Fault Detection and Classification Market Share, Size, Trends, Industry Analysis Report

By Fault Type (Dimensional Fault, Others); By Technology; By Offering; By Application; By End Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Feb-2024

- Pages: 117

- Format: PDF

- Report ID: PM4626

- Base Year: 2023

- Historical Data: 2020-2022

Report Outlook

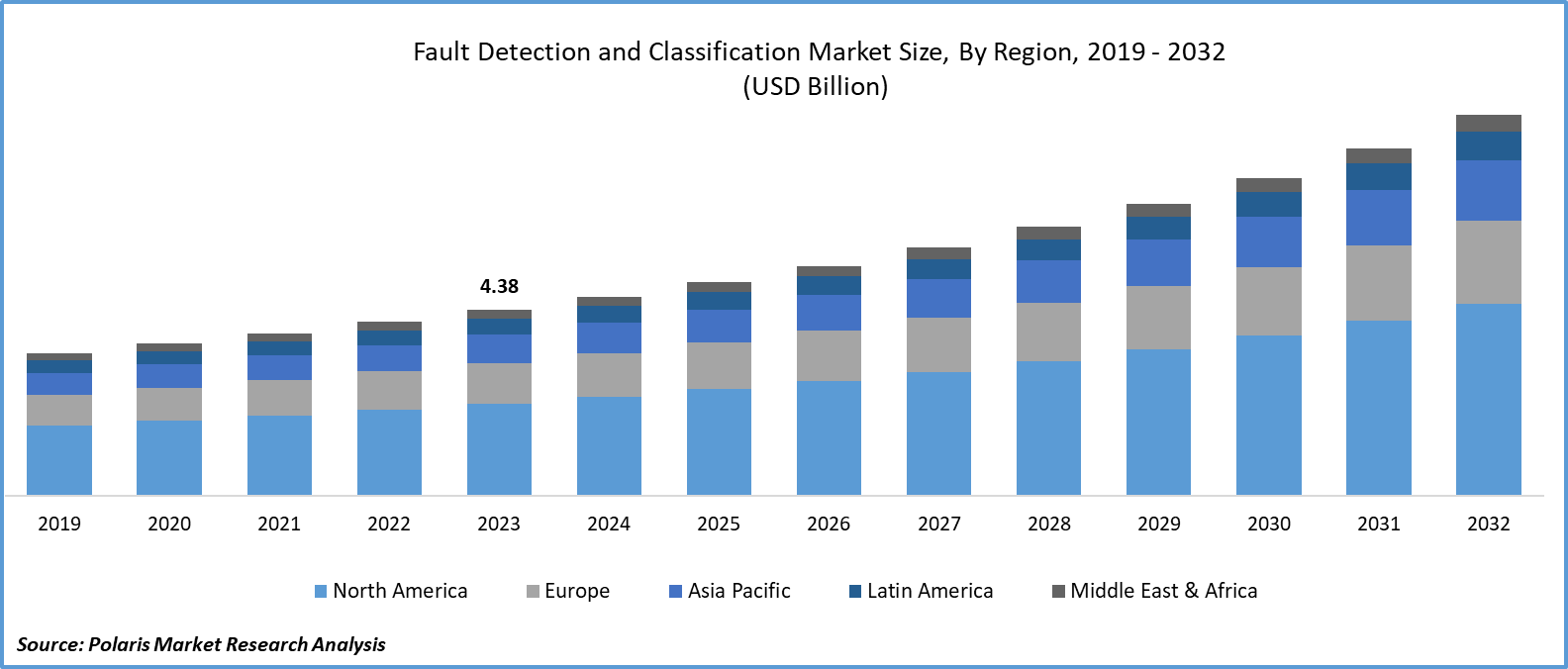

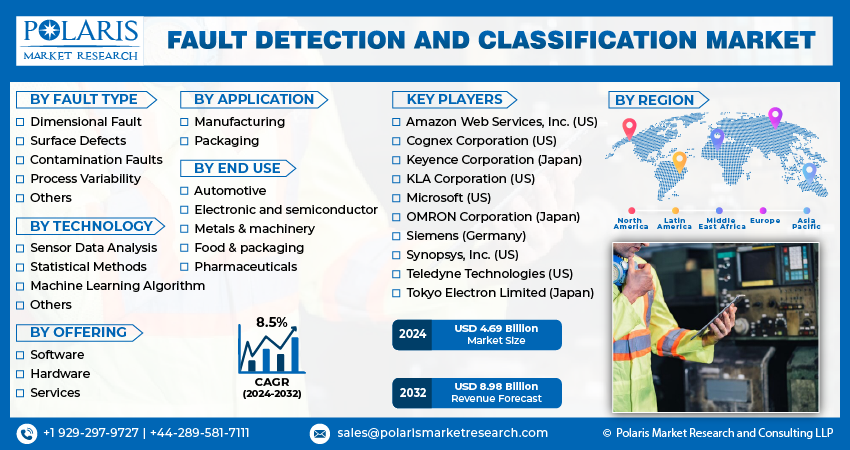

Fault Detection and Classification Market size was valued at USD 4.38 billion in 2023. The market is anticipated to grow from USD 4.69 billion in 2024 to USD 8.98 billion by 2032, exhibiting the CAGR of 8.5% during the forecast period.

Market Overview

The growth of the fault detection and classification market is attributable to the rising focus on product quality and the increased government interventions in monitoring the safety of various products produced by companies in the global market. The growing quality assurance demand by the major companies engaged in production and manufacturing services is showing a significant commitment to adopt fault detection and classification tools in the world.

For instance, in September 2023, Mathwork unveiled the Matlab and Simulink product families, 2023B. It introduced two new products and other feature upgrades to monitor and detect faults in the researchers and engineers workflows.

To Understand More About this Research: Request a Free Sample Report

Moreover, the ongoing global transition towards the adoption of renewable energy and increasing focus on energy efficiency is positively influencing the fault detection and classification market. For instance, a 2023 study published in Scientific Reports focused on developing a machine learning model with a view to classify pollution sources using photovoltaic panels. This model provided a timely framework for cleaning panels to enhance the solar power-producing capacity.

Growth Drivers

Rising Adoption of Technological Advancements

The increasing efforts by the researchers to promote the availability of safe and good quality goods in society are significantly influencing the adoption of fault detection and classification systems. Furthermore, these systems are expected to improve the operational performance in the product manufacturing, by identifying or classifying improper labelled and packaged goods at one place with the automation technologies. For instance, a 2023 study published in Springer Link developed a fault diagnosis model using image-based deep learning networks and vibration signals. The results of the model demonstrated 99% accurate fault detection capabilities in rolling bearings.

