Syringes Market Size, Share, Trends, Industry Analysis Report

By Usage, By Material, Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6339

- Base Year: 2024

- Historical Data: 2020-2023

Overview

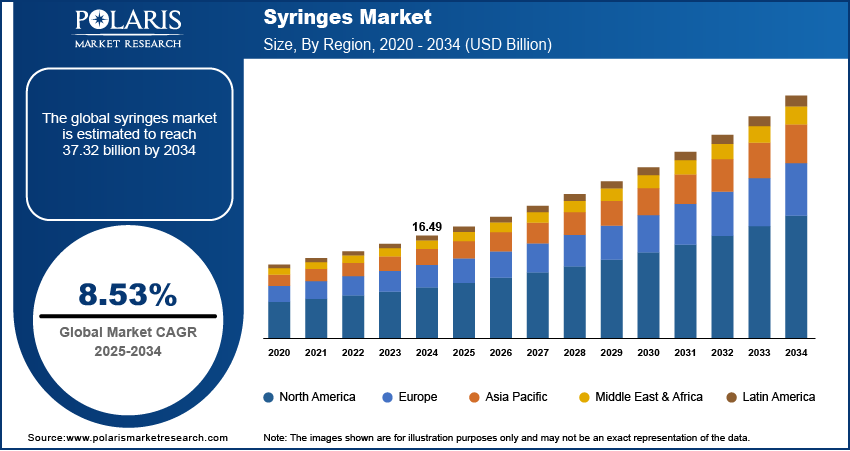

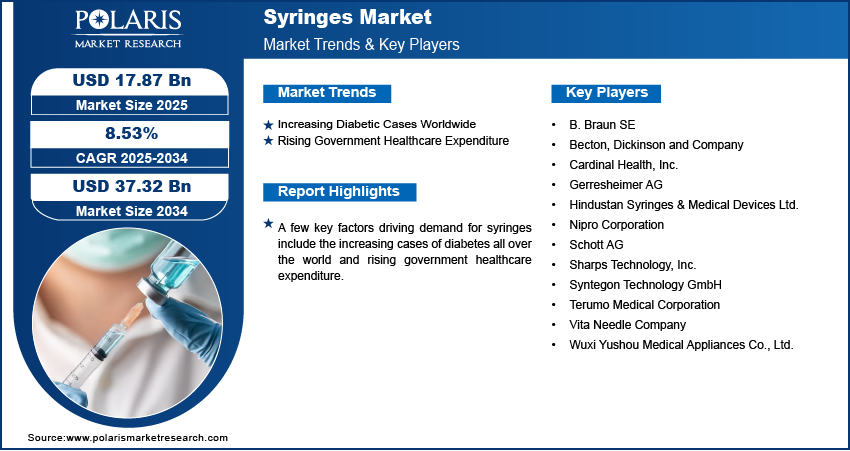

The global syringes market size was valued at USD 16.49 billion in 2024, growing at a CAGR of 8.53% from 2025 to 2034. Key drivers of syringe are the rising number of cases of diabetes globally and heightened government healthcare spending.

Key Insights

- The disposable syringes segment held the largest market share in 2024.

- The prefilled syringes segment is expected to expand at a high growth rate in the next few years due to an upsurge in demand for accuracy in dosage, lower contamination risks, and patient convenience.

- The syringes market in North America held the largest global market share in 2024.

- The U.S. market for syringes is expanding based on excessive adoption of innovative drug delivery systems and rising healthcare spending.

- The Asia Pacific market is expected to expand at a rapid growth rate from 2025-2034, driven by increased cases of chronic diseases and growing pharmaceutical production.

- China and Japan are among the top countries contributing to regional expansion, because of massive vaccination programs, sophisticated medical device production, and favorable healthcare policies.

Industry Dynamics

- Rising diabetic cases worldwide is fueling the market growth due to increasing need for insulin delivery and frequent self-administration of injections.

- Growing government healthcare spending worldwide drive the demand for syringes due to large-scale immunization campaigns, public health initiatives, and investments in modern healthcare infrastructure.

- The expansion of biologics and specialty drugs, is expected to create lucrative opportunities during the forecast period.

- The growing scrutiny over medical waste and single-use plastic syringes is anticipated to restrain market growth.

Market Statistics

- 2024 Market Size: USD 16.49 Billion

- 2034 Projected Market Size: USD 37.32 Billion

- CAGR (2025–2034): 8.53%

- North America: Largest Market Share

The syringes market involves a broad array of medical devices utilized for injecting or withdrawing liquids in healthcare procedures. These devices are critical in hospitals, clinics, diagnostic laboratories, and home healthcare for delivering drugs, vaccination, blood sample withdrawal, and therapeutic purposes. Syringes are produced with different types, such as disposable, safety, and prefilled designs, to address various clinical needs while maintaining patient safety and infection prevention. The growing incidence of chronic conditions, increased vaccination programs, and growing demand for self-injecting devices are inducing large-scale adoption. Precision, safety, and efficiency are being emphasized in healthcare systems, aligning syringes as an essential part of contemporary medical delivery systems.

The growing incidence of chronic diseases globally is driving demand for syringes since long-term treatments require repeated injections, immunotherapies, and biologic drugs. A growing patient base requires reliable and safe drug delivery systems to manage conditions such as cancer and cardiovascular disorders. According to the U.S. Department of Health and Human Services, an estimated 129 million people in the U.S. live with at least one major chronic disease. Data updated through 2023 from Eurostat asserts that the distribution of chronic health cases in Finland amounts to 50.6% and above, while in Germany, it is 43.2%. The considerable disease burden underscores how significant syringes are for delivery of treatment.

Elderly population's growth stimulates the demand for syringes since elderly people undergo more surgical procedures, routine checkups, and preventive care treatments. With rising life expectancy, injectable therapies such as vaccines and routine health monitoring for quality aging are more intensively used. In light of the demographic transition, healthcare systems are striving to enhance medical services and care delivery, in turn increasing demand for syringes worldwide.

Drivers & Opportunities

Increasing Diabetic Cases Worldwide: There is an increase in diabetic population prevailing in the demand of syringes for the ongoing insulin therapy and in other treatments based on injectables in their efficient form of disease management. Worldwide increasing incidences of diabetes are pressuring healthcare systems to ensure wider access to insulin delivery devices that assure dosing accuracy and are safe for patients. The International Diabetes Federation estimates that the diabetic population will count to 853 million by the year 2050, from 589 million in the year 2024. This projection has rapidly spurred the use of advanced syringes and their disposable counterparts by healthcare providers, further setting the growth perspective for demand among hospitals, clinics, and homecare institutes.

Rising Government Healthcare Expenditure: Due to the rising government healthcare spending, the syringes market has been receiving a push, as expanding access to essential medical services under the auspices of government health schemes, vaccination programs, and hospital infrastructure. Even though this raises the bar for patient care in the prevalent healthcare systems, it also ensures that the supply of medical devices remains uninterrupted and allows the patient to benefit from injections that have gained newer technologies.

Segmental Insights

Usage Analysis

Based on usage, the segmentation includes sterilizable/reusable syringes, disposable syringes, and prefilled syringes. The disposable syringes segment dominated the market in 2024 due its universal use within hospitals and diagnostic clinics for normal procedures and immunization drives. The single-use nature greatly helps in minimizing the threat of cross-contamination and hospital-acquired infections, rendering it the choice in mass immunization programs. Moreover, government-sponsored vaccination programs in developed and emerging nations keep propelling the demand for disposable syringes.

The prefilled syringes segment is projected to expand at the fastest pace during the forecast period, owing to its increasing application in biologics injection, oncology, and chronic disease management like diabetes thereby driving adoption. Prefilled formats promote dosage accuracy, minimize preparation mistakes, and increase patient convenience, in self-administration contexts. For example, in June 2025. W.L. Gore launched its 0.5 mL silicone-free Gore ImProject syringe plunger, which is used for prefilled syringes in ophthalmic and other delicate use cases, commercially.

Material Analysis

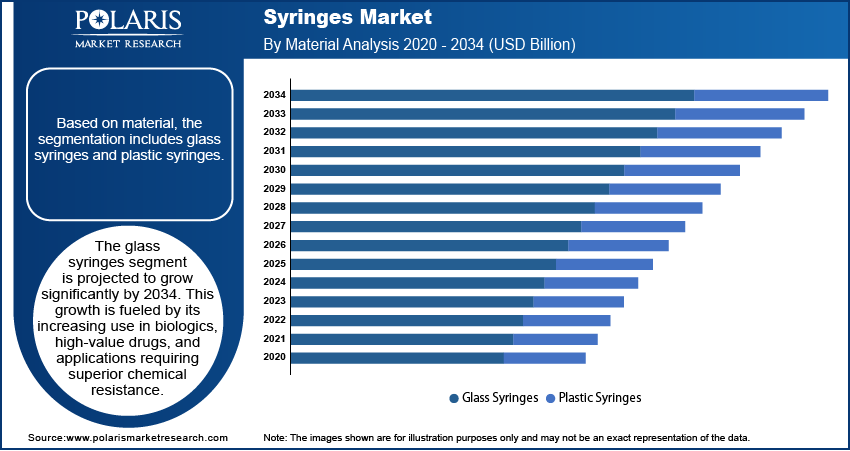

Based on material, the market is categorized into glass syringes and plastic syringes. The plastic segment dominated in 2024 owing to cost efficiency lightweight structure and lower risk of breakage during handling and transportation its adaptability enables wide use in single use vaccination campaigns and therapeutic injections. This secures its position as a critical component in healthcare delivery.

Glass syringes are anticipated to grow steadily throughout the forecast period, fueled by compatibility with sensitive biologics, specialty injectables, and potent drugs. Chemical stability is provided by glass, as it avoids interactions with intricate formulation, making it the preferred material for the manufacture of biologics. The increased pipeline of injectable biologics and greater regulatory scrutiny on drug stability are crucial drivers for the growth of this segment.

Application Analysis

By application the market is segmented into vaccines and immunizations, anaphylaxis, diabetes, oncology and others. Where the vaccines and immunizations segment led in 2024 driven by global vaccination programs influenza booster initiatives and procurement activities by regulatory bodies such as WHO and UNICEF that collectively sustained consistent syringe demand worldwide

The diabetes segment is expected to witness the fastest growth through 2034 due to the increasing global prevalence of diabetes and growing dependence on injectable insulin with syringes serving as a primary mode for daily administration in regions. This insulin pens remain less accessible while rising awareness early detection and higher healthcare expenditure continue to strengthen adoption.

End User Analysis

Direct tenders commanded the highest market share in 2024, as governments and healthcare facilities buy syringes in bulk to sustain national immunization and therapeutic programs. Centralized procurement schemes provide cost savings and access to large quantities in the public health system.

The online pharmacies segment is anticipated to register the strongest growth over the forecast period due to the fast development of e-commerce in healthcare coupled with consumer demand for convenience and competitive pricing. Online platforms are increasingly making strides in emerging markets, where growing internet penetration and home delivery operations are revolutionizing healthcare access. The growth of chronic disease management kits and home-based care solutions is likely to further enhance this channel's market presence.

Regional Analysis

North America led the syringes market in 2024 due to robust healthcare infrastructure and growing demand for sophisticated drug delivery systems. Ongoing investment in vaccine programs, the management of chronic diseases, and injectable therapy is driving market growth in the region. Having well-established major medical device companies and a highly regulated healthcare environment further stimulates the production and dissemination of advanced technology syringes.

The U.S. Syringes Market Insights

The U.S. syringes market is propelled by the increasing cancer burden, as oncology treatments require repeated and accurate injectable delivery to administer chemotherapy, immunotherapy, and targeted biologics. Increasing adoption of advanced therapeutics like monoclonal antibodies and CAR-T therapies also increase the dependency on high-quality syringes for secure and accurate administration. As per the American Cancer Society, Inc., 2,041,910 new cancer diagnoses are registered in 2025, and cancer fatalities stand at 618,120 in the United States. This increased incidence of cancer is compelling healthcare professionals and pharmaceutical companies to expand the utilization of syringes in hospitals, oncology centers, and specialty facilities to guarantee successful patient care and treatment.

Europe Syringes Market Assessments

The European market is expected to dominate revenue share in 2034 due to the well-established pharmaceutical production base, growing incidence of chronic diseases, and focus on patient safety within clinical procedures. Preventive healthcare emphasis within the region, along with regulatory requirements for safety-engineered and single-use syringes, is fueling steady demand. Germany, France, and Italy are experiencing extensive consumption within hospitals, diagnostic facilities, and outpatient clinics, guaranteeing long-term market growth.

Asia Pacific Syringes Market Trends

Asia Pacific is expected to witness the quickest growth over the forecast period due to extensive use of safety syringes to reduce needle-stick injuries and increased vaccination programs in developing economies. Increased government funding in public health programs and increasing access to advanced medical facilities are fueling syringe adoption in urban as well as rural geographies. The growth of the region's pharmaceutical industry and vast patient population are also propelling demand for an extensive variety of syringes in therapeutic and prophylactic use.

India Syringes Market Overview

India syringes market is growing due to the advancements in safety-engineered devices that take care of the healthcare worker safety and infection control. Introduction of next-generation safety syringes reduces the risk of unintended needle-stick injury while meeting stringent regulatory standards. For example, in April 2024, Hindustan Syringes and Medical Devices (HMD) introduced Dispojekt, a state-of-the-art safety needle syringe aimed at minimizing unintentional needle-stick injuries and increasing India's share in the world medical device market. These product innovations improve patient and caregiver safety as well as increase adoption in hospitals, clinics, and homecare environments, thus driving overall market expansion.

Key Players & Competitive Analysis

The syringes market is competitive, with prominent companies being Becton, Dickinson and Company (BD), Terumo Medical Corporation, Nipro Corporation, Gerresheimer AG, Schott AG, Cardinal Health, Inc., B. Braun SE, and Hindustan Syringes & Medical Devices Ltd. These players concentrate on offering innovative syringe solutions such as prefilled syringes, safety syringes, and specialty syringes to serve needs across drug delivery, vaccination, and the management of chronic diseases. The competitive dynamics are also influenced by introductions and alliances with pharmaceutical firms to provide big-scale production contracts. Growing investment in automated manufacturing, needle-stick injury prevention devices, and green materials is transforming the competitive dynamics.

A few major companies operating in the Syringes industry include Becton, Dickinson and Company, Terumo Medical Corporation, Nipro Corporation, Gerresheimer AG, Schott AG, Cardinal Health, Inc., B. Braun SE, Hindustan Syringes & Medical Devices Ltd., Wuxi Yushou Medical Appliances Co., Ltd., Syntegon Technology GmbH, Sharps Technology, Inc., and Vita Needle Company.

Key Players

-

- B. Braun SE

- Becton, Dickinson and Company

- Cardinal Health, Inc.

- Gerresheimer AG

- Hindustan Syringes & Medical Devices Ltd.

- Nipro Corporation

- Schott AG

- Sharps Technology, Inc.

- Syntegon Technology GmbH

- Terumo Medical Corporation

- Vita Needle Company

- Wuxi Yushou Medical Appliances Co., Ltd.

Syringes Industry Developments

April 2025: Syntegon introduced the MLD Advanced, a state-of-the-art filling machine designed for ready-to-use (RTU) nested syringes that combines proven technologies from vial and cartridge lines. It delivers high output and ensure precise filling and weight verification for each syringe.

April 2025: Gerresheimer launched syringe systems made of glass and cyclic olefin polymer that are completely free of silicone oil and PFAS, offering a safer solution for sensitive biologics and applications including ophthalmology.

April 2024: BD introduced the Neopak XtraFlow glass prefillable syringe to support the expanding biologics market more effectively and increased production capacity. The new syringe has an 8mm needle and a thinner wall cannula, which improves delivery of drugs with higher viscosities through less injection force and time.

Syringes Market Segmentation

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Sterilizable/Reusable Syringes

- Hypodermic Syringes

- Oral Syringes

- Disposable Syringes

- Conventional Syringes

- Safety Syringes

- Retractable Safety Syringes

- Non-Retractable Safety Syringes

- Prefilled Syringes

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Glass Syringes

- Plastic Syringes

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Vaccines and Immunizations

- Anaphylaxis

- Diabetes

- Oncology

- Others

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Direct Tenders

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Syringes Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 16.49 Billion |

|

Market Size in 2025 |

USD 17.87 Billion |

|

Revenue Forecast by 2034 |

USD 37.32 Billion |

|

CAGR |

8.53% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.49 billion in 2024 and is projected to grow to USD 37.32 billion by 2034.

The global market is projected to register a CAGR of 8.53% during the forecast period.

North America dominated the market in 2024 driven by advanced healthcare infrastructure, high vaccination coverage, and strong demand for safety and prefilled syringes.

A few of the key players in the market are Becton, Dickinson and Company, Terumo Medical Corporation, Nipro Corporation, Gerresheimer AG, Schott AG, Cardinal Health, Inc., B. Braun SE, Hindustan Syringes & Medical Devices Ltd., Wuxi Yushou Medical Appliances Co., Ltd., Syntegon Technology GmbH, Sharps Technology, Inc., and Vita Needle Company.

The vaccines and immunizations segment dominated the market revenue share in 2024 due to rising global vaccination programs, increased awareness of infectious disease prevention, and government-led immunization initiatives.

The online pharmacies segment is projected to witness the fastest growth during the forecast period due to increasing digital healthcare adoption and convenience in home delivery of medical supplies.

The global market size was valued at USD 16.49 billion in 2024 and is projected to grow to USD 37.32 billion by 2034.

The global market is projected to register a CAGR of 8.53% during the forecast period.

North America dominated the market in 2024 driven by advanced healthcare infrastructure, high vaccination coverage, and strong demand for safety and prefilled syringes.

A few of the key players in the market are Becton, Dickinson and Company, Terumo Medical Corporation, Nipro Corporation, Gerresheimer AG, Schott AG, Cardinal Health, Inc., B. Braun SE, Hindustan Syringes & Medical Devices Ltd., Wuxi Yushou Medical Appliances Co., Ltd., Syntegon Technology GmbH, Sharps Technology, Inc., and Vita Needle Company.

The vaccines and immunizations segment dominated the market revenue share in 2024 due to rising global vaccination programs, increased awareness of infectious disease prevention, and government-led immunization initiatives.

The online pharmacies segment is projected to witness the fastest growth during the forecast period due to increasing digital healthcare adoption and convenience in home delivery of medical supplies.