Optical Imaging Systems Market Share, Size, Trends, Industry Analysis Report

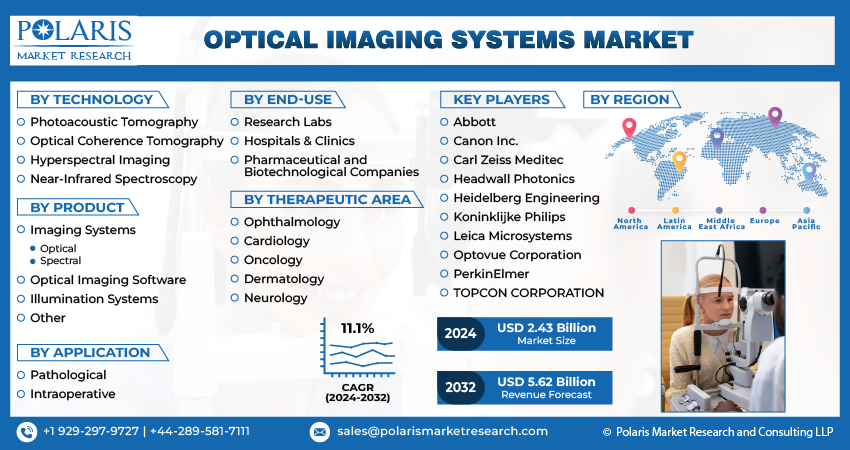

By Technology, By Product, By Application (Pathological, Intraoperative), By Therapeutic Area, By End Use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Aug-2025

- Pages: 150

- Format: PDF

- Report ID: PM4197

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global Optical Imaging Systems Market was valued at USD 2.5 billion in 2024 and is projected to grow at a CAGR of 10.01% from 2025 to 2034. Technological advancements in biomedical imaging, non-invasive diagnostics, and real-time visualization tools are key growth enablers.

Optical imaging systems present significant potential for enhancing disease diagnosis and improving disease prevention and treatment within the healthcare sector. The market is experiencing growth driven by the expanding range of applications and a growing preference for noninvasive technologies. Additionally, the increasing incidence of chronic diseases and eye disorders contributes to the market's expansion. The sales of optical imaging systems are anticipated to surge, propelled by a rising demand for effective solutions and a heightened focus on the early detection of diseases.

To Understand More About this Research: Request a Free Sample Report

Optical imaging systems play a crucial role in various applications, including preclinical research, disease diagnosis, and the scanning of numerous cellular and molecular in vivo processes. These processes encompass critical activities such as protein integration, protein degradation, and protease activity. The market for optical imaging systems has garnered widespread acceptance, particularly from biotechnological and pharmaceutical companies that leverage the technology for its diverse applications.

The expanding range of applications for optical imaging systems is expected to drive market growth throughout the forecast period. Another significant contributing factor to this growth is the rising prevalence of eye disorders. Ophthalmologists increasingly utilize optical imaging systems for the diagnosis of various eye disorders. As the prevalence of such disorders continues to increase, there is a corresponding growth in the patient pool seeking diagnostic services. This surge in demand for eye disorder diagnosis is consequently propelling the sales of optical imaging systems.

As per data from the CDC, approximately 6.8% of children under the age of 18 in the U.S. have been diagnosed with an eye and vision condition. Furthermore, the organization reports that there are around 12 million individuals aged 40 and over in the U.S. with vision impairment. Among them, 3 million experience vision impairment even with correction, 1 million are classified as blind, and 8 million have vision impairment attributed to uncorrected refractive error.

Growth Drivers

Advancements in imaging technology

One of the notable advantages of optical imaging technology lies in its remarkable flexibility, attributed to its multispectral potential and high resolution. This capability allows it to provide detailed insights into biological processes at the cellular and molecular levels. Specifically, in the context of diagnosing and treating atherosclerosis and related diseases, optical imaging systems offer precision and clarity in capturing intricate details. This aids healthcare professionals in understanding the underlying biological mechanisms, facilitating more accurate diagnoses and targeted treatment strategies. The versatility and advanced capabilities of optical imaging contribute to its prominence in biomedical research and clinical applications within the healthcare sector.

Report Segmentation

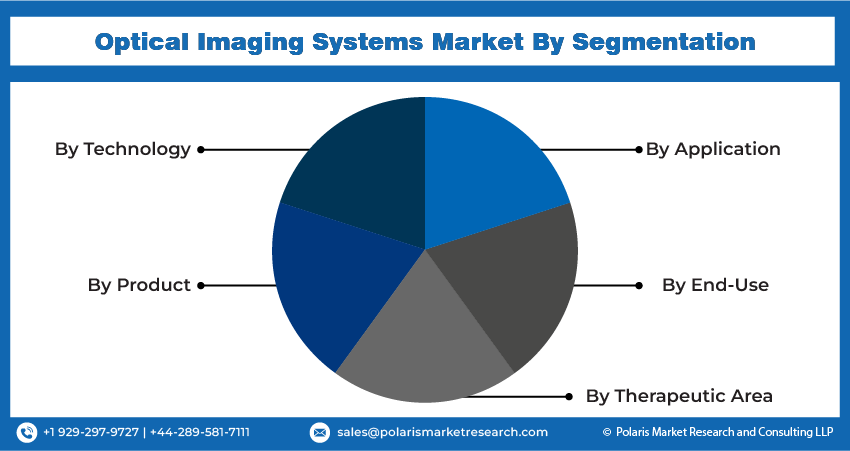

The market is primarily segmented based on technology, product, application, end use, therapeutic area, and region.

|

By Technology |

By Product |

By Application |

By End-Use |

By Therapeutic Area |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

Optical coherence tomography segment held the largest share in 2024

The optical coherence tomography segment held the largest share. This leadership position is attributed to the increased adoption of optical imaging systems for intravascular imaging within the diagnostic domain. The market's growth is further anticipated to be propelled by recent technological advancements in optical coherence tomography. Key players in the market are actively concentrating on the development of sophisticated optical coherence tomography devices, strategically aiming to fortify their positions in the market.

The photoacoustic tomography segment is projected to grow at the fastest rate. Recognized as a hybrid noninvasive modality catering to both molecular and functional imaging, photoacoustic tomography is gaining prominence. The accelerated adoption of noninvasive technology and the superior performance demonstrated by optical tomography in biomedical imaging, in comparison to traditional optical imaging counterparts, are key factors driving the swift expansion of this technology.

By Product Analysis

Imaging systems segment registered the largest market share in 2024

Imaging systems segment accounted for the largest share. This growth is primarily driven by the growing utilization of imaging systems in disease diagnosis across diverse applications. The versatility of optical imaging, allowing for comprehensive spatial imaging scales spanning from cells to organ systems, has sparked renewed interest in its application in medical imaging. Additionally, optical imaging boasts diverse contrast mechanisms, providing the capability to differentiate between normal and pathological processes and tissues.

By Application Analysis

Pathological segment held the significant market revenue share in 2024

The pathological segment held the largest share and is expected to register the highest growth rate. This dominance is attributed to the increasing incidence of chronic diseases, driven by the adoption of sedentary lifestyles, unhealthy dietary habits, lack of exercise, a growing geriatric population, and heightened consumption of processed foods. According to the National Cancer Institute, as of January 2019, there were approximately 19.6 million cancer survivors in the U.S., and this figure is expected to rise to 22.2 million by 2030. The persistent increase in the prevalence of chronic diseases underscores the sustained dominance of the pathological segment throughout the forecast period.

By End Use Analysis

Research labs segment held the significant market revenue share in 2024

The research labs segment held the largest share. This dominance is primarily attributed to the escalating emphasis on R&D activities aimed at exploring various new applications of optical imaging. The expanding use of optical imaging methods in preclinical research and drug discovery processes is expected to drive significant growth in this segment. The anticipated surge in research and development endeavors within the life sciences sector is poised to bolster market growth further.

