Laser Optics Market Size, Share, Trends, Industry Analysis Report

By Components (Laser Mirrors & Windows, Lenses, Filters, Optical Modulator, Others), By Application, By End-User Industry, By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM6139

- Base Year: 2024

- Historical Data: 2020 - 2023

Market Overview

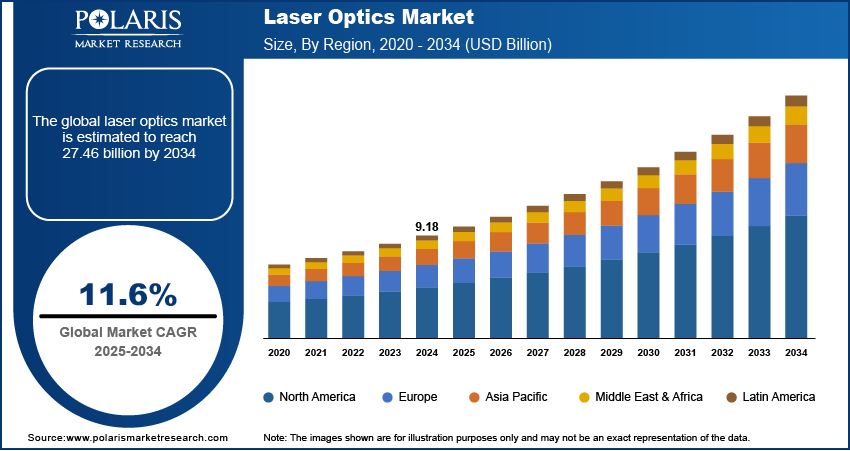

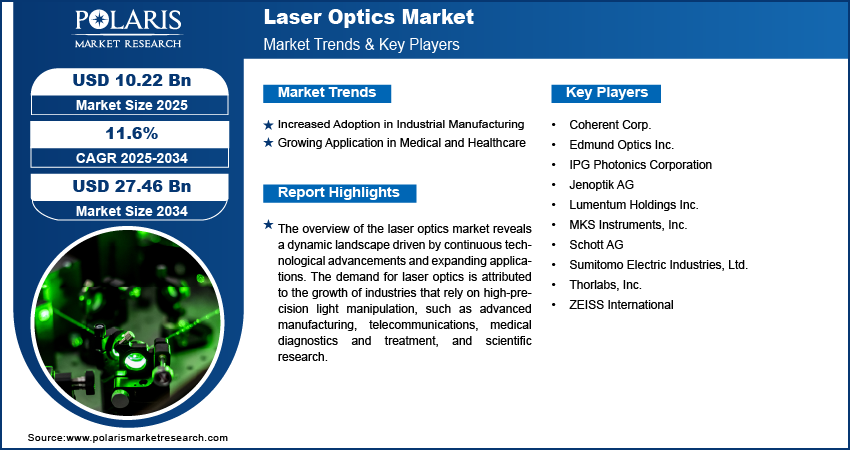

The global laser optics market size was valued at USD 9.18 billion in 2024 and is anticipated to register a CAGR of 11.6% from 2025 to 2034. The industry is significantly driven by the increasing demand for high-precision industrial manufacturing, with lasers being crucial for various tasks such as cutting, welding, and marking in multiple sectors. The growing adoption in the medical and healthcare fields, particularly for surgeries and cosmetic procedures, also contributes to its expansion.

