Finished Lubricants Market Size, Share, Trends, Industry Analysis Report

: By Type, Base Oil Source (Mineral, Synthetic, and Semi-Synthetic), Viscosity Grade, Performance Level, Additive Package, End-Use Industry, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 116

- Format: PDF

- Report ID: PM1463

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

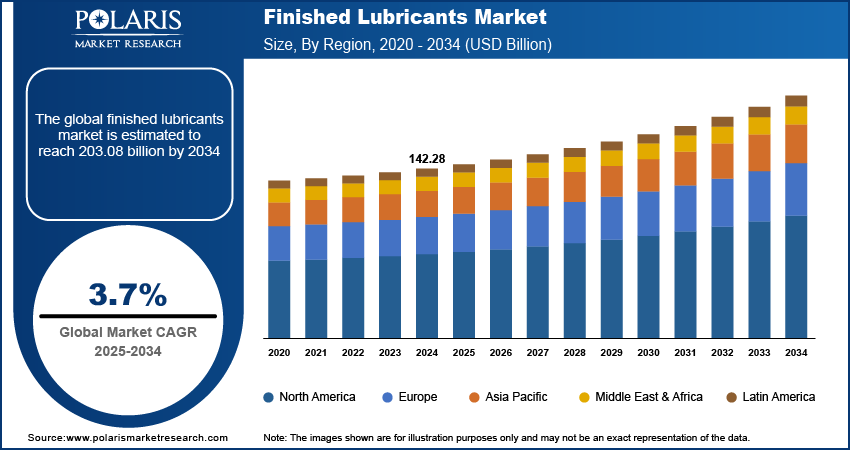

The global finished lubricants market size was valued at USD 142.28 billion in 2024, exhibiting a CAGR of 3.7% from 2025 to 2034. The market growth is primarily driven by the growing vehicle ownership rates globally and rapid industrialization in both developed and emerging economies.

Key Insights

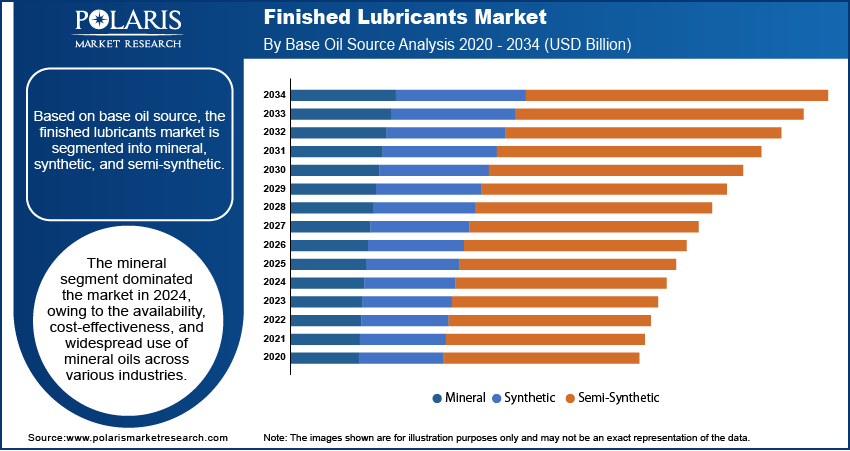

- The mineral segment led the market in 2024 due to the cost-effectiveness and widespread use of mineral oils across various sectors.

- The automotive segment dominated the market in 2024, driven by the significant rise in the production of commercial and passenger vehicles globally.

- Asia Pacific accounted for the largest market share in 2024, primarily due to growing vehicle ownership rates and rapid industrialization in emerging economies like China and India.

- North America is projected to register the fastest growth during the projection period, owing to the region’s robust industrial base and stringent environmental regulations.

Industry Dynamics

- Innovations and advancements in manufacturing processes are primarily driving the market. These innovations have enabled the development of high-performance lubricants with improved properties like reduced friction and minimized wear.

- The growing emphasis on sustainability has prompted governments and organizations globally to introduce regulations that minimize the environmental impact of lubricants and promote the adoption of eco-friendly lubricants.

