Service Laboratory Market Share, Size, Trends, Industry Analysis Report

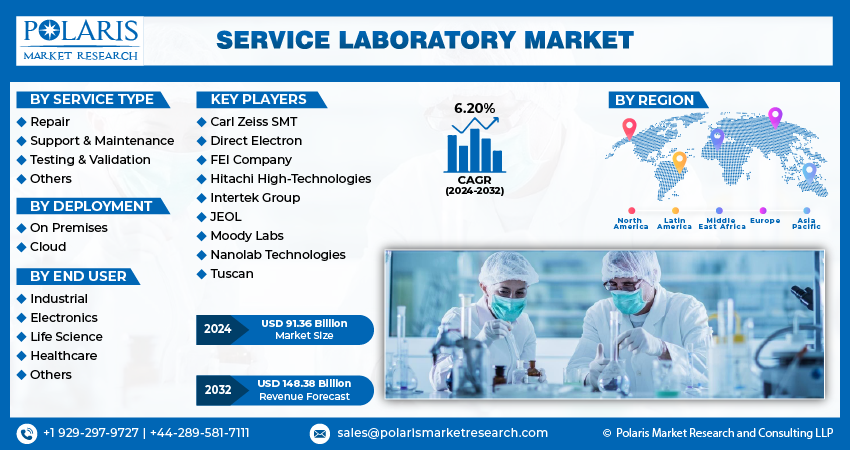

By Service Type (Repair, Support & Maintenance, Testing & Validation, and Others); By Deployment; By End User; By Region; Segment Forecast, 2024-2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM3851

- Base Year: 2023

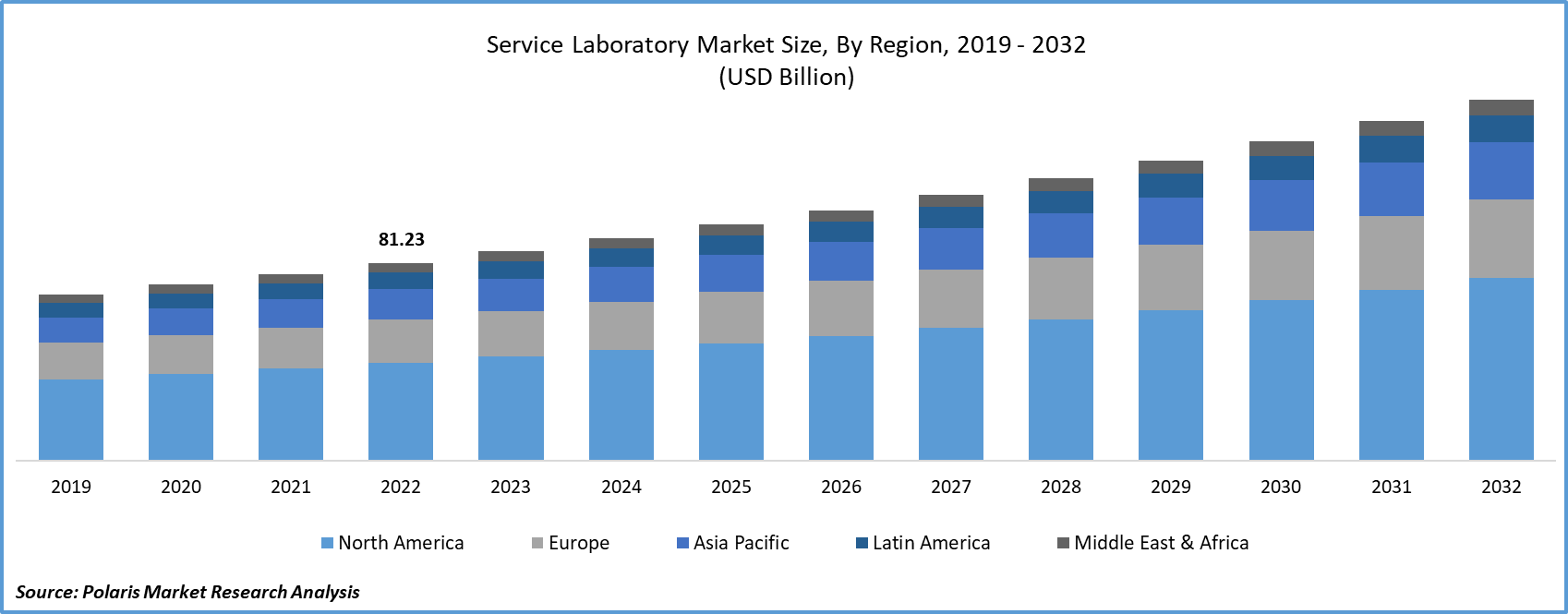

- Historical Data: 2019-2022

Report Outlook

The global service laboratory market size and share was valued at USD 86.13 billion in 2023 and is expected to grow at a CAGR of 6.20% during the forecast period.

Modern laboratories could be revolutionized by automating the processing of physical samples, the generation of patient lab test results, and the reporting of those results due to the development of ultrafast cloud computing, robots, and AI technology.

A laboratory is a facility that offers a controlled environment in which scientific research, testing, and experiments can be performed. Many healthcare units, companies, and research organizations tend to have their labs where they can conduct experiments and carry out tests. However, some companies may take the help of outside laboratories to perform their tests and experiments.

A service laboratory is a specialized setting that provides a wide range of analytical, testing, and research services. Organizations, researchers, and industries use service laboratories to get reliable and accurate data to support their projects. Service laboratory market key players employ top-notch equipment, cutting-edge technology skilled professionals to perform a wide range of experiments and analyses.

The services provided by these laboratories have a wide range of end uses across several sectors. They include oil & gas, automotive, chemical, semiconductor, life science and healthcare. The adaptability of these facilities makes them essential for addressing several sophisticated and multifaceted issues faced by various industries. Furthermore, these labs also act as collaboration hubs that encourage interdisciplinary research and cross-industry partnerships.

To Understand More About this Research: Request a Free Sample Report

- For instance, in June 2023, Inify Laboratories released AI-powered cancer diagnostic services. By helping scientists to evaluate and understand massive amounts of data rapidly and accurately, AI is revolutionizing the field of lab technology. Improvement in digitalization is transforming the services in laboratories and helping the global market.

Service laboratories offer a range of services to support various industries and their specific needs. Repair services help laboratories extend the lifespan of their equipment, reduce downtime, and avoid the cost of purchasing new instruments. Service laboratories offer ongoing support and maintenance services for laboratory equipment. It includes preventive maintenance, calibration, and routine inspections to ensure that instruments are operating accurately and in compliance with relevant standards. Additionally, service laboratories may offer validation services for laboratory methods, equipment qualification, and process validation, ensuring that laboratories adhere to regulatory requirements and industry standards.

The need for testing during the COVID-19 pandemic skyrocketed, driving a surge in demand for laboratory testing services. Service laboratories played a crucial role in conducting COVID-19 diagnostic tests, including PCR tests, antigen tests, and antibody tests. The high volume of testing required laboratories to ramp up their capacity, expand their capabilities, and adopt new testing methodologies. The pandemic spurred an unprecedented level of research and development activities related to COVID-19. Laboratories focused their efforts on developing vaccines, treatments, and diagnostic tools for the virus. It led to increased demand for laboratory services, including sample analysis, clinical trials, genomic sequencing, and data analysis.

Moreover, the pandemic highlighted the importance of biosafety and biosecurity measures in laboratories. Laboratories had to strengthen their protocols to ensure the safe handling and processing of infectious samples, including SARS-CoV-2. It led to increased demand for services related to biosafety training, risk assessment, facility design, and adherence to regulatory guidelines.

The research report offers a quantitative and qualitative analysis of the service laboratory market size and share to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

Industry Dynamics

Growth Drivers

Advancements in Technology

Rapid advancements in laboratory equipment and technologies, such as automation, data analytics, and high-throughput screening, enable service laboratories to offer more efficient and accurate testing and analysis, attracting more clients, which drives the market.

As industry competitors concentrate on forming strategic alliances and partnerships to support market expansion, independent labs are coming together. In October 2020, CENTOGENE collaborated with U-Diagnostics to increase its reach across the Netherlands. To enhance and expand diagnostic testing services across 2,500 labs, Targos Molecular Pathology & HistoCyte Laboratories signed a cooperation agreement with Diaceutics in July 2020. The market for clinical laboratory services has increased as a result of these changes.

Cloud deployment drives the Service Laboratory market by providing cost-effective, scalable, and secure solutions for data storage, collaboration, analytics, and integration. For example, in March 2023, KYNDRYL was chosen by DR LAL PATHLABS for the management of seamless cloud services. The world's largest provider of IT infrastructure services, Kyndryl, has been chosen by Dr. Lal PathLabs, with more than 250 labs & 4500 sample access points, to manage its entire IT infrastructure stack. These enable laboratories to optimize resources, enhance research capabilities, improve collaboration, & accelerate scientific discoveries.

Report Segmentation

The market is primarily segmented based on service type, deployment, end user, and region.

|

By Service Type |

By Deployment |

By End User |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Type Analysis

The repair segment held the largest market share in 2022

In 2022, the repair segment held the largest market share, which often offers a more cost-effective solution compared to other service types. Laboratories, especially those operating on tight budgets, prefer repair services as they allow them to restore and extend the lifespan of their equipment at a fraction of the cost of purchasing new ones. Further, this enables laboratories to prolong the lifespan of their equipment. By regularly maintaining and repairing their instruments, laboratories can avoid premature equipment failure and the need for costly replacements.

Also, this type of service can offer customized solutions tailored to the specific needs of laboratories. They can address unique challenges and requirements associated with different types of equipment. By providing personalized repair services, providers can build long-term relationships with laboratories and establish themselves as trusted partners in equipment maintenance.

By Deployment Analysis

The cloud segment accounted for the highest market share during the forecast period.

The cloud segment accounted for the highest market share during the forecast period. Cloud services offer vast storage capabilities, allowing laboratories to store and access large amounts of data securely. It is particularly important for laboratories dealing with substantial volumes of research data, experimental results, and samples. Cloud-based storage solutions eliminate the need for physical storage infrastructure and enable convenient access to data from anywhere with an internet connection. Moreover, Cloud services offer scalability, allowing laboratories to easily adjust their computing and storage resources based on their needs. It is particularly advantageous for laboratories that experience fluctuating workloads or those that require additional resources for specific projects.

By End User Analysis

The life science segment dominated the global market in 2022

The life science segment dominated the global market in 2022, which encompasses pharmaceuticals, biotechnology, and biomedical research, and has witnessed significant growth in recent years. The demand for advanced research and development activities, including drug discovery, genomics, proteomics, and personalized medicine, has fuelled the need for specialized laboratory services.

Service laboratories catering to the life science segment have experienced increased demand for their expertise and services. Furthermore, companies often prefer to concentrate on their core competencies, such as drug discovery or clinical trials, while outsourcing laboratory services to specialized providers. Service laboratories offer a wide array of services, including sample preparation, analytical testing, bioassays, & data analysis.

Regional Insights

North America dominated the largest market share in 2022

In 2022, North America dominated the largest market share, particularly the United States, which has a highly developed healthcare and life sciences industry. For example, the third-largest sector of the American economy is healthcare. The U.S. spends the most on healthcare ($10,224 per person). The United States spends twice as much on healthcare as other nations. The region is home to numerous pharmaceutical companies, biotechnology firms, research institutions, and academic centers that heavily rely on laboratory services for research, development, and testing.

Asia Pacific accounted for the fastest-growing region during the forecast period. Countries are implementing initiatives to promote research and development, healthcare infrastructure development, and innovation. For example, recently, the Indian government struck credit deals with foreign organizations to borrow up to INR 13,879 crore for the improvement of its healthcare infrastructure. Loan contracts for USD 300 million with the Asian Development Bank (ADB) and 50 billion yen with the Japan International Cooperation Agency (JICA) have both been inked. IBRD (International Bank for Reconstruction and Development) has been given a USD 1 billion approval from the World Bank for PM-ABHIM. This factor is largely heightening the growth of the market in this region at a rapid pace.

Key Market Players & Competitive Insights

Kery players are crucial for understanding the dynamics of the Service Laboratory Market, which is marked by intense competition and evolving trends. By gaining insights into competitive forces, market participants can make informed decisions, adapt to changing conditions, and identify growth opportunities.

The major global players include;

- Carl Zeiss SMT

- Direct Electron

- FEI Company

- Hitachi High-Technologies

- Intertek Group

- JEOL

- Moody Labs

- Nanolab Technologies

- Tuscan

Recent Developments

- In June 2022, the expansion of the CB Trial Laboratory is improving LabCorp's drug development capabilities in the country.

Service Laboratory Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 91.36 billion |

|

Revenue forecast in 2032 |

USD 148.38 billion |

|

CAGR |

6.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Service Type, By Deployment, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of the service laboratory market in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 202932 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

FAQ's

The global service laboratory market size is expected to reach USD 148.38 billion by 2032.

Key players in the market are Carl Zeiss SMT, Direct Electron, FEI Company, Hitachi High-Technologies, Intertek Group.

North America contribute notably towards the global service laboratory market.

The global service laboratory market is expected to grow at a CAGR of 6.2% during the forecast period.

The service laboratory market report covering key segments are service type, deployment, end user, and region.