.

Industry Dynamics

- Increased R&D expenditure globally is driving market growth owing to advancements in formulations, productivity improvements, and increased biodegradability.

- Regulations for strict environmental controls are boosting the demand for fatty methyl ester sulfonate owing to the prohibition of non-biodegradable surfactants and encouragement of sustainable cleaning products.

- Circular economy & sustainability shift is expected to create opportunities in the forecast period.

- Price volatility and supply chain volatility are expected to hinder market growth.

Market Statistics

- 2024 Market Size: USD 1,442.28 Billion

- 2034 Projected Market Size: USD 11,281.43 Billion

- CAGR (2025–2034): 22.9%

- Europe: Largest Market Share

Fatty methyl ester sulfonate (FMES) is a natural oil-based biodegradable surfactant from palm and coconut oils, which serves as an environmentally friendly alternative to conventional surfactants. FMES is used in detergents, personal care products, household cleaning products, and industrial cleaners due to its intense cleaning, foaming, and mildness. FMES performs effectively in hard water, is gentle on skin, and enables sustainable use. Its use is increasing in laundry, dishwashing, shampoos, and cosmetics as consumers and industries are shifting towards green products.

The fatty methyl ester sulfonate market is growing with rapid urbanization and infrastructure development, as expanding cities increase the need for detergents, cleaners, and personal care items. The UN indicates that 57% of global inhabitants resided in urban areas in 2023, and this is anticipated to be 68% in 2050. This shift enhances the use of green processing and cleaning chemicals in homes, businesses and industries.

The market for fatty methyl ester sulfonate is increasing with rising demand for environmentally friendly ingredients in home care and personal care products. Consumers are shifting toward sustainable, plant-based surfactants in shampoos, soaps, detergents, and cleaning agents due to rising environmental awareness and concerns over skin sensitivity caused by synthetic alternatives. The continuous expansion of the global personal care and home care industries is therefore accelerating the adoption of FMES, positioning it as a preferred sustainable surfactant solution.

Drivers & Opportunities

Global R&D Investments on the Rise: Global R&D expenditure is propelling growth in the fatty methyl ester sulfonate market through the development of bio-based formulations, green chemistry, and sustainable manufacturing practices. OECD statistics indicate that in 2023, Israel invested 6.3% of GDP on R&D, Korea invested 5%, and Sweden invested 3.6%. The higher R&D budgets improves product efficiency boosting market growth.

Strict Environmental Laws Across the Globe: Strict environmental laws across the globe are compelling the FMES market as companies are diverting their interest from petrochemical surfactants to biodegradable products. The regulations promote the adoption of FMES, with strong biodegradability and a lower carbon footprint, enabling the manufacturers to achieve global sustainability targets.

Segmental Insights

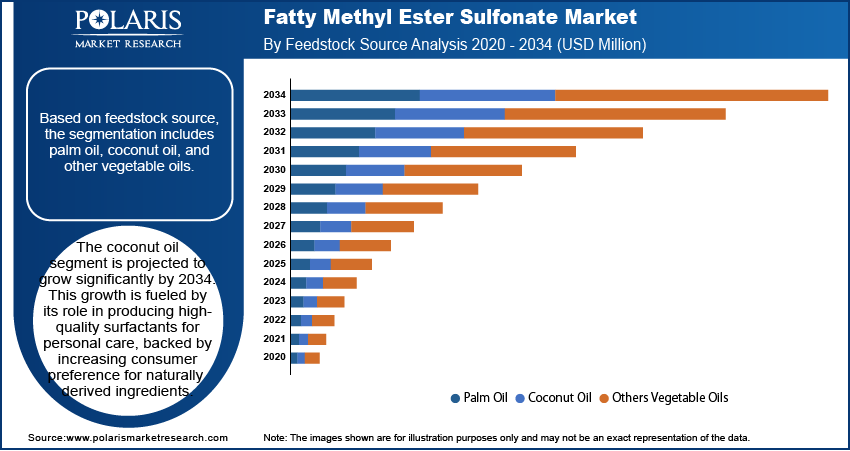

Feedstock Source Analysis

By feedstock source, the market is divided into palm oil, coconut oil, and other vegetable oils. The palm oil segment held the largest market share in 2024 due to its availability and strong global supply base. FMES based on palm oil finds broad application in detergent making, providing consistent cleaning and foaming capabilities under various washing conditions.

The coconut oil segment is expected to grow at fastest rate through 2034 as it is a major source of high-performance surfactants for personal care applications. Rising use of natural and skin-safe ingredients in shampoos, soaps, and cosmetics is fueling its application. The International Coconut Community indicates that global coconut oil production is set to reach 3,564 MT in 2025 from 3,556 MT in 2023, providing consistent supply for FMES in eco-friendly personal care formulations.

Application Analysis

By application, the market is categorized into detergents, personal care, industrial & institutional (I&I) cleaning, and others. The segment of detergents dominated the market in 2024 owing to high demand from residential and commercial cleaning requirements. FMES is widely used in laundry and dishwashing products for its strong cleaning power, biodegradability, and easy blending with other surfactants.