Regulatory Standards in Food Production and the Pharmaceutical Space

The growing concerns about food safety and rising government guidelines in the pharmaceutical and food packaging domains are highly motivating the adoption of fault detection and classification systems. C ompanies are stepping forward to install fault detection and classification models in their production and packaging processes to adhere to the stringent regulations set by the government.

Furthermore, fault detection and classification tools are registering adoption in the power transmission functionalities. For instance, in February 2024, a study published in Scientific Reports focused on the development of an algorithm for power transmission line fault identification with the optimization of YOLOv4 model.

Restraining Factors

Higher Costs of the Adoption of Fault Detection and Classification Systems

The huge costs of the deployment of fault detection and classification tools in the manufacturing or packaging industry are negatively impacting market growth. The moderate complexity of these tools is expected to limit their adoption by small and medium manufacturing companies.

Report Segmentation

The market is primarily segmented based on fault type, technology, offering, application, end use, and region.

|

By Fault Type |

By Technology |

By Offering |

By Application |

By End Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Fault Type Analysis

Dimensional Fault Segment Is Expected to Witness the Highest Growth During the Forecast Period

The dimensional fault segment is projected to grow at an optimal CAGR during the projected period, mainly driven by its automation capabilities, contributing to the efficient monitoring of faults in multiple production and manufacturing processes. This type of fault mostly occurs in the packaging of end products, including pharmaceuticals and food. The evolving food and snack production is driving the demand for fault detection and classification software to counter dimension faults.

The surface defects segment led the market with a substantial revenue share in 2023, largely attributable to its ability to offer precise detection mechanisms. The ability to assist in producing of reliable products and stimulate the operational efficiency in the manufacturing process is driving the demand for fault detection and classification in the marketplace.

