Field Device Management Market Size, Share, Trends, Industry Analysis Report

: By Offering (Hardware and Software), Deployment, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1647

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

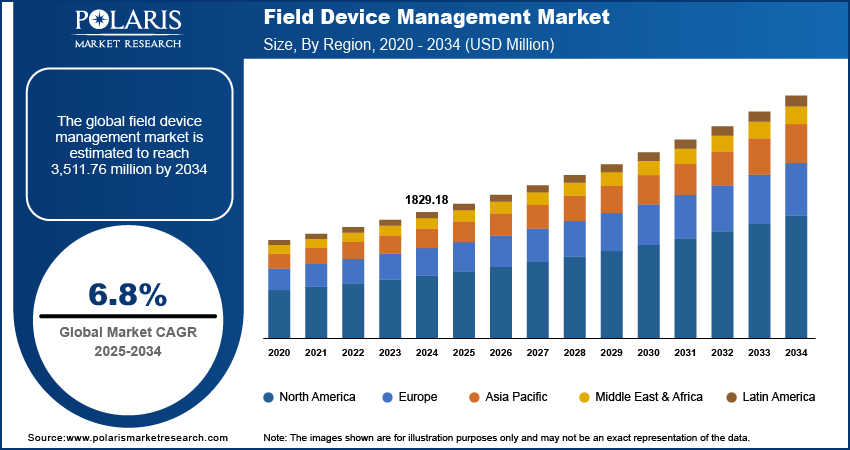

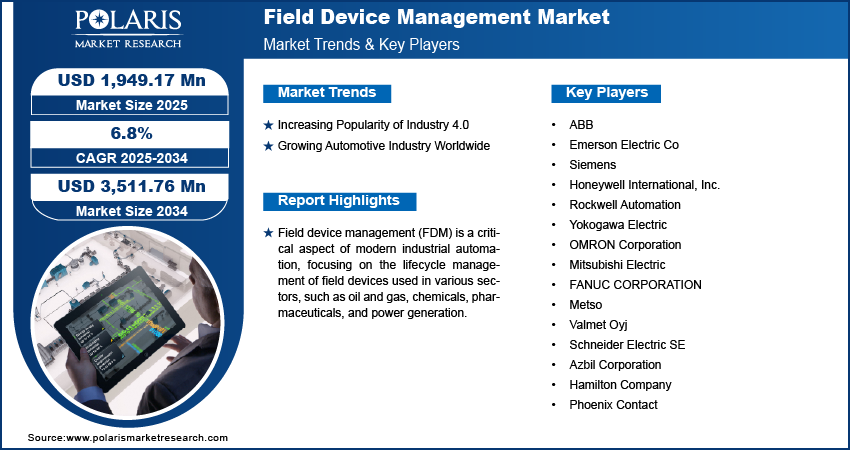

Field device management market size was valued at USD 1,829.18 million in 2024, growing at a CAGR of 6.8% during the forecast period. The market is driven by the rise of smart factories, increasing urbanization, growing Industry 4.0 adoption, and expanding automotive manufacturing.

Key Insights

- The hardware segment led in 2024 due to high demand for IoT-enabled devices such as sensors, controllers, and gateways in industrial automation.

- The on-premises segment dominated in 2024, driven by industries such as oil & gas and utilities for data security, customization, and regulatory compliance.

- North America held the largest market share in 2024, led by strong IoT adoption, a robust manufacturing base, and early digital transformation.

- The US led the region due to widespread implementation in industries such as oil & gas, pharma, and automotive.

- Asia Pacific is expected to grow at the highest CAGR, driven by rapid industrialization, government-backed smart manufacturing, and expanding infrastructure.

- China is a key growth driver due to its vast manufacturing sector and aggressive integration of automation and IoT technologies.

Industry Dynamics

- Smart factories increasingly adopt IIoT devices, boosting demand for FDM systems to ensure seamless monitoring, diagnostics, and maintenance operations.

- Rising urbanization leads to smart infrastructure development, requiring FDM solutions for the reliable performance of interconnected industrial devices.

- Integration of AI and cloud technologies in FDM systems enhances scalability, enabling predictive maintenance and real-time operational insights.

- High implementation costs and integration complexity with legacy systems hinder the adoption of FDM solutions across small and mid-sized enterprises.

Market Statistics

2024 Market Size: USD 1,829.18 million

2034 Projected Market Size: USD 3,511.76 million

CAGR (2025–2034): 6.8%

North America: Largest market in 2024

AI Impact on Field Device Management Market

- AI enhances predictive maintenance in field device management by analyzing real-time data to anticipate equipment failures before they occur.

- It improves operational efficiency by automating diagnostics, reducing manual intervention, and enabling quicker issue resolution across industrial networks.

- AI-powered analytics provide actionable insights, helping industries optimize device performance and reduce unplanned downtime significantly.

- Integration of AI supports smarter decision-making by continuously learning from historical data and adapting to changing operational conditions.

To Understand More About this Research: Request a Free Sample Report

Field device management (FDM) is a critical aspect of modern industrial automation, focusing on the lifecycle management of field devices used in various sectors, such as oil and gas, chemicals, pharmaceuticals, and power generation. This management system encompasses the configuration, commissioning, maintenance, and diagnostics of field devices, ensuring they operate efficiently and reliably throughout their operational lifespan.

The growing adoption of smart factories worldwide is driving the global field device management market demand. Smart factories integrate sensors, actuators, and other field devices into their IIoT networks, requiring efficient monitoring, configuration, and maintenance solutions. FDM systems play a critical role in ensuring seamless communication between these devices, enabling predictive maintenance, reducing downtime, and enhancing operational efficiency. Additionally, as smart factories prioritize scalability and adaptability, FDM solutions become essential for managing the increasing complexity of device ecosystems, ensuring consistent performance, and supporting industry standards such as OPC UA.

The field device management market growth is driven by the rising urbanization across the globe. According to data published by the United Nations, more than half of the global population lives in urban areas, up from around one-third in 1950 and projected to increase to around two-thirds in 2050. Urbanization drives the development of smart infrastructure, such as intelligent transportation systems, smart grids, and automated water and waste management systems, all of which rely on interconnected field devices. FDM systems enable efficient management of these devices by providing tools for real-time monitoring, configuration, and diagnostics, ensuring reliable and optimized performance. Therefore, as urbanization rises, the demand for FDM also spurs.

Market Dynamics

Increasing Popularity of Industry 4.0

The increasing popularity of Industry 4.0 is projected to propel the global field device management market. Industry 4.0 emphasizes interconnected systems, real-time analytics, and smart manufacturing, requiring seamless integration and management of field devices such as sensors, actuators, and controllers. FDM systems are essential in these circumstances, providing centralized tools to configure, monitor, and maintain these devices, ensuring their interoperability and reliability within complex industrial networks.

Growing Automotive Industry Worldwide

The growing automotive industry worldwide is expanding the global field device management market. As per data published by the European Automobile Manufacturers' Association, global car production hit 76 million units in 2023, a substantial 10.2% increase from 2022. Automotive manufacturing relies heavily on interconnected field devices such as robotic arms and controllers for tasks such as assembly, quality control, and material handling. FDM systems are crucial for managing these devices, ensuring seamless communication, efficient operation, and minimal downtime. Additionally, the automotive industry's shift towards electric vehicles (EVs) and autonomous driving systems requires more advanced manufacturing processes, further increasing the complexity and volume of connected devices. This boosts demand for FDM solutions for maintaining operational efficiency, optimizing device performance, and supporting predictive maintenance.

