Fertility Supplements Market Share, Size, Trends, Industry Analysis Report

By Ingredient (Natural, Synthetic, Blend of Natural and Synthetic); By Product; By End User; By Sales Channel; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4611

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

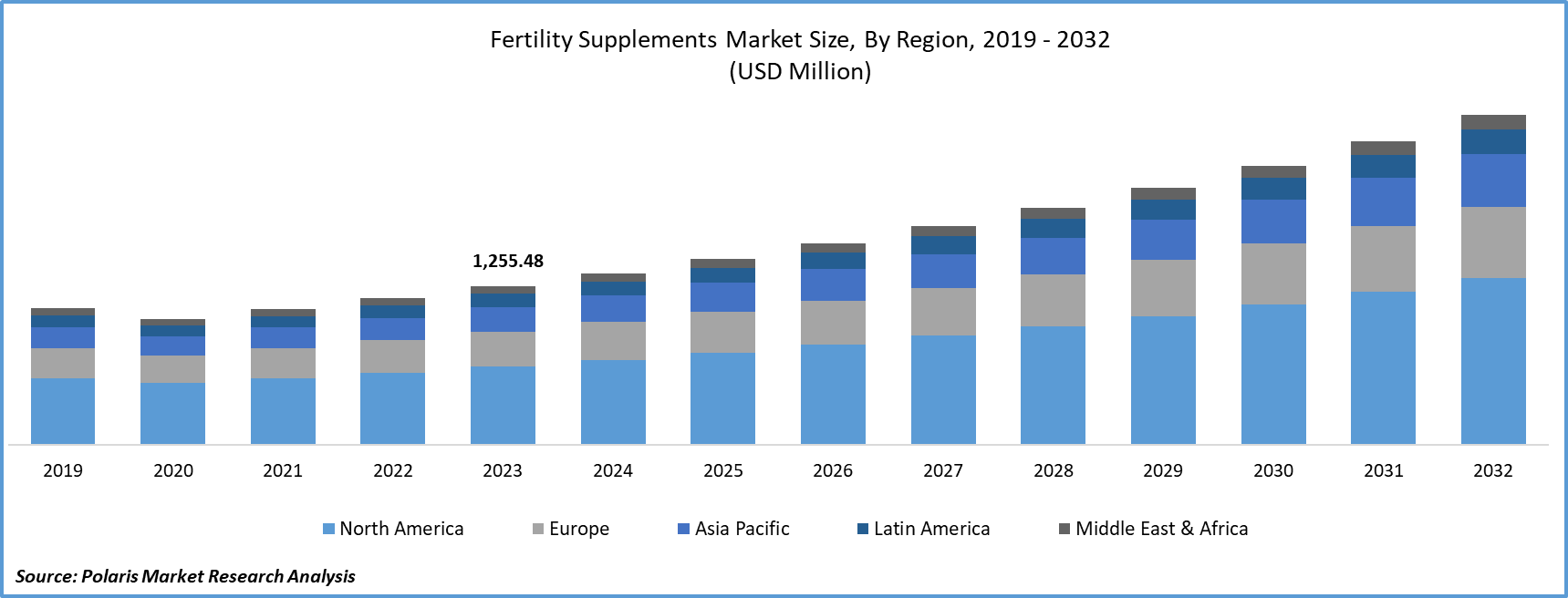

Fertility Supplements Market size was valued at USD 1,255.48 million in 2023.

The market is anticipated to grow from USD 1,358.80 million in 2024 to USD 2,609.71 million by 2032, exhibiting the CAGR of 8.5% during the forecast period.

Market Introduction

Modern lifestyles, characterized by high stress, sedentary habits, and poor diets, contribute to growing fertility challenges. Conditions like obesity, known to affect fertility negatively, drive the demand for supplements addressing these lifestyle-related issues. Enriched with essential vitamins and minerals, fertility supplements are sought after as individuals recognize the need to enhance reproductive well-being. The trend of delaying family planning due to career commitments has created a demographic seeking conception support later in life. The market's growth is fueled by the accessibility and convenience of supplements, aligning with the contemporary proactive approach to health and wellness.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen their presence.

