Bio-lubricants Market Size, Share, Trends, & Industry Analysis Report

By Base Oil Type (Vegetable Oils, Animal Fats), By Application, By End-Use, By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM2489

- Base Year: 2024

- Historical Data: 2020-2023

What is Bio-Lubricants Market Size?

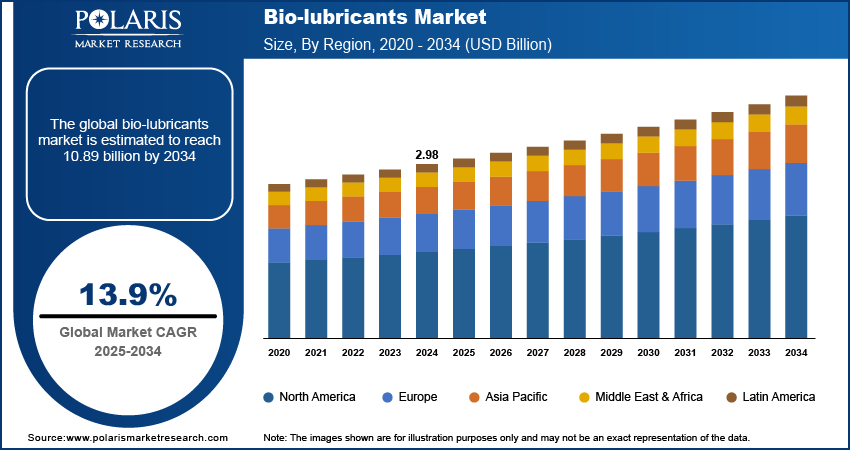

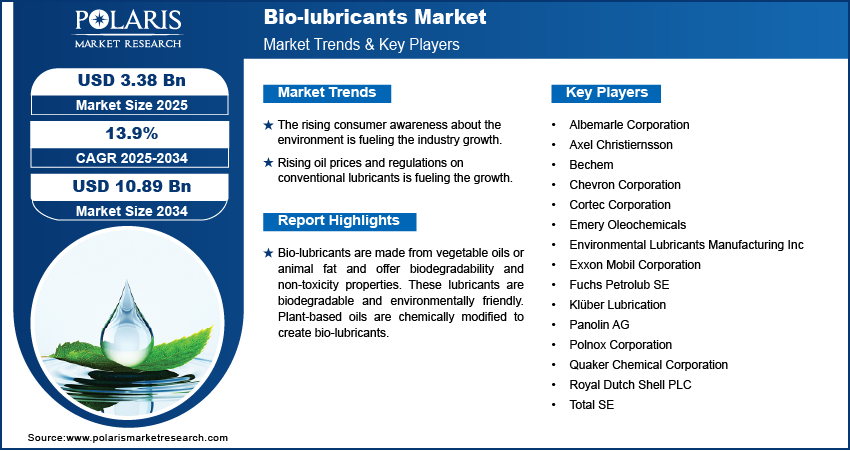

The global bio-lubricants market was valued at USD 2.98 billion in 2024 and is expected to grow at a CAGR of 13.9% during the forecast period. The growth is driven by rising environmental concerns, and expansion of end use industries in developing countries such as India, Taiwan, and Brazil.

Key Insights

- The hydraulic fluids are expected to witness significant growth during the forecast period due to high demand for hydraulic elevators, sweepers, garage trucks, forklifts, motor graders, and front-end loaders.

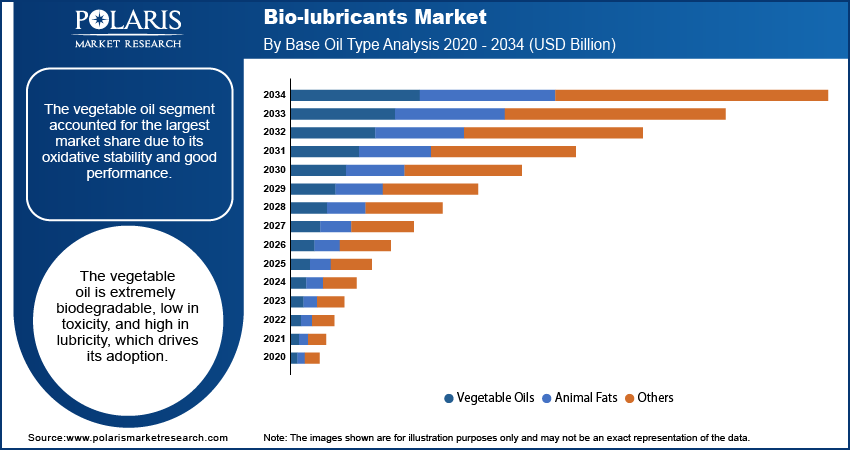

- The vegetable oil segment accounted for the largest share in 2024 driven by its oxidative stability and good performance.

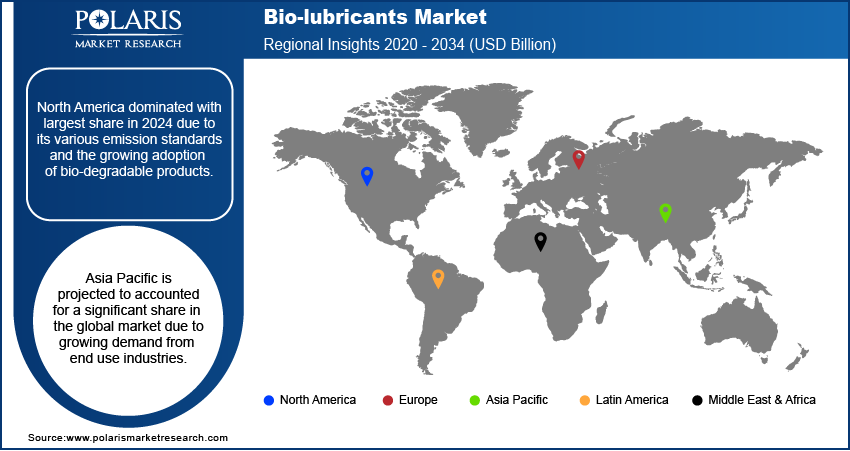

- North America dominated with largest share in 2024 due to its various emission standards and the growing adoption of bio-degradable products.

- Asia Pacific is projected to accounted for a significant share in the global market due to growing demand from end use industries.

Industry Dynamics

- The rising consumer awareness about the environment is fueling the industry growth.

- Rising oil prices and regulations on conventional lubricants is fueling the growth.

- The technological advancement in extraction is driving the growth.

- High production costs and limited availability of raw materials limits the growth.

Market Statistics

- 2024 Market Size: USD 2.98 Billion

- 2034 Projected Market Size: USD 10.89 Billion

- CAGR (2025-2034): 13.9%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Bio-lubricants are made from vegetable oils or animal fat and offer biodegradability and non-toxicity properties. These lubricants are biodegradable and environmentally friendly. Plant-based oils are chemically modified to create bio-lubricants. Due to their eco-friendly and bio-degradable qualities, they are utilized to reduce friction between surfaces in heavy machinery such as railroad flanges, chainsaw bars, and two-stroke engines. Petroleum-based lubricants commonly cause skin inflammation, which bio-based lubricants do not. They also have a number of advantages, including lower energy consumption, lower labor costs, higher employee safety, improved environmental conditions, longer machine life, and enhanced productivity, all of which contribute to the bio-lubricants industry's growth.

Several R&D efforts to improve the physicochemical properties of bio-based lubricants have been completed. These were ideally made from petroleum-based oil with a low degradability. Petroleum products pollute the environment by collecting in bodies of water, endangering aquatic life. Bio-lubricants can be utilized as an alternative to petroleum-based oils, according to these findings. As a result, increased awareness of environmentally friendly lubricant solutions is projected to drive bio-lubricant demand in the near future. Bio-lubricants are more environmentally friendly than traditional lubricants. The increased use of these lubricants in the transportation and manufacturing industries is predicted to drive up global demand for bio-based lubricants. This is mostly due to increased environmental consciousness and understanding, the implementation of stringent legislation, and the market adoption of bio-based lubricants.

Industry Dynamics

Growth Drivers

What are Factors Driving the Bio-Lubricants Market?

The global bio-lubricants market is expected to grow in response to rising consumer awareness about the environmental issues and diminishing crude oil reserves in developed nations. The bio-lubricants is gaining traction as they are regarded as viable alternatives to petroleum-based oils. This adjustment is expected to have a favorable influence on environmental concerns and will aid in their solution. The lifecycle of a bio lubricant is now being studied using a systematic method, which includes the environmental effects of bio-based lubricants throughout processing, usage, and disposal. Moreover, the expansion of the automotive sector is further driving the demand for the lubricants for engine oils, greases, transmission and other fluids, thereby driving the growth of industry.

Bio-based lubricants would benefit from the increased interest in environmental issues and will thus lead to growth in the bio-lubricants demand. The United States and Europe are the most advanced regions and are encouraging the use of bio-based materials due to their lower environmental impact. Also, rising oil prices and environmental regulations on conventional lubricants are expected to fuel global market expansion.

Report Segmentation

The market is primarily segmented based on base oil type, application, end-use, and region.

|

By Base Oil Type |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Which Segment by Base Oil Type Dominated with Largest Share in 2024?

The vegetable oil segment accounted for the largest market share due to its oxidative stability and good performance. The vegetable oil is extremely biodegradable, low in toxicity, and high in lubricity, which drives its adoption. Moreover, the abundance of vegetable oil seeds, which are used as raw materials is further driving its usage for bio-lubricants. Concerns for wildlife protection are also anticipated to improve vegetable oil's market share over animal fat, thereby driving the segment growth.

Why Hydraulic Fluids Segment is Expected to Witness Significant Growth in Forecast Period?

The hydraulic fluids market segment is expected to witness the fastest growth during the forecast period due to high demand for hydraulic elevators, sweepers, garage trucks, forklifts, motor graders, and front-end loaders. Bio-based lubricants are also commonly used as hydraulic fluids in wide range of applications to improve operations such as harvesters, cranes, tractors, and load carriers. Moreover, hydraulic fluids are synthetic formulations which are also utilized in mining, industrial, agricultural, and marine industries to transmit power in hydraulic machines.

How North America Captured Largest Market Share in 2024?

North America dominated with largest share in 2024 due to its various emission standards and the growing adoption of bio-degradable products. The demand of bio-lubricants is driven by the evolution of various government initiatives to reinforce environmental regulation. The renewed automobile sector in the United States and Canada, as well as more regulatory action by the US government regarding the use of conventional lubricants is further driving the demand. Moreover, the US Air Force encourages plant-derived biodegradable products as part of its strategic and fundamental approach to national defense, which is further driving the adoption in North America. The rising governmental spending on bio-lubricants used in the marine and automotive industries is expected to create lucrative opportunities for bio-lubricants.

What is the Reason for Asia Pacific's Significant Growth?

The Asia Pacific is expected to witness significant growth during the forecast period due to rising industrialization in the region. The region has highest number of industries worldwide and developing countries in the region such as India, Taiwan, and Vietnam are expanding their manufacturing capacities. This growth is fueling the demand for the different type of lubricants including bio-lubricants. These lubricants are used in heavy machinery, vehicles, and power plants to work efficiently. Moreover, the automotive sales and production in the region is increasing. This increased is fueled by rising demand for personal and public transports. As a result, the demand for lubricants for engine oils, greases, and transmission is rising, thereby driving the growth in the region.

Who are the Major Players in Market?

The key players in the bio-lubricants market are Albemarle Corporation, Axel Christiernsson, Bechem, Chevron Corporation, Cortec Corporation, Emery Oleochemicals, Environmental Lubricants Manufacturing Inc., Exxon Mobil Corporation, Fuchs Petrolub SE, Klüber Lubrication, Panolin AG, Polnox Corporation, Quaker Chemical Corporation, Royal Dutch Shell PLC, and Total SE.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the bio-lubricants market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Recent Developments

June 2024, TotalEnergies launched its first lubricant ranges, Quartz EV3R for passenger cars and Rubia EV3R for trucks, formulated with premium regenerated base oils. These eco-designed products reduce environmental impact and feature bottles made from 50% recycled plastic, supporting sustainable mobility.

In December 2021, RSC Bio Solutions and Standard Sekiyu Osaka Hatsubaisho Co., Ltd (SSOH) announced a new partnership for distribution and to meet the growing demand in Japan for Environmentally Acceptable Lubricant offerings for marine and industrial applications.

In October 2021, Neste, a well-known oil refiner, collaborated with Hesburger, a well-known restaurant chain in Finland, to collect waste cooking oil from more than 300 local restaurants. This will be used to make bio-lubricants and renewable diesel. Also, restaurants will employ Neste's MY Renewable Diesel across their entire transport fleet in Finland.

Bio-lubricants Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.98 billion |

| Market size value in 2025 | USD 3.38 billion |

|

Revenue forecast in 2034 |

USD 10.89 billion |

|

CAGR |

13.9% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Base Oil Type, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Albemarle Corporation, Axel Christiernsson, Bechem, Chevron Corporation, Cortec Corporation, Emery Oleochemicals, Environmental Lubricants Manufacturing Inc., Exxon Mobil Corporation, Fuchs Petrolub SE, Klüber Lubrication, Panolin AG, Polnox Corporation, Quaker Chemical Corporation, Royal Dutch Shell PLC, and Total SE. |

FAQ's

• The market size was valued at USD 96.89 Billion in 2024 and is projected to grow to USD 131.85 Billion by 2034.

The market is projected to register a CAGR of 3.1% during the forecast period.

• A few of the key players in the market are Albemarle Corporation, Axel Christiernsson, Bechem, Chevron Corporation, Cortec Corporation, Emery Oleochemicals, Environmental Lubricants Manufacturing Inc., Exxon Mobil Corporation, Fuchs Petrolub SE, Klüber Lubrication, Panolin AG, Polnox Corporation, Quaker Chemical Corporation, Royal Dutch Shell PLC, and Total SE.

• The vegetable oil segment accounted for the largest market share in 2024.

• The hydraulic oil segment is expected to record significant growth.