Segment Analysis

Field Device Management Market Assessment by Offering

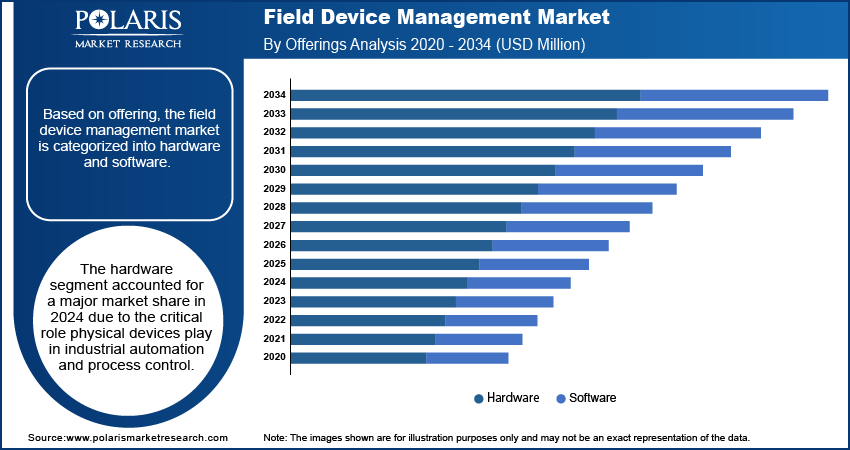

Based on offering, the field device management market is categorized into hardware and software. The hardware segment accounted for a major market share in 2024 due to the critical role physical devices play in industrial automation and process control. Hardware components such as controllers, sensors, actuators, and gateways form the backbone of device management systems. Industries increasingly prioritized upgrading equipment to smarter, IoT-enabled devices, driving significant investments in reliable hardware solutions. The push toward Industry 4.0 further emphasized the need for advanced hardware capable of seamless integration with industrial systems and networks. Additionally, the proliferation of industrial IoT (IIoT) and edge computing created a surge in demand for hardware that efficiently processes data and enables real-time decision-making.

The software segment is also expected to grow at a rapid pace in the coming years, owing to the rising need for advanced analytics, predictive maintenance, and remote monitoring capabilities. Software solutions gain importance for their ability to enhance operational efficiency, reduce downtime, and optimize asset performance as industries adopt digital transformation strategies. Cloud-based platforms and AI-powered analytics tools are particularly driving this expansion, offering scalability and actionable insights. Moreover, the trend toward subscription-based models provides cost-effective options for businesses, enabling wider adoption of software solutions.

Field Device Management Market Evaluation by Deployment

In terms of deployment, the field device management market is divided into cloud and on-premises. The on-premises segment dominated the market in 2024 due to its strong appeal in industries that prioritize control, security, and compliance. Industries such as oil and gas, manufacturing, and utilities relied heavily on on-premises solutions to manage critical infrastructure. These industries often deal with sensitive operational data and prefer local storage and management to mitigate risks associated with data breaches and regulatory non-compliance. On-premises deployment also allowed businesses to customize systems to meet specific operational requirements, a factor particularly valued in environments with unique or complex workflows. Additionally, the ability to maintain operations without dependency on external internet connectivity further bolstered the preference for on-premises systems.

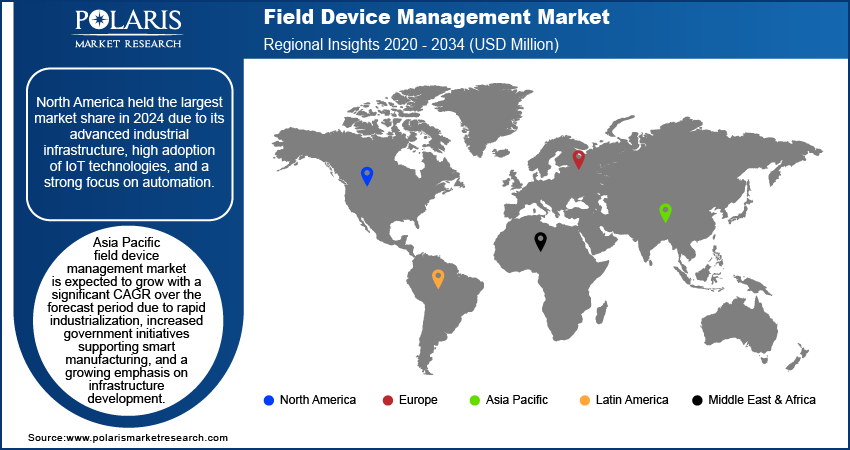

Field Device Management Market Share by Region

By region, the study provides the field device management market insights into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America held the largest field device management market share in 2024 due to its advanced industrial infrastructure, high adoption of IoT technologies, and a strong focus on automation. The US emerged as the dominant country within the region, accounting for the largest share due to its well-established manufacturing sector, significant investments in digital transformation, and early adoption of smart factory solutions. Industries such as oil and gas, automotive, and pharmaceuticals extensively implemented field device management systems to enhance operational efficiency and ensure regulatory compliance. Additionally, the region’s robust technology ecosystem, featuring major players in industrial automation and software development, further fueled market growth.

The field device management market in Asia Pacific is expected to grow with a significant CAGR over the forecast period due to rapid industrialization, increased government initiatives supporting smart manufacturing, and a growing emphasis on infrastructure development. China stands out as the major country in the region, driven by its expansive manufacturing base and aggressive adoption of IoT and automation technologies. The country’s focus on improving productivity, reducing costs, and modernizing legacy systems positions it as a key contributor to the region’s growth. Moreover, rising investments in industries such as electronics, automotive, and energy across India and Southeast Asia further amplify the market’s expansion in the region.

Field Device Management Key Market Players & Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will help the field device management industry grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint. Important market developments include innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The field device management market is fragmented, with the presence of numerous global and regional market players. Major players in the market include ABB; Emerson Electric Co; Siemens; Honeywell International, Inc.; Rockwell Automation; Yokogawa Electric; OMRON Corporation; Mitsubishi Electric; FANUC CORPORATION; Metso; Valmet Oyj; Schneider Electric SE; Azbil Corporation; Hamilton Company; and Phoenix Contact.

Honeywell International Inc. is a prominent US based multinational company with a diverse portfolio that spans several industries, including aerospace, building technologies, performance materials, energy & sustainability solutions, and industrial automation. Honeywell has positioned itself as the major player in Industry 4.0, characterized by the integration of digital technologies into manufacturing processes. The company launched Honeywell Forge in June 2019 in the context of Industry 4.0. Honeywell Forge, an enterprise performance management software that integrates data from multiple sources to provide real-time insights into operations. This platform enables businesses to monitor asset performance, streamline processes, and make data-driven decisions that lead to increased efficiency and reduced costs. Honeywell Forge assists organizations in identifying inefficiencies and predicting maintenance needs before they become critical issues by harnessing the power of AI and machine learning.

Rockwell Automation, headquartered in Milwaukee, Wisconsin, is a major provider of industrial automation and digital transformation technologies, serving a diverse range of sectors, including aerospace, automotive, food and beverage, and oil and gas. The company specializes in integrated control systems, smart devices, and software solutions that enhance operational efficiency and productivity across manufacturing environments. A key aspect of Rockwell's offerings is its Field Device Management capabilities, which are integrated into its FactoryTalk AssetCentre software. This system employs Field Device Tool (FDT) technology to standardize communication between various field devices and control systems. This enables manufacturers to manage process devices and maintain compliance with regulatory standards efficiently.

Key Companies

- ABB

- Emerson Electric Co

- Siemens

- Honeywell International, Inc.

- Rockwell Automation

- Yokogawa Electric

- OMRON Corporation

- Mitsubishi Electric

- FANUC CORPORATION

- Metso

- Valmet Oyj

- Schneider Electric SE

- Azbil Corporation

- Hamilton Company

- Phoenix Contact

Field Device Management Market Developments

October 2024: Siemens, a global technology company, launched an intelligent link module, SIRIUS 3RC7, to boost industrial automation data transparency.

August 2024: Emerson, a global technology and engineering company, released the Rosemount 802 Wireless Multi-Discrete Input or Output Transmitter to enable remote asset control, which help industries cut costs, improve safety, and increase productivity.

December 2023: ABB, a global engineering company that focuses on electrification, robotics, automation, and motion, launched ABB Ability Field Information Manager 3.0 to help future-proof industrial operations.

Field Device Management Market Segmentation

By Offering Outlook (Revenue, USD Million, 2020 - 2034)

- Hardware

- Software

By Deployment Outlook (Revenue, USD Million, 2020 - 2034)

- Cloud

- On-premise

By Industry Vertical Outlook (Revenue, USD Million, 2020 - 2034)

- Discrete Industry

- Manufacturing

- Automotive

- Aerospace & Defense

- Process Industry

- Energy & Utilities

- Metals & Mining

- Oil & Gas

- Food & Beverages

- Chemicals

- Pharmaceuticals

- Others

By Regional Outlook (Revenue, USD Million, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Field Device Management Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,829.18 million |

|

Market Size Value in 2025 |

USD 1,949.17 million |

|

Revenue Forecast in 2034 |

USD 3,511.76 million |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global field device management market size was valued at USD 1,829.18 million in 2024 and is projected to grow to USD 3,511.76 million by 2034.

The global market is projected to grow at a CAGR of 6.8% during the forecast period.

North America had the largest share of the global market in 2024.

Some of the key players in the market are ABB; Emerson Electric Co; Siemens; Honeywell International, Inc.; Rockwell Automation; Yokogawa Electric; OMRON Corporation; Mitsubishi Electric; FANUC CORPORATION; Metso; Valmet Oyj; Schneider Electric SE; Azbil Corporation; Hamilton Company; and Phoenix Contact.

The software segment is projected for significant growth in the global market.

The on-premises segment dominated the field device management market in 2024.