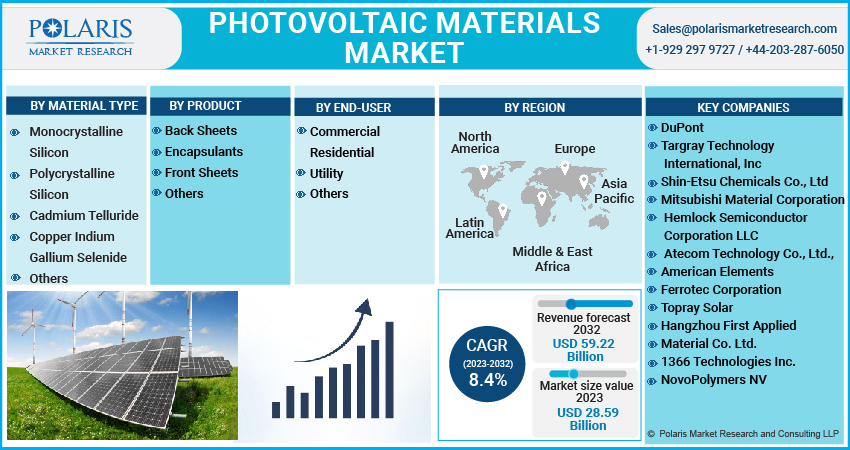

Global Photovoltaic Materials Market [By Material Type (Monocrystalline Silicon, Polycrystalline Silicon, Cadmium Telluride, Copper Indium Gallium Selenide, Others); By Product (Back Sheets, Encapsulants, Front Sheets, Others); By End-User (Commercial, Residential, Utility, Others); By Region]: Market Size & Forecast, 2023 – 2032

- Published Date:May-2023

- Pages: 119

- Format: PDF

- Report ID: PM1042

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

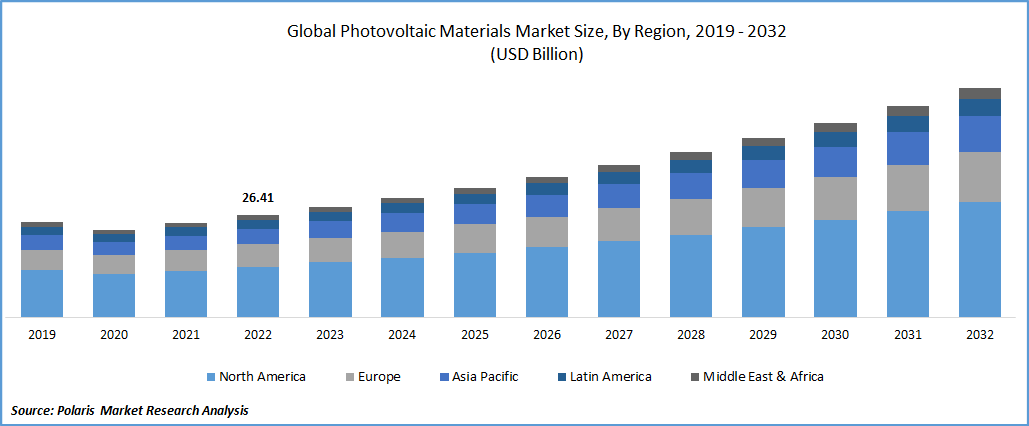

The gobal photovoltaic materials market was valued at USD 26.41 billion in 2022 and is expected to grow at a CAGR of 8.4% during the forecast period. Photovoltaic (PV) materials are materials that convert solar energy into electrical energy through the photovoltaic effect. PV materials are widely used in the manufacturing of solar panels and other solar devices. These materials are critical to the performance, efficiency, and cost-effectiveness of solar energy systems. The most commonly used photovoltaic materials are crystalline silicon, thin-film solar cells, and organic photovoltaic materials. Let's take a closer look at each of these materials.

Know more about this report: Request for sample pages

Crystalline silicon is the most widely used photovoltaic material, accounting for approximately 90% of the global PV market. It is a highly efficient material that is commonly used in the manufacturing of solar panels. There are two types of crystalline silicon: monocrystalline silicon and polycrystalline silicon.

Thin-film solar cells are made from thin layers of semiconductor materials such as amorphous silicon, cadmium telluride, and copper indium gallium selenide. These materials are applied onto a substrate such as glass, metal, or plastic. Thin-film solar cells are less efficient than crystalline silicon, but they are less expensive to manufacture and can be used in a wider range of applications.

Organic photovoltaic materials are made from organic polymers that are flexible, lightweight, and can be produced using low-cost manufacturing methods such as printing. Organic photovoltaic materials are less efficient than crystalline silicon and thin-film solar cells, but they have the potential to be used in a wide range of applications, including wearable devices and building-integrated photovoltaics.

In addition to these three main types of photovoltaic materials, there are also emerging materials such as perovskite solar cells, which have the potential to be highly efficient and low-cost. However, these materials are still in the early stages of development and are not yet widely used in commercial applications.

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global market for photovoltaic (PV) materials is expected to grow significantly in the coming years, driven by several growth drivers. The increasing demand for renewable energy sources, declining cost of solar energy systems, and favourable government policies are some of the key factors that are expected to fuel the growth of the photovoltaic materials market.

One of the major growth drivers for the PV materials market is the increasing demand for renewable energy sources. With the rise of concerns about climate change and the need to reduce carbon emissions, there is a growing need for clean and sustainable sources of energy. Solar energy is a highly attractive option as it is abundant, renewable, and produces zero emissions. As a result, there has been a significant increase in the adoption of solar energy systems, which has in turn driven the demand for PV materials.

Another key growth driver for the PV materials market is the declining cost of solar energy systems. Over the past few years, the cost of solar energy has decreased significantly, making it more accessible and cost-effective for consumers and businesses. This has been largely due to advancements in technology and improvements in manufacturing processes. As the cost of solar energy systems continues to decline, the demand for PV materials is expected to increase, further driving the growth of the market.

Government policies and incentives are also driving the growth of the photovoltaic materials market. Many governments around the world are implementing policies and incentives to encourage the adoption of renewable energy sources such as solar energy. These policies include tax credits, feed-in tariffs, and renewable portfolio standards. In addition, many countries have set renewable energy targets, which are expected to further increase the demand for PV materials.

The Asia-Pacific region is expected to be a major growth driver for the PV materials market. This is due to the high demand for solar energy in countries such as China, Japan, and India, as well as the increasing investment in renewable energy infrastructure in the region. In addition, the region is home to many leading PV material manufacturers, which are expected to drive the growth of the market.

In conclusion, the global market for PV materials is expected to grow significantly in the coming years, driven by several growth drivers. The increasing demand for renewable energy sources, declining cost of solar energy systems, and favourable government policies are some of the key factors that are expected to fuel the growth of the market. As the demand for solar energy continues to rise, the PV materials market is expected to play a critical role in the development and success of the industry.

Report Segmentation

The market is primarily segmented based on material type, product, end-user and region.

|

By Material Type |

By Product |

By End-User |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

The Copper Indium Gallium Selenide segment is expected to witness the fastest growth over forecasted period

The Copper Indium Gallium Selenide (CIGS) segment of the solar market is expected to witness the fastest growth in the coming years. CIGS solar cells are thin-film solar cells that offer several advantages over traditional silicon-based solar cells. One of the key advantages of CIGS solar cells is their high efficiency, which can be up to 22% for laboratory cells and around 17% for commercial cells. This makes CIGS cells one of the most efficient thin-film solar technologies available on the market today.

Another advantage of CIGS solar cells is their flexibility. Because they are made from thin-film materials, CIGS cells can be fabricated on a variety of substrates, including flexible plastics. This makes them ideal for a range of applications, including building-integrated photovoltaics, where solar cells can be integrated into building materials such as windows, roofs, and facades. The flexibility of CIGS solar cells also makes them suitable for use in portable and wearable devices.

In addition to their high efficiency and flexibility, CIGS solar cells also offer environmental benefits. Unlike traditional silicon-based solar cells, CIGS cells require less energy to manufacture and produce fewer greenhouse gas emissions. This is because CIGS cells can be manufactured using a low-temperature process that requires less energy than traditional high-temperature silicon manufacturing processes. CIGS cells also contain less toxic materials than other thin-film solar technologies such as cadmium telluride.

The growth of the CIGS segment is expected to be driven by several factors. These include the increasing demand for renewable energy sources, the declining costs of CIGS manufacturing, and the development of new CIGS production technologies that enable higher efficiency and lower costs. In addition, the increasing use of CIGS cells in building-integrated photovoltaics and portable and wearable devices is expected to drive demand for the technology in the coming years.

The Encapsulants segment accounted for the largest market share in 2022

The encapsulants segment of the solar module materials market currently accounts for the largest market share. Encapsulants are essential components of solar modules as they protect the solar cells from physical damage, moisture, and UV radiation, which can reduce the performance of the cells over time. Encapsulants also help to improve the performance of solar cells by reducing reflection losses and increasing the electrical conductivity of the module.

There are several factors that have contributed to the growth of the encapsulants market in recent years. One of the key drivers of growth is the increasing demand for solar energy. As the world moves towards a more sustainable energy future, the demand for solar energy is expected to continue to grow. This is driving demand for solar modules, which in turn is driving demand for encapsulants.

Another factor contributing to the growth of the encapsulants market is the increasing adoption of new encapsulant materials. While ethylene-vinyl acetate (EVA) has traditionally been the most widely used encapsulant material, new materials such as polyolefin-based encapsulants are gaining popularity due to their superior performance and durability. Polyolefin-based encapsulants are more resistant to UV radiation and moisture than EVA and are therefore better suited for use in harsh environments.

The development of new encapsulant technologies is also driving growth in the market. For example, encapsulant films that can be applied using a lamination process are becoming increasingly popular. These films are thinner than traditional encapsulant sheets, which can reduce the weight and cost of the solar module. They are also easier to apply, which can reduce production time and costs.

The demand in North America is expected to witness significant growth in coming years

The demand for photovoltaic materials is expected to witness significant growth in the Asia Pacific region in the coming years. This is due to several factors, including the growing demand for solar energy, government initiatives to support the adoption of renewable energy, and the availability of low-cost labor and materials in the region.

The key drivers of growth in the Asia Pacific region is the increasing demand for solar energy. Countries such as China, Japan, and India are rapidly expanding their solar energy capacities to meet growing energy demands and reduce dependence on fossil fuels. This is driving demand for photovoltaic materials such as solar cells, encapsulants, and back-sheets.

The food and beverage industry in North America is highly competitive, with manufacturers constantly looking for new ways to differentiate their products and offer unique value to consumers. Photovoltaic Materials can improve the texture, mouthfeel, and stability of food and beverage products, making it an attractive ingredient for manufacturers looking to enhance the functionality and nutritional properties of their products.

The growth of the photovoltaic materials market in the Asia Pacific region is expected to continue in the coming years. While the market is currently dominated by China, other countries in the region such as India, Japan, and South Korea are also expected to witness significant growth. The increasing demand for solar energy, government initiatives to support the adoption of renewable energy, and the availability of low-cost labor and materials are all expected to drive growth in the market.

Competitive Insight

Some of the major players operating in the global market include DuPont, Targray Technology International, Inc, Shin-Etsu Chemicals Co., Ltd., Mitsubishi Material Corporation, Hemlock Semiconductor Corporation LLC, Atecom Technology Co., American Elements,Ferrotec Corporation, Topray Solar,Hangzhou First Applied Material Co. Ltd., 1366 Technologies Inc., NovoPolymers NV

Recent Developments

- In March 2023, the company launch JinkoSolar brings its new liquid cooling energy storage system for C&I application and showcases it in this year’s PV Japan 2023.

- In January 2022, JinkoSolar, launch the Second-Generation Tiger Neo.

Global Photovoltaic Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 28.59 billion |

|

Revenue forecast in 2032 |

USD 59.22 billion |

|

CAGR |

8.4% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By material type, By product, By end-user, By region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

DuPont, Targray Technology International, Inc, Shin-Etsu Chemicals Co., Ltd., Mitsubishi Material Corporation, Hemlock Semiconductor Corporation LLC, Atecom Technology Co., Ltd., American Elements,Ferrotec Corporation, Topray Solar,Hangzhou First Applied Material Co. Ltd., 1366 Technologies Inc., NovoPolymers NV |

FAQ's

Key companies in photovoltaic materials market are DuPont, Targray Technology International, Inc, Shin-Etsu Chemicals Co., Ltd., Mitsubishi Material Corporation, Hemlock Semiconductor Corporation LLC, Atecom Technology Co.

The gobal photovoltaic materials market expected to grow at a CAGR of 8.4% during the forecast period.

The photovoltaic materials market report covering key segments are material type, product, end-user and region.

Key driving factors in photovoltaic materials market are increasing demand for renewable energy sources.

The global photovoltaic materials market size is expected to reach USD 59.22 billion by 2032