Omega 3 Market Share, Size, Trends, Industry Analysis Report

By Type [DHA (Docosahexaenoic Acid), ALA (Alpha Linolenic Acid), and EPA (Eicosapentaenoic Acid)]; By Source; By Application; By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 153

- Format: PDF

- Report ID: PM1061

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The omega 3 market was valued at USD 3.82 billion in 2024 and is projected to expand at a CAGR of 7.10% between 2025 and 2034. The market has experienced significant growth and diversification in recent years, driven by various socioeconomic and health trends influencing consumer preferences.

Market Insights

- Based on type, the DHA (docosahexaenoic acid) segment held the largest market in 2024, primarily driven by its increasing use in infant formulas to enhance overall infant health.

- The pharmaceuticals application is expected to be the fastest-growing segment during the forecast period. The segment growth is attributed to omega 3’s role in managing cardiovascular diseases, cancer, asthma, and depression, which projects it as an active ingredient in many pharmaceuticals and nutraceuticals.

- North America dominated the market with the largest share in 2024, driven by the increased demand for omega 3 fatty acids in food and dietary supplement manufacturing facilities across the region.

- The market in Asia Pacific is projected to grow at the fastest CAGR from 2024 to 2032, driven by a rising awareness of preventive healthcare.

Industry Dynamics

- Surging awareness regarding the health benefits of omega 3 fatty acids drives its demand across sectors such as pharmaceuticals, nutraceuticals, cosmetics, food and beverages, and dietary supplements.

- The rising aging population, coupled with the prevalence of chronic diseases, drives consumer inclination toward supplements fortified with omega 3 fatty acids as part of a healthy lifestyle regimen.

- Technological advancements in extraction and processing techniques are expected to enhance the profitability of omega 3 manufacturing processes by increasing yields and reducing waste, thereby creating an attractive growth opportunity in the future.

- Strategic collaborations, partnerships, mergers, and acquisitions among key industry players are anticipated to drive market consolidation and foster innovation and marketing strategies in the years to come.

- Fluctuations in raw material prices, mainly fish & fish by-products and shellfish, hamper the business performance of omega 3 manufacturers.

Market Statistics

Market Size in 2024: USD 3.82 billion

Projected Market Size in 2034: USD 7.55 billion

CAGR, 2025–2034: 7.10%

Largest Regional Market, 2024: North America

AI Impact on Omega 3 Market

- AI tools are used to recommend omega 3 supplements tailored to individual needs based on genetic, lifestyle, and microbiome data.

- AI can simplify imaging and spectroscopic analyses, and improve the efficiency of these tools in detecting contaminants in fish oil and algal omega 3 products, ensuring safety and compliance.

- Machine learning systems are important in tracking dietary supplement usage patterns, health app data, and e-commerce trends to forecast the demand for omega 3 fatty acid products.

- AI enhances logistics for sourcing fish, krill, and algae, helping balance sustainability, costs, and global supply-demand fluctuations. These tools also assist in the traceability of raw materials (especially fish and algae), which may attract consumers looking for eco-friendly and sustainable omega 3 sources.

- AI tools enable manufacturers to monitor changing regulatory conditions for dietary supplements, labeling, and health claims across various geographic markets.

To Understand More About this Research: Request a Free Sample Report

The omega 3 market has experienced significant growth and diversification in recent years, driven by various factors influencing consumer preferences and industry dynamics. As awareness regarding the health benefits of these fatty acids continues to rise, growing demand for Omega 3 fortified products across sectors such as pharmaceuticals, nutraceuticals, food and beverages, and dietary supplements is boosting demand for omega-3. Furthermore, the expanding aging population, coupled with the prevalence of chronic diseases, has bolstered the demand for these supplements as part of a healthy lifestyle regimen.

