Pharmaceutical Excipients Market Size, Share, Trends, Industry Analysis Report

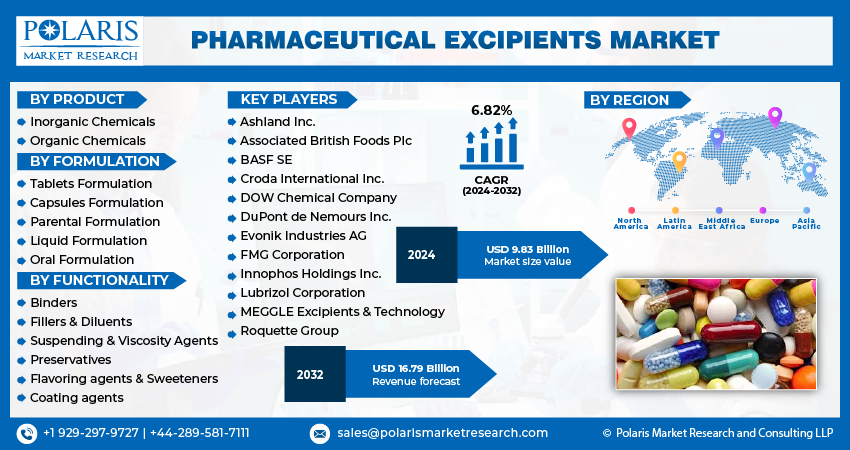

: By Product (Inorganic Chemicals and Organic Chemicals), Formulation, Functionality, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 117

- Format: PDF

- Report ID: PM3919

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The pharmaceutical excipients market was valued at USD 10.70 billion in 2024, growing at a CAGR of 6.6% during 2025–2034. The expanding pharmaceutical industry and increased demand for functional excipients that enhance bioavailability are a few of the key factors driving market growth.

Key Insights

- The organic chemicals segment accounts for a larger market share. The versatility and compatibility of organic chemicals drive their leading market share.

- The tablets formulation segment is projected to register significant growth. The stability, convenience, and cost-effectiveness of tablets make them a preferred dosage form.

- Europe accounts for a larger market share. The regional market dominance is attributed to its stringent regulatory framework and well-established pharmaceutical sector.

- Asia Pacific is registering the fastest growth. The introduction of favorable government policies and rising healthcare expenditures are a few of the key factors driving the regional market growth.

Industry Dynamics

- Rising investments by pharmaceutical companies in the expansion of their manufacturing facilities is fueling the demand for pharmaceutical excipients in drug manufacturing, driving market growth.

- Increased efforts for reforming clinical trial regulations is another key factor fueling market expansion.

- Advancements in drug delivery formulations are expected to provide several market opportunities.

- Regulatory compliance and stringent quality standards may hinder market growth.

Market Statistics

2024 Market Size: USD 10.70 billion

2034 Projected Market Size: USD 20.22 billion

CAGR (2025-2034): 6.6%

Europe: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The pharmaceutical excipients market encompasses the various substances used in drug formulations to enhance stability, bioavailability, and patient acceptability. Excipients serve as carriers, fillers, binders, disintegrants, preservatives, and coating agents, ensuring the effective delivery and performance of active pharmaceutical ingredients (APIs). The market is driven by the growing pharmaceutical industry, advancements in drug formulations, and increasing demand for functional excipients that improve drug solubility and bioavailability. Additionally, the rising prevalence of chronic diseases and the expansion of generics and biologics further support market growth.

Key drivers influencing the pharmaceutical excipients market trends include the increasing adoption of innovative drug delivery systems, the rising demand for oral and parenteral formulations, and stringent regulatory requirements promoting the use of high-quality excipients. The growing preference for multifunctional and co-processed excipients to optimize drug formulation processes also contributes to pharmaceutical excipients market expansion. Furthermore, the development of biopharmaceuticals and personalized medicine is fueling the demand for novel excipients with enhanced performance characteristics.

