Fibrate Drugs Market Share, Size, Trends, & Industry Analysis Report

By Drug (Clofibrate, Gemfibrozil, Fenofibrate, Others); By Product Type; By Form; By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4332

- Base Year: 2024

- Historical Data: 2020 - 2023

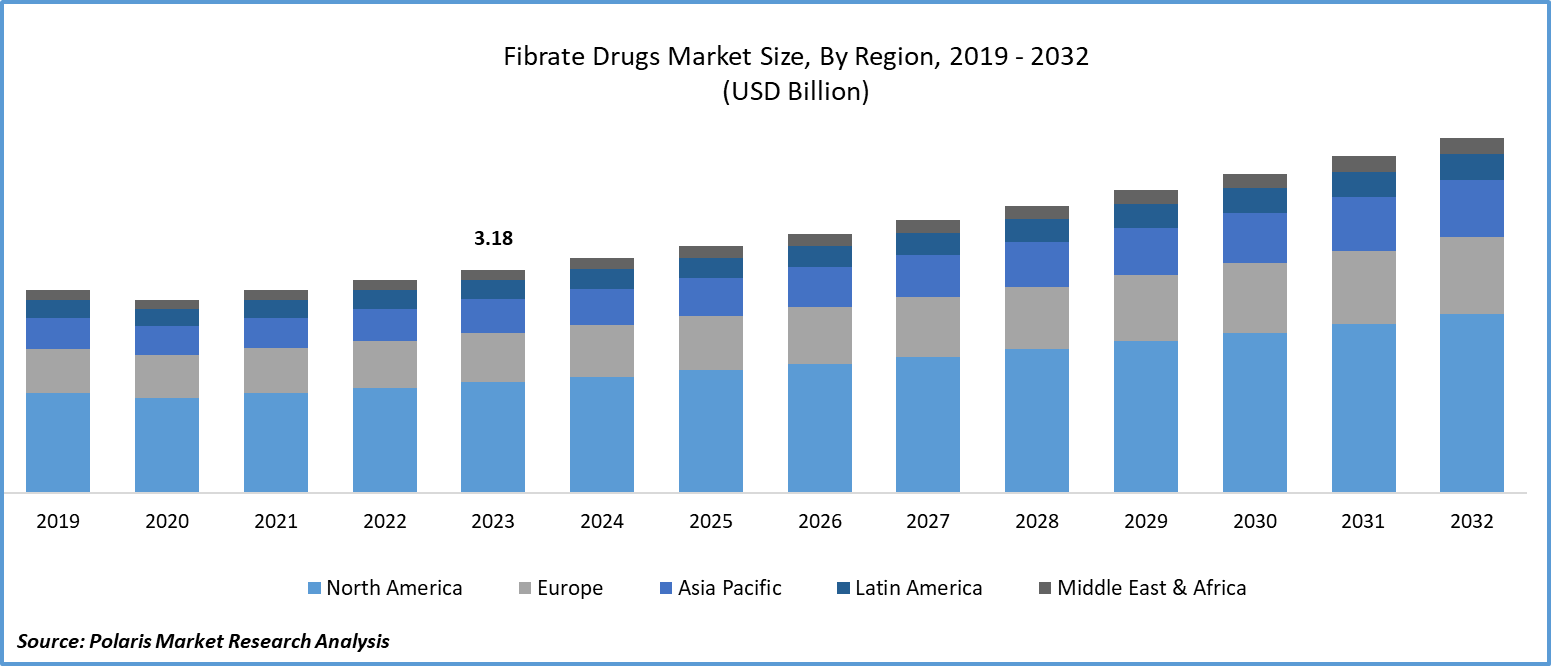

The Fibrate Drugs Market is estimated at USD 1.5 billion in 2024, growing at a CAGR of 2.12% from 2025 to 2034. Growth stems from rising cases of hyperlipidemia, aging populations, and increased use of combination therapies for managing cardiovascular risks.

Market Overview

Increasing levels of triglycerides among a large group of patients is one of the primary drivers for market growth. Moreover, high risks of heart attack and stroke associated with the increase of triglycerides in the body coupled with low levels of cholesterols are driving the growth of the fibrate drugs market. Furthermore, a large population pool is using alcohol excessively, which increases the risk of dyslipidemia. Rising research and development activities for the management of high triglyceride levels will contribute to the global fibrate drugs market growth during the forecast period.

