Floating Power Plant Market Size, Share, Trends, Industry Analysis Report

: By Power Source (Non-Renewable and Renewable), Power Rating, Platform Type, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 114

- Format: PDF

- Report ID: PM4088

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

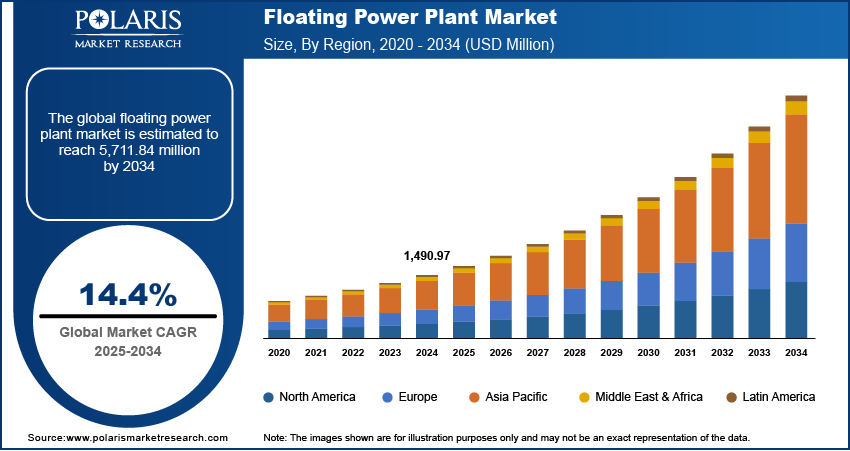

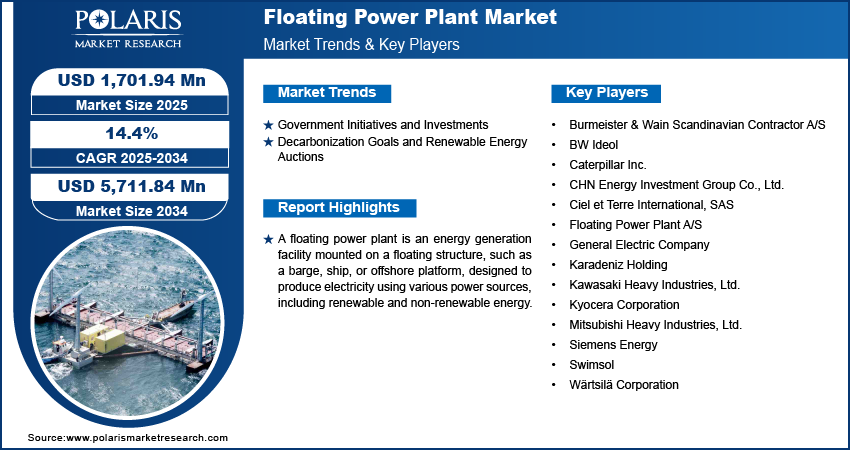

The floating power plant market size was valued at USD 1,490.97 million in 2024, exhibiting a CAGR of 14.4% during 2025–2034. The market is driven by the increasing demand for decentralized and flexible power solutions, renewable energy adoption, government investments, technological advancements in floating structures and hybrid power generation, and the growing need to reduce carbon emissions and enhance energy reliability in remote or disaster-prone areas.

Key Insights

- The non-renewable power source segment dominates the floating power plant market due to established infrastructure, operational reliability, and consistent energy output, especially in regions with unstable power access.

- The high segment holds the largest market share, driven by the significant energy needs of rapidly developing economies in Asia, including India, China, and Southeast Asian nations, supporting industrial and infrastructure growth.

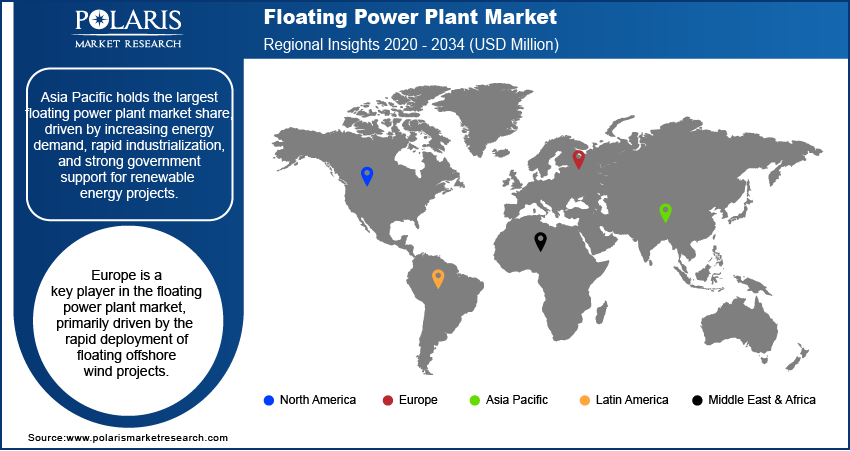

- Asia Pacific leads the floating power plant market, driven by strong government support, industrialization, and the need for clean energy in remote and coastal areas, with countries such as China and India investing heavily in renewable floating power solutions.

- Europe is also witnessing significant market growth, propelled by floating offshore wind projects, government-backed funding, and regulatory support, with countries including the UK, France, and Norway leading the way in renewable energy expansion.

Industry Dynamics

- Growing demand for decentralized power generation and renewable energy adoption are key factors driving the floating power plant market.

- Technological advancements in floating platforms and power generation systems, along with supportive government initiatives, further boost market growth.

- Investment in offshore wind energy infrastructure and decarbonization goals represents a key area for increasing floating power plant deployment.

- High installation and maintenance costs for floating power plants pose a challenge to their widespread adoption and scalability.

Market Statistics

2024 Market Size: USD 1,490.97 million

2034 Projected Market Size: USD 5,711.84 million

CAGR (2025–2034): 14.4%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The floating power plant market is driven by the increasing demand for decentralized power generation, the need for flexible energy solutions, and the rising adoption of renewable energy sources. These power plants, installed on floating platforms, provide an efficient solution for regions with limited land availability and remote locations requiring stable electricity supply. Technological advancements in floating structures and power generation systems, coupled with government initiatives to promote clean energy, further contribute to market expansion. The growing focus on reducing carbon emissions and integrating offshore wind and solar energy also drives market growth. Additionally, the ability of floating power plants to provide emergency power in disaster-prone areas enhances their adoption.

The floating power plant market is experiencing significant growth due to its versatility across diverse geographical and climatic conditions. These plants offer a flexible and efficient solution for power generation in coastal areas, islands, and regions with limited land availability. Market participants are heavily investing in research and development to enhance operational efficiency, minimize costs, and improve scalability. Innovations in hybrid power generation, integrating renewable sources such as solar and wind with conventional fuels, are further driving adoption. This hybrid approach ensures energy reliability while reducing carbon emissions. Additionally, advancements in floating platform technology, improved grid integration, and supportive regulatory frameworks are fostering market expansion. As global energy demand rises, floating power plants are emerging as a key sustainable solution.

Market Dynamics

Government Initiatives and Investments

Government support plays a key role in the growth of the floating power plant market through investments and policy initiatives. For example, the UK government has invested $71.15 million in the Port of Cromarty Firth, Scotland, to develop it as a hub for floating offshore wind projects. This investment supports Britain’s goal of decarbonizing its electricity sector by 2030, showing the importance of floating power plants in clean energy plans.

Additionally, the UK’s Floating Offshore Wind Manufacturing Investment Scheme (FLOWMIS) offers up to $207 million in grant funding. This funding helps develop critical port infrastructure, making it easier for companies to build and deploy floating power plants. These initiatives demonstrate strong government backing for renewable energy and sustainable power solutions.

Decarbonization Goals and Renewable Energy Auctions

Global decarbonization goals and renewable energy auctions have been instrumental in driving the floating power plant market growth. The UK's renewable energy auction in 2024 secured 131 new renewable projects, including wind, solar, and tidal power, sufficient to power 11 million homes. Auction like this reflects the government's commitment to expanding renewable energy capacity, with a significant portion allocated to offshore wind farms. Such initiatives demonstrate the critical role of floating power plants and nuclear power plants in achieving national and international carbon reduction targets, thereby driving the growth of the market.