To Understand More About this Research: Request a Free Sample Report

For instance, in February 2022, Pillar Healthcare innovated by creating four novel nutritional formulations: Methylfolate, Omega-3 for Pregnancy, Ubiquinol Q10, and Myo-Inositol. These formulations are specifically crafted to aid couples on their fertility journey and provide support throughout the pregnancy process.

Increasing numbers of individuals and couples prefer holistic approaches to reproductive health, driving demand for supplements with natural ingredients. This trend mirrors a broader cultural shift towards natural health solutions, with consumers seeking cleaner and more sustainable options. The perceived lower risk of side effects compared to synthetic alternatives adds to the appeal. Manufacturers are responding with formulations emphasizing natural ingredients.

The Fertility Supplements Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Industry Growth Drivers

Increasing Prevalence of Infertility is Projected to Spur the Product Demand

The fertility supplements market share is surging due to a global rise in infertility, influenced by lifestyle changes, stress, and environmental factors. Couples seeking assisted reproductive technologies and alternative conception methods are driving the demand for supplements containing vitamins, minerals, and herbal extracts. Increasing awareness of nutrition's role in fertility, coupled with delayed parenthood trends, contributes to the market's growth. Individuals incorporate these supplements into wellness routines as a complement to medical interventions.

Growing Awareness is Expected to Drive Fertility Supplements Market Growth

The fertility supplements market forecast is thriving due to increasing awareness of fertility issues and a growing emphasis on reproductive health. As societal awareness expands regarding factors influencing fertility, individuals, and couples are turning to fertility supplements for proactive reproductive support. Lifestyle-related challenges and delayed family planning contribute to the rising demand for supplements containing essential vitamins and minerals known to impact fertility positively. Online resources and awareness initiatives empower informed choices, propelling market growth. The preference for natural and holistic approaches to fertility drives the popularity of these supplements, creating opportunities for innovation.

Industry Challenges

Regulatory Challenges are Likely to Impede the Market Growth

Regulatory challenges significantly hinder the fertility supplements market's growth. Stringent regulations and diverse approval processes across regions create obstacles for manufacturers, demanding substantial scientific evidence for reproductive health claims. The need for a standardized regulatory framework, coupled with the ambiguity in categorizing supplements, complicates compliance. Labeling regulations, particularly regarding health claims and ingredient transparency, add further complexity. Concerns about misuse and the need for consumer safety prompt strict oversight by regulatory bodies.

Report Segmentation

The fertility supplements market analysis is primarily segmented based on ingredient, product, end user, sales channel, and region.

|

By Ingredient |

By Product |

By End User |

By Sales Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Ingredient Analysis

Synthetic Segment Held Significant Market Revenue Share in 2023

The synthetic segment held a significant revenue share in 2023. Fertility supplements with synthetic ingredients offer precision in formulation, tailoring supplements for specific fertility needs with consistent and predictable dosages. The standardized nature of synthetic components ensures reliability, affordability, and accessibility. Their ability to target specific reproductive processes enhances efficacy in addressing fertility challenges. Synthetic ingredients also provide shelf stability, extending product lifespan and maintaining potency. Despite concerns about bioavailability and long-term effects, these supplements offer benefits in precision, cost-effectiveness, targeted support, and stability.

By Product Analysis

Capsules Segment Held Significant Market Revenue Share in 2023

The capsules segment held a significant revenue share in 2023. Capsule-form fertility supplements are a popular choice for individuals seeking reproductive health support. Meticulously formulated with essential vitamins, minerals, antioxidants, and herbal extracts, these capsules offer convenient and discreet consumption. The encapsulation ensures precise dosage, ease of integration into daily routines, and optimal absorption in the digestive system. Key components like folic acid, coenzyme Q10, and myo-inositol contribute to reproductive wellness. The adaptability of capsules to modern lifestyles, providing a hassle-free method for fertility support, has made them a preferred choice in the growing demand for fertility supplements.

By End User Analysis

Women Segment Held Significant Market Revenue Share in 2023

The women segment held a significant revenue share in 2023. Women's fertility supplements offer vital support by providing essential vitamins like folic acid and minerals such as iron and omega-3 fatty acids. Addressing nutritional gaps, these supplements ensure convenient and optimal nutrient intake. Incorporating herbal ingredients like chasteberry and maca root, they take a natural approach to fertility support. Regular consumption promotes hormonal balance and a healthy ovulatory process. Fertility supplements empower women proactively, offering accessible means to optimize reproductive potential, especially during preconception and fertility journey phases.