- For instance, according to the science research presented at the American Heart Association’s Scientific Sessions in November 2022, pemafibrate (a new medication) reduced triglyceride levels by 26% compared to placebo during the clinical trials.

Factors such as lack of exercise, high-fat diet, and smoking can lower the high-density lipoprotein (HDL) cholesterol, thereby generating the demand for fibrate drugs. The high prevalence of low HDL cholesterol levels, the rising number of patients suffering from cardiovascular diseases, and the increasing focus of market players toward the introduction of more efficient drugs are expected to support the fibrate drugs market expansion in the coming years.

To Understand More About this Research: Request a Free Sample Report

However, the availability of alternative drugs to treat high triglyceride levels and low HDL levels will limit the market growth. Moreover, stringent regulatory requirements and product recalls due to safety issues are some of the factors limiting the growth of the fibrate drugs market. Furthermore, side effects associated with the use of fibrate drugs, such as abdominal pain, constipation, and diarrhea, are expected to hamper the overall market growth over the forecast timeframe.

Growth Factors

-

High risk associated with the increased levels of low-density lipoproteins (LDL) will significantly drive the market growth.

LDL is considered a bad cholesterol as its high levels lead to an accumulation of cholesterol, forming plaque in the arteries. This increases the possibility of various medical conditions such as coronary artery disease, peripheral artery disease, carotid artery disease, and hypertension. A large patient population suffering from coronary artery disease is one of the major factors boosting the market growth. For instance, according to the British Heart Foundation, in June 2023, it is estimated that around 200 million people in the world are living with coronary heart disease. The treatment of these patients includes the drugs that are necessary to reduce the LDL levels. Factors such as a sedentary lifestyle, smoking habits, and lack of physical activities are expected to increase the risk of heart diseases, thereby fostering the growth of the fibrate drugs market.

-

The increasing prevalence of diabetes worldwide is expected to boost the demand for fibrate drugs.

Diabetes is linked with several quantitative changes in the amount of circulating lipids. These changes include a rise in triglycerides, an increase in LDL, and a decrease in HDL. Factors such as urbanization, increasing aging population, decreasing levels of physical activity, and increasing prevalence of obesity are the key contributors to diabetes. The growing prevalence of diabetes is expected to increase the demand for fibrate drugs in the upcoming years.

For instance, the International Diabetes Federation (IDF) reported that there were around 537 million adults (20-79 years) living with diabetes in 2021. IDF predicts that around 643 million adults will have diabetes by 2030. Over time, high blood sugar can increase the triglyceride and lower the levels of HDL cholesterol, thereby increasing the risk of heart disease. Such long-term risks associated with diabetes are expected to contribute to the fibrate drugs market revenue over the forecast period.

Restraining Factors

-

The availability of alternate treatment options is limiting the demand for fibrate drugs.

There are various treatment options available for medical conditions, such as high triglycerides, low HDL cholesterol, and high LDL cholesterol. For instance, therapeutic classes, including statins, cholesterol absorption inhibitors, PCSK9 inhibitors, citrate lyase inhibitors, niacin, and omega-3 fatty acids, are also used as cholesterol medications. Moreover, better safety and efficacy associated with statins over fibrate drugs will hamper the market growth in the coming years.

Report Segmentation

The market is primarily segmented based on drug, product type, form, distribution channel, and region.

|

By Drug |

By Product Type |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Drug Insights

The fenofibrate segment is expected to witness significant growth in the projected years.

The fenofibrate segment is expected to expand at a significant CAGR during the forecast period. The growth of the segment is attributed to the high efficacy of the drugs and an increasing number of patients suffering from hypercholesterolemia. For instance, according to the data by the Australian Bureau of Statistics, in 2022, in Australia, one in twelve people had self-reported having high cholesterol. Moreover, over the past decades, fibrates have demonstrated efficacy in lowering triglyceride levels and improving lipid profiles, which also contributes to the long-term growth of the fenofibrate segment.

By Product Type Insights

The branded segment dominated the fibrate drugs market share in 2024.

The branded segment held the largest fibrate drugs market share in 2023. The large share is majorly due to the patents owned by key market players. For instance, Lupin Pharmaceuticals, Inc. currently owns two patents for fenofibrate. Moreover, the increasing focus of customers toward the purchase of fibrate drugs from recognized companies over generic drug manufacturers contributes to the segmental share. Furthermore, the high safety profile and effectiveness of branded drugs are also driving segmental growth.

By Form Insights

The tablets segment is expected to witness significant growth during the forecast period.