Additionally, the incorporation of these ingredients in functional foods and beverages has gained traction, driven by the trend towards fortified products catering to specific health needs. Moreover, technological advancements in extraction and processing techniques have enhanced the availability and bioavailability of related supplements, further fueling industry growth. Industry players are also investing in research and development activities to explore new sources and develop innovative delivery formats to cater to diverse consumer preferences. There is an increasing emphasis on sustainability and environmental considerations in sourcing, with growing interest in sustainable fisheries or alternative sources like algae-based options.

Strategic collaborations, partnerships, mergers, and acquisitions among key industry players are anticipated to drive market consolidation and foster innovation in product development and marketing strategies. For instance, in January 2021, GC Rieber VivoMega AS announced its partnership with Meelung Trading Co. Ltd, a nutritional supplements distributor to sell VivoMega Omega 3 fish oils in Taiwanese markets. As the industry continues to evolve, with expanding applications and a widening consumer base, industry stakeholders are poised to capitalize on the lucrative opportunities presented by this dynamic market landscape. In addition, regulatory initiatives and endorsements by healthcare professionals and regulatory bodies advocating the benefits of Omega 3 consumption are expected to bolster revenue share for omega-3.

Market Trends

Increasing Product Application

The CAGR for this market is growing significantly due to the expanding application of these fatty acids across various end-use industries. Known for their extensive health benefits, they are increasingly utilized in the pharmaceutical and nutraceutical sectors, as well as in food and beverage, cosmetics, and animal feed. The versatility of EPA and DHA has driven their incorporation into a wide range of products aimed at improving heart health, cognitive function, joint support, eye health, and immune performance. This broadening application scope is a major growth driver, as consumers become more aware of the associated health benefits.

Moreover, the rising prevalence of chronic diseases, particularly cardiovascular conditions, has further propelled demand for these essential nutrients as both preventive and therapeutic measures. Countries such as India and China are witnessing a surge in heart disease cases, creating a substantial market for heart health products enriched with these fatty acids. According to the United Nations Population Fund (India), the number of senior citizens affected by heart disease in India is projected to reach 19.1 million by 2050. This growing demand underscores their vital role in promoting overall health and preventing chronic illnesses.

Growing Use of Omega 3 in Cosmetics and Personal Care Products

The growing use of these fatty acids in cosmetics and personal care products is significantly boosting market demand. They are becoming increasingly popular in skincare and haircare formulations, known for their anti-inflammatory and skin-nourishing properties. Consumers are seeking products that enhance both appearance and long-term health, making these ingredients highly desirable.

This trend is driven by heightened consumer awareness of the benefits of natural, health-oriented products. Enriched cosmetics are marketed as offering superior hydration, anti-aging effects, and improved skin elasticity—qualities that resonate with health-conscious individuals. As holistic wellness becomes a greater priority, the incorporation of such nutrients into personal care aligns well with this shift, fostering stronger demand.

Moreover, their integration complements the broader trend of functional beauty. This synergy between health benefits and aesthetic outcomes is propelling the market, encouraging more manufacturers to innovate and include these components in their formulations, thereby driving revenue growth.

Advancements in Omega 3 Extraction Technologies

The growing use of these fatty acids in cosmetics and personal care products is significantly boosting market demand. Known for their anti-inflammatory and skin-nourishing properties, they are becoming increasingly popular in skincare and haircare formulations. Consumers are seeking products that enhance appearance while supporting long-term health, making these ingredients highly desirable.

This trend is driven by heightened consumer awareness about the benefits of natural and health-oriented products. Enriched cosmetics are marketed as offering superior hydration, anti-aging effects, and improved skin elasticity—appealing to the health-conscious demographic. As holistic wellness becomes a priority, the inclusion of such ingredients in personal care aligns well with this shift, fostering greater demand.

Moreover, their integration into beauty products complements the broader trend of functional cosmetics. This synergy between health benefits and aesthetic outcomes is propelling the market, encouraging more manufacturers to innovate and incorporate these nutrients into their formulations, thus driving revenue growth.

Segment Insights

Type Insights:

The type segment includes DHA (Docosahexaenoic Acid), ALA (Alpha Linolenic Acid), and EPA (Eicosapentaenoic Acid). DHA (Docosahexaenoic Acid) held the largest market in 2024, primarily driven by its increasing use in infant formulas to enhance overall infant health. As the most vital and abundant fatty acid of its kind in the human diet, DHA plays a key role in maintaining health, particularly in the development and maturation of an infant's brain and eyesight. Innovation introduced by key players in this product segment indicates a notable rise in demand across the broader market.

These innovations include advancements such as improved formulation techniques, enhanced bioavailability, novel delivery methods, and the development of products with higher concentrations of DHA, known for its numerous health benefits. As a result, consumers are showing increased interest in products that offer targeted benefits such as cognitive support, heart health, and overall wellness. For instance, in November 2022, Orlo Nutrition launched a DHA Starter Kit featuring an algae-based supplement designed to support brain, heart, joint, and general health. Additionally, these fatty acids are widely used in dietary supplements and fortified foods, with applications extending to the treatment of dementia, attention deficit hyperactivity disorder (ADHD), coronary artery disease (CAD), and Type 2 diabetes. The associated health and longevity benefits have also led to their inclusion in geriatric nutrition.

Application Insights

The application segment includes Pharmaceutical, Dietary Supplements, Animal Feed & Pet Food, Functional Food & Beverages, and Infant Formula. The Pharmaceuticals segment is expected to be the fastest-growing CAGR during the forecast period. Due to the benefits of Omega 3 fatty acids in reducing the risk of abnormal heartbeats (arrhythmias) leading to sudden death, lowering triglyceride levels, slowing atherosclerotic plaque growth, and decreasing blood pressure. The nutrients also offer potential benefits in managing conditions like cancer, asthma, and depression. In dermatology, Omega 3's scalp nourishment properties are valued for preserving skin lipid content, preventing moisture loss, and maintaining skin hydration. The rising use of Omega 3 in pharmaceutical applications for treating skin and scalp conditions is expected to drive omega 3 market growth. Factors such as the growing elderly population, lifestyle-related diseases, and cancer prevalence are driving the demand for Omega 3-based pharmaceutical products.

Moreover, technological advancements in active pharmaceutical ingredient (API) manufacturing are also projected to enhance industry revenue share. Key players are collaborating to innovate Omega 3 products tailored for pharmaceutical industry use, further fueling market expansion. For instance, in August 2020, KD Pharma Group SA and Stratum Nutrition announced a partnership aimed at developing a distinctive joint health formula by combining Stratum's NEM brand eggshell membrane with KD Pharma's kd-pür marine omega oils. The resulting combined product, named MOVE3, is being marketed in soft gel form through the global sales networks of both Stratum and KD Pharma. The collaboration between Stratum and KD Pharma includes a global exclusivity agreement for the combination of NEM and kd-pür marine fish oils. A recent study has been published assessing the combination's effectiveness in treating joint pain and stiffness.

Global Omega-3 Market, Segmental Coverage, 2020 - 2034 (USD Million)

