Financial Leasing Market Share, Size, Trends, Industry Analysis Report

By Type (Banking, Non-Banking); By Business Type; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4035

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

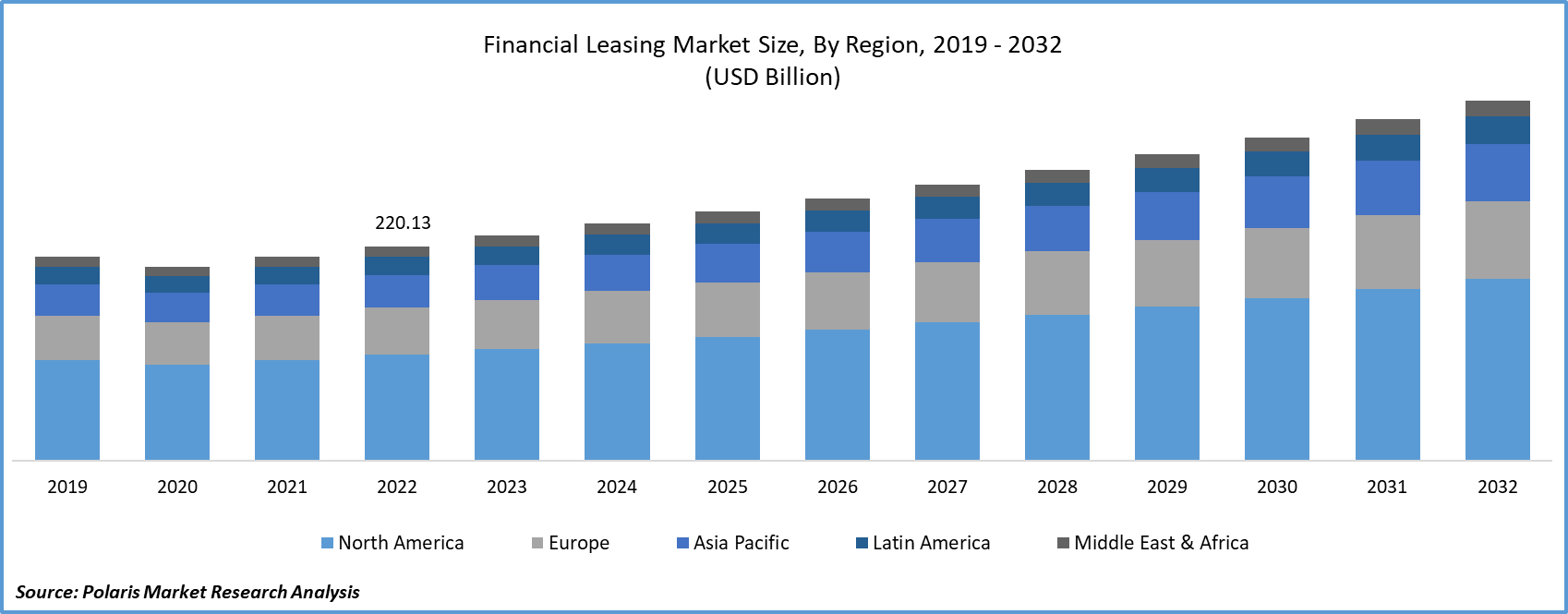

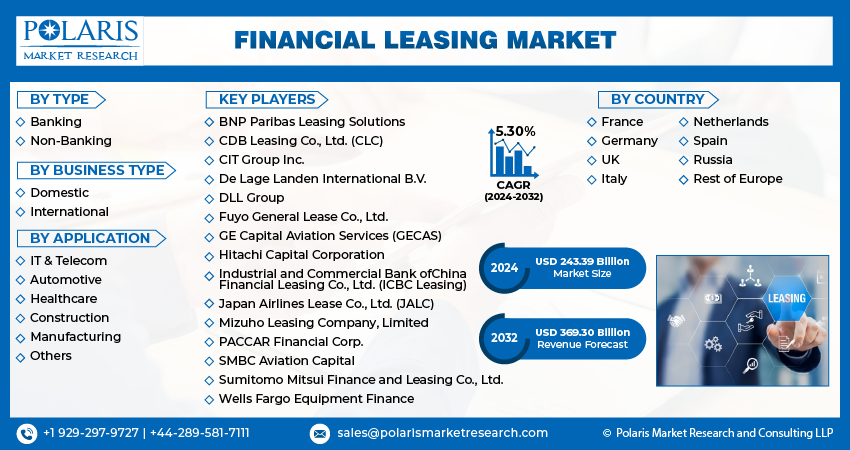

The global financial leasing market was valued at USD 231.42 billion in 2023 and is expected to grow at a CAGR of 5.30% during the forecast period.