Fibrate drugs are available in tablet and capsule forms. The tablets segment is expected to witness significant growth over the forecast timeframe. The ability to accommodate higher doses of the active ingredients and longer shelf life are expected to increase segmental growth. Moreover, the increasing focus of companies operating in the fibrate drugs market toward the production of drugs in tablet form will drive segmental growth. For instance, companies such as Aurobindo Pharma, AbbVie Inc., Lupin Pharmaceuticals, Inc., and Ajanta Pharma Inc. produce their fibrate drugs in tablet forms.

By Distribution Channel Insights

The hospital & retail pharmacy segment accounted for the largest market share in 2024.

The hospital & retail pharmacy segment accounted for the largest market share in 2024. Increasing hospital admissions for the treatment of heart diseases and other medical conditions associated with cholesterol are driving segmental growth. For instance, according to the data published by the British Heart Foundation, in the UK, around 100,000 patients were admitted every year due to moderate to high-risk heart attacks. Moreover, the collaborative environment between hospital pharmacists and patients to deliver comprehensive patient care also contributes to segmental growth.

Regional Insights

North America region dominated the global market in 2024.

The North American fibrate drugs market held the largest share in 2024. This dominance is due to the high incidence of low HDL cholesterol and the growing number of patients suffering from heart diseases. For instance, according to the data published by the Centers for Disease Control & Prevention, in 2021, nearly 2 in 10 deaths from heart-related problems happened in adults or people aged less than 65 years old. Such a high prevalence of heart diseases will lead to cholesterol problems, thereby spurring the fibrate market demand in North America. Moreover, the market players focusing on the development & launch of fibrate drugs in the U.S. region will significantly drive the fibrate drugs market growth in the coming years.

The Asia Pacific region is projected to expand at the highest CAGR during the forecast period. A large portion of the adult population in this region is inclined towards a sedentary lifestyle, smoking & drinking habits, and physical inactivity. This increases the possibility of abnormal cholesterol levels among adults, thereby triggering the growth of the fibrate drugs market. Moreover, the increasing burden of diabetes coupled with the rising prevalence of coronary artery disease is expected to drive the market growth. For instance, according to the recently published study in the Lancet, in 2023, approximately 101 million people in India will be living with diabetes.

Key Market Players & Competitive Insights

The entry of generic drug manufacturers to increase competition in the coming years

In terms of competitive analysis, the fibrate drugs market is fragmented. The key companies operating in the market are expected to face intense competition due to the entry of generic drug manufacturers during the forecast period. These companies are strengthening their market position by undertaking various strategies such as new product launches, partnerships, and acquisitions.

Some of the major players operating in the global market report include:

- AbbVie Inc.

- Ajanta Pharma Inc.

- ANI Pharmaceuticals, Inc.

- Aurobindo Pharma

- Cipla

- Lupin Pharmaceuticals, Inc.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Zydus Group

Recent Developments in the Industry

- In March 2025 – The PROMINENT trial sponsored by Kowa Research Institute demonstrated no cardiovascular benefit for pemafibrate in type 2 diabetes

- In December 2022, Esperion has recently received approval for the late-breaking clinical trial of NEXLETOL Bempedoic acid, a groundbreaking medication for lowering cholesterol through fibrate, along with an ACL-inhibiting Regimen Outcomes Experiment. This trial is scheduled to be presented at ACC.23/WCC.

- In November 2021, Lupin Pharmaceuticals, Inc. announced the introduction of an authorized generic version of Antara (Fenofibrate) capsules. This capsule is indicated for the treatment of adult patients with primary hypercholesterolemia.

Report Coverage

The fibrate drugs market report emphasizes key regions across the globe to provide a better understanding of the product to the users. Also, the report provides market insights into recent developments and trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers an in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides a detailed analysis of the market while focusing on various key aspects such as competitive analysis, drug, product type, form, distribution channel, and futuristic growth opportunities.

Fibrate Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1.5 billion |

|

Revenue Forecast in 2034 |

USD 1.8 billion |

|

CAGR |

2.12% from 2025– 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global fibrate drugs market size is expected to reach USD 1.8 billion by 2034

Key players in the market are Viatris Inc., Aurobindo Pharma, Lupin Pharmaceuticals, Inc., AbbVie Inc

North America contribute notably towards the global Fibrate Drugs Market

Fibrate drugs market exhibiting a CAGR of 2.12% during the forecast period.

The Fibrate Drugs Market report covering key segments are drug, product type, form, distribution channel, and region.