By Sales Channel Analysis

Over the Counter Segment Held Significant Revenue Share in 2023

The over-the-counter segment held a significant revenue share in 2023. The increasing availability of fertility supplements over the counter (OTC) signifies a shift in consumer preferences towards accessible reproductive health solutions. These supplements, accessible without a prescription, empower individuals to make informed choices about their fertility. The OTC model offers convenience, allowing consumers to directly purchase fertility supplements from various outlets, aligning with the trend of proactive health management. This approach emphasizes personal autonomy and privacy, catering to those seeking discreet access to fertility support.

Regional Insights

Asia-Pacific is Expected to Experience Significant Growth During the Forecast Period

Asia-Pacific is expected to experience growth during the forecast period. Distinct regional factors influence the Asia-Pacific fertility supplements industry. Increasing fertility challenges, evolving lifestyles, and delayed family planning contribute to heightened demand for supplements. Countries like China, India, and Japan witness a growing awareness of reproductive health, fostering proactive measures. Government initiatives and healthcare advancements support industry growth, providing accessibility through online platforms and traditional retail channels.

In 2023, the North American region accounted for a significant market share. The North American fertility supplements market size is flourishing, fueled by a rising focus on reproductive health and family planning. Increasing awareness and lifestyle-related fertility challenges drive the demand for supplements, reflecting a proactive approach to reproductive wellness. Advanced healthcare infrastructure and heightened awareness contribute to widespread supplement adoption. Stringent regulations play a pivotal role in influencing product offerings and marketing strategies. The market features a diverse range of products, from traditional vitamins to herbal formulations.

Key Market Players & Competitive Insights

The fertility supplements market encompasses a varied range of participants, and the anticipated entry of new entrants is set to heighten the competitive landscape. Key industry leaders consistently improve their technologies to sustain a competitive edge, prioritizing efficiency, reliability, and safety. These entities focus on strategic initiatives such as forging alliances, enhancing product portfolios, and engaging in collaborative ventures. Their primary objective is to surpass competitors within the sector, ultimately securing a substantial fertility supplements market share.

Some of the major players operating in the global market include:

- Active Bio Life Science GmbH

- Babystart Ltd

- Cassava Sciences

- Coast Science

- Crown Nutraceuticals

- Fairhaven Health

- Fertility Nutraceuticals LLC

- Gonadosan Distribution GmbH

- Lenus Pharma GesmbH

- NutraBlast

- Orthomol

- Solaray

- Vitabiotics Ltd.

- Xena Bio Herbals Pvt. Ltd.

- Yadtech

Recent Developments

- In July 2023, Needed unveiled Sperm Support+, a product designed to assist men in optimizing their contribution to achieving successful and healthy conception.

- In November 2022, Anglo French Drugs & Industries ventured into the fertility sector by introducing the LYBER Range. The newly launched products include LYBER-M and LYBER-PCO.

- In October 2020, CaDi introduced two DHA omega-3 supplements, one crafted to support women's ovarian health and another specifically formulated to prepare them for egg retrieval and IVF. These supplements will be complemented by AI technology, offering personalized and monitored treatment plans for each individual patient.

Report Coverage

The fertility supplements market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, ingredients, products, end users, sales channels, and their futuristic growth opportunities.

Fertility Supplements Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1,358.80 million |

|

Revenue forecast in 2032 |

USD 2,609.71 million |

|

CAGR |

8.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Delve into the intricacies of Non-Invasive Prenatal Testing in 2024 through the Fertility Supplements Market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2029 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The Fertility Supplements Market report covering key segments are ingredient, product, end user, sales channel, and region.

Fertility Supplements Market Size Worth $2,609.71 Million By 2032

Fertility Supplements Market exhibiting the CAGR of 8.5% during the forecast period.

Asia-Pacific is leading the global market

key driving factors in Fertility Supplements Market are Increasing prevalence of infertility is projected to spur the product demand