- The increased demand for high-performance lubricants in industries like marine and aerospace is expected to provide various market opportunities.

- Volatile raw material prices may present challenges to market growth.

Market Statistics

2024 Market Size: USD 142.28 billion

2034 Projected Market Size: USD 203.08 billion

CAGR (2025-2034): 3.7%

Asia Pacific: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Finished lubricants are fluids that contain specific amounts of selected additives blended into a particular base oil. These lubricants are designed to perform a variety of functions, such as cooling components, protecting against environmental factors, and enhancing performance. They are used in a wide range of applications, including industrial machinery, automobile engines, electric vehicles, aerospace, and military.

The finished lubricants market is a highly profitable segment of the downstream petroleum industry, playing a crucial role in providing growth prospects for oil marketing companies and creating target markets for new entrants. Rising vehicle ownership rates worldwide and the rapid pace of industrialization in both developed and emerging nations are among the key factors driving the finished lubricants market demand. Further, the presence of stringent environmental laws that encourage the production and usage of high-quality lubricants contribute to the increased market demand.

The shift toward additive manufacturing is a key market trend anticipated to drive the adoption of finished lubricants in the future. The increased demand for high-performance lubricants in industries such as marine, automotive, and aerospace, where machinery operates under extreme conditions, is anticipated to provide lucrative finished lubricants market opportunities during the forecast period.

Finished Lubricants Market Dynamics

Innovations and Advancements in Manufacturing Processes

Innovations and advancements in manufacturing processes have enabled the production of high-performance lubricants. The incorporation of nanotechnology has led to the development of lubricants with enhanced properties, such as improved viscosity, minimized wear, and reduced friction. In addition, the adoption of digitalization and automation into production processes has further boosted efficiency, optimized manufacturing processes, and ensured consistent product quality. Therefore, the rising innovations and advancements in manufacturing processes boost the finished lubricants market development.

Rising Focus on Sustainability

The rising focus on sustainability has prompted governments and organizations worldwide to implement regulations to minimize the environmental impact of lubricants and promote the use of eco-friendly lubricants. This has led to the creation of bio-based lubricants derived from renewable sources, such as plant extracts and vegetable oils. In addition, reuse and recycling of lubricants have gained traction, driven by the need to protect resources and reduce waste. Thus, the growing emphasis on sustainability and implementation of environmental regulations are driving the finished lubricants market growth.

.webp)

Finished Lubricants Market Segment Insights

Outlook Based on Base Oil Source

The finished lubricants market, based on base oil source, is segmented into mineral, synthetic, and semi-synthetic. The mineral segment dominated the market with the largest revenue share in 2024. The segment’s dominance is primarily attributed to the availability, cost-effectiveness, and widespread use of mineral oils across various industries. Mineral oil-based finished lubricants are derived from petroleum and produced by refining crude oil. They are used in a wide range of applications, including industrial machinery, internal combustion engines, and hydraulic systems.

Evaluation Based on End-Use Industry

The finished lubricants market, based on end-use industry, is segmented into automotive, oil refining, textile manufacturing, metal working, petrochemical & chemicals, industrial, and others. The automotive segment led the market in 2024, owing to the significant rise in the production volumes of commercial and passenger vehicles worldwide. The demand for finished lubricants in the automotive industry is further supported by the implementation of stringent regulations to reduce emissions and improve fuel efficiency.

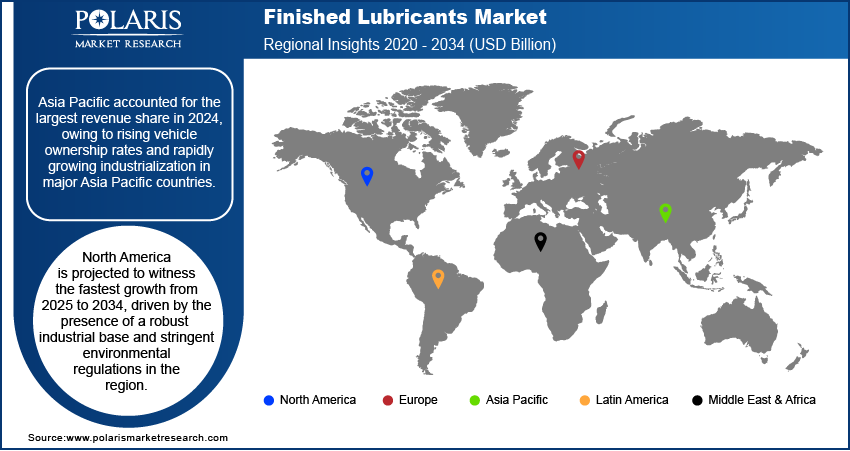

Regional Analysis

By region, the market report offers finished lubricants market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for the largest revenue share in 2024, owing to rising vehicle ownership rates and rapidly growing industrialization in countries such as India, China, and other Southeast Asian countries. Increasing industrial expenditure and rise in infrastructural activities further contribute to the robust demand for finished lubricants in the region.

North America is projected to witness the fastest growth from 2025 to 2034. This is primarily due to the presence of a robust industrial base and stringent environmental regulations in the region. Also, technological developments and the rising use of high-performance lubricants are other factors contributing to the regional market demand.

Key Players and Competitive Insights

The market for finished lubricants is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce advanced finished lubricants to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly finished lubricants that comply with stringent government regulations. The finished lubricants market research report offers a market assessment of all the leading players, including BP, Castrol Lubricants, Shell Oil Marketing Company, Essar Oil, Sinopec Corp., Universal Lubricants, Bharat Petroleum, Hindustan Petroleum, Chevron Corporation, Reliance Oil, and Gulf Oil Corporation.

List of Key Players

- BP

- Castrol Lubricants

- Shell Oil Marketing Company

- Essar Oil

- Sinopec Corp.

- Universal Lubricants

- Bharat Petroleum

- Hindustan Petroleum

- Chevron Corporation

- Reliance Oil

- Gulf Oil Corporation

Finished Lubricants Industry Developments

January 2024: Shell U.K. Limited announced the completion of the acquisition of MIVOLT and MIDEL from M&I Materials Ltd. The company stated that the acquisition will enable it to offer advanced transformer oils and biodegradability solutions to its customers.

February 2022: Chevron entered into a definitive agreement with Bunge Limited for the creation of a joint venture. According to Chevron, the joint venture will focus on the development of renewable feedstocks by leveraging Chevron’s expertise in fuel manufacturing and Bunge’s expertise in oilseed processing.

Finished Lubricants Market Segmentation

- Metal Working Fluids

- Transformer Oils

- Gear Oils

- Hydraulic Oils

- Engine Oils

By Base Oil Source Outlook

- Mineral

- Synthetic

- Semi-Synthetic

By Viscosity Grade Outlook

- SAE Grade

- ISO Grade

- API Grade

By Performance Level Outlook

- Conventional

- Premium

- High-Performance

By Additive Package Outlook

- Anti-Wear Additives

- Anti-Oxidant Additives

- Anti-Friction Additives

- Extreme Pressure Additives

By End-Use Industry Outlook

- Automotive

- Oil Refining

- Textile Manufacturing

- Metal Working

- Petrochemical & Chemicals

- Industrial

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Finished Lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 142.28 billion |

|

Market Size Value in 2025 |

USD 145.83 billion |

|

Revenue Forecast by 2034 |

USD 203.08 billion |

|

CAGR |

3.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 142.28 billion in 2024 and is projected to grow to USD 203.08 billion by 2034.

The market is projected to register a CAGR of 3.7% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are BP, Castrol Lubricants, Shell Oil Marketing Company, Essar Oil, Sinopec Corp., Universal Lubricants, Bharat Petroleum, Hindustan Petroleum, Chevron Corporation, Reliance Oil, and Gulf Oil Corporation.

The mineral segment accounted for the largest market share in 2024.

The automotive segment dominated the market in 2024.