The personal care segment is anticipated to grow at the maximum rate driven by increasing use of eco-friendly surfactants in shampoos, body washes, and face cleaners. Increasing demand for safe and sustainable ingredients from consumers and regulatory pressures for more sustainable products are driving FMES adoption among worldwide personal care companies.

Regional Analysis

Europe dominated the FMES market in 2024 due to strict environmental regulations, focus on sustainable chemistry and dominating personal care and cleaning industries. Demand for renewable raw materials and green products motivates bio-based chemical adoption. Western European countries are also promoting circular economy principles, further propelling FMES demand.

Germany Fatty Methyl Ester Sulfonate Market Insights

Growth in the cosmetics and personal care sector is boosting FMES use in shampoos, cleansers, body washes and skincare products. It is a more suitable choice than surfactants due to its mild nature, biodegradability, and high foaming capacity. Strict regulations encouraging sustainable ingredients are boosting large-scale use of bio-based surfactants in Germany. According to Cosmetic Europe, Germany holds the largest share of the cosmetics market accounting to USD 17.14 billion in 2023. This steady industry growth is creating significant opportunities for FMES adoption in cosmetics and personal care applications in this region.

North America Fatty Methyl Ester Sulfonate Market Assessments

The North America market is expected to hold a strong share by 2034, driven by rising demand for biodegradable cleaning products and growing focus on environmental safety. The region shows strong R&D support and active manufacturers working on better, low-toxicity FMES products for industries such as personal care, household cleaning, and oilfield chemicals. Strict regulations promoting sustainable raw materials are also boosting the use of bio-based surfactants in the region.

Asia Pacific Fatty Methyl Ester Sulfonate Market Trends

Asia Pacific is expected to develop the fastest rate due to demand from household care, detergents and personal care products in this region. Easy access to palm oil and other natural feedstocks lowers production costs, while government support for sustainable practices and the rise of regional hubs promote large-scale FMES manufacturing.

India Fatty Methyl Ester Sulfonate Market Overview

Rising palm oil production is boosting FMES manufacturing in India, as palm oil is the main raw material. Its affordability favors huge supply in scale for home care, personal care, and industry cleaning segments. According to IBEF, India's palm oil production is anticipated to grow to 1.2–1.5 million metric tons by 2030–31, from around 400,000 tons, increasing raw material availability and promoting FMES utilization as a sustainable option.

Key Players & Competitive Analysis

The fatty methyl ester sulfonate market is moderately competitive with leading players such as KLK OLEO, Wilmar International Ltd., Lion Corporation, Procter & Gamble, Stepan Company, Chemithon Corporation, and Emery Oleochemicals. The firms specialize in coconut oil and palm oil-derived bio-based surfactants to serve detergents, personal care and industrial cleaning applications. Market rivalry depends on capacity expansion and strategic partnerships to increase global outreach and meet soaring demand for eco-friendly surfactants.

A few major companies operating in the fatty methyl ester sulfonate industry include KLK OLEO, Wilmar International Ltd., Lion Corporation, Krishi Oils Limited, Chemithon Corporation, Zanyu Technology Group Co., Ltd., FENCHEM, Emery Oleochemicals, Stepan Company, Henan Jiahe Biotechnology Co.,Ltd., Zhenggang Chemical, and Procter & Gamble.

Key Players

- Chemithon Corporation

- Emery Oleochemicals

- FENCHEM

- Henan Jiahe Biotechnology Co., Ltd.

- KLK OLEO

- Krishi Oils Limited

- Lion Corporation

- Procter & Gamble

- Stepan Company

- Wilmar International Ltd.

- Zanyu Technology Group Co., Ltd.

- Zhenggang Chemical

Fatty Methyl Ester Sulfonate Industry Developments

February 2025: KLK OLEO expanded its business in India focusing on methyl ester sulfonates to boost local partnerships and supply for industrial, household and personal care industries.

Fatty Methyl Ester Sulfonate Market Segmentation

By Feedstock Source Outlook (Revenue, USD Billion, 2020–2034)

- Palm Oil

- Coconut Oil

- Other Vegetable Oils

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Detergents

- Personal Care

- Industrial & Institutional (I&I) Cleaning

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Fatty Methyl Ester Sulfonate Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1,442.28 Billion |

|

Market Size in 2025 |

USD 1,769.76 Billion |

|

Revenue Forecast by 2034 |

USD 11,281.43 Billion |

|

CAGR |

22.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1,442.28 billion in 2024 and is projected to grow to USD 11,281.43 billion by 2034.

The global market is projected to register a CAGR of 22.9% during the forecast period.

Europe dominated the market in 2024 driven by stringent environmental regulations and strong demand for eco-friendly surfactants.

A few of the key players in the market are KLK OLEO, Wilmar International Ltd., Lion Corporation, Krishi Oils Limited, Chemithon Corporation, Zanyu Technology Group Co., Ltd., FENCHEM, Emery Oleochemicals, Stepan Company, Henan Jiahe Biotechnology Co.,Ltd., Zhenggang Chemical, and Procter & Gamble.

The palm oil segment dominated the market revenue share in 2024 due to its abundant availability, cost-effectiveness, and wide use in large-scale surfactant production.

The personal care segment is projected to witness the fastest growth during the forecast period due to rising consumer demand for natural, biodegradable, and skin-friendly ingredients in soaps, shampoos, and cosmetics.