Segment Insights

Assessment by Power Source

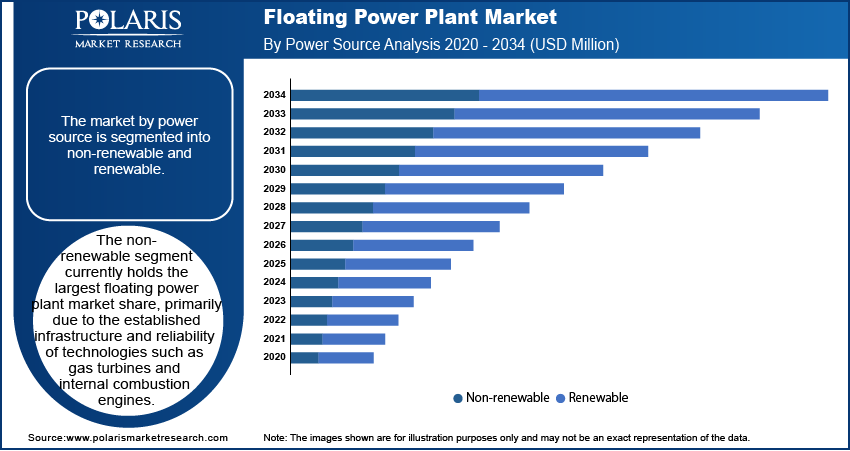

The floating power plant market segmentation, based on power source, includes non-renewable and renewable. The non-renewable segment holds the largest floating power plant market share, primarily due to the established infrastructure and reliability of technologies such as gas turbines and internal combustion engines. These systems offer high power density and operational flexibility, making them suitable for regions with fluctuating energy demands and limited access to stable power sources. The ability of non-renewable floating power plants to provide consistent energy output, irrespective of environmental conditions, has solidified their dominance in the market. Additionally, the existing supply chains and technological familiarity associated with non-renewable energy sources have facilitated their widespread adoption in floating power applications.

Evaluation by Power Rating

The floating power plant market is segmented by power rating into high, medium, and low. The high holds the largest market share. This dominance is attributed to the substantial energy demands of rapidly developing economies, particularly in regions such as South Asia. Countries including India, China, Malaysia, and Singapore are experiencing continuous population growth and urbanization, leading to increased infrastructure development across sectors such as healthcare, manufacturing, and construction. To meet these escalating energy requirements, high-capacity floating power plants are deployed, offering efficient and reliable power generation solutions. These plants are also utilized to supply electricity to offshore oil and gas platforms, where traditional grid infrastructure is often unfeasible. The ability of high-power floating power plants to deliver large-scale energy output makes them indispensable in supporting the industrial and economic expansion of these nations.

Regional Insights

By region, the study provides floating power plant market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific holds the largest market share, driven by increasing energy demand, rapid industrialization, and strong government support for renewable energy projects. Countries such as China, Japan, South Korea, and India are actively investing in floating wind and solar power plants to address land constraints and expand clean energy capacity. Additionally, Southeast Asian nations, including Indonesia and the Philippines, are deploying floating power plants to electrify remote islands and coastal regions where grid connectivity is limited. The presence of extensive coastlines and favorable offshore wind conditions further support the growth of floating power plants in the region. Government policies promoting renewable energy, along with advancements in floating infrastructure technology, have strengthened Asia Pacific’s leadership in the floating power plant market.

The floating power plant market in Europe is experiencing significant growth, primarily driven by the rapid deployment of floating offshore wind projects. Countries such as the UK, France, and Norway are leading in the development of floating wind farms, supported by government policies and funding initiatives aimed at achieving carbon neutrality. The European Union’s strong commitment to renewable energy expansion, along with favorable regulatory frameworks and financial incentives, has encouraged large-scale investments in floating power plants. Additionally, advancements in floating platform technology and collaborations between energy companies and research institutions have further accelerated market growth in the region. The presence of established offshore wind infrastructure and a skilled workforce also contributes to the steady expansion of floating power solutions across European waters.

Key Players and Competitive Insights

The floating power plant market comprises several active companies contributing to its development and deployment. Notable entities include Wärtsilä Corporation; Siemens Energy; Kawasaki Heavy Industries, Ltd.; Mitsubishi Heavy Industries, Ltd.; General Electric Company; Ciel et Terre International, SAS; Floating Power Plant A/S; Karadeniz Holding; CHN Energy Investment Group Co., Ltd.; Swimsol; Burmeister & Wain Scandinavian Contractor A/S; BW Ideol; Caterpillar Inc.; Kyocera Corporation.

These companies are actively engaged in advancing floating power plant technologies through various strategies. For instance, Floating Power Plant A/S has developed a patented platform that integrates wind and wave energy generation, aiming to enhance efficiency and reliability in offshore environments. Similarly, Wärtsilä Corporation offers comprehensive solutions, including floating power barges and energy storage systems, to provide flexible and sustainable energy options. Siemens Energy focuses on integrating advanced turbine technologies into floating structures, optimizing performance, and reducing operational costs. Ciel et Terre International, SAS specializes in floating solar photovoltaic systems, expanding renewable energy possibilities on water bodies.

The competitive landscape is characterized by continuous innovation and strategic collaborations. Companies such as Mitsubishi Heavy Industries, Ltd. and General Electric Company are leveraging their extensive engineering expertise to develop scalable floating power solutions. BW Ideol and Principle Power, Inc. are pioneering floating foundation designs, facilitating the deployment of wind turbines in deeper waters. Additionally, firms such as Karadeniz Holding and Burmeister & Wain Scandinavian Contractor A/S are providing turnkey floating power plants, addressing immediate energy needs in various regions. This dynamic environment fosters technological advancements and contributes to the global transition towards sustainable energy sources.

Wärtsilä Corporation is a Finnish company specializing in innovative technologies and lifecycle solutions for the marine and energy markets. They focus on sustainable technology and services to enhance environmental and economic performance. Siemens Energy, headquartered in Germany, is a global energy technology company offering products, solutions, and services across the energy value chain, including power generation, transmission, and storage.

Siemens Energy offers SeaFloat, which is a mobile floating power plant solution designed to provide accessible electricity and clean water while minimizing environmental impact. Built on proven gas and steam turbine series like SGT-800 and SST-600, these plants offer power outputs ranging from 150 MW to 1,330 MW with high efficiency. SeaFloat plants are mobile and flexible and eliminate the need for land acquisition, making them ideal for electrifying remote areas, providing rapid support during catastrophes, and rebuilding damaged infrastructure. They have a global operational scope and are adaptable to various floating devices, including integration with oil and gas facilities. The Ultra Light Combined Cycle (ULCC) design targets offshore projects, reducing carbon footprint and enabling greener fossil fuel utilization. This innovative solution offers short lead times and reduced project investments, making it an efficient, ecological, economical, and resilient power solution that overcomes land and cost constraints worldwide.

List of Key Companies

- Burmeister & Wain Scandinavian Contractor A/S

- BW Ideol

- Caterpillar Inc.

- CHN Energy Investment Group Co., Ltd.

- Ciel et Terre International, SAS

- Floating Power Plant A/S

- General Electric Company

- Karadeniz Holding

- Kawasaki Heavy Industries, Ltd.

- Kyocera Corporation

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- Swimsol

- Wärtsilä Corporation

Floating Power Plant Industry Developments

- March 2025: Siemens Energy secured a USD 1.6 billion contract to supply technology for two gas-fired power plants in Saudi Arabia, contributing an additional 3.6 gigawatts to the national grid.

- December 2024: BP and Japan's JERA announced a joint venture to combine their offshore wind operations. The venture aims to generate up to 13 gigawatts of power, with a combined investment of up to USD 5.8 billion by 2030.

Floating Power Plant Market Segmentation

By Power Source Outlook (Revenue-USD Million, 2020–2034)

- Non-Renewable

- Renewable

By Power Rating Outlook (Revenue-USD Million, 2020–2034)

- High

- Medium

- Low

By Platform Type Outlook (Revenue-USD Million, 2020–2034)

- Floating Structures

- Power Barges

- Power Ships

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Floating Power Plant Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 1,490.97 million |

|

Market Size Value in 2025 |

USD 1,701.94 million |

|

Revenue Forecast by 2034 |

USD 5,711.84 million |

|

CAGR |

14.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The floating power plant market has been segmented into detailed segments of power source, power rating, and platform type. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy

The growth and marketing strategy of the floating power plant market focuses on technological advancements, strategic partnerships, and expanding renewable energy adoption. Companies are investing in research and development to enhance the efficiency, scalability, and cost-effectiveness of floating power solutions. Government incentives and favorable policies are driving market expansion, particularly in offshore wind and solar energy sectors. Key players are forming collaborations with utility providers and infrastructure firms to accelerate project deployment. Additionally, market participants are targeting regions with high energy demand and limited land availability, leveraging floating power plants as a sustainable and flexible alternative to traditional energy sources.

FAQ's

The floating power plant market size was valued at USD 1,490.97 million in 2024 and is projected to grow to USD 5,711.84 million by 2034.

The market is projected to register a CAGR of 14.4% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

The floating power plant market comprises several active companies contributing to its development and deployment. Notable entities include Wärtsilä Corporation; Siemens Energy; Kawasaki Heavy Industries, Ltd.; Mitsubishi Heavy Industries, Ltd.; General Electric Company; Ciel et Terre International, SAS; Floating Power Plant A/S; Karadeniz Holding; CHN Energy Investment Group Co., Ltd.; Swimsol; Burmeister & Wain Scandinavian Contractor A/S; BW Ideol; Caterpillar Inc.; and Kyocera Corporation.

The non-renewable segment accounted for the larger share of the market in 2024.

A floating power plant is a mobile or stationary energy generation facility that produces electricity on a floating structure, such as a barge, ship, or platform.