Fire Resistant Tapes Market Share, Size, Trends, Industry Analysis Report

By Coating (Single coated and Double coated); By Type; By Application; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4878

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

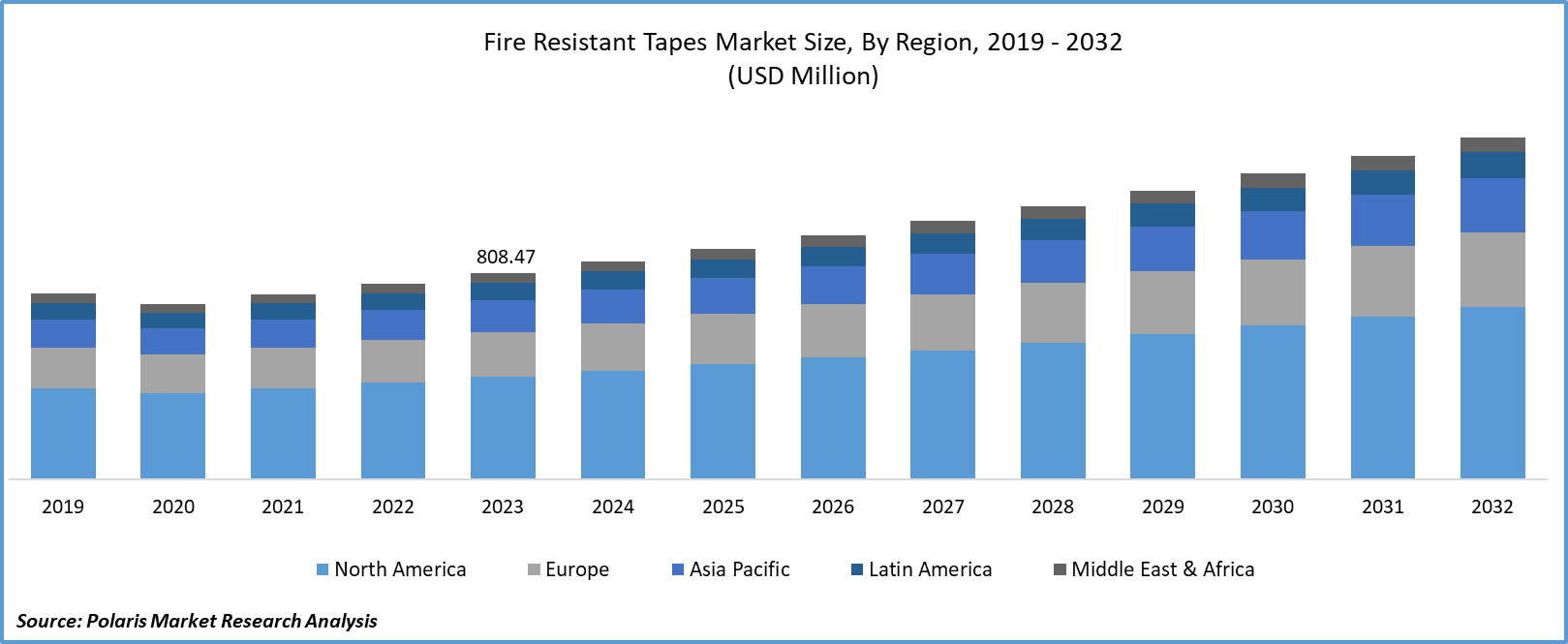

The fire-resistant tapes market size was valued at USD 808.47 million in 2023. The market is anticipated to grow from USD 854.47 million in 2024 to USD 1,339.44 million by 2032, exhibiting a CAGR of 5.8% during the forecast period.

Industry Trend

Fire-resistant tape serves as a vital fire barrier, particularly in public spaces, enclosed areas, and underground environments, where stringent fire propagation and survival standards must be met. These tapes are engineered to withstand and impede the spread of fire, offering enhanced protection and safety measures in critical settings. The fire-resistant tapes market is growing as safety rules become stricter, more people become aware of fire safety, construction, and infrastructure projects grow, tape tech gets better, and industries focus more on reducing risks.

To Understand More About this Research:Request a Free Sample Report

Moreover, ongoing construction projects worldwide are fueling the demand for fire-resistant tapes in building insulation, electrical wiring, and various applications, thereby increasing opportunities in the fire-resistant tapes market. Moreover, the automotive and aerospace industries are placing a greater emphasis on vehicle safety and lightweight materials, creating further opportunities for fire-resistant tapes in areas like vehicle interiors, wiring harnesses, and component protection. This results in the growth of fire-resistant tape market share.

The innovation landscape for fire-resistant tape is dynamic and evolving rapidly as industries prioritize safety and compliance with stringent fire regulations. Manufacturers are continuously developing and enhancing fire-resistant tape formulations to address emerging challenges and meet the evolving needs of various sectors. Key areas of innovation include the development of tapes with superior fire-retardant properties, increased durability, enhanced adhesion to diverse surfaces, and compatibility with a wide range of applications. Furthermore, advancements in materials science and engineering are driving the creation of eco-friendly and sustainable fire-resistant tapes to align with growing environmental concerns.

For instance, in March 2023, SEKISUI CHEMICAL CO., LTD. revealed an innovative High-Performance Plastics Company: the double-faced tapes named "High heat-resistant transfer tape 5503HT・5505HR." These tapes boast four key attributes: exceptional heat resistance, ultra-thin film construction, low levels of volatile organic compounds (VOCs), and superior adhesion, even on rough surfaces.

The COVID pandemic has led to shifts in demand patterns across industries. While sectors like construction, automotive, and aerospace experienced slowdowns initially due to lockdown measures and economic uncertainty, other industries such as healthcare and data centers witnessed increased demand for fire-resistant tapes as they expanded or upgraded infrastructure to respond to the crisis. Hence fire-resistant tapes market size is anticipated to grow during the forecast period.

Key Takeaway

- Asia Pacific dominated the largest market and contributed to more than 38% of the share in 2023.

- The North America market is expected to be the fastest-growing CAGR during the forecast period.

- By end use, the electrical and electronics segment accounted for the largest market share in 2023.

- By type category, the normex segment is projected to grow at a fastest CAGR during the projected period.

What are the market drivers driving the demand for the fire-resistant tapes market?

Expansion of Construction and Infrastructure Projects have been Projected to Spur Product Demand

Fire resistant tapes play a crucial role in ensuring fire safety across a wide range of construction projects, encompassing various types of structures and infrastructure. In commercial buildings, where large numbers of people gather daily for work, shopping, or leisure activities, fire safety is paramount. Fire-resistant tapes are utilized in these buildings for multiple purposes, including sealing joints and gaps in fire-rated walls and ceilings, insulating electrical wiring to prevent short circuits and electrical fires, and protecting critical structural components from fire damage. By providing a barrier against the spread of flames and smoke, fire-resistant tapes help contain fires within localized areas, allowing occupants to evacuate safely and reducing the extent of property damage. Therefore, the fire-resistant tapes market size is expected to increase throughout the forecast period.

Similarly, in residential complexes such as apartment buildings and condominiums, fire-resistant tapes are utilized to enhance fire safety measures. These tapes are applied in areas such as fire-rated doors and windows, HVAC ductwork, and electrical conduits to maintain the integrity of fire barriers and prevent fire and smoke from spreading between units. Additionally, fire-resistant tapes may be used to seal penetrations in walls and floors, preventing the passage of flames and hot gases from one area to another.

In infrastructure projects such as bridges, tunnels, and airports, where fire safety is critical due to the high volume of traffic and potential risks associated with transportation systems, fire-resistant tapes are employed to protect vital infrastructure components. For example, fire-resistant tapes are used to seal expansion joints in bridges and tunnels, preventing the ingress of water and chemicals that can compromise the structural integrity of these elements. In airports, fire-resistant tapes are installed in terminal buildings, hangars, and aircraft maintenance facilities to meet stringent fire safety regulations and protect passengers, aircraft, and infrastructure from fire hazards. Hence fire-resistant tapes market share is anticipated to grow during the forecast period.

Which factor is restraining the demand for fire resistant tapes?

High Cost of Material Used in Manufacturing are Expected to Hinder the Growth of the Market

Fire resistant tapes often require specialized materials and manufacturing processes to meet stringent safety standards, which can lead to higher production costs compared to conventional tapes. As a result, the selling price of fire-resistant tapes may be higher, making them less economically viable for some end-users, particularly in industries where cost considerations are paramount.

Additionally, the perception of fire risk varies across different industries and regions. Some sectors may prioritize other aspects of safety or invest in alternative fire protection measures, leading to lower demand for fire-resistant tapes. For example, industries with relatively lower fire risk or those where fire safety regulations are less stringent may opt for less expensive alternatives or allocate resources to other areas of operation. Hence fire-resistant tapes market share is expected to hinder the market growth

Report Segmentation

The market is primarily segmented based on coating, type, application, end use, and region.

|

By Coating |

By Type |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By End Use Insights

Based on end-use analysis, the market is segmented into aerospace and defense, building and construction, electrical and electronics, and others. The electrical and electronics held the largest market in 2023. The Electricals and Electronics industry encompasses a wide range of products, including appliances, consumer electronics, industrial machinery, and electrical infrastructure. With the proliferation of electronic devices and electrical equipment in various applications, there is a growing need for fire protection measures to ensure the safety and reliability of these systems. The Electricals and Electronics industry is subject to stringent safety regulations and standards to prevent fire hazards and electrical failures. Fire-resistant tapes are essential components of fire protection systems in electrical equipment, providing insulation, thermal protection, and flame resistance to mitigate the risk of electrical fires. Increasing awareness of fire safety risks and the importance of fire protection measures has led to greater adoption of fire-resistant tapes in the Electricals and Electronics industry.