Pharmaceutical & biotechnology companies are expected to grow at the fastest rate. This growth is attributed to the escalating utilization of these systems in the preclinical & clinical studies conducted by concerned companies. Additionally, the strategic initiatives undertaken by companies with substantial investments in R&D to create new and technologically advanced products are expected to be key drivers for the growth of this segment throughout the forecast period.

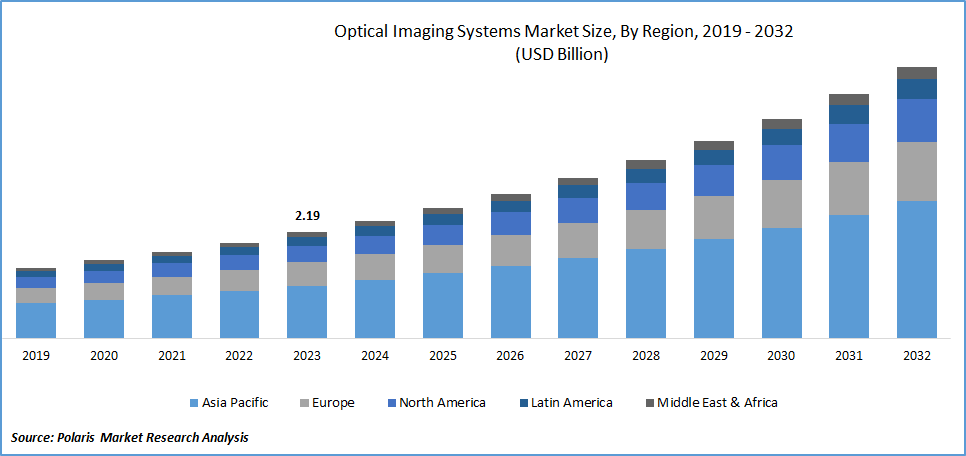

Regional Insights

North America region held the largest share of the global market in 2024

The North America region dominated the optical imaging systems market. The region’s dominance is due to the presence of skilled professionals, a well-established research infrastructure, and government initiatives aimed at fostering technological advancement in the industry through investments and funds. Furthermore, the rapid adoption of technologically advanced products in the region is anticipated to provide an additional impetus to market growth.

The Asia Pacific region is projected to grow at a rapid pace. This growth is due to the cost-effectiveness of research, favorable regulatory guidelines, and a rising geriatric population that is particularly susceptible to the development of chronic diseases. Additionally, the heightened focus on the healthcare sector by governments in the region stands as another significant driver contributing to the growth of this segment throughout the forecast period.

Key Market Players & Competitive Insights

The emergence of new mid or small-sized companies with a primary focus on optical imaging technology poses a threat. In response to this challenge, established key players are consistently prioritizing R&D activities and engaging in acquisitions of companies that can contribute to securing their market position.

Some of the major players operating in the global market include:

- Abbott

- Canon Inc.

- Carl Zeiss Meditec

- Headwall Photonics

- Heidelberg Engineering

- Koninklijke Philips

- Leica Microsystems

- Optovue Corporation

- PerkinElmer

- TOPCON CORPORATION

Recent Developments

- In July 2021, Topcon Corporation finalized the acquisition of VISIA Imaging, a manufacturer of ophthalmic devices.

Optical Imaging Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.8 billion |

|

Revenue forecast in 2034 |

USD 6.5 billion |

|

CAGR |

10.01% from 2025– 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Technology, Product, Application, End Use, Therapeutic Area, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Browse Our More Top Selling Reports:

Fishing Reels Market Size & Share

Stepper Motors Market Size & Share

Service Laboratory Market Size & Share

FAQ's

The global optical imaging systems market size is expected to reach USD 6.5 billion by 2034.

Abbott, PerkinElmer, Carl Zeiss Meditec, Leica Microsystems are top market players in the market.

North America region contribute notably towards the global Optical Imaging Systems Market.

The global optical imaging systems market is expected to grow at a CAGR of 10.01% during the forecast period.

Technology, product, application, end use, therapeutic area, and region are key segments in the Optical Imaging Systems Market.