.png)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

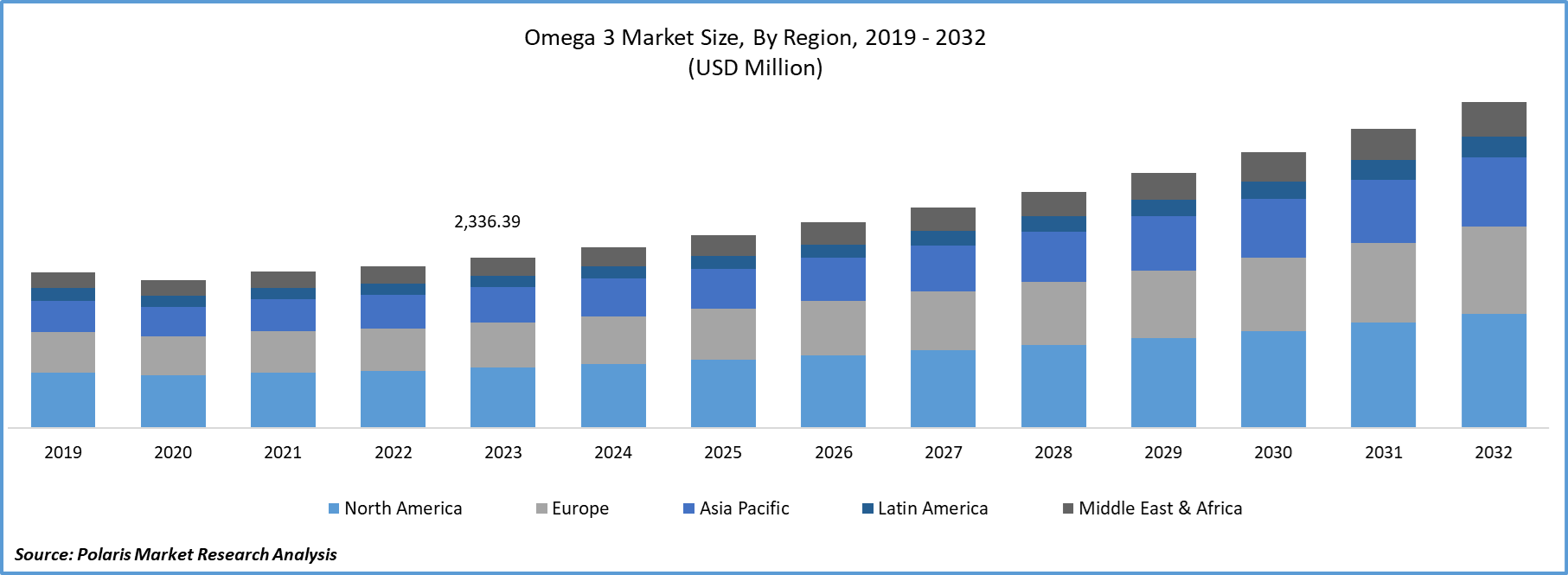

Regional Insights:

By region, the study provides the insights into North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. North America region accounted to be the largest market share in 2023, driven by the increasing consumer awareness of the health benefits associated with Omega 3 fatty acids and their growing incorporation into various food and dietary supplements. The primary driving factor behind market growth is the rising prevalence of chronic diseases such as cardiovascular disorders, arthritis, and cognitive impairments. According to the Centers for Disease Control and Prevention, approximately 695,000 people died due to heart disease in 2021. Fatty acids like EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid) have been extensively researched for their potential to reduce the risk of these conditions and support overall heart and brain health.

As a result, consumers in North America are increasingly turning to fortified products, including functional foods and supplements, as part of their daily diets. Growing healthcare expenditure in the region also supports this trend. With rising health consciousness, more people are adopting nutritional solutions rich in essential fatty acids. The regional market is expected to maintain strong momentum, supported by product innovation, consumer awareness, and favorable regulatory frameworks.

The Asia-Pacific market is projected to grow at the fastest CAGR from 2024 to 2032, driven by a rising focus on preventive healthcare. Fatty acids are recognized for their ability to reduce risks associated with lifestyle-related diseases like cardiovascular issues, diabetes, and obesity. In India, the growing incidence of such conditions—due to changing diets, sedentary lifestyles, and stress—has spurred interest in supplements and fortified foods.

India’s market is expected to see steady growth throughout the forecast period, fueled by rising awareness and demand for health-enhancing products. Companies like Evonik, a global leader in specialty chemicals, are launching new offerings in India to gain a foothold in Asia. The country’s strategic location also provides access to neighboring markets, offering significant opportunities for expansion and broader distribution.