By Technology Analysis

Dimensional Fault Segment is Expected to Witness the Highest Growth During the Forecast Period

The machine learning algorithm segment received the largest market share in 2023 and is likely to retain its market position throughout the forecast period. The rising research and development studies focusing on the utilization of artificial intelligence, particularly machine learning in fault detection and classification are expected to show tremendous growth potential in the coming years. For instance, in September 2023, Lucy Electric introduced new technology, SYNAPS to detect grid’s fault connection with the integration of artificial intelligence, reducing the maintenance costs by 66%.

By Application Analysis

Manufacturing Segment Received a Dominant Share over Other Applications in 2023

The manufacturing segment registered the highest share of growth by application in 2023 and is likely to stimulate its growth trajectory in the coming years. The evolution of manufacturing companies in the world and the presence of larger production machines are projected to drive the employment of fault detection and classification in the marketplace.

The packaging segment is likely to showcase significant growth potential for fault detection and classification during the study period, owing to the growing product assurance measures taken by the companies to promote their brand coverage with the offering of higher quality goods and services.

By End Use Analysis

Automotive Segment Dominated the Global Market in 2023

The automotive segment witnessed the dominant share in fault detection and classification market. This is mainly attributable to its ability to enhance product quality. The rising concerns about automobile safety, driven by its potential to cause human losses in society is expected to boost the demand for fault detection and classification tools in the global marketplace.

The electronic and semiconductor segments are projected to witness growth opportunities during the forecast time frame due to rising concerns about anomaly detection in manufacturing activities. The growing need for efficient electronic equipment, is anticipated to showcase new demand potential for the fault detection and classification market in the long run.

Regional Insights

North America Region Registered the Largest Share of the Global Market in 2023

The North America region held the dominant share in 2023. Region’s dominance is largely influenced by the presence of strong infrastructure in the region. The existence of an established manufacturing and packaging industry with advanced fault detection and classification is likely to promote market growth during the forecast period.

Additionally, the growing fault detection systems in the electrical sector is playing vital role in the market expansion. For instance, in February 2024, ONYX Insight announced the launch of blade root surveillance tool.

The Asia Pacific region is expected to be the fastest growing region with a healthy CAGR during the projected period. This is owing to the growing technological adoption, primarily artificial intelligence in the production process, and the adoption of advanced automation technologies in business operations, which are projected to drive demand for the fault detection and classification market in the coming years. Growing measures by the major companies to promote the electrical productivity is optimally influencing the market growth. For instance, in February 2024, Adani Electricity Mumbai announced the establishment of Advanced Distribution Management System in India with a view to limit power outages by the integration of fault detection capabilities.

Key Market Players & Competitive Insights

Strategic partnerships to drive the competition

The fault detection and classification market is a mix of consolidation. Major players in the market are showing interest in adopting advanced technologies to detect faults efficiently and driving innovations around the world. For instance, in March 2023, Utilifeed introduced a fault detection tool to monitor district heating systems.

Some of the major players operating in the global market include:

- Amazon Web Services, Inc. (US)

- Cognex Corporation (US)

- Keyence Corporation (Japan)

- KLA Corporation (US)

- Microsoft (US)

- OMRON Corporation (Japan)

- Siemens (Germany)

- Synopsys, Inc. (US)

- Teledyne Technologies (US)

- Tokyo Electron Limited (Japan)

Recent Developments in the Industry

- In September 2023, IFS, a cloud enterprise software company, announced the acquisition of Falconry, an AI-based data analysis service provider for the manufacturing industry. This acquisition is aiming to promote its offering of fault detection software on the market.

- A 2023 study published in the Institute of Engineering and Technology explored the development of fault detection and classification models with the incorporation of neuro-fuzzy and deep learning algorithms in a smart distribution grid. The experiment showcased 99.99% accuracy in fault detection.

Report Coverage

The fault detection and classification market report emphasize on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, fault type, technology, offering, application, end use, and their futuristic growth opportunities.

Fault Detection and Classification Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 4.69 billion |

|

Revenue forecast in 2032 |

USD 8.98 billion |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global fault detection and classification market size is expected to reach USD 8.98 billion by 2032

Key players in the market are Amazon Web Services, Inc., Cognex Corporation, Keyence Corporation, KLA Corporation

North America contribute notably towards the global Fault Detection and Classification Market

Fault Detection and Classification Market exhibiting a CAGR of 8.5% during the forecast period.

The Fault Detection and Classification Market report covering key segments are fault type, technology, offering, application, end use and region.