Key Insights

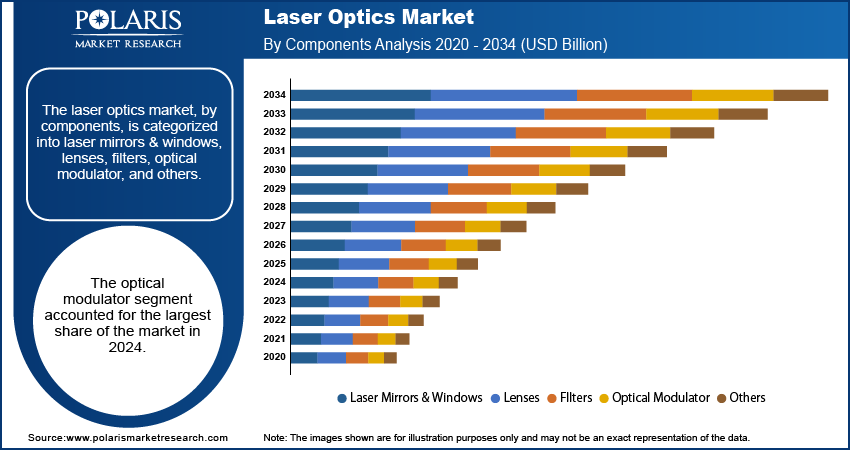

- By components, the optical modulators segment held the largest share in 2024, due to their essential role in high-speed data encoding for telecommunications and data transmission. Their indispensable function in modern communication infrastructure, especially with the growth of 5G networks, drives their significant presence.

- By application, the optical communication segment held the largest share in 2024, propelled by the explosive global demand for data traffic and the need for efficient communication networks. These systems form the backbone of the internet, supporting various digital activities and relying on advanced laser optics for swift data transfer.

- By end-user industry, the telecommunications & consumer electronics segment held the largest share in 2024, driven by the widespread integration of laser technology in everyday devices and critical communication infrastructure. The continuous expansion of global internet connectivity and the rising demand for high-bandwidth data centers underscore its dominant position.

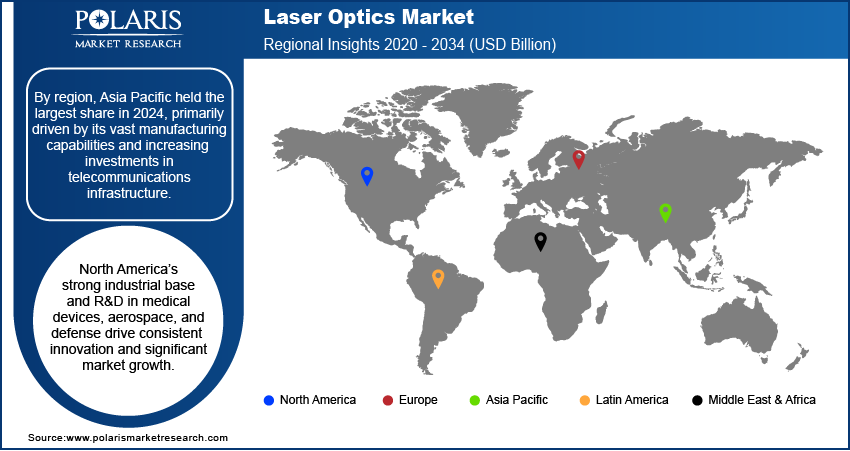

- By region, Asia Pacific held the largest share in 2024 and is rapidly expanding for laser optics, primarily driven by its vast manufacturing capabilities and increasing investments in telecommunications infrastructure.

Industry Dynamics

- The increasing demand for precise manufacturing across various industries is a major driver. Lasers are essential for tasks such as cutting, welding, and marking in sectors like electronics, automotive, and aerospace, where high accuracy and efficiency are critical for production processes.

- Growing adoption of laser technology in the medical and healthcare sectors significantly contributes to demand. Lasers are widely used in advanced surgical procedures, diagnostic tools, and cosmetic treatments, driven by the need for minimally invasive techniques and improved patient outcomes.

- The rapid expansion of optical communication infrastructure, including fiber-optic networks and 5G technology, is another strong growth factor. This drives the need for high-performance optical components to support fast and reliable data transmission in telecommunications and data centers.

Market Statistics

- 2024 Market Size: USD 9.18 billion

- 2034 Projected Market Size: USD 27.46 billion

- CAGR (2025–2034): 11.6%

- Asia Pacific: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

The laser optics sector involves the design, production, and use of optical components and systems that control, focus, and manipulate laser light. These components are essential for maintaining beam quality and system efficiency across diverse applications.

A few drivers shaping the industry expansion include the growing use of laser optics in scientific research and advancements in defense and military applications. These areas may not have the same widespread commercial volume as industrial or medical uses, but they represent specialized and high-value segments.