GLOBAL OMEGA 3 MARKET, REGIONAL COVERAGE, 2020 - 2034 (USD Million)

.png)

Source: Secondary Research, Primary Research, PMR Database and Analyst Review

Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the omega 3 market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Omega 3 industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global omega 3 industry to benefit clients and increase the market sector. In recent years, the Omega 3 industry has offered some technological advancements. Major players includes AKER BIOMARINE, BASF SE, Croda International Plc, Pelagia Holding AS, GC Rieber, DSM-Firmenich AG, Omega Protein Corporation, Corbion, Nuseed Global, and Cargill Inc.

Aker BioMarine AS specializes in krill-derived products for nutraceuticals, pet food, and aquaculture, operating globally with segments in Ingredients and Brands, and offering circular recycling solutions. In September 2023, Aker BioMarine collaborated with Swisse to introduce Swisse Ultiboost High Strength Krill Oil, featuring Superba Boost, with exclusive health benefits in Australia.

GC Rieber, a privately owned company, operates in industry, shipping, and commercial property, offering VivoMega oils for health and high-quality nutritional solutions like Seven OceanS Rations and BP-5 for malnutrition and survival. In January 2021, GC Rieber VivoMega AS announced its partnership with Meelung Trading Co. Ltd, a nutritional supplements distributor and marketer, to exclusively sell VivoMega Omega 3 fish oils in Taiwanese markets.

Key Companies in the Market Include:

- AKER BIOMARINE

- BASF SE

- Croda International Plc

- Corbion

- Cargill Inc.

- DSM-Firmenich AG

- GC Rieber

- Nuseed Global

- Omega Protein Corporation

- Pelagia Holding AS

Industry Developments

- In July 2024: Arjuna Natural Extracts launched a high-concentrate, one-shot omega-3 ingredient, formulated from wild-caught sardines and produced using sustainable, solar-powered technology.

- March 2024: DSM-Firmenich partnered with SCN BestCo to develop high-load Omega 3 gummies using Life’s OMEGA O33-P100. The company aims to offer superior formulations exceeding 400 mg EPA+DHA per two-piece serving, revolutionizing Omega 3 supplementation in North America with science, taste, and sustainability.

- October 2023: DSM-Firmenich introduced Life’s OMEGA 03020, an algal omega 3 with EPA/DHA ratio matching fish oil. This product addresses sustainability concerns in the marine Omega 3 market while offering consumers a plant-based alternative to meet nutritional needs.

- September 2023: Aker BioMarine collaborated with Swisse to introduce Swisse Ultiboost High Strength Krill Oil, featuring Superba Boost, with exclusive health benefits in Australia

Market Segmentation:

Type Outlook

- DHA (Docosahexaenoic Acid)

- ALA (Alpha Linolenic Acid)

- EPA (Eicosapentaenoic Acid)

Source Outlook

- Plant-Based

- Marine-Based

Application Outlook

- Pharmaceutical

- Dietary Supplements

- Animal Feed & Pet Food

- Functional Food & Beverages

- Infant Formula

Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Omega 3 Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.82 billion |

|

Market size value in 2025 |

USD 4.07 billion |

|

Revenue Forecast in 2034 |

USD 7.55 billion |

|

CAGR |

7.10% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global Omega 3 industry size was valued at USD 3.82 billion in 2024 and is projected to be valued at USD 7.55 Billion by 2034

The global market is projected to grow at a CAGR of 7.10% during the forecast period, 2025 - 2034

North America had the largest share in the global market

The key players in the market are AKER BIOMARINE, BASF SE, Croda International Plc, Pelagia Holding AS, GC Rieber, DSM-Firmenich AG, Omega Protein Corporation, Corbion, Nuseed Global, and Cargill Inc.

The DHA (Docosahexaenoic Acid) category dominated the market in 2024

The pharmaceuticals had the fastest share in the global market