The financial lease market holds significant sway in the global economy, offering businesses an alternative avenue for acquiring vital assets. In contrast to conventional loans or direct purchases, financial leasing empowers companies to harness assets without shouldering the responsibilities of ownership. This piece delves into the complexities of the financial lease market, delving into its prominent trends, inherent risks, and promising opportunities.

To Understand More About this Research: Request a Free Sample Report

The surging demand for costly equipment, machinery, and indispensable assets in sectors like IT and telecom, healthcare, and construction is the chief impetus behind the financial leasing market's growth. The escalation of long-term business requirements and a heightened emphasis on the convenience and advantages of lease financing further bolster this market's expansion.

- For instance, in October 2023, Volta Trucks, entered into a partneship with SGEF to integrate vehicle financing into Volta Trucks' comprehensive Truck as a Service (TaaS) offering.

Additionally, the upswing in disposable income and heightened consumer appetite for home décor items are propelling positive growth trends in the financial leasing market. Furthermore, the swift proliferation of business-to-business leasing in regions like the Nordic countries and emerging markets such as India is poised to forge advantageous growth avenues for key players in the financial leasing market in the foreseeable future.

However, economic uncertainties can lead to decreased business activities, impacting lessees' ability to meet their lease obligations. Market volatility can also affect the value of leased assets. Also, asset depreciation and obsolescence is another factor hampering the growth of financial leasing market. Depending on the nature of the asset, its value may depreciate rapidly or become obsolete, leading to potential losses for the lessor upon disposal.

Growth Drivers

- Rise in urbanization and increasing purchase parity is projected to spur the product demand.

The primary reason behind the increase in the financial leasing market is the rising global trend toward industrialization. Furthermore, the widespread adoption of business asset leasing services by small and medium-sized enterprises, particularly for procuring IT equipment, is propelling market growth. Consumer preferences are also shifting towards cutting-edge commercial equipment to optimize business operations. Amidst the ongoing global pandemic, organizations are increasingly opting to lease equipment rather than purchase it outright, a strategic move to mitigate business risks and minimize potential losses.

Additionally, the market is witnessing a surge in growth due to the introduction of comprehensive 360-degree asset leasing and rental services encompassing both fixed and mobile assets. These innovative platforms amalgamate solutions for efficient stock management, streamlined fleet operations, warranty services, permits, and compliance protocols for equipment. Moreover, factors such as the availability of asset leasing services at competitive interest rates and the efficacy of government policies are further catalyzing the growth of the market.

Report Segmentation

The market is primarily segmented based on type, business type, application, and region.

|

By Type |

By Business Type |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Banking segment accounted for the largest market share in 2022

The banking segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period.

The banking segment plays a crucial role in the financial leasing market, acting as a cornerstone for facilitating leasing transactions. Banks often serve as lessors, providing the necessary capital to acquire assets that are then leased to businesses or individuals. This enables businesses to access essential equipment, machinery, and technology without the need for substantial upfront capital expenditure.

Banks in the financial leasing market employ a range of financial instruments and expertise to underwrite leasing transactions. They assess creditworthiness, evaluate the potential risks, and structure lease agreements that align with the financial capabilities of lessees. Moreover, banks may offer specialized leasing products tailored to specific industries, such as healthcare, manufacturing, or transportation.

Additionally, banks contribute significantly to risk management in the financial leasing market. They have mechanisms in place to hedge against potential defaults or market volatility. This ensures a level of stability and security for both lessors and lessees involved in the transaction.

In recent years, technological advancements have further augmented the role of banks in the financial leasing segment. Digital platforms and automation have streamlined the leasing process, making it more efficient and accessible for businesses of all sizes. Moreover, banks are increasingly incorporating data analytics to make more informed lending decisions, enhancing the overall efficiency and effectiveness of leasing operations.

Overall, the banking segment is a cornerstone of the financial leasing market, providing the necessary financial infrastructure and expertise to facilitate leasing transactions and drive economic growth.

By Business Type Analysis

- International segment is expected to witness highest growth during forecast period

The international segment is projected to grow at a CAGR during the projected period. International business in the financial leasing market is a dynamic and interconnected arena that spans across borders, playing a pivotal role in the global economy. This facet of commerce involves the leasing of assets, such as equipment, machinery, and vehicles, to entities in different countries. It facilitates the acquisition of essential resources for businesses worldwide, offering an alternative to direct purchase or traditional financing.

One of the key drivers of international business in the financial leasing market is the diverse range of industries it serves. From aviation to healthcare, construction to technology, businesses in various sectors seek to lease equipment and assets to optimize their operations. This trend is particularly evident in emerging markets, where industries are rapidly evolving, and demand for equipment is on the rise.

Furthermore, international business in financial leasing requires a deep understanding of cross-border regulations, tax implications, and legal frameworks. It involves navigating complexities related to currency exchange rates, trade agreements, and compliance with international accounting standards. This necessitates the involvement of financial institutions, leasing companies, and legal advisors with expertise in international business operations.

In an era of globalization, international business in the financial leasing market continues to be a vital component of the economic landscape, fostering economic growth and cooperation on a global scale.

By Application Analysis

- IT & Telecom segment held the significant market revenue share in 2022

The IT & Telecom segment held a significant market share in revenue share in 2022 owing to rapid technological advancements and frequent equipment upgrades, making leasing an attractive option. Companies in this sector often opt for financial leasing to access cutting-edge technology without significant upfront costs. This allows them to remain competitive and adapt to evolving industry standards. Additionally, leasing agreements can be structured to accommodate the specific needs of IT and telecom businesses, providing them with flexibility and scalability. The financial leasing market in this segment serves as a crucial enabler for businesses to harness the power of technology in an ever-evolving digital landscape.

Regional Insights

- North America region dominated the global market in 2022

The North America region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. The financial leasing market in North America is a robust and dynamic sector. Boasting a highly developed economy, the region is a hub for diverse industries, including technology, healthcare, and transportation. North American businesses often turn to financial leasing as an efficient means to acquire essential assets while conserving capital for core operations. With well-established regulatory frameworks and a mature financial services industry, the market offers a wide range of leasing options. Additionally, the region's technological prowess has facilitated the emergence of innovative leasing solutions, further propelling the growth of the financial leasing market in North America.

The Asia-Pacific region is expected to witness the highest growth during the forecast period. This is due to rapid economic expansion in industries such as manufacturing, construction, and technology that are driving the demand for leased assets. Businesses in this region increasingly turn to financial leasing to access state-of-the-art equipment and technology without substantial upfront costs. Government initiatives and favorable regulatory environments further stimulate market growth. Additionally, the Asia-Pacific market benefits from a rising trend in cross-border leasing transactions as businesses seek cost-effective financing options.

Key Market Players & Competitive Insights

The financial leasing market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- BNP Paribas Leasing Solutions

- CDB Leasing Co., Ltd. (CLC)

- CIT Group Inc.

- De Lage Landen International B.V.

- DLL Group

- Fuyo General Lease Co., Ltd.

- GE Capital Aviation Services (GECAS)

- Hitachi Capital Corporation

- Industrial and Commercial Bank of China Financial Leasing Co., Ltd. (ICBC Leasing)

- Japan Airlines Lease Co., Ltd. (JALC)

- Mizuho Leasing Company, Limited

- PACCAR Financial Corp.

- SMBC Aviation Capital

- Sumitomo Mitsui Finance and Leasing Co., Ltd.

- Wells Fargo Equipment Finance

Recent Developments

- In February 2023, Omega Seiki Mobility (OSM), the electric vehicle manufacturer, has unveiled a strategic collaboration with Mufin Green Finance. This partnership aims to facilitate leasing and retail financing for 7,500 EVs to be delivered to OSM's customers by the upcoming year.

Financial Leasing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 243.39 billion |

|

Revenue forecast in 2032 |

USD 369.30 billion |

|

CAGR |

5.30% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Business Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |