Optical Sensors Market Share, Size, Trends, Industry Analysis Report

By Type (Extrinsic Sensor, Intrinsic Sensor); By Sensor Type; By Application; By End-use; By Region; And Segment Forecasts, 2024 - 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4581

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

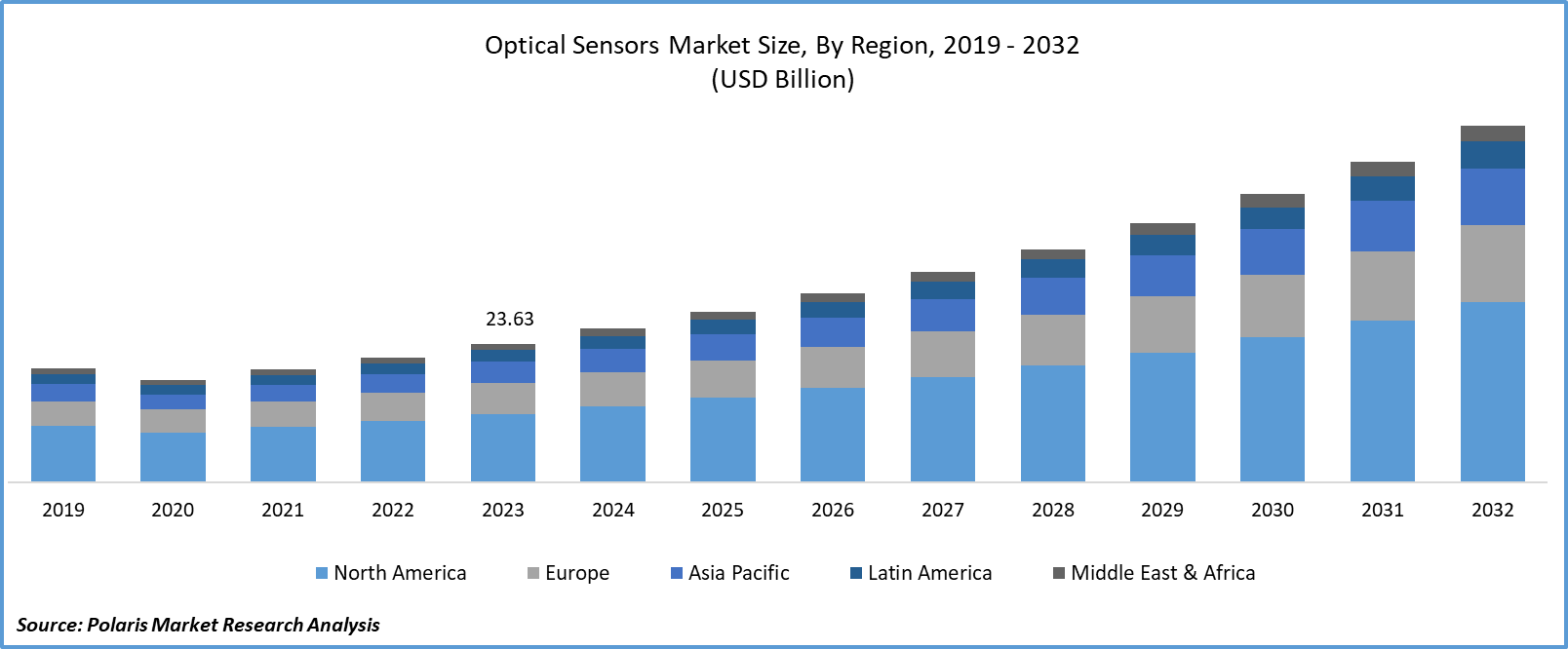

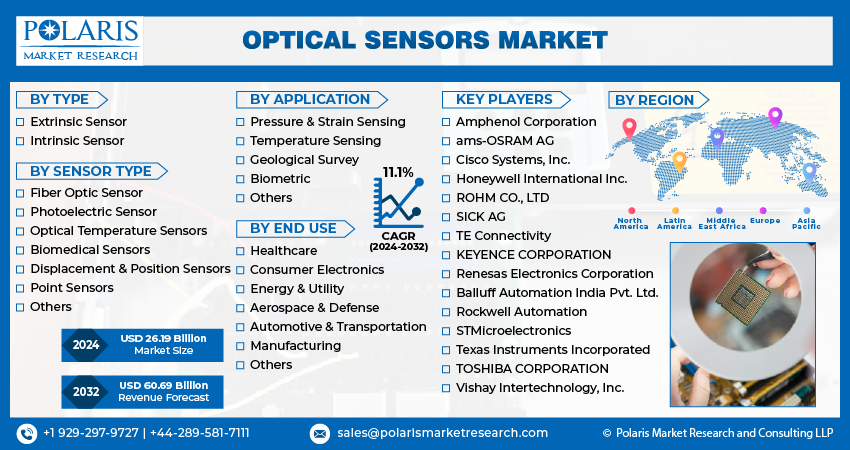

Global optical sensors market size was valued at USD 23.63 billion in 2023. The market is anticipated to grow from USD 26.19 billion in 2024 to USD 60.69 billion by 2032, exhibiting the CAGR of 11.1% during the forecast period.

Market Overview

The optical sensors market finds applications across diverse industries, including telecommunications, healthcare, automotive, aerospace, consumer electronics, industrial automation, and more. Their ability to detect and measure light makes them versatile for various sensing tasks. Ongoing advancements in optical sensor technologies, such as improvements in sensitivity, resolution, and miniaturization, contribute to expanding their scope. Innovations may lead to the development of new applications and markets. The increasing demand for consumer electronic devices, such as smartphones, tablets, cameras, and wearables, drives the use of optical sensors for applications like gesture recognition, ambient light sensing, and proximity sensing.

The market is witnessing substantial expansion owing to its varied applications across diverse industries. In the consumer electronics sector, optical sensors play a crucial role in enhancing display technologies, improving the functionality of digital cameras, and driving innovations in optical mice for computers. These sensors are essential for advancing safety functionalities such as automatic headlights and adaptive cruise control systems in the automotive industry. Furthermore, the medical field leverages optical sensors for diagnostics, imaging, and surgical instruments, facilitating minimally invasive procedures.

To Understand More About this Research: Request a Free Sample Report

