Flavoring Agents Market Share, Size, Trends, Industry Analysis Report

By Type (Natural Flavors, Artificial Flavors); By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Dec-2023

- Pages: 118

- Format: PDF

- Report ID: PM1919

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

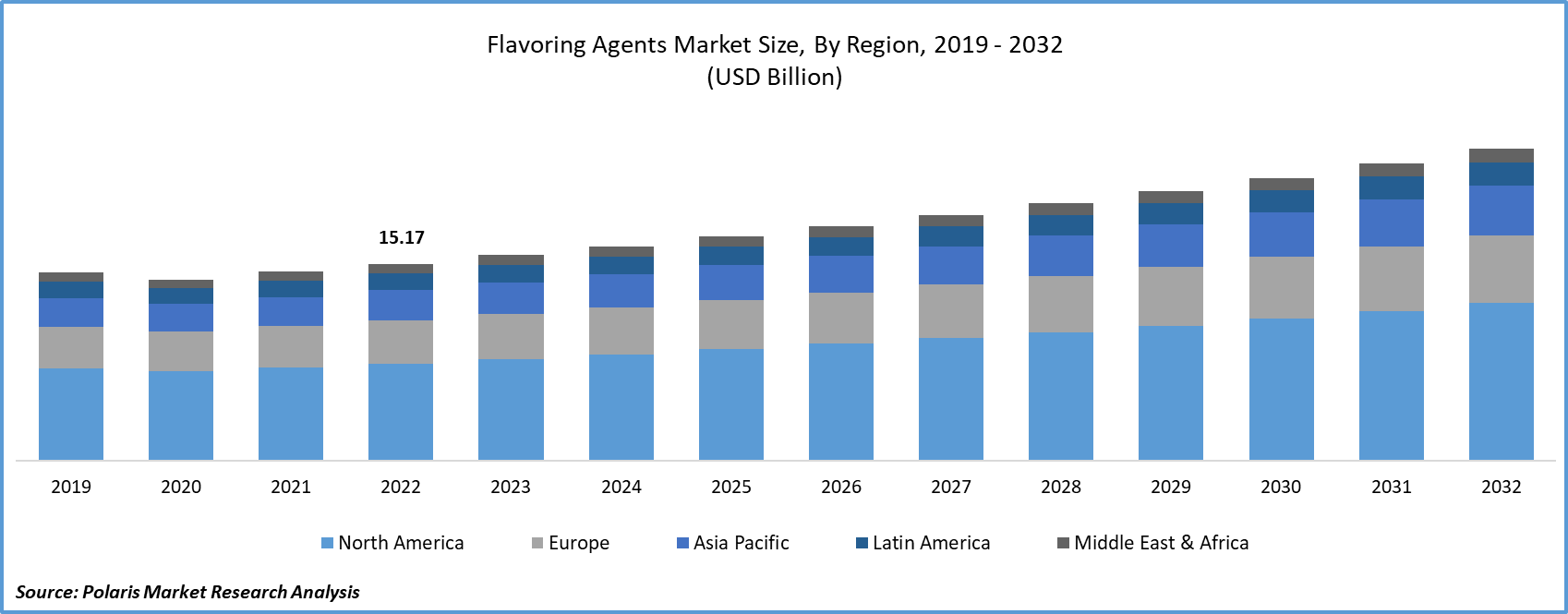

The global Flavoring Agents market was valued at USD 15.17 billion in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period.

Flavoring agents, serving as preservatives in food and related products, enhance flavor, taste, and freshness. Categorized into natural and artificial types, they maintain the original flavor over an extended period during preservation. Liquid and dry forms of flavoring agents are prevalent in the market and deemed safe for a wide array of foods, including confectionery, beverages, desserts, and snacks. These widely accepted ingredients play a crucial role in various food and beverage applications, contributing to improved taste, aroma, and essence.

To Understand More About this Research: Request a Free Sample Report

The development of an approved food preservatives list by the EU and FDA, along with government initiatives to introduce new natural flavoring agents, is expected to influence the flavoring agents' market share positively. The versatile applications of flavoring agents in dietary supplements, food catering, processed food and beverages, and nutraceuticals further encourage flavoring agents market growth. However, challenges such as price variations in raw materials and the formulation complexities for achieving clean product classification may hinder market expansion.

Factors contributing to market acceleration include increased concern for new food preservatives, product advancements, consumer demand for flavor innovations, advancements in food technology, aromatic compounds in some flavors, research, and development investments, safe artificial flavoring agents, applications in distasteful medicines and cigarettes, product line expansion, enhanced flavor perception, diverse flavoring agent variations, technological advancements, adjustments in existing products, introduction of new and unique flavors, improved sensory assessment, the impact of flavoring agents on overall food product acceptance, and increased accuracy of processed and ready-to-eat products.