By Type Insights

Based on type analysis, the market has been segmented on the basis of acetate, glass cloth, normex, polyimide, PPS, PVC. The normex segment is anticipated to experience the highest compound annual growth rate (CAGR) during the forecast period. Normex, which refers to a type of non-woven fabric made from a blend of synthetic fibers, is increasingly being used as a substrate material for fire-resistant tapes. Normex offers several advantages, including high tensile strength, thermal stability, chemical resistance, and good adhesion properties, making it well-suited for use in fire-resistant tapes for various applications. Normex materials are inherently fire retardant, meaning they have built-in resistance to ignition and flame spread. When used as a substrate for fire-resistant tapes, normex enhances the overall fire protection performance of the tapes, making them highly effective in preventing the spread of flames, smoke, and heat. Industries require high-performance fire protection solutions to comply with safety regulations, protect assets, and ensure operational continuity, driving the demand for normex-based fire-resistant tapes.

Regional Insights

Asia PacificTop of Form

Asia Pacific is accounted for the largest market share in 2023 for fire resistant tapes market. Asia Pacific is experiencing rapid industrialization and urbanization, leading to increased construction activities, infrastructure development, and industrial expansion. As a result, there is a growing demand for fire-resistant tapes in various sectors such as construction, automotive, electronics, and manufacturing to ensure fire safety compliance and protect assets from fire hazards. Governments in countries across the Asia Pacific have been implementing stringent fire safety regulations and standards to enhance public safety and mitigate the risk of fire-related incidents. Compliance with these regulations drives the demand for fire-resistant tapes as essential components of fire protection systems in buildings, vehicles, and industrial facilities. As a result, the market size of fire-resistant tapes is projected to expand throughout the forecast period.

Heightened awareness of the devastating consequences of fire incidents and the need to protect lives, property, and assets has led to greater investments in fire protection solutions, including fire-resistant tapes.

North America

North American region expected for the growth of fastest CAGR during the forecast period. The North American region is a hub for technological advancements and innovation in the fire protection industry. Manufacturers and suppliers in the region are continuously investing in research and development to innovate and improve fire-resistant tape formulations, materials, and manufacturing processes, driving growth and competitiveness in the market. North America has been experiencing an increase in the incidence of wildfires and natural disasters in recent years, leading to a greater focus on fire safety and resilience measures. Fire-resistant tapes are utilized in wildfire mitigation efforts, building fireproofing, and disaster response applications, driving demand in the region. As a result, the fire-resistant tapes market share is projected to grow throughout the forecast period.

Competitive Landscape

The competitive landscape of the fire-resistant tapes market is characterized by key players in the market focus on strategic businesses, product innovation, and geographical expansion to gain a competitive edge. The market is fragmented, with several companies offering a wide range of fire-resistant tapes tailored to various industries and applications. Pricing, product quality, distribution networks, and customer service are critical factors influencing competitiveness in the market. Overall, the fire-resistant tapes market is dynamic and competitive, driven by evolving customer needs, technological advancements, and regulatory requirements.

Some of the major players operating in the global market include:

- 3M

- Americover Inc.

- Boyd Corporation

- Avery Dennison Corporation

- Nichiban Co. Ltd.

- Nitto Denko Corporation

- Rogers Corporation

- Saint Gobain

- Scapa Group Ltd.

- Shurtape Technologies LLC.

- Tape-Pak Inc.

- Tesa SE

Recent Developments

- In July 2023, Shurtape Technologies, LLC, renowned for its adhesive tape and consumer products, has recently announced the opening of a new manufacturing facility. This expansion extends the existing distribution center that was inaugurated in 2020.

- In December 2022, Tesa, a global manufacturer of adhesive tapes and self-adhesive system solutions, Introduced a range of flame-retardant adhesive tapes. The latest addition, tesa flameXtinct, previously utilized in the construction sector, is now being deployed in the transportation and passenger transport industries. Notably, these new adhesive tapes possess unique characteristics: they self-extinguish shortly after a fire incident and are entirely halogen-free.

Report Coverage

The fire resistant tapes market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, coating, type, application, end use, and their futuristic growth opportunities.

Fire Resistant Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 854.47 million |

|

Revenue forecast in 2032 |

USD 1,339.44 million |

|

CAGR |

5.8% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Coating, By Type, By Application, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global fire resistant tapes market size is expected to reach USD 1,339.44 million by 2032

Key players in the market are 3M, Americover Inc., Boyd Corporation, Avery Dennison Corporation, Nichiban Co. Ltd., Nitto Denko Corporation

North America contribute notably towards the global Fire Resistant Tapes Market

The fire-resistant tapes market exhibiting a CAGR of 5.8%during the forecast period.

The Fire Resistant Tapes Market report covering key segments are coating, type, application, end use and region.