Fill Finish Manufacturing Market Share, Size, Trends, Industry Analysis Report

By Product (Consumables and Instruments); By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 136

- Format: PDF

- Report ID: PM2723

- Base Year: 2024

- Historical Data: 2020-2023

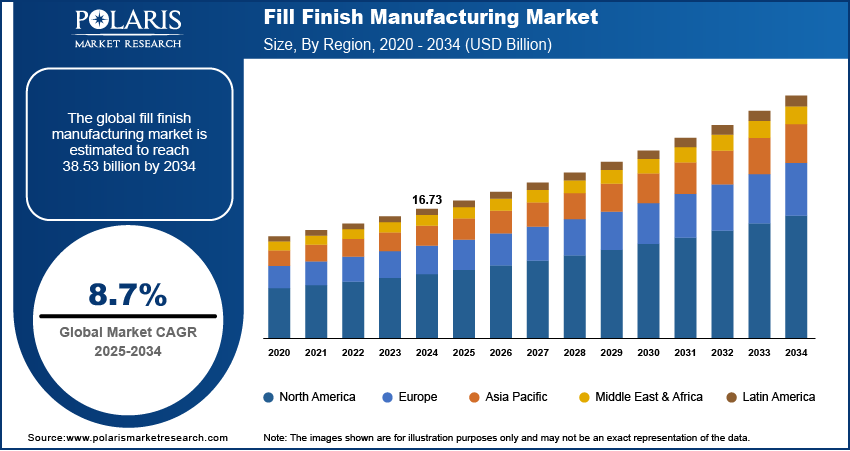

The global fill finish manufacturing market was valued at USD 16.73 billion in 2024 and is expected to grow at a CAGR of 8.7% during the forecast period. The growing demand for fill-finish manufacturing is expected to be driven by rising demand for affordable drugs and increasing adoption of prefilled syringes.

Key Insights

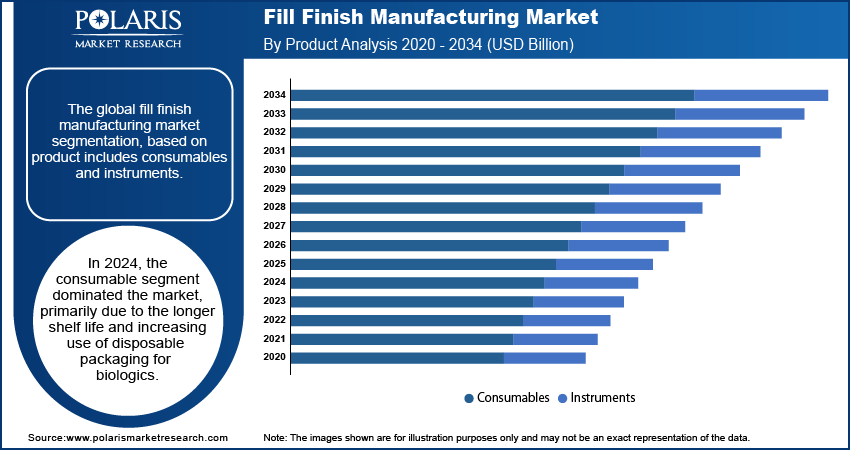

- In 2024, the consumable segment dominated the market, primarily due to the longer shelf life and increasing use of disposable packaging for biologics.

- The contract manufacturing organization (CMO) segment is expected to witness rapid growth during the forecast period. This is due to the rise in adoption of new medications and the outsourcing of the manufacturing of drug substances.

