Peripheral Vascular Device Market Size, Share, Trends, Industry Analysis Report

: By Device, Material, Application, Modality (Minimally Invasive, Invasive, and Non-Invasive), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Mar-2025

- Pages: 119

- Format: PDF

- Report ID: PM1344

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

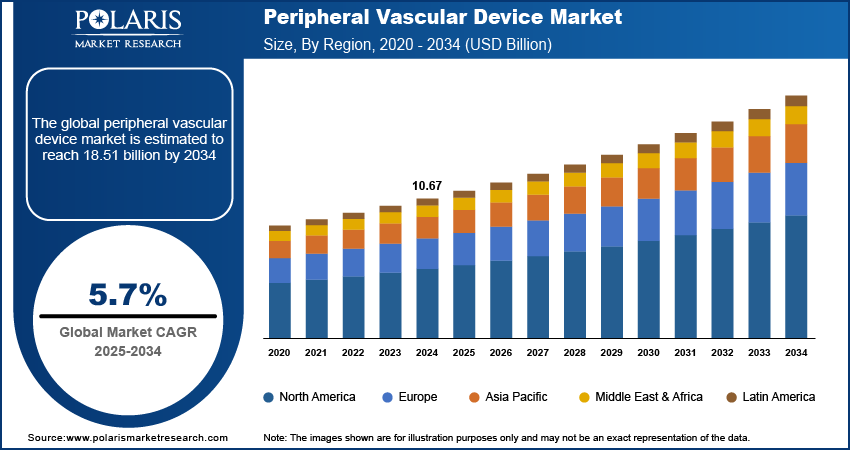

The global peripheral vascular device market size was valued at USD 10.67 billion in 2024. The market is projected to grow from USD 11.27 billion in 2025 to USD 18.51 billion by 2034, at a CAGR of 5.7% from 2025 to 2034. The growing existence of peripheral arterial disease (PAD) in entrenched and other vascular diseases are becoming more normal and geriatric population and other probabilities such as diabetes, obesity, and hypertension are causing the market to expand.

Key Insights

- The peripheral arterial disease segment witnessed the maximum revenue share in 2024.

- The stents segment dominated the market in 2024 due to its sizeable application in handling of peripheral artery disease.

- North America peripheral vascular device market garnered the largest share in the region because of growing existence of PAD, the maturing population, and the speedy advancement and arrangement of progressive medical techniques.

- Asia Pacific is anticipated to grow at the fastest rate due to the surging existence of diabetes, pushed by demographic moves and altering lifestyles, which has pushed the market forward.

Industry Dynamics

- The growing existence of diabetes worldwide is propelling the market growth.

- Technological progressions have caused the advancement of convenient, less invasive and excessively productive peripheral vascular devices that boosts the market demand.

- The growing prevalence of emergency and crucial care acceptance for arterial blockage is anticipated to reinforce the market advancement in the near future.

- But recurring product fiasco and recalls and strict product approval procedures may impede the market growth.

Market Statistics

2024 Market Size: USD 10.67 billion

2034 Projected Market Size: USD 18.51 billion

CAGR (2025-2034): 5.7%

North America: Largest Market in 2024.

To Understand More About this Research:Request a Free Sample Report

Peripheral vascular devices are used to treat peripheral vascular illnesses, which are blood circulation issues caused by blockages, narrowing, or spasms in blood vessels due to the accumulation of fat and plaque. Vascular grafts, peripheral venous catheters, stents, and catheters are some commonly used peripheral vascular devices.

The rising prevalence of peripheral arterial disease (PAD) in established and emerging economies is driving the peripheral vascular device market growth. PAD and other vascular illnesses are becoming more common due to the aging population and other risk factors such as diabetes, obesity, and hypertension. The growing number of vascular health-focused clinical trials and research is also contributing to the market expansion. With clinical studies, researchers can assess the safety and effectiveness of novel tools and methods for treating PVD. These studies can also confirm current technologies and support the development of new treatments to cater to diverse medical needs.

Technological advancements in device design, including the development of minimally invasive treatments that use drug-eluting stents to reduce recovery time and complexities, are making peripheral vascular devices more appealing to patients and healthcare professionals. Additionally, the rising frequency of emergency and critical care admissions for arterial blockage treatment is expected to support the peripheral vascular device market development in the coming years.

Market Dynamics

Rising Incidence of Diabetes Globally

The growing prevalence of diabetes globally is propelling the peripheral vascular device market revenue. Diabetes damages blood vessels through a process called atherosclerosis, which involves the accumulation of plaque inside arteries; however, certain diabetes drugs—such as SGLT2 inhibitors and GLP-1 analogues —have been shown to help reduce cardiovascular risk and slow the progression of vascular damage. This process is significantly fueled by inflammation caused by high blood sugar levels associated with diabetes. Healthcare providers better address these complications with AI in diagnostics improving early detection and treatment planning. People with diabetes are at risk of developing PAD and other peripheral vascular disorders that mostly affect blood circulation in the lower limbs. With the growing diabetic population, PAD cases and severe outcomes such as severe limb ischemia and amputations are also rising. To address these issues, stents, angioplasty balloons, and atherectomy devices are essential for restoring blood flow.

Technological Advancements in Diagnostics

Technological advancements have led to the development of user-friendly, less intrusive, and highly effective peripheral vascular devices. PAD and other vascular illnesses can now be diagnosed and treated with greater accuracy due to advancements in modern imaging technology. Technological advancements in peripheral vascular devices include drug-coated balloons, stents, atherectomy devices, and wearable sensors. These devices are intended to improve treatment options and outcomes for peripheral artery disease (PAD). Thus, technological advancemnts are propelling the expansion of the peripheral vascular devices market globally.

Segment Insights

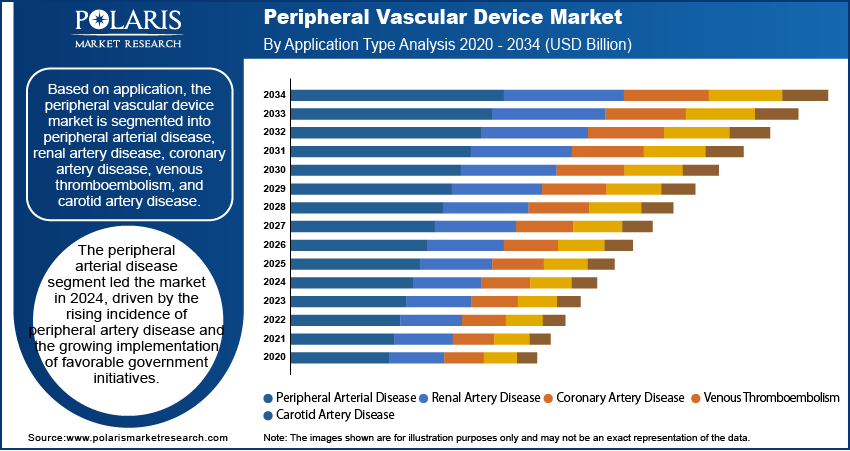

Evaluation by Application Insights

The global vascular device market, based on application, is segmented into peripheral arterial disease, renal artery disease, coronary artery disease, venous thromboembolism, and carotid artery disease. The peripheral arterial disease segment dominated the market with a 47.6% revenue share in 2024, driven by the rising incidence of peripheral artery disease and the growing implementation of favorable government initiatives. In addition, the increasing prevalence of cardiovascular disorders and improvements in diagnostic tools have led to a notable surge in PAD research in recent years, thereby contributing to the segment’s leading market position.

Assessment by Device Insights

Based on device, the market for peripheral vascular device market is segmented as catheters, atherectomy devices, stents, endograft, and stent-grafts. The stents segment of the peripheral device market dominated the market in 2024 due to its extensive application in the management of peripheral artery disease. The rising incidence of cardiovascular illnesses is also driving the need for stents. In addition, technological developments in stents, including the development of drug-eluting stents, contribute to the segment’s leading position in the market.

The catheters segment accounted for a sizable market share in 2024. Catheters are widely used in therapeutic and diagnostic treatments, including atherectomy and angioplasty. Catheters allow access to peripheral arteries, enabling doctors to deliver treatment devices like stents, balloons, or embolization agents directly to the affected area. The growing prevalence of PAD, coupled with advancements in catheter technology like drug-eluting balloons and an increase in minimally invasive operations, is driving the market for peripheral vascular catheters.

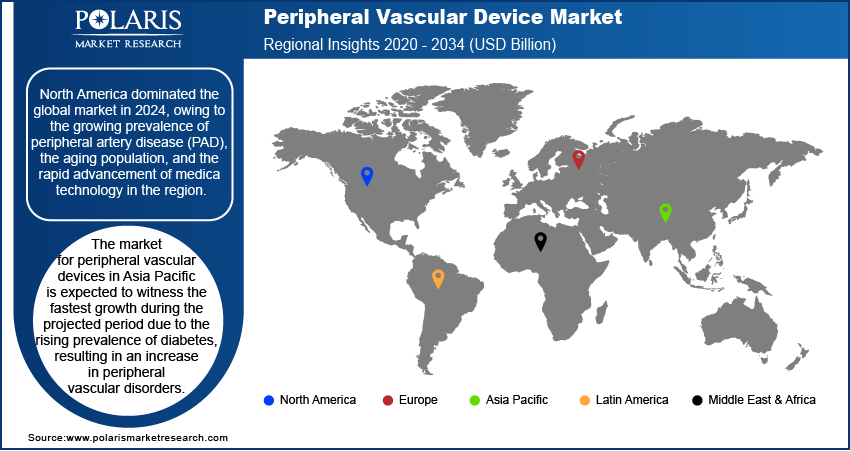

Regional Analysis

By region, the report offers peripheral vascular device market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America led the global market with a 40.8% market share in 2024, driven by the increasing prevalence of PAD, the aging population, and the quick development and deployment of advanced medical technologies. The rising number of PAD patients highlights the growing need for advanced stenting methods to deal with the complexities of the disease. The introduction of new products, rising healthcare costs, and the presence of a robust healthcare infrastructure are other factors driving the regional market dominance.

The Asia Pacific peripheral vascular device market is anticipated to register the fastest growth during the projected period. The rising prevalence of diabetes, driven by demographic shifts and changing lifestyles, has led to an increase in peripheral vascular illnesses across the Asia Pacific. Additionally, the development of new, minimally invasive vascular intervention devices due to continuous improvements in medical technology is having a favorable impact on the regional market growth. The improving healthcare infrastructure in emerging countries further contributes to the market expansion in the region.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their offerings, which will help the market grow even more. Market participants are also undertaking a variety of strategic activities, such as innovative product launches, international collaborations, higher investments, and mergers and acquisitions to expand their global footprint. To expand and survive in a more competitive and rising market environment, market participants must offer cost-effective solutions.

The peripheral vascular device market faces competition from major global players. These players dominate the market with their extensive production capacities and advanced technologies. Competition is further heightened by fluctuating raw material prices, stringent environmental regulations, and the necessity for technological advancements to improve device efficiency. A few of the major key players involved in the market are Abbott Laboratories, Angioscore, Edward Lifesciences Corporation, Medtronic, Becton, Teleflex Medical, Volcano Corporation, BD, Teleflex Medical, Cook Group, Cordis Corporation, and St. Jude Medical.

List of Key Players

- Abbott Laboratories

- BD

- Becton

- C.R.Bard

- Cook Group

- Cordis Corporation

- Covidien

- Edward Lifesciences Corporation

- Medtronic

- St. Jude Medical

- Teleflex Medical

- Volcano Corporation

Peripheral Vascular Device Industry Developments

December 2024: Terumo Interventional Systems (TIS) launched its R2P NaviCross Peripheral Support Catheter. According to TIS, the new catheter comes with a double-braided construction to ensure enhanced trackability and torque control.

October 2024: BD introduced its new BD Intraosseous Vascular Access System. The new system comes with an electric IO driver that allows for rapid access to the circulatory system in critical care situations.

In June 2024, Philips introduced their Duo Venous Stent System in the US, targeting people with venous blockages. With premarket approval (PMA) from the US Food and Drug Association (FDA), this innovative device aims to address the root causes of chronic deep vein thrombosis.

In April 2024, Abbott's ground-breaking Esprit BTK System, which makes use of an Enviroximes Eluting Resorbable Scaffold, was formally approved by the US FDA. According to Abbott, this innovative method is designed to treat chronic limb-threatening ischemia (CLTI) that affects the BTK.

Peripheral Vascular Device Market Segmentation

By Device Outlook

- Catheters

- Atherectomy Devices

- Stents

- Endograft

- Stent-Grafts

By Material Outlook

- Biodegradable

- Nitinol-Based

- Metallic

- Polymer-Based

- Platinum-Based

By Application Outlook

- Peripheral Arterial Disease

- Renal Artery Disease

- Coronary Artery Disease

- Venous Thromboembolism

- Carotid Artery Disease

By Modality Outlook

- Minimally Invasive

- Invasive

- Non-Invasive

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.67 billion |

|

Market Size Value in 2025 |

USD 11.27 billion |

|

Revenue Forecast by 2034 |

USD 18.51 billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The peripheral vascular device market was valued at USD 10.67 billion in 2024 and is projected to grow to USD 18.51 billion in 2034.

The market is projected to register a CAGR of 5.7% during the forecast period.

North America held the largest market share in 2024.

Becton, Teleflex Medical, Volcano Corporation, BD, Teleflex Medical, Cook Group, Cordis Corporation, Covidien, Edward Lifesciences, C.R.Bard, St. Jude Medical, Medtronic, and Abbott Laboratories are a few of the key players in the market.

The peripheral arterial disease segment led the market in 2024.

The stents segment held the largest market share in 2024.