Food Trays Market Share, Size, Trends, Industry Analysis Report

By Material Type (Plastic, PP, PET, Paper & Paper Board); By Tray Type (Single Cavity, Multi Cavity); By End Use; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jul-2023

- Pages: 116

- Format: PDF

- Report ID: PM3681

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

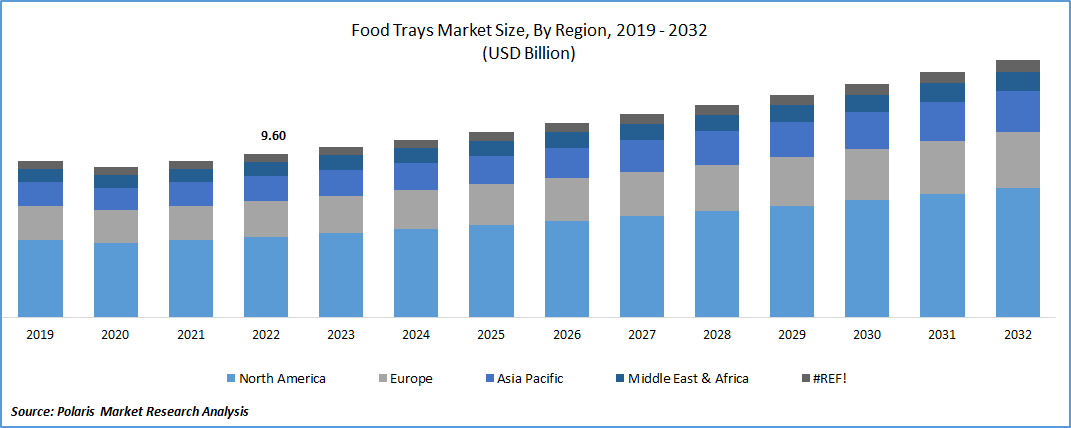

The global food trays market was valued at USD 9.60 billion in 2022 and is expected to grow at a CAGR of 4.7% during the forecast period.

The growing number of product launches in the food trays market is a significant driver of its growth.

- The introduction of the “Harvest Fiber Oval Bowls” by the Genpak, along with their clear, over-cap lids, is driving the market forward. These bowls, which are part of the Genpak's sustainable packaging line, are specifically designed for grab 'n go and take-out applications.

To Understand More About this Research: Request a Free Sample Report

Their innovative features and eco-friendly materials meet the increasing demand for sustainable and convenient packaging solutions in the food industry. By offering a reliable and environmentally conscious option, Genpak is contributing to the expansion of the food trays market and catering to the evolving needs of customers. With increasing consumer demand for convenience and on-the-go food options, foodservice operators and packaging companies are introducing new and innovative food tray solutions to cater to these needs.

Industry Dynamics

Growth Drivers

The growing trend of acquisitions in the food trays market is driving the overall growth of the industry.

Acquisitions play a significant role in shaping the competitive landscape, expanding market reach, and driving innovation and product development. Huhtamaki, a renowned global packaging company, has successfully finalized the acquisition of Huhtamaki Tailored Packaging (HTP), a prominent distributor and wholesaler of foodservice packaging in Australia. The growing trend of acquisitions in the food trays market drives market growth through market consolidation, diversification of product portfolios, market expansion, operational efficiencies, and access to new technologies and expertise. These acquisitions foster competition, stimulate innovation, and offer customers a wider range of options, ultimately propelling the growth of the food trays market.

For Specific Research Requirements, Speak With Research Analyst

Report Segmentation

The market is primarily segmented based on material type, tray type, end use and region.

|

By Material Type |

By Tray Type |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Material Type

Plastic segment projected to have faster growth over the projection timeline

Plastic segment is expected to have faster growth for the market. These trays offer a wide range of design options and can be easily customized to meet specific requirements. They are available in various shapes, sizes, and colors, making them suitable for different food applications. Plastic trays are known for their durability and strength. They can withstand rough handling during transportation and are less prone to breakage compared to other materials. This makes them ideal for use in foodservice establishments, catering services, and takeaway/delivery applications. They can be designed with features that promote food safety and hygiene. They are easy to clean, sanitize, and maintain, ensuring proper food handling practices.

By Tray Type

Multi cavity segment accounted for the largest market share in 2022

Multi cavity segment holds the largest market share for the market in the study period. This type of food trays allows for the packaging of multiple food items or portions in a single tray. This increases efficiency in food preparation, packaging, and serving processes. It saves time and effort by eliminating the need for separate trays or containers for each food item. Multi cavity trays optimize space utilization during transportation and storage. By accommodating multiple food items in a single tray, it reduces the overall footprint and maximizes the use of available space.

This is especially important for bulk packaging, catering services, and food delivery, where efficient space utilization is crucial. They are designed to accommodate specific portion sizes for each food item. They provide a standardized portioning solution, ensuring consistency and accuracy in serving sizes. This is beneficial for foodservice establishments, meal prep services, and portion-controlled food packaging.

By End Use

Restaurants & Cafe segment is expected to hold the larger revenue share

Restaurants & Cafe segment is projected to witness a larger revenue share in the coming years. The growing trend of eating out at restaurants and cafes has significantly contributed to the demand for food trays. As more people choose to dine at these establishments, there is a need for efficient and convenient ways to serve and present food. Food trays offer a practical solution for serving multiple dishes and accommodating different food items on a single tray. They often provide takeaway and delivery services to cater to customers who prefer to enjoy their meals at home or in other locations. Food trays play a crucial role in packaging and transporting food items for takeaway and delivery orders. These trays ensure that the food remains secure, organized, and in optimal condition during transit, enhancing the overall customer experience.

Regional Insights

Asia Pacific registered with the highest growth rate in the study period

APAC is projected to witness a higher growth rate for the market. The region is experiencing rapid urbanization, changing lifestyles, and a rise in disposable income. These factors have led to an increased preference for dining out and the growth of the foodservice industry. Restaurants, cafes, food courts, and other food outlets are driving the demand for food trays as they seek convenient and efficient solutions for serving and presenting food to customers.

ICRA predicts that India's quick service restaurant sector would rise by 20–25% in FY24 driven by factors such as demand uptick, increasing penetration, and rapid expansion of stores, playing a significant role in driving the overall growth of the market. India's projected growth in the quick service restaurant (QSR) industry, supported by increasing demand and expanding store networks, contributes to the demand for food trays. As India represents a significant market within the region, the growth of the QSR industry in India has a ripple effect on the demand for food trays across the region.

North America garnered with the larger revenue share in the forecast time frame

North America is expected to witness a larger revenue share for the market. The rise in online food delivery platforms and the growing popularity of takeout services have fueled the demand for food trays. As more consumers choose to order food for delivery or takeout, the need for durable, convenient, and eco-friendly food trays has increased. The substantial achievement of DoorDash and its subsidiary Caviar in capturing 65 percent of U.S. consumers' meal delivery sales is a significant driver of the growth in the food trays market in the United States, which, in turn, influences the market in North America. This achievement has a profound impact on the industry.

The dominance of DoorDash and Caviar in the meal delivery sector translates to an increased demand for food trays. As online food orders surge due to the popularity of these platforms, there is a growing need for packaging solutions that can effectively package and transport meals. Food trays are a preferred choice as they offer convenience, protect the food during delivery, and ensure its quality upon arrival. The rise in meal delivery services, led by DoorDash and Caviar, drives the demand for food trays as an essential packaging solution.

Key Players and Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share

Some of the major players operating in the global market include:

- Amcor

- Anchor Packaging

- Be Green Packaging

- Biopac

- Cascades

- Coveris

- D&W Fine Pack

- Dart Container

- Eco-Products

- Genpak

- Huhtamaki

- Novolex

- Pactiv

- Sabert

- WestRock Company

Recent Developments

- In April 2023, Huhtamaki, introduced ground-breaking mono-material technology in its flexible packaging offerings. This innovative & sustainable packaging, available in Paper, PE, & PP retort materials, is designed to meet the evolving needs of customers and consumers.

- In January 2023, Pactiv Evergreen introduced a new line of tamper-evident fry cartons, catering to the changing requirements of modern foodservice operators. In response to the growing trends of takeout and delivery, these innovative cartons prioritize portability, safety, and security.

Food Trays Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 10.02 billion |

|

Revenue forecast in 2032 |

USD 15.13 billion |

|

CAGR |

4.7% from 2023 - 2032 |

|

Base year |

2022 |

|

Historical data |

2019 - 2021 |

|

Forecast period |

2023 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Material Type, By Tray Type, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in food trays market are Amcor, Anchor Packaging, Be Green Packaging, Biopac, Cascades.

The global food trays market is expected to grow at a CAGR of 4.7% during the forecast period.

The food trays market report covering key segments are material type, tray type, end use and region.

key driving factors in food trays market are • the growing trend of acquisitions in the food trays market is driving the overall growth of the industry.

The global food trays market size is expected to reach USD 15.13 billion by 2032.