The expansion of scientific research activities, particularly in fields such as quantum physics and advanced spectroscopy, significantly contributes to demand for laser optics. Researchers utilize highly specialized laser optics to develop new technologies, explore fundamental scientific principles, and improve measurement capabilities. The National Institute of Standards and Technology (NIST), a U.S. government agency, uses precise laser systems with advanced optics for developing atomic clocks, which require extreme accuracy and stable laser sources. These research efforts often push the boundaries of current optical technology, driving innovation and demand for custom or high-performance components.

Drivers and Trends

Increased Adoption in Industrial Manufacturing: The growing demand for high-precision and efficient manufacturing processes is a primary driver. Industries such as automotive, aerospace, and electronics heavily rely on laser technology for tasks such as cutting, welding, drilling, and marking due to the superior accuracy, speed, and automation capabilities lasers offer compared to traditional methods. The need for intricate designs and minimal material waste in modern production lines further boosts the adoption of laser-based systems.

Advanced manufacturing trends, including the shift toward Industry 4.0 and smart factories, necessitate sophisticated laser optics for automated production and quality control. For example, the National Institute of Standards and Technology highlighted in a 2021 report titled "Additive Manufacturing of Metals: The Science of the Laser Powder Bed Fusion Process" how optical components are critical for controlling the laser beam in additive manufacturing (3D printing) of metals, ensuring the precision required for complex parts. Such developments underline the indispensable role of robust and high-quality optical components in supporting these high-tech manufacturing processes. This continuous integration of laser technology into automated and precision-intensive industrial applications is driving the demand for specialized laser optics.

Growing Application in Medical and Healthcare: The expanding use of laser technology in the medical and healthcare fields is another major factor contributing to the growth. Lasers are increasingly preferred for a variety of diagnostic, therapeutic, and surgical procedures due to their ability to provide highly precise, minimally invasive treatments with reduced recovery times and improved patient outcomes. This includes applications in ophthalmology for vision correction, dermatology for skin treatments, and various surgical specialties for tissue ablation and coagulation.

Innovations in medical laser systems, such as advanced imaging techniques and targeted therapies, rely heavily on sophisticated optical components to ensure optimal performance and safety. According to an article published in PubMed Central in 2021, "Pattern of technology diffusion in the adoption of stereotactic laser interstitial thermal therapy (LITT) in neuro-oncology," laser interstitial thermal therapy (LITT) utilization increased by ~400% relative to craniotomy for neuro-oncology indications between 2012 and 2018. This demonstrates the rising preference and adoption of laser-based surgical techniques due to their effectiveness and minimally invasive nature. The continuous development and integration of laser technology in diverse medical applications are thus propelling the growth.

Segmental Insights

Components Analysis

Based on components, the segmentation includes laser mirrors & windows, lenses, filters, optical modulator, and others. The optical modulator segment held the largest share in 2024. These devices are critical for telecommunications and data transmission, enabling the high-speed encoding of information onto laser beams. Their central role in converting electrical signals into optical signals at extremely fast rates makes them indispensable in modern communication infrastructure, particularly with the global rollout of private 5G networks and the continuous expansion of data centers. The increasing demand for bandwidth and faster data transfer rates across consumer and enterprise applications directly translates into a significant need for sophisticated and efficient optical modulators. As the backbone of high-speed fiber optic networks, these components facilitate the complex processing and routing of optical signals, driving their substantial presence and dominance.

The

Application Analysis

Based on application, the segmentation includes laser processing, optical communication, medical laser systems, barcode scanner, and others. The optical communication segment held the largest share in 2024, driven by the explosive growth in global data traffic, necessitating high-speed, reliable, and efficient communication networks. Optical communication systems, powered by advanced laser optics, are the backbone of the internet, supporting everything from cloud computing and online streaming to mobile data and teleconferencing. The increasing deployment of fiber optic cables worldwide, coupled with the rising demand for higher bandwidth and lower latency in data centers and telecommunication networks, ensures a continuous and substantial need for laser optics components. The advent of 5G technology and ongoing advancements in network infrastructure further solidify this segment's leading position, as these developments heavily rely on sophisticated optical solutions and optical sensors to transmit vast amounts of data swiftly and efficiently.