Market Dynamics

Rising Investments in Pharmaceutical Manufacturing

The companies worldwide are investing substantially to expand the manufacturing facilities. For instance, in February 2025, Eli Lilly announced a USD 27 billion investment to establish four manufacturing mega-sites in the US. This substantial investment to expand manufacturing facility is driving the demand for the pharmaceutical excipients in drug manufacturing to improve stability, bioavailability, and patient acceptability. Additionally, government initiatives are expected to increase the demand for locally sourced excipients, as pharmaceutical companies seek to comply with new regulations and benefit from government incentives, thereby driving the pharmaceutical excipients market growth.

Regulatory Reforms Enhancing Clinical Trial Processes

Efforts to reform clinical trial regulations are driving the pharmaceutical excipients market demand. Improved regulatory reforms support streamlining regulatory processes and offering incentives to attract more trials. Such changes are anticipated to increase pharmaceutical research and development activities, subsequently elevating the demand for specialized excipients required in various drug formulations. Thus, regulatory reforms enhancing clinical trial processes are fueling the pharmaceutical excipients market development.

Market Segment Insights

Assessment – By Product

The pharmaceutical excipients market, by product, is segmented into inorganic chemicals and organic chemicals. The organic chemicals segment holds a larger pharmaceutical excipients market share, driven by their versatility and compatibility in drug formulation. This category includes oleochemicals, carbohydrates, petrochemicals, and proteins, which are integral in enhancing the stability, bioavailability, and patient acceptability of pharmaceutical products. The rising preference for organic excipients is largely attributed to their nontoxic nature, biocompatibility, and environmental sustainability, making them favorable choices in the development of various dosage forms such as tablets, capsules, and liquid formulations. Additionally, the growing consumer inclination toward natural and plant-based products has further propelled the demand for organic excipients in the pharmaceutical industry.

Evaluation – By Formulation

The pharmaceutical excipients market, by formulation, is segmented into tablets formulation, capsules formulation, parental formulation, liquid formulation, and oral formulation. The tablets formulation segment is expected to witness significant growth during the forecast period. This growth is attributed to the widespread use of tablets as a preferred dosage form due to their convenience, stability, and cost-effectiveness. Tablets offer precise dosing, ease of administration, and extended shelf life, which contribute to their extensive adoption across therapeutic areas. The increasing prevalence of chronic diseases and the rising demand for oral solid dosage forms further support the growth of the tablets formulation segment. Additionally, advancements in tablet manufacturing technologies, such as coated and controlled-release tablets, enhance patient compliance and drive the segment's expansion.

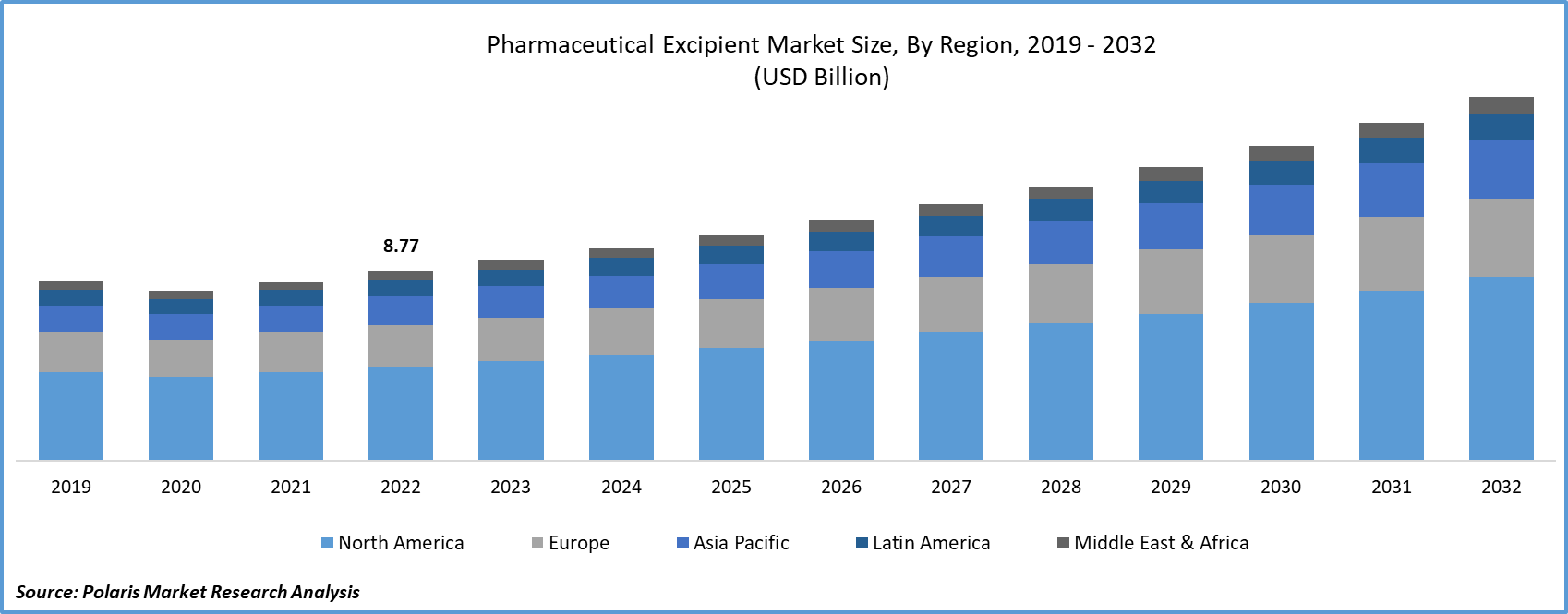

Regional Insights

By region, the study provides pharmaceutical excipients market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe holds the largest market share due to its well-established pharmaceutical industry, stringent regulatory framework, and continuous advancements in drug formulation technologies. The presence of key pharmaceutical companies and contract manufacturing organizations (CMOs) has contributed to the growing demand for high-quality excipients in the region. Regulatory agencies such as the European Medicines Agency (EMA) enforce strict quality standards, driving the adoption of functional and co-processed excipients to enhance drug formulations. Additionally, the increasing demand for generic medicines and biosimilars, particularly in countries such as Germany, France, and the UK, supports market growth. The region’s focus on innovation and sustainability has also led to the rising adoption of naturally derived and multifunctional excipients.

The Asia Pacific pharmaceutical excipients market is experiencing rapid growth, driven by expanding pharmaceutical manufacturing, increasing healthcare expenditures, and favorable government policies. Countries such as China, India, and Japan are key contributors, with China and India serving as major hubs for pharmaceutical production and exports. The region benefits from a cost-effective manufacturing landscape, strong generic drug production, and rising investments in research and development. Government initiatives aimed at strengthening domestic pharmaceutical industries and improving drug accessibility further propel demand for excipients. Additionally, the growing prevalence of chronic diseases and the rising adoption of novel drug delivery systems have increased the need for specialized excipients in the region.

Key Players and Competitive Insights

The pharmaceutical excipients market features several prominent companies actively contributing to the industry. These include The Lubrizol Corporation; Archer Daniels Midland Company; DuPont de Nemours, Inc.; BASF SE; Evonik Industries AG; Ashland Global Holdings Inc.; Roquette Frères; Kerry Group plc; Croda International Plc; DFE Pharma; JRS Pharma; Colorcon, Inc.; MEGGLE GmbH & Co. KG; Wacker Chemie AG; and Associated British Foods plc. Each of these entities plays a vital role in supplying essential excipients for pharmaceutical formulations.

Kerry Group plc provides a wide array of taste and nutrition solutions, including excipients that improve drug palatability. Croda International Plc offers specialized lipid-based excipients, facilitating advanced drug delivery mechanisms. DFE Pharma and JRS Pharma are known for their excipient expertise, supplying high-quality lactose and cellulose-based products, respectively. Colorcon, Inc. excels in film coating technologies, enhancing the aesthetic and functional properties of oral dosage forms. MEGGLE GmbH & Co. KG provides lactose-based excipients, while Wacker Chemie AG offers cyclodextrins and other specialized excipients. Associated British Foods plc, through its subsidiary SPI Pharma, delivers a range of excipients focusing on patient-friendly formulations.

The Lubrizol Corporation, a subsidiary of Berkshire Hathaway, specializes in specialty chemicals, delivering solutions that enhance the performance of products across various industries, including pharmaceuticals. Their expertise in polymer technologies and excipients plays a crucial role in drug formulation and delivery systems.

BASF SE, headquartered in Germany, is a prominent chemical company with a diverse portfolio encompassing chemicals, materials, and solutions for various sectors. In the pharmaceutical excipients market, BASF offers a wide range of products that aid in drug formulation, stability, and bioavailability.

List of Key Companies

- Archer Daniels Midland Company

- Ashland Global Holdings Inc.

- Associated British Foods plc

- BASF SE

- Colorcon, Inc.

- Croda International Plc

- DFE Pharma

- DuPont de Nemours, Inc.

- Evonik Industries AG

- JRS Pharma

- Kerry Group plc

- MEGGLE GmbH & Co. KG

- Roquette Frères

- The Lubrizol Corporation

- Wacker Chemie AG

Pharmaceutical Excipients Industry Developments

-

May 2025: Roquette revealed the completion of the acquisition of IFF Pharma Solutions. According to Roquette, the acquisition is a major step in its goal of becoming a key player in support of the global pharma markets.

-

November 2024: Nagase Vitta announced an injectable-grade stabilizer, SUCROSE SG. The company revealed that the stabilizer is eco-friendly and is designed to improve the stability of biopharmaceutical formulations.

- November 2024: Clariant's new high-performing excipients were introduced at CPHI India 2024, showcasing products designed for sensitive APIs, parenteral formulations, and colorless applications, enhancing global pharmaceutical solutions and compliance.

- October 2023: Three new excipient grades, LYCATAB CT-LM, MICROCEL 103 SD, and MICROCEL 113 SD, were introduced by Roquette at CPHI Barcelona, enhancing moisture protection for moisture-sensitive pharmaceutical formulations.

Pharmaceutical Excipients Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Inorganic Chemicals

- Organic Chemicals

By Formulation Outlook (Revenue-USD Billion, 2020–2034)

- Tablets Formulation

- Capsules Formulation

- Parental Formulation

- Liquid Formulation

- Oral Formulation

By Functionality Outlook (Revenue-USD Billion, 2020–2034)

- Blinders

- Fillers & Diluents

- Suspending & Viscosity agents

- Preservatives

- Flavoring Agents & Sweeteners

- Coating Agents

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Pharmaceutical Excipients Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 10.70 billion |

|

Market Size Value in 2025 |

USD 11.37 billion |

|

Revenue Forecast by 2034 |

USD 20.22 billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The pharmaceutical excipients market has been segmented into detailed segments of product, formulation, and functionality. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The pharmaceutical excipients market expansion and marketing strategy focuses on product innovation, strategic collaborations, and geographic expansion. Companies are investing in research and development to introduce multifunctional and co-processed excipients that enhance drug formulation efficiency and patient compliance. Partnerships with pharmaceutical manufacturers and contract research organizations (CROs) are strengthening distribution networks and improving market reach. Regulatory compliance and adherence to quality standards are key priorities, ensuring product acceptance across global markets. Additionally, sustainability-driven initiatives, including the development of plant-based and biodegradable excipients, are gaining traction to align with evolving industry trends and regulatory expectations.

FAQ's

The market size was valued at USD 10.70 billion in 2024 and is projected to grow to USD 20.22 billion by 2034.

The market is projected to register a CAGR of 6.6% during the forecast period.

Europe had the largest share of the market in 2024.

A few key players in the market include The Lubrizol Corporation; Archer Daniels Midland Company; DuPont de Nemours, Inc.; BASF SE; Evonik Industries AG; Ashland Global Holdings Inc.; Roquette Frères; Kerry Group plc; Croda International Plc; DFE Pharma; JRS Pharma; Colorcon, Inc.; MEGGLE GmbH & Co. KG; Wacker Chemie AG; and Associated British Foods plc.

The organic chemicals segment accounted for the larger share of the market in 2024.

The tablet segment is expected to witness significant growth during the forecast period.