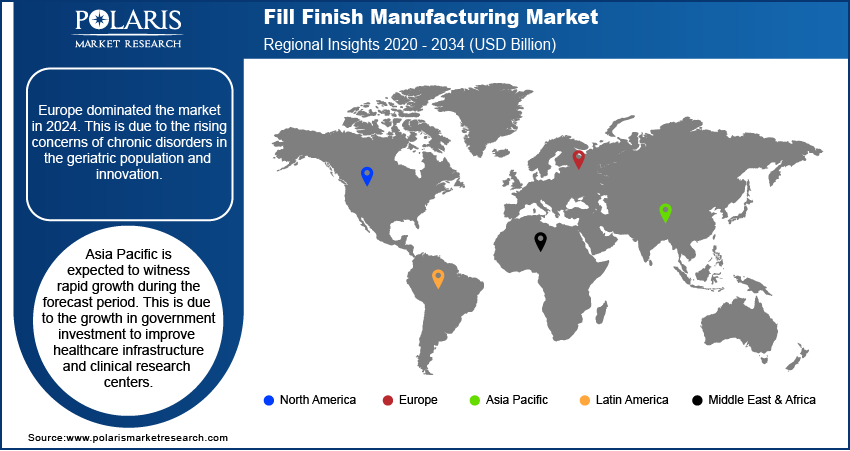

- Europe dominated the market in 2024. This is due to the rising concerns of chronic disorders in the geriatric population and innovation.

- Asia Pacific is expected to witness rapid growth during the forecast period. This is due to the growth in government investment to improve healthcare infrastructure and clinical research centers.

Industry Dynamics

- The increasing number of biopharmaceutical companies and the growing demand for biologics drive the market demand.

- The increase in the adoption of contract manufacturing organizations is due to the overall development costs incurred by both the CMO and the company, as well as the reduced risk of failure, which boosts the market growth.

- Rising investment and integration with existing equipment create challenges to adopt AI technologies.

- Adaptation of new drugs and personalized treatments, with smart AI and flexible production, creates new revenue opportunities.

Market Statistics

- 2024 Market Size: USD 16.73 billion

- 2034 Projected Market Size: USD 38.53 billion

- CAGR (2025-2034): 8.7%

- Largest market in 2024: Europe

To Understand More About this Research: Request a Free Sample Report

AI Impact on Agriculture Drones Market

- Optimize processes and automate tasks to accelerate production and minimize waste.

- Instant detection of defects is done through smart vision systems to ensure essential vitals are filled.

- Prevents costly unplanned downtime and failures with machine data analysis.

- Forecast demand and manage inventory for material availability.

Fill finish processes are replacing conventional manufacturing processes due to their self-sterilization capabilities and reduced need for human intervention. Additionally, technological advancements in fill-finish manufacturing, such as the use of robotic machines to handle vials and syringes, are expected to accelerate the market growth over the forecast period.

Furthermore, robotic production requires less maintenance and makes end products reliable and clean in an aseptic fill finish, ultimately reducing operating costs and propelling market growth as product quality and safety are the primary concerns. Fill-finish production of end pharmaceutical products with sterilization and reduced human contact ultimately boosts market growth. These are mainly operated on isolators and restricted-access barrier systems (RABS), which prevent contamination risks in the environment. These systems offer a more efficient environment for manufacturing various biopharmaceutical products, but come at a higher price. Most small-scale companies find it challenging to adopt these technologies due to their expense and therefore look for alternatives, which restrains market growth.

Industry Dynamics

Growth Drivers

The global fill-finish manufacturing market is driven by the increasing number of biopharmaceutical companies and the growing demand for biologics in both developed and developing nations. In addition, while manufacturing various biopharmaceutical products, novel procedures and equipment play a crucial role in maintaining product integrity, which is preserved during the fill-finish procedure, thereby boosting market growth.

The increasing adoption of contract manufacturing organizations (CMOs) by various biotech companies is also considered a significant factor driving market growth. Many small-scale biotechnological and biopharmaceutical companies are inclined to outsource their fill-finish operations to CMOs, as the overall development cost is incurred by both the CMO and the company, and the chances of risk are lowered, which ultimately boosts market growth.

Moreover, the CMO has great technical skills, which help in the innovation of various drug discoveries and maintain financial stability. For instance, Berkshire's sterile manufacturing CMO developed a new sterile fill-finish procedure for clients with limited drug products. It was observed that 1.1 L of drug product is expected to be produced in a single run, which ultimately reduced product loss.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Product Analysis

The consumable segment accounted for the highest revenue share in 2024, owing to longer shelf life and rising use of disposable packaging for biologics. In addition, the prefilled syringes (PFS) are expected to support the market revenue due to the growing adoption of PFS in various applications such as lyophilization and increasing fill finish outsourcing.

Furthermore, PFS delivers both conventional and novel medications with complex drug molecules with less error and prevents overfilling, which is an essential factor in driving market growth over the forecast period.

End Use Analysis

The contract manufacturing organization (CMO) segment is expected to witness fastest growth during the forecast period owing to the increasing new medications and outsourcing manufacturing of drug substances. In addition, CMO offers drug development services and handles drug innovation during the pharmaceutical industry's manufacturing process, which is an essential factor in propelling the market.

Moreover, CMO is an expertise that not only reduces the financial risk but also outsources the production process of pharmaceutical and biologics companies to improve their process effectiveness, accelerating market growth.

Regional Analysis

Europe Fill Finish Manufacturing Market Insights

Europe accounted for the largest share in 2024 owing to the rising concerns of chronic disorders in the geriatric population and innovation in various drug developments. In addition, growing R&D investments in developing affordable biologics in regions such as France, Italy and Germany are expected to drive market growth over the forecast period.

Asia Pacific Fill Finish Manufacturing Market Assessment

Asia Pacific is expected to witness fastest growth during the forecast period due to the growing government investment to improve healthcare infrastructure and clinical research Centers. In addition, the growing penetration of contract manufacturing organizations with many leading pharmaceutical companies and increasing construction of fill-finish plants in regions such as China, Japan, and India is expected to drive market growth.

Competitive Insight

Some of the major players operating in the global market include Aenova Group, Bausch+ Strobel, Baxter, BECTON, DICKINSON And Company, Curia, Cytiva, Fujifilm Corporation, GERRESHEIMER AG, GRONINGER & Co Gmbh, IMA S.P.A., Johnson & Johnson, Maquinaria Industrial Dara, Moderna, Nipro Medical Corporation, Nipro Pharm Packaging, Optima Packaging Group GmbH, Piramal Pharma Solutions, Robert Bosch, Schott AG, SGD Pharma, Stevanato Group, Thermo Fisher Scientific, and West Pharmaceutical Services.

Industry Developments

September 2024: Fill Finish Technology collaborated with KBiotech. The collaboration enables their capability to bring together project expertise with innovative equipment solutions.

March 2022: SGD pharma launched its ready-to-use sterile 100 ml molded glass vials which protect drug stability and eliminates scratches on vials to enhance visual inspection. This type I molded glass vials are used for fill finish parental drug products.

February 2022: Moderna and Thermo Fisher scientific underwent long-term strategic collaboration to scale up the range of aseptic fill-finish manufacturing of Spikevax, Covid-19 vaccines, and different mRNA medicines in the U.S.

Fill Finish Manufacturing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 16.73 billion |

| Market size value in 2025 | USD 18.15 billion |

|

Revenue forecast in 2034 |

USD 38.53 billion |

|

CAGR |

8.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Aenova Group, Bausch+ Strobel, Baxter, BECTON, DICKINSON And Company, Curia, Cytiva, Fujifilm Corporation, GERRESHEIMER AG, GRONINGER & Co Gmbh, IMA S.P.A., Johnson & Johnson, Maquinaria Industrial Dara, Moderna, Nipro Medical Corporation, Nipro Pharm Packaging, Optima Packaging Group GmbH, Piramal Pharma Solutions, Robert Bosch, Schott AG, SGD Pharma, Stevanato Group, Thermo Fisher Scientific, and West Pharmaceutical Services. |

FAQ's

• The global market size was valued at USD 16.73 billion in 2024 and is projected to grow to USD 38.53 billion by 2034.

• The global market is projected to register a CAGR of 8.7% during the forecast period.

• Europe dominated the global market share in 2024.

• A few of the key players in the market are Aenova Group, Bausch+ Strobel, Baxter, BECTON, DICKINSON And Company, Curia, Cytiva, Fujifilm Corporation, GERRESHEIMER AG, GRONINGER & Co Gmbh, IMA S.P.A., Johnson & Johnson, Maquinaria Industrial Dara, Moderna, Nipro Medical Corporation, Nipro Pharm Packaging, Optima Packaging Group GmbH, Piramal Pharma Solutions, Robert Bosch, Schott AG, SGD Pharma, Stevanato Group, Thermo Fisher Scientific, and West Pharmaceutical Services.

• In 2024, the consumable segment dominated the market.

• The contract manufacturing organization (CMO) segment is expected to witness rapid growth during the forecast period.