The laser processing application segment is anticipated to register the highest growth rate during the forecast period. This rapid growth is fueled by the widespread adoption of laser technology in various industrial sectors, including automotive, electronics, and medical device manufacturing. Laser processing techniques such as cutting, welding, drilling, and marking offer unparalleled precision, speed, and automation capabilities, leading to higher efficiency and reduced material waste compared to traditional manufacturing methods. The continuous push for miniaturization in electronics, the demand for complex geometries in aerospace components, and the need for sterile and precise fabrication in medical instruments all contribute to the escalating use of laser processing.

End-User Industry Analysis

Based on End-User Industry, the segmentation includes telecommunications & consumer electronics, medical, semiconductors & electronics, aerospace & automotive, research, and others. The telecommunications & consumer electronics segment held the largest share in 2024. In consumer electronics, lasers play a vital role in functions in smartphones, displays, and optical data storage devices. The increasing sophistication of these devices, driven by consumer demand for better performance and new features, necessitates advanced optical components. More significantly, the telecommunications industry relies heavily on laser optics for transmitting vast amounts of data over long distances through fiber optic networks. The continuous expansion of global internet connectivity, the rollout of 5G technology, and the escalating need for high-bandwidth data centers are foundational drivers, making this segment a dominant force. The sheer volume of optical transceivers, fiber optic components, and display technologies required to support modern digital life underpins its leading position.

The medical segment is anticipated to register the highest growth rate during the forecast period. This rapid expansion is primarily driven by continuous innovation in medical procedures and diagnostic tools that favor minimally invasive and highly precise solutions. Lasers are increasingly becoming the standard for various medical treatments, including intricate surgeries in ophthalmology, dermatology, and dentistry, as well as for advanced optic imaging and therapeutic applications. The rising global prevalence of chronic diseases, coupled with a growing emphasis on early diagnosis and effective treatment, fuels the adoption of sophisticated medical laser systems. As healthcare providers seek better patient outcomes, reduced recovery times, and enhanced procedural accuracy, the demand for specialized laser optics in medical devices continues to accelerate, positioning this segment for substantial future growth.

Regional Analysis

The Asia Pacific laser optics market accounted for the largest share in 2024, driven by its vast manufacturing capabilities and increasing investments in telecommunications infrastructure. Countries in this region are major global production hubs for electronics, automotive components, and various consumer goods, all of which increasingly integrate laser processing for efficiency and precision. The rapid urbanization and digital transformation across many Asia Pacific economies are fueling massive investments in fiber optic networks and data centers, creating substantial demand for laser optics in optical communication applications.

China Laser Optics Market Overview

China dominated the Asia Pacific laser optics industry in 2024, largely due to its immense manufacturing sector and strategic national investments in advanced technologies. The country's ambitious industrial policies, which promote automation and high-tech manufacturing, significantly boost the adoption of laser processing equipment and, consequently, the demand for laser optics. Additionally, China's massive telecommunications infrastructure development and its growing domestic consumer electronics sector contribute immensely to the expansion. The continuous growth in these sectors positions China as a critical and rapidly evolving for laser optics.

North America Laser Optics Market Insights

The market in North America is significantly influenced by its strong industrial base and consistent innovation in advanced technologies. The region benefits from substantial investments in research and development, particularly in sectors such as medical devices, aerospace, and defense. The presence of numerous leading technology companies and research institutions contributes to a high demand for advanced laser optics in various applications, from precision manufacturing and scientific instrumentation to advanced communication systems. Furthermore, the robust healthcare infrastructure and the increasing adoption of minimally invasive laser-based procedures also act as strong drivers, solidifying North America's important position in the global landscape.

U.S. Laser Optics Market Trends

In North America, the U.S. is a key contributor to the laser optics industry. Its leadership stems from a highly developed economy, a strong emphasis on technological advancements, and significant government and private sector funding for research. The U.S. is a hub for innovation in diverse fields, including advanced manufacturing, telecommunications, and a rapidly expanding medical technology sector. The country's strong defense sector also drives demand for high-performance laser optics for various military applications. This environment fosters the development and early adoption of new laser technologies and their optical components, making the U.S. a vital for laser optics industry ecosystems.