For instance, in July 2022, Sony Corporation unveiled plans to launch the IMX675, a 1/3-type CMOS image sensor designed for security cameras. With around 5.12 megapixels, the sensor offers simultaneous full-pixel output of captured images along with rapid production of specific areas of interest.

The demand for optical sensors market, including various sensors, continues to grow across various industries. Pressure sensors play a crucial role in industrial applications, monitoring and measuring pressure changes in real time. Fiber optic sensors, known for their precision and reliability, are in high demand, especially in telecommunications, industrial automation, and healthcare. The fiber optic temperature sensors contribute to accurate temperature measurements in critical environments, such as industrial processes and medical applications. The combined demand for these optical sensors reflects the ongoing importance of advanced sensing technologies in enhancing efficiency, safety, and performance across a diverse range of sectors.

Furthermore, as industries increasingly adopt robotics and automation as part of Industry 4.0, there is a growing demand for precision in operations, highlighting the necessity for photoelectric sensors. The packaging, material handling, and automotive sectors have underscored the importance of photoelectric sensors, particularly due to the integration of the Industrial Internet of Things (IIoT) with Big Data and the dependence on data provided by intelligent sensors.

Growth Factors

Rising Adoption in Industrial Settings

The increasing adoption of optical sensors in industrial settings has seen widespread use, playing key roles in quality control systems, robotics, and environmental monitoring. The growing demand for optical sensors is driven by the quest for greater efficiency, precision, and miniaturization, alongside the rising requirement for automation and accuracy across diverse industries. This period represents a notable transition towards incorporating optical sensor technologies into commonplace devices, driving progress across multiple sectors and fostering avenues for future optical sensors market trends.

Advancement of LiDAR Sensors

Light Detection and Ranging (LiDAR) technology has seen a remarkable uptake recently, largely fuelled by its integration into the autonomous vehicle sector. LiDAR sensors utilize laser pulses to generate detailed 3D maps of the environment, enabling safe and precise navigation for autonomous vehicles. As the autonomous vehicle market size expands, the demand for LiDAR sensors is projected to surge.

Innovations in LiDAR technology are underway to address industry needs, including the development of compact, lightweight, and cost-efficient solid-state systems, replacing traditional bulky setups. Moreover, the integration of optical sensing with artificial intelligence (AI) and machine learning has enhanced object detection and recognition capabilities, bolstering the safety and dependability of autonomous vehicles.

Restraining Factors

Regulatory Compliances

The increasing regulatory oversight serves as a restraint factor in the optical sensors market, particularly concerning regulatory compliances. As the market experiences continuous growth, regulations governing optical sensors are becoming more stringent, encompassing various aspects such as safety, precision, and industry-specific requirements. This heightened regulatory environment poses challenges for companies operating in the optical sensors market. Different industries have specific regulatory requirements for the use of optical sensors. For example, the automotive industry may have distinct regulations compared to healthcare or industrial automation. Adhering to these industry-specific regulations requires manufacturers to customize their optical sensors accordingly, adding complexity to the development process.

Report Segmentation

The market is primarily segmented based on type, sensor type, application, end-use, and region.

|

By Type |

By Sensor Type |

By Application |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Insights

Intrinsic Sensors Segment Accounted for the Largest Market Share in 2023

In 2023, the intrinsic sensors segment accounted for the largest global market share. These sensors gauge a range of physical parameters such as strain, temperature, and pressure by altering the intensity, wavelength, or timing of light within fibers. Intrinsic optical sensors present fewer connectivity issues compared to extrinsic counterparts and pose challenges for multiplexing. They are predominantly employed for distributed sensing across extensive distances. Common applications include monitoring rotation, acceleration, strain, and acoustic pressure. In addition, intrinsic sensors exhibit resistance to electromagnetic interference and are capable of functioning in extreme temperature conditions.

The extrinsic sensor is a key segment that will grow rapidly. These sensors operate by transmitting modulated light from a non-fiber optical sensor through optical fibers coupled to an optical transmitter. Utilizing optics, they extract light from the fiber and modulate it within another medium. Extrinsic sensors are designed to measure various parameters, including rotation, vibration, displacement, acceleration, velocity, torque, and temperature.

By Sensor Type Insights

The Biomedical Sensors Segment is Expected to Witness the Fastest CAGR During the Forecast Period

The biomedical sensors segment is expected to witness the fastest CAGR during the forecast period. Biomedical sensors are electronic devices designed to convert diverse non-electrical parameters within biomedical domains into readily detectable electrical signals. As such, they play a vital role in healthcare diagnostics, enabling the market analysis of human physiological and pathological data.

The optical temperature sensors segment dominated the market. The surge in Industrial Internet of Things (IIoT) applications and the integration of smart manufacturing methods have heightened the requirement for temperature sensors. Precise temperature monitoring is essential for ensuring operational efficiency and averting critical breakdowns in both renewable energy and conventional power generation sectors. The expanding renewable energy sector offers substantial avenues for the growth of optical temperature sensors.

By Application Insights

The Biometric Segment Held the Largest Market Share in 2023

The biometric segment held the largest market share outlook in 2023. A dedicated sensor is essential for detecting biometric signals, with the specific sensor type contingent upon the nature of the biometric signal being measured. Integrating a biometric sensor into contactless payment cards enables users to authenticate each transaction using unique credentials like their fingerprints. The growing adoption of contactless payments worldwide is anticipated to drive the demand for biometric optical sensors.

Temperature sensors are expected to grow at the fastest rate. Advances in materials science and optical technology have led to the creation of sensors with heightened precision in temperature detection. This advancement entails the utilization of innovative materials to enhance both the modulation and detection of light. As a result, these sensors are increasingly integrated into Internet of Things (IoT) systems and smart networks, serving various industries, including home automation, industrial monitoring, and healthcare.

Regional Insights

Apac Region Accounted for the Largest Market Share in 2023

In 2023, the APAC region accounted for the largest market share. The rapid expansion of end-user sectors such as consumer electronics, industrial applications, automotive, and textiles is playing a pivotal role in propelling the optical sensors market growth. These sensors are instrumental in enhancing the efficiency of manufacturing operations by providing real-time data that can be promptly analyzed and utilized.

According to IBEF, the Indian appliances and consumer electronics industry recently recorded a value of USD 9.84 billion. It is anticipated to surpass INR 1.48 lakh crore (USD 21.18 billion) by 2025, more than doubling its current size.

North America is Expected to Witness the Fastest CAGR over the Forecast Period

North America is expected to witness the fastest CAGR over the forecast period. The extensive uptake of smartphones, electric vehicles, and diverse smart home solutions fuels the region’s growth. Moreover, the integration with prominent social media platforms enhances the exposure of live commerce events. Within the U.S. market, there is a notable uptick driven by heightened demand for advanced safety systems and automotive technology. Increasing consumer inclination towards road safety, coupled with growing government initiatives to mitigate road accidents, serves as the primary catalyst for the adoption of optical sensors in Advanced Driver Assistance Systems (ADAS).

As per the Annual Internet Report by Cisco, it is projected that by 2023, the number of network-connected devices and connections will approach nearly 29 billion.

Key Market Players & Competitive Insights

The optical sensors market is currently in a phase of moderate growth, with the pace of expansion accelerating. Notably, the market is marked by a significant level of innovation driven by swift technological progress. Ongoing and varied research and development initiatives in optical sensors are prevalent, due to the introduction of cutting-edge sensing devices and methodologies on a consistent basis. The key players in the optical sensors market, backed by comprehensive market statistics and facts, showcase a dynamic and evolving landscape. These industry leaders contribute significantly to the scope of the market, demonstrating innovation, technological advancements, and strategic initiatives.

Some of the major players operating in the global market include:

- Amphenol Corporation

- ams-OSRAM AG

- Balluff Automation India Pvt. Ltd.

- Cisco Systems, Inc.

- Honeywell International Inc.

- KEYENCE CORPORATION

- Renesas Electronics Corporation

- Rockwell Automation

- ROHM CO., LTD

- SICK AG

- STMicroelectronics

- TE Connectivity

- Texas Instruments Incorporated

- TOSHIBA CORPORATION

- Vishay Intertechnology, Inc.

Recent Developments in the Industry

- In July 2023, ams OSRAM unveiled the TCS3530, an advanced color sensor. This state-of-the-art sensor enables smartphone cameras to attain exceptional color accuracy irrespective of lighting variations. Additionally, it enhances displays to produce images with a more genuine and lifelike quality.

- In August 2022, Rockwell Automation introduced globally applicable Photoelectric Sensors. The newest additions, the 42JA VisiSight M20A and Allen-Bradley 42EA RightSight S18 photoelectric sensors, offer cost-effective and easily applicable sensing solutions. These sensors provide a diverse range of mounting options, sensing modes, and unique features, making them ideal solutions for operations on a global scale.

Report Coverage

- The optical sensors market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

- The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, type, sensor type, application, end use, and their futuristic growth opportunities.

Optical Sensors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 26.19 billion |

|

Revenue forecast in 2032 |

USD 60.69 billion |

|

CAGR |

11.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global optical sensors market size is expected to reach USD 60.69 billion by 2032

Key players in the market are ams-OSRAM, TOSHIBA, Texas Instruments, Renesas Electronics

North America contribute notably towards the global Optical Sensors Market

Global optical sensors market exhibiting the CAGR of 11.1% during the forecast period.

The Optical Sensors Market report covering key segments are type, sensor type, application, end use, and region.