Fire Stopping Materials Market Share, Size, Trends, Industry Analysis Report

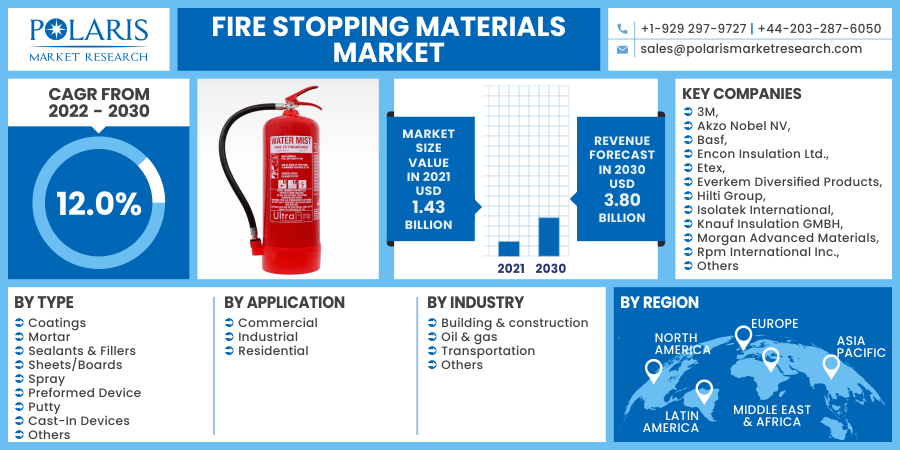

By Type (Coatings, Mortar, Sealants & Fillers, Sheets/Boards, Spray, Preformed Device, Putty, Cast-In Devices, Others), By Application (Commercial, Industrial, Residential); By Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 110

- Format: PDF

- Report ID: PM2199

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Outlook

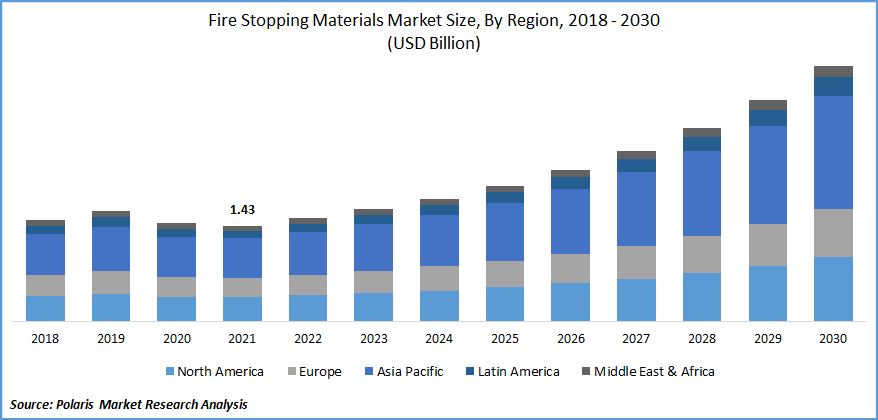

The global fire stopping materials market was valued at USD 1.43 billion in 2021 and is expected to grow at a CAGR of 12.0% during the forecast period. The prime factors for the industry development are the growing construction industry and the rising implementation of fire safety regulations, along with the formulation of stringent building policies and codes. Investments in the construction of commercial and residential spaces on account of the rising urbanization, growing disposable income, and changing living standards of the population across developing nations such as India and China, among others, are anticipated to drive the demand for the industry.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The rising awareness regarding fire safety coupled with the technological advancements on account of the rising R&D investments is anticipated to drive the global fire stopping materials market growth. Furthermore, the growing developments by key industry players globally are anticipated to drive the demand for these materials. For instance, in July 2020, Rex Materials Group, one of the leading manufacturers of thermal components, acquired Unifrax, a key provider of specialty materials that are focused on flames stopping applications.

The COVID-19 pandemic has had a negative impact on the fire-stopping materials market. This is due to the imposition of lockdowns due to the COVID-19 outbreak. As the lockdowns were imposed, there was a halt in the production and a huge delay in various construction projects globally. The lockdowns almost halted transport activities which in turn has downturned the size of the industry. Furthermore, the spread of the virus has had a negative impact on most of the end-user industries of the flames-stopping materials, thus declining their demand. The outbreak has also impacted the supply chain of the industry, making the cost of raw materials highly volatile, in turn hindering the growth of the fire stopping materials market. However, as the end-user industries are recovering from the outbreak and the rising number of construction projects is anticipated to drive the industry growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The wide application of various flame-stopping materials across different end-user industries such as building & construction, oil & gas, transportation, and others is one of the primary driving factors for the global fire stopping materials market. The fast adoption of advanced fireproof materials across the commercial sector, along with the implementation of stringent fire safety policies by governments across nations, is expected to boost the demand for the product. For instance, NBC (National Building Code of India), is determining various specifications such as fire zones, fire resistance type for both structural and non-structural components, and others for new construction.

Additionally, the rising focus of the aerospace and automotive industry towards these-stopping materials is expected to provide huge industry growth opportunities. Nowadays, the automotive industry is shifting its focus towards the installation of fire-stopping materials in heavy-duty & passenger vehicles. For instance, in February 2021, Sika Automotive announced a new flame stopping coating for EV (electric vehicle) battery systems in order to improve fire safety.

Report Segmentation

The market is primarily segmented on the basis of type, application, industry, and region.

|

By Type |

By Application |

By Industry |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Commercial segment accounted for the largest share in the global fire stopping materials market. The rising demand for fire stopping, along with the growing focus on safety, are a few of the major factors driving the growth of the segment. Further, the rising capital expenditure on commercial infrastructures such as offices, educational institutions, hospitals, and others is expected to drive the demand for these-stopping materials globally. The progression of the retail industry is playing a vital role in the expansion of commercial spaces, thus having a positive impact on the growth of the segment. The growing implementation of safety regulations in commercial spaces is further anticipated to provide huge growth opportunities to the segment.

However, the industrial segment accounts for a significant share in the overall industry. This can be acknowledged to factors, including rapid industrialization across developed and developing nations globally, growing focus toward safety across production plants of various industries, among others. Further, the implementation of stringent safety policies across industrial plants on account of a rising number of incidents due to fire is expected to drive the growth of the segment.

Insight by Industry

The building & construction segment is recorded with the largest shares in 2020 and is expected to lead the industry in the forecasting years. The lucrative growth in the construction industry globally is the major factor driving the growth of the segment. Further, according to GCP (Global Construction Perspectives) and oxford economics, the global construction market is estimated to grow to over USD 8 trillion by 2030, primarily driven by US, India, and China. This global growth in construction volume is anticipated to offer huge growth opportunities to this segment. Further, the improving attitude for the stringent safety codes & policies implemented by government authorities is anticipated to drive the growth of the segment.

The oil & gas segment is also projected to experience considerable growth across the market. This growth can be attributed to the rise in oil and gas drilling activities across various nations, including the US and Saudi Arabia. The rising prices of crude oil are leading to the increase in the exploration of shale resources. For instance, in March 2019, Exxon Mobil has started construction in its refinery at Beaumont in order to make it the largest facility in the US. Further, the increase in the demand for these-stopping materials from various oil & gas drilling activities is anticipated to drive the growth of the segment.

Geographic Overview

Geographically, North America is accounted largest revenue share in the global market in 2021 and is likely to dominate the market over the upcoming scenario. This is due to the rising demand for flame-stopping material in the new and existing infrastructure across the region. Further, the lucrative growth in the construction sector, especially in the number of skyscrapers in major cities, is anticipated to provide huge growth opportunities to the market in the region.

The growing focus towards building safety and the implementation of stringent building policies and codes is further estimated to drive the growth of the market in North America. Nowadays, government bodies across the region are implementing stringent fire safety norms. The presence of major market players in the region, such as 3M, HoldRite, and others, along with the rise in the number of certified fire contractors who can provide written specifications of products required by the architect, is anticipated to drive the demand for fire-stopping materials in the region.

Moreover, the Asian-Pacific market is anticipated to grow with the highest CAGR among all other regions rapidly. This fast growth of the market can be attributed to the rising population along with the improving standards of living (social-economic factors). The huge investment in commercial construction across developing nations such as India, China, and Indonesia, among others is further anticipated to stimulate the growth of the market. Additionally, the rapid industrialization in the region is expected to provide huge market growth opportunities. The growing focus on safety on account of a rising number of accidents is expected to drive the demand for fire-stopping materials across the construction industry in the region.

Competitive Insight

Some of the major players operating in the global market include 3M, Akzo Nobel NV, Basf, Encon Insulation Ltd., Etex, Everkem Diversified Products, Hilti Group, Isolatek International, Knauf Insulation GMBH, Morgan Advanced Materials, Rpm International Inc., Sika AG, Specified Technologies Inc, Supremex Equipments, Tenmat LTD., Walraven.

Fire Stopping Materials Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.43 billion |

|

Revenue forecast in 2030 |

USD 3.80 billion |

|

CAGR |

12.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Industry, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

3M, Akzo Nobel NV, Basf, Encon Insulation Ltd., Etex, Everkem Diversified Products, Hilti Group, Isolatek International, Knauf Insulation GMBH, Morgan Advanced Materials, Rpm International Inc., Sika AG, Specified Technologies Inc, Supremex Equipments, Tenmat LTD., Walraven |