Europe Laser Optics Market Outlook

The European laser optics market is characterized by a strong tradition in precision engineering and a growing focus on industrial automation and advanced manufacturing. Many European countries are at the forefront of developing and implementing sophisticated laser processing technologies for industries such as automotive, machinery, and electronics. The region's commitment to research and innovation, often supported by various European Union initiatives, ensures a steady demand for high-quality laser optics. Furthermore, the well-established medical device sector in Europe contributes significantly with the increasing applications of lasers in diagnostics and therapies.

The Germany laser optics market plays a prominent role in the European landscape. Its position as a global leader in mechanical engineering and automotive manufacturing creates a robust demand for industrial laser processing solutions, which inherently require advanced laser optics. The country has a long-standing reputation for precision optics and a strong ecosystem of specialized manufacturers, research institutes, and universities collaborating on photonic technologies. This strong domestic industrial base, coupled with significant investments in research and development, ensures that Germany remains a crucial for innovative laser optics in Europe.

Key Players and Competitive Insights

The laser optics market is characterized by a mix of established global corporations and specialized manufacturers, all vying for leadership through innovation, product quality, and strategic partnerships. The competitive landscape is shaped by continuous advancements in laser technology, increasing demand across diverse applications, and the need for highly precise and reliable optical components. Companies often differentiate themselves through their research and development capabilities, offering customized solutions, and focusing on niche markets. Strategic collaborations, and mergers and acquisitions are common as companies seek to expand their product portfolios, enhance technological capabilities, and strengthen their regional presence. The intense competition drives innovation in materials, manufacturing processes, and design, leading to improved performance and cost-effectiveness of laser optics.

A few prominent companies in the landscape include Coherent Corp.; Edmund Optics Inc.; IPG Photonics Corporation; Thorlabs, Inc.; Schott AG; Lumentum Holdings Inc.; Sumitomo Electric Industries, Ltd.; Jenoptik AG; MKS Instruments, Inc.; and ZEISS International.

Key Players

- Coherent Corp.

- Edmund Optics Inc.

- IPG Photonics Corporation

- Jenoptik AG

- Lumentum Holdings Inc.

- MKS Instruments, Inc.

- Schott AG

- Sumitomo Electric Industries, Ltd.

- Thorlabs, Inc.

- ZEISS International

Laser Optics Industry Developments

June 2025: During the Laser World of Photonics (LWoP) 2025 event in Munich, Han’s Laser showcased over 40 innovative products, including the complete lineup of the new “Han’s Handheld Welding Family.”

May 2025: JENOPTIK AG launched the Modular Beam Splitting System (MBSS), aimed at delivering high-precision and efficient laser processing for solar cells.

Laser Optics Market Segmentation

By Components Outlook (Revenue – USD Billion, 2020–2034)

- Laser Mirrors & Windows

- Lenses

- Filters

- Optical Modulator

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Laser Processing

- Optical Communication

- Medical Laser Systems

- Barcode Scanner

- Others

By End-User Industry Outlook (Revenue – USD Billion, 2020–2034)

- Telecommunications & Consumer Electronics

- Medical

- Semiconductors & Electronics

- Aerospace & Automotive

- Research

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Laser Optics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 9.18 billion |

|

Market Size in 2025 |

USD 10.22 billion |

|

Revenue Forecast by 2034 |

USD 27.46 billion |

|

CAGR |

11.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.18 billion in 2024 and is projected to grow to USD 27.46 billion by 2034.

The global market is projected to register a CAGR of 11.6% during the forecast period.

North America dominated the share in 2024.

A few key players include Coherent Corp.; Edmund Optics Inc.; IPG Photonics Corporation; Thorlabs, Inc.; Schott AG; Lumentum Holdings Inc.; Sumitomo Electric Industries, Ltd.; Jenoptik AG; MKS Instruments, Inc.; and ZEISS International.

The optical modulator segment accounted for the largest share in 2024.

The laser processing segment is expected to witness the fastest growth during the forecast period.