On the other hand, challenges such as high costs of raw materials, unpleasant aftertaste of certain flavoring agents, bans on specific flavoring ingredients deemed unfit for human consumption, allergic reactions, traditional flavoring techniques, attitudes toward artificial flavoring agents, and heightened competition are factors likely to impede the growth of the flavoring agent market.

For Specific Research Requirements: Request for Customized Report

The primary hindrance to the flavoring agent market is the emergence of serious health problems associated with certain chemicals present in both natural and artificial flavors.

Industry Dynamics

Growth Drivers

- Stringent Regulations Promoting the Use of Natural Flavoring Agents

Flavoring agents have a longstanding presence in various industries, with adoption in sectors like the pet food industry increasing over the past decade. While the food and pharmaceutical industries have matured in their use of flavoring agents, there is significant untapped potential in the pet food sector. Common additions to pet food include savory or meaty flavors, derived either chemically from Pyrazines and sulfur compounds or naturally from ingredients like onions and garlic. Natural flavors are gaining traction due to stringent government regulations, prompting manufacturers to reduce the use of artificial flavoring agents. Synthetic chemicals like ethyl acrylate, benzophenone, and styrene, known for their carcinogenic properties, have led to a shift towards natural flavors.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- The Artificial Flavors segment held the largest revenue share in 2022

The high demand from food manufacturers for flavoring agents stems from their role in enhancing the flavor, essence, and visual appeal of the final product, compensating for losses during processing. Growth in this segment is driven by key factors such as the easy availability, cost-effectiveness, and convenient manufacturing process of flavoring agents compared to natural ingredients.

The market share of natural flavors is projected to grow, driven by increasing consumer awareness of the benefits of consuming natural ingredients. The industry is expected to experience robust expansion due to the increased production of alcoholic beverages, juices, and carbonated drinks in diverse flavors. The demand for natural flavors is anticipated to escalate as concerns about food poisoning related to the consumption of artificial chemicals in food and beverages continue to rise.

By Application Analysis

- The Beverages segment accounted for the highest market share during the forecast period

The beverage segment is poised for significant growth, driven by the extensive utilization of flavors in hot beverages, alcoholic beverages, sports and nutritional drinks, as well as juices and carbonated soft drinks. The expanding consumption of ethnic beverages, coupled with lifestyle changes among the adult population in emerging nations, is expected to contribute to market expansion. Furthermore, a robust demand for processed organic beverages is anticipated to serve as a major growth catalyst for the industry.

Increasing consumer fascination with probiotic beverages, coupled with evolving dietary preferences, is set to propel growth in the dairy sector. Flavored dairy products, enriched with essential nutrients such as magnesium, calcium, and potassium, have experienced substantial growth in recent times.

Regional Insights

- Asia Pacific dominated the largest market in 2022

The flavoring agents’ market is flourishing in the Asia-Pacific region, driven by an increased demand for food and beverages. With the Indian government permitting 100% FDI in the food processing industry, there is anticipated growth in the supply chain and employment, leading to heightened demand for flavoring agents in the food sector. The rising demand for packaged juices, energy drinks, and sports drinks is contributing to the expansion of the beverage flavoring agent’s market. Additionally, Asia-Pacific is experiencing the fastest growth in consumer spending on dining out, reflecting a significant shift in dining culture as more consumers opt for restaurant dining.

In contrast, the retail markets in the Americas and Europe are arguably more mature, leading to a saturated demand for flavoring agents in these regions. Furthermore, stringent regulations regarding flavoring agents in Europe have contributed to a decline in demand. Conversely, the Americas have experienced a rapid increase in pet adoptions, driving the need for flavoring agents in pet food.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Givaudan SA

- Takasago

- International Flavors & Fragrances Inc.

- Sensient, Kerry, Mane

- Symrise AG

- Wild

- Haubao

- Hasegawa

- Firmenich

- Robertet

Recent Developments

- In May 2023, Swiss flavor and fragrance company Firmenich merged with Dutch health & nutrition company DSM to establish a new entity named "DSM-Firmenich," aiming to leverage the collective expertise of both companies.

- In February 2022, Sweegen unveiled its cutting-edge sweetening solution, 'Ultratia,' a high-intensity sweetener incorporating brazzein. This groundbreaking product is a result of the company's proprietary precision fermentation process, known for producing clean and sustainable ingredients.

Flavoring Agents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 15.83 billion |

|

Revenue forecast in 2032 |

USD 24.03 billion |

|

CAGR |

4.7% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments Covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |