Flavors Market Share, Size, Trends, Industry Analysis Report

By Ingredient (Synthetic, Natural); By Form; By Application; By Region; Segment Forecast, 2024- 2032

- Published Date:May-2024

- Pages: 116

- Format: PDF

- Report ID: PM4915

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

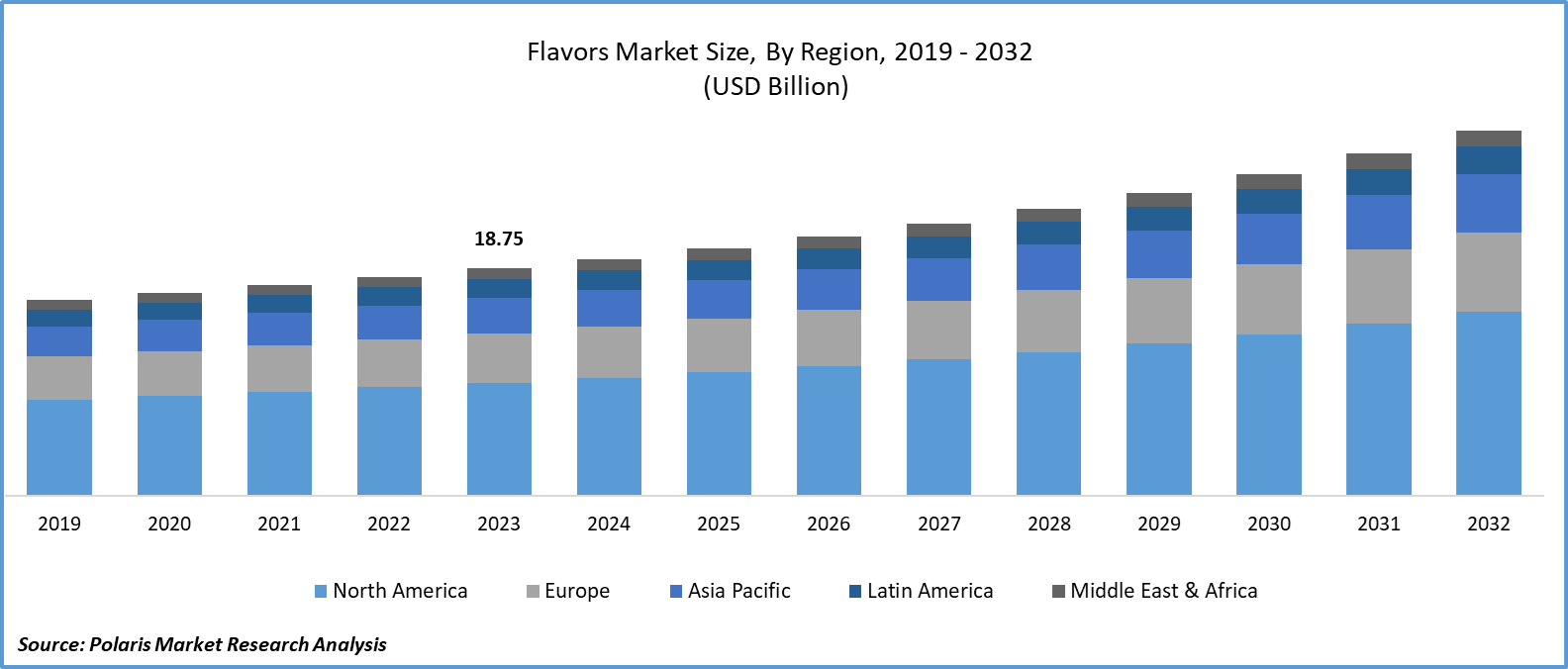

Flavors Market size was valued at USD 18.75 billion in 2023.

The market is anticipated to grow from USD 19.53 billion in 2024 to USD 30.10 billion by 2032, exhibiting the CAGR of 5.6% during the forecast period.

Market Introduction

Diversity in consumer preferences is fueling innovation in the flavors market. The market demand for a varied palette is reshaping the landscape, with food manufacturers incorporating a mix of traditional and international flavors in response to a globalized consumer base. This shift towards diverse applications is evident in the fusion of unique and authentic tastes across food and beverage products. The market is evolving as manufacturers recognize the importance of catering to multicultural preferences, driving experimentation and creativity.

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in September 2022, Solvay broadened the spectrum of its key product, Rhovanil Natural CW, by introducing three additional natural flavor components namely Rhovanil Natural Delica, Alta, and Sublima.

To Understand More About this Research: Request a Free Sample Report

Innovation and product development are pivotal in propelling the flavors market. The ever-changing landscape of consumer preferences and global culinary diversity demands constant novelty in taste experiences. Utilizing cutting-edge technologies and inventive approaches, the food and beverage industries are expanding traditional flavor profiles. Emphasizing natural and sustainable sourcing, coupled with health-conscious trends, fosters innovative product development.

Industry Growth Drivers

Health and Wellness Trends Are Driving Product Demand

The surge in health and wellness consciousness is reshaping the flavors market. Consumers, increasingly focused on well-being, are driving market demand for flavors aligned with healthier lifestyles. Natural and organic ingredients are gaining prominence as clean labels and minimal processing become priorities. This trend extends to functional and nutritional products, where flavors play a vital role. Plant-based diets and the need for reduced sugar and salt options further propel the need for health-oriented, innovative flavors.

Owing to growing trends in e-commerce and retail sectors, the market growth factors suggest the continuous demand of flavors for different cuisines. In addition, market growth factors showcase that the flavors market is experiencing a significant impact from the evolving landscape of e-commerce and retail trends. The rise of online shopping has altered consumer behaviors, creating new opportunities and challenges for the flavors industry. E-commerce platforms provide a global marketplace for diverse and unique flavors, allowing consumers to explore and purchase international tastes easily. Virtual storefronts and digital marketing strategies have become essential for flavor manufacturers to showcase their products and engage with a broader audience. Additionally, the demand for convenience and personalized experiences has led to the growth of e-commerce platforms specializing in curated flavor selections and subscription services.

Industry Challenges

Regulatory Compliance Is Likely to Impede the Market Growth

The market growth analysis comprises of various regulatory compliance that poses a constraint in the flavors market, shaping the landscape for manufacturers. Strict guidelines demand rigorous adherence to safety and quality standards, complicating the approval process for novel formulations. Gaining regulatory approval involves exhaustive testing and documentation and can significantly extend time-to-market, imposing financial burdens. Multinational companies face added challenges with varying regulations across regions, necessitating tailored compliance strategies. Transparent and accurate labeling, coupled with evolving regulatory requirements, adds complexity.

Report Segmentation

The flavors market analysis is primarily segmented based on ingredient, form, application, and region.

|

By Ingredient |

By Form |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Ingredient Analysis

The Natural Segment Is Expected to Experience Significant Growth During the Forecast Period

The market future foresees natural segment to experience significant growth during the forecast period. The food and beverage industry witnesses a rising demand for natural ingredient flavors, reflecting consumers' growing preference for healthier and authentic options. This shift favors flavors derived from real fruits, herbs, and spices, aligning with the trend of clean-label products and transparent ingredient sourcing. The surge in demand not only caters to health-conscious choices but also mirrors a broader societal interest in sustainability. In response, food manufacturers are incorporating natural flavors into a variety of products, including snacks, beverages, and packaged meals.

By Form Analysis

Powder Segment Held a Significant Market Revenue Share in 2023

The market growth analysis reflects powder segment to held a significant revenue share in 2023. Powder flavors are dehydrated and concentrated forms of flavorings commonly found in powder or granulated formats. Spray-drying or freeze-drying is among the methods of generating powder form for these flavors, which eliminates moisture, ensuring a stable and easily stored product. Widely used in the food and beverage, nutrition, and pharmaceutical industries, powder flavors enhance the taste of various products such as snacks, beverages, and soups. Their versatility lies in convenient storage, transportation, and adaptable application. The powder form of flavors has a vital role in the food and beverage sector in improving the taste profile of different items. The market continually evolves to meet consumer demands for cleaner labels and health-conscious options, emphasizing natural alternatives and innovation.

By Application Analysis

Food Segment Held a Significant Market Revenue Share in 2023

The food segment held a significant market revenue share in 2023. The food industry is experiencing a surge in flavor demand, reflecting evolving consumer preferences for unique and diverse tastes. With palates becoming more sophisticated, there is a growing interest in exotic and novel culinary experiences. Social media amplifies these trends, fostering a globalized appreciation for diverse flavors. Health-conscious consumers are fueling demand for natural and organic options. Younger generations prioritizing adventurous gastronomy contribute to the rising demand for bold flavor profiles. This shift has prompted food manufacturers to innovate, investing in research and development to meet the escalating demand for distinct and memorable taste experiences during the market future expansion paradigm.

Regional Insights

Asia-Pacific Held a Significant Market Revenue Share in 2023

In 2023, Asia-Pacific region accounted for a significant market share in 2023. The Asia-Pacific flavors industry embraces diverse culinary traditions, featuring umami-rich elements like soy sauce, ginger, and sesame. Tropical fruits such as mango, lychee, and coconut, along with a reliance on spicy profiles, contribute to the region's unique taste landscape. Medicinal herbs like ginseng and lemongrass, along with tea-based flavors such as green tea and jasmine, add depth to Asian cuisine. Seafood flavors, regional variations like Szechuan peppercorn and kaffir lime, and the fusion of Western and Asian tastes reflect the dynamic nature of the industry. Evolving preferences also see a focus on functional ingredients and local, artisanal influences, including street food-inspired flavors.

The market forecast North American region to be driven by consumer preferences favoring natural and clean-label products. There is a growing demand for functional flavors with health benefits that align with the wellness trend. The market size spans diverse sectors, prompting innovation and regulatory considerations. E-commerce has transformed distribution channels, providing convenient access to a range of flavors. Sustainability is gaining importance, influencing eco-friendly sourcing practices. Major market manufacturers operate in this competitive landscape, and ongoing adaptation to changing consumer behavior, accelerated by the COVID-19 pandemic, continues to shape the industry. Moreover, largest market manufacturers are promoting the growth of different cuisine by analyzing the market trends for rise in demand for flavor food items.

Key Market Players & Competitive Insights

The flavors market comprises a diverse array of players, and the expected entry of new contenders is poised to intensify competitive dynamics. Largest market manufacturers are continuously enhancing their technologies, striving to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These entities prioritize strategic endeavors, including forming alliances, improving product portfolios, and participating in collaborative ventures. Their primary goal is to outperform others in the industry, ultimately securing a significant flavors market share. Further, the market forecast the entry of new players upon favorable conditions provided by the food monitoring bodies.

Some of the major market manufacturers operating in the global flavors market include:

- Archer Daniels Midland Company (ADM)

- Bell Flavors & Fragrances, Inc.

- Blue Pacific Flavors

- Firmenich

- FONA International, Inc.

- Givaudan

- Huabao International Holdings Limited

- Kerry Group

- MANE

- Robertet Group

- Sensient Technologies Corporation

- Silesia Flavors, Inc.

- Symrise AG

- Takasago International Corporation

Recent Developments

- In October 2023, T. Hasegawa USA introduced two technologies focused on creating genuine flavors for food and beverage products. The North American market witnessed the launch of HASEAROMA and ChefAroma flavor enhancers for an authentic taste experience.

- In October 2023, Isobionics, a division under BASF Aroma Ingredients, introduced two novel natural products that are Isobionics Natural (-)-alpha-Bisabolol 99 and Isobionics Natural alpha-Bisabolene 98 were incorporated in the product lineup.

Report Coverage

The flavors market research report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides insights into recent developments, market trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the market research report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The industry analysis report provides detailed market analysis while focusing on various key aspects such as competitive analysis, ingredients, forms, applications, and their futuristic growth opportunities.

Flavors Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 19.53 billion |

|

Revenue forecast in 2032 |

USD 30.10 billion |

|

CAGR |

5.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in Flavors Market are Archer Daniels Midland Company (ADM), Firmenich, FONA International, Inc

Flavors Market exhibiting the CAGR of 5.6% during the forecast period.

The Flavors Market report covering key segments are ingredient, form, application, and region.

key driving factors in Flavors Market are Health and wellness trends

The global Flavors market size is expected to reach